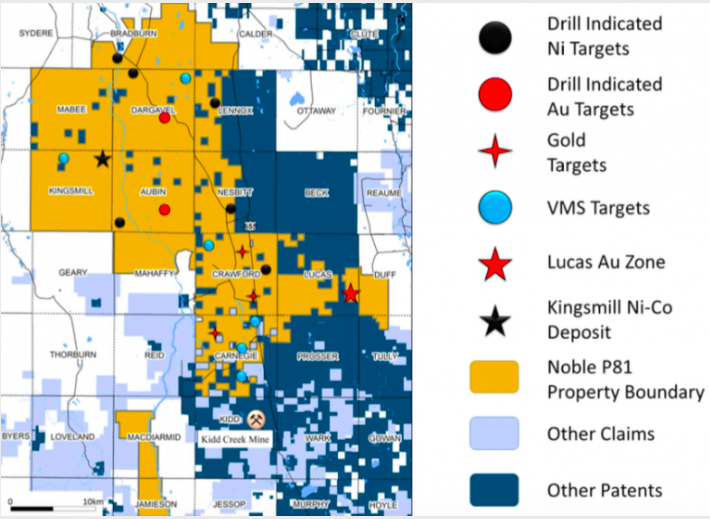

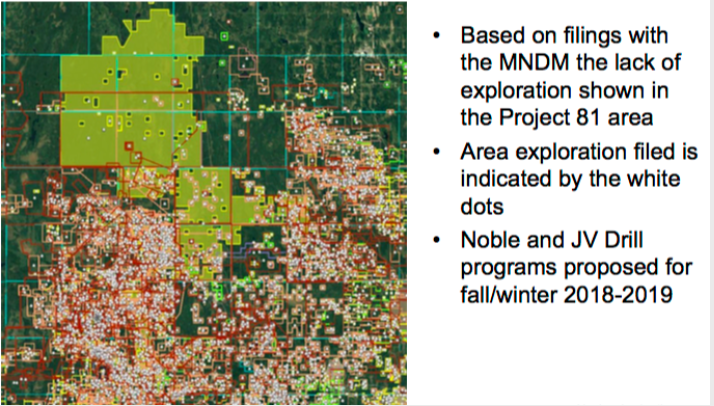

Noble Mineral Exploration (TSX-V: NOB) has a lot of blue sky potential, but it is still early days for the Company. It owns 79,000 hectares (~195,200 acres) in a prime location, just north of Glencore’s world-class Kidd Creek Mine. The property, called Project 81, has access to ample infrastructure a skilled labor force, plus mining consultant services & equipment. However, it has been under-explored for decades due to private land ownership and to widespread overburden, making it difficult to determine the underlying geology necessary for finding deposits.

But, all of that is changing. New technologies, far superior to those used in the 1960’s-1970’s, are being aggressively deployed. Late last week one of its earn-in partners released 4 assays on a small portion of Project 81, and the results were impressive.

In the following interview of CEO Vance White of Noble Mineral Exploration, I asked about the prospects for 2019 and the drill results from his earn-in partner. It turns out there are a number of near-term catalysts to watch out for, including the Company signing on additional earn-in partners in what is rapidly becoming a project generator business model. I wrote about Noble Mineral Exploration a month ago, there’s a lot of valuable information in that piece, but this interview has the newest, freshest most actionable information on the Company.

Please give readers the very latest snapshot of Noble Mineral Exploration.

Sure, we are a junior company that has the single largest contiguous package of land (79,000 Ha, “Project 81“) in the Timmins-Cochrane area, just north of the world-class Kidd Creek Mine, which has produced in excess of 160 M tonnes of high-grade base metal ores.

Our Project 81 could potentially host the next 1 to 3 high-grade Kidd Creek style deposits and/or Kidd Creek satellite deposits. Satellite deposits in this kind of environment could contain perhaps 30 to 50 M tonnes of ore each. In addition, we may have several mega-deposits containing low-grade Nickel (Ni), Cobalt & PGE metals, which are important metals in the fast developing EV market.

We are successfully executing a project generator business model to de-risk our early-stage exploration on several properties contained within Project 81. Based on historic drill indications, we may have 3 or more gold deposits as well.

We have infrastructure galore (roads, rail, water, power, skilled labor, equipment suppliers and contractors, etc.)

Can you tell us more about Project 81?

It’s a large land position adjacent to the Kidd Creek Deposit with multiple drill-ready, geophysical targets of VMS, Nickel-Cobalt-PGE & Gold. We are looking for additional partners to systematically explore and drill this giant land package. In fact, one of our partners (Spruce Ridge Resources Ltd) just released positive drill results of Ni-Co-& PGE on an earn-in property on March 1st.

