Albert Mining (TSX-V: AIIM) is a company undergoing change, the share price is changing, it’s up a lot. The Chairman resigned on Feb. 25th, but a high-powered replacement is actively being sought. There’s a new player in Albert’s niche market, and that new player is making waves and drawing attention to itself, Artificial Intelligence (“AI“) & Albert Mining. The management team, led by Michel Fontaine, the CEO, proposes to change the way his team does business. For example, they’re looking at new applications for their technology and taking working interests in mining exploration projects. For more on this quickly moving story, please continue reading.

Please give readers the latest snapshot of Albert Mining.

Albert Mining’s team (TSX-V: AIIM) and its CARDS (Computer Aided Resources Detection System) and the use of data mining & machine learning using Artificial Intelligence (“AI“) have been at work in the mining sector since 2005. The value behind Albert Mining is that it has already signed $15 M in revenues and spent $4.2 M to develop CARDS and the data mining software. There have been more than 27 client discoveries and the Company has a technology that’s proven beyond all reasonable doubt that it works.

We are the only AI system in the mining sector in the world with a proven track record. We have an approximate 70% success rate. Our team has demonstrated it can reduce exploration time & costs by decreasing the surface area to be investigated by 95% to 97%. We’ve completed 65-70 projects.

We feel this is just the beginning of something potentially much bigger. For example, we believe our technology can find water and we think governments and armies can benefit from using our AI technology to more accurately & safely locate buried anti-personnel mines.

Those applications alone are game-changers for us. They are just 2 wide-ranging examples of many ideas bouncing around in the heads of our AI experts, many of whom have been with the Company for 6-10 years. No other company, has the breadth & depth, and the vast experience in AI technology for mining that we do. No one.

The last several days your share price has been up considerably on heavy volume. Are you aware of why that might be?

Well, it’s not my job to follow the stock price that closely, but obviously I’m being asked this question a lot. I’ve been told that certain stock chat rooms are talking a lot about Albert Mining and Goldspot Discoveries, which is a new AI company.

Goldspot (SPOT.V) went public last week with a market cap of more than $50 M. Albert Mining today, even after a big move in our share price, has a market cap of ~$10 M. Last week, several people told me there was less risk of buying Albert Mining than Goldspot. But, that’s not for me to decide. Remember, we were one of the first to sell its services and use AI in the mining sector, and we have already proven many times that our AI technology works with some significant discoveries.

What are your thoughts on Goldspot?

I wish them the best of luck. I think they have brought some much needed attention to the niche sector that Albert Mining is in. Goldspot’s entry into the sector has certainly drawn attention to us. More important, the world needs to see what our AI technology is capable of. We’ve barely scratched the surface. There are many things being investigated that, for competitive reasons, we can’t talk about.

But, with the increased awareness of both Albert Mining and Goldspot, we are optimistic that larger mining companies and in fact government entities from around the world will find their way to our doorstep. Our goal is to secure larger contracts and hire more AI experts to run additional projects and invest in R&D. It would not take a great deal more in revenues to get started down that path.

Can you describe some past successes Albert Mining has had using its AI technology?

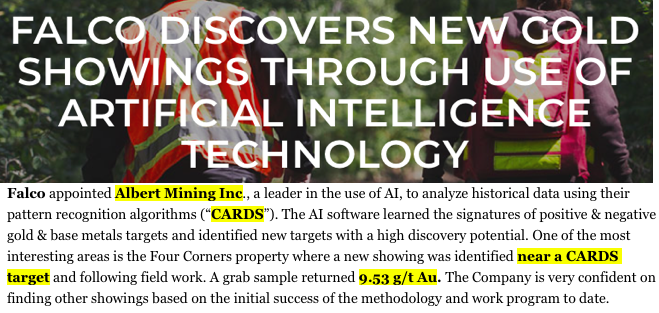

Yes, of course. Falco Resources was pleased with our services, we used more than 100,000 assays and modeled 4 different signatures (copper, zinc, gold & silver). Based on the use of our AI technology they reported in a press release that field work resulted in the discovery of new gold showings at Four Corners, 20 km from the Horne 5 Project in Quebec. {see image above}. We have letter testimonials and we have examples of our successes on our website. We’ve run over 65-70 projects, so there are plenty of success stories!