What is the significance to Noble Mineral Exploration of the drill results by your property partner Spruce Ridge Resources on the Crawford Township project?

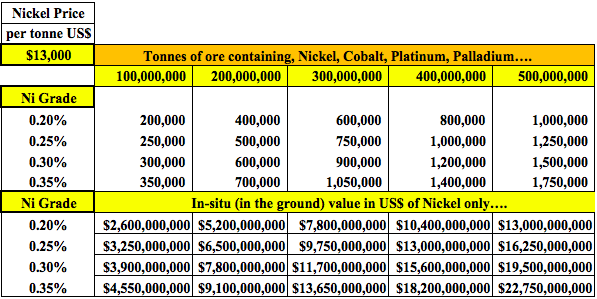

Good question, we believe the results were very significant for both them and for us. Spruce Ridge Resources drilled 4 holes totaling 1,818m. Three intersected persistent Nickel values greater than 0.25% over core lengths up to 291m. Using a lower threshold of 0.20% Ni, multiple long intervals were present in all 4 holes, with a maximum core length of 558m. Spruce Ridge also announced potentially significant assays of cobalt, platinum & palladium. Exciting news for sure, because this is a huge anomaly, on the order of 2.5-3.0 km in strike length. Note: {lengths are core lengths, not true widths. The Company has insufficient information to determine true widths}

We own 3 M shares, plus 5 M warrants at C$0.05/shr. in Spruce Ridge Resources. In the 2nd quarter, we are to receive 3 M additional shares, plus 5 M more warrants, struck at a future market price. So, success for them in Project 81 is really important to us. Even more so considering that we are negotiating with multiple prospective earn-in partners. Those negotiations are a lot easier when we can point to successes like Spruce Ridge in Crawford Township. .

If the next drill program by Spruce Ridge were to demonstrate the potential for a large tonnage deposit of low-grade Ni-Cobalt & PGE, that could add significant value to the remainder of Project 81. If they earn-into 75% of their Crawford Township property, they would own 1.9% of Project 81, leaving tremendous upside from the remaining 98.1%. As can be seen in the chart below, in-situ values in the US$ billions of dollars are possible if a large deposit is found. Royal Nickel’s deposit in Quebec is ~2 billion tonnes of 0.26%-0.28% Ni, plus a few ancillary minerals.

What are the biggest risks facing Project 81?

Not being able to execute our plan, coupled with a lack of field success. A collapse in Gold, Ni, Co & PGE metal and other base metals prices. But, in our view this is not going to happen.

Outside of Project 81, are there any other assets in the Company worth mentioning?

Yes, we have an option & JV with a private investor group. We own shares & warrants in TSX-V: BMK. As mentioned, we also own shares & warrants in Spruce Ridge Resources (TSX-V: SHL). And, we have a dedicated & loyal investor group and an experienced & dedicated management team.

What are some near-term catalysts for Noble Mineral Exploration?

Additional JV partners, Orix Geoscience’s compilation & modeling over the entire project area, Airborne Geophysical coverage by Steve Balch of the entire project area with EM & Mag, Falcon Gravity Gradiometer by CGG Inc., Artificial Intelligence coverage of select areas conducted by Albert Mining (TSX-V: AIIM), and additional exploration & drill results from our earn-in partners.

How many new partners are you looking for at Project 81? Are you close to landing any new partners?

Ten or more JV partners, but the project is large enough to support even more. We are looking to have at least C$10M to C$20M spent on this project area over the next 2 to 3 years. Depending on successes, as in the case of Spruce Ridge, total expenditures could be higher.

Are any prospective partners larger companies, say companies with market caps > C$100 M?

With our project generator business model and other potential near-term developments, including drilling success by our partners, we believe that we will be able to attract these type of companies in the near future.

Why should readers consider buying shares of Noble Mineral Exploration?

The Company currently has a market cap of ~C$17 M, (@ C$0.135 on March 4th) a single significant discovery (and remember there is a potential for multiple discoveries) could move the needle 10+ times, plus provide additional liquidity through our shareholdings, options / warrants in a growing list of Option & JV partners.

Disclosures: The content of this interview is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Noble Mineral Exploration, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Noble Mineral Exploration are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Noble Mineral Exploration was an advertiser on [ER], and Peter Epstein did not own any shares, warrants or stock options in the Company. Readers understand and agree that they must conduct their own due diligence above and beyond reading this interview. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)