Andre Tremblay of Metanor Resources extolled,

“A prospecting program carried out over 4 main targets defined by Albert Mining brought to light a promising new gold structure on either side of the access road to the Bachelor property, only 2.5 km from the Bachelor Lake Mill. When this new mineralized zone was sampled, the best results included grab samples of 11.03 g/t Au, 14.8 g/t Au an 11.05 g/t Au.”

Albert Mining helped Noble Mineral Exploration and its earn-in partner Spruce Ridge Resources choose base metal targets. Spruce Ridge drilled 4 holes based in part on Albert Mining’s AI technology. The property is in Carnegie & Crawford Townships and is part of Noble Mineral Exploration’s ~79,000 hectare Project 81, which is located in the Timmins-Cochrane area of Northern Ontario. Drill results are expected any day now.

And then there’s Ned Goodman, one of the best resource stock investors in Canada, if not the world. In 2011, Mr Goodman came to our office for the first time. At the end of our presentation, he told us, ‘you are the future of exploration, everyone will use this kind of tool soon.’ Between 2013-2016, Ned Goodman was one of our largest shareholders. Your readers should know, Mr Goodman is a visionary. We worked for him on our biggest contract, over 300,000 sq. km, and found more than 15 grass roots discoveries. {Ned Goodman on Albert Mining’s technology}

Can you name any mistakes made and what, if anything, you learned from the mistakes?

Mistakes! Yes, of course we’ve made mistakes, they are the only way to become better! Internally, we had done a Kimberlite project in Quebec. The goal was to extract patterns from all the kimberlites found in the area around the Stornoway diamond mine and find more diamonds close to the mine. We used public information from the Quebec government database. We did the work and found some targets. We staked the best ones and sent some geologists & specialists in geochemistry. We did not find anything.

We learned that the resolution of the geophysical data was too far behind the size of the kimberlites in Quebec. We always learn from our mistakes and change the way we work. Each project is different. If we count all internal work, R&D and service contracts, we have worked on more than 65-70 projects since 2005. You can’y buy that know how and experience, you have to earn it, it must be lived day in and day out, project after project. Over the years, we have kept the same technical team, which is a great strength of Albert Mining. New companies that enter the field, with teams that haven’t made mistakes yet, they have a lot of mistakes ahead of them!

Why should readers consider buying shares in Albert Mining

Albert Mining (TSX-V: AIIM) has been powered by Artificial Intelligence, machine learning & data mining since 2005, with more than 27 discoveries to our credit. These are not just words, we use these tools every day. For the first time in several years, Albert Mining will begin to promote itself and explain the value behind our proven technology. We will start developing partnerships with many companies we hope to work with. Albert Mining is looking for JVs by way of funding and owning working interests in exploration projects. We want to have skin in the game with our future partners.

I am very confident our CARDS system can find many more deposits/mines in the future if the clients, the VPs of Exploration & Geologists, are serious about the way to validate the targets generated by our skilled team. The biggest problem in exploration is overburden. 99% of all mines/deposits were found at or very near surface. Next, mines will be found under of 5-50 meters of overburden. We need other tools, new tools, to find the next mines.

That why Albert Mining has the solution. Using AI, machine learning & data mining to find patterns in complex databases, because mining teams are working with too many variables, they’re exploring too many sq. km of property. We narrow the search for better outcomes, we are the pioneers!

To have skin in the game is to have incurred risk (monetary or otherwise) by being involved in achieving a shared goal. And the goal is to find mines. We are the future of mining. We are doing a reset. We are making many changes at Albert Mining right now. You will see!

Disclosures: The content of this interview is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Albert Mining, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Albert Mining are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Albert Mining was an advertiser on [ER], and Peter Epstein did not own any shares, warrants or stock options in the Company. Readers understand and agree that they must conduct their own due diligence above and beyond reading this interview. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)