{Please see disclosures at bottom of page}

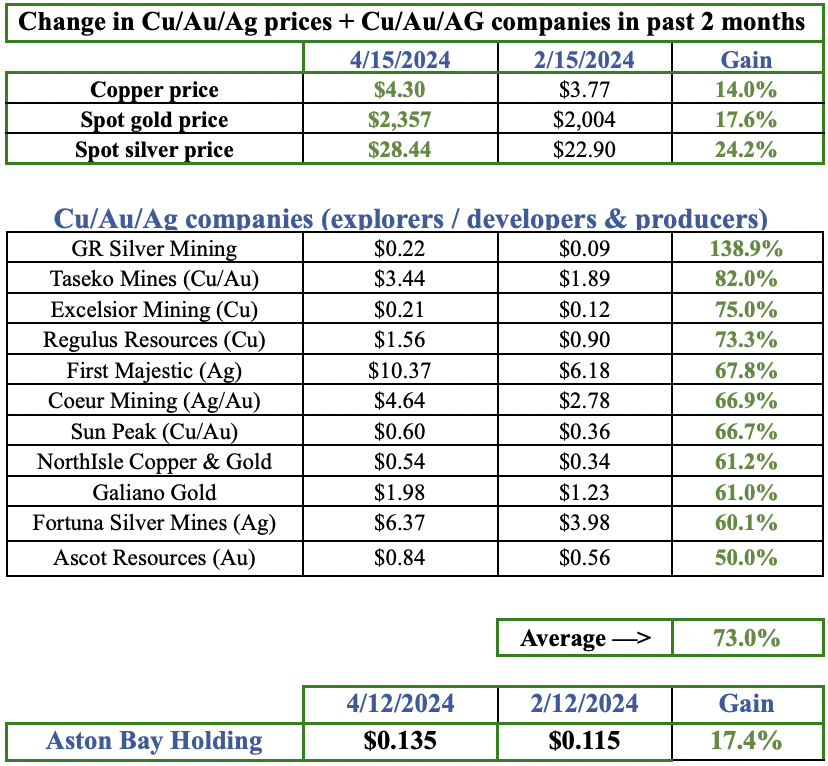

The following exclusive interview is with President, CEO & Director Peter Espig of Nicola Mining (TSX-V: NIM). No, Nicola Mining is not “mining” bitcoin, growing cannabis/weed or exploring for lithium in Argentina, but I encourage readers to keep reading. Nicola is old-school, it is exploring for Copper (“Cu“) in British Columbia, Canada. Cu might not be sexy, but it has one of the best fundamentals of any metal in the world. Simply put, Cu will benefit from all the battery-powered technology changes coming our way, but also from a massive wave of green energy infrastructure building.

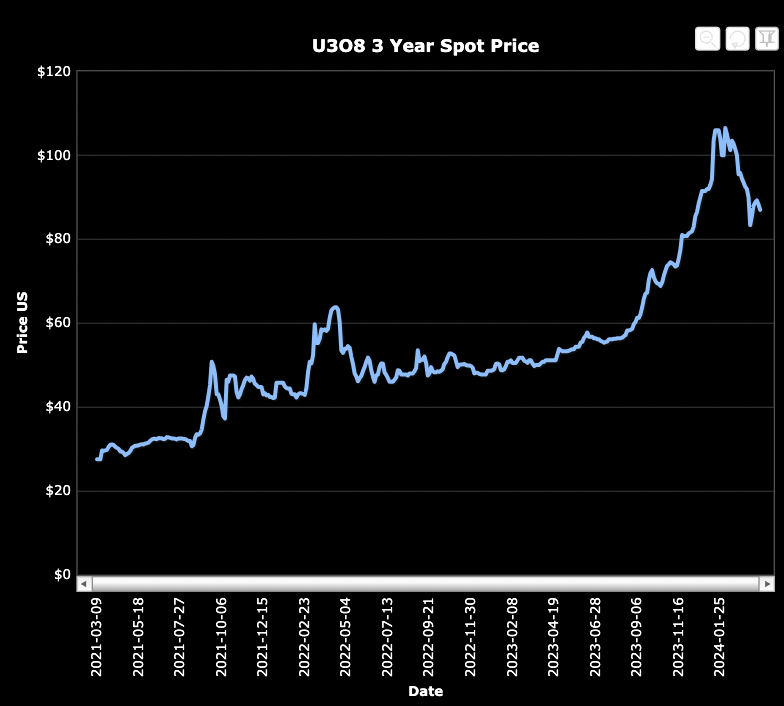

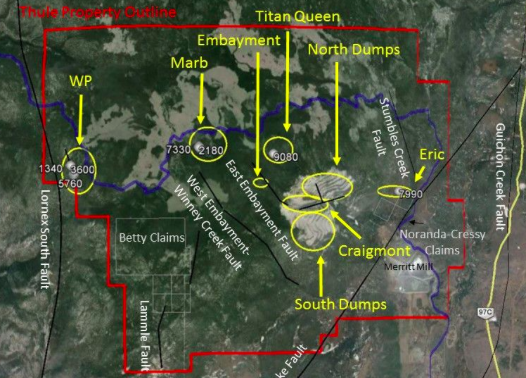

CEO Espig is actively exploring the past producing Craigmont mine site, one of the highest-grade open pit Cu mines in North America at its time. Last year, a drill hole on the project, called Thule Copper, returned 1.11% Cu over 86 meters. 1.11% is a tremendous grade, and the fact that the grade stretches over 86 meters made it a blockbuster hole. The market cared for a few days, then investors retreated to the cannabis craze, or was it drones? Unlike more lackluster gold and silver prices, Cu is up over 40% in the past year.

Espig would like readers to know that Thule Copper could be (subject to further drilling that is currently underway) a very large, high-grade, near-surface Cu deposit. One that’s not located in a crazy country in Africa or in Indonesia (where Freeport-McMoRan has just agreed to hand over a majority stake in its world famous Grasberg Cu / Gold mine). Globally, both Cu grades and major new Cu discoveries are in steady decline, and resource nationalism is on the rise.

Nicola also has a world-class 200 tonne/day gold processing facility, (the Merritt Mill), also in BC, Canada. Readers can learn more about the Company on its website…. but first, please continue on to the interview.

Your New Craigmont Property, aka Thule Copper, seems like a blockbuster exploration project. You described a drill hole grading 1.11% over 86 m as, “one of the top Cu intersections in British Columbia in recent years.” Yet, the market doesn’t seem to appreciate it quite as much as you! What might investors be missing?

That’s a very good question. I would say that the market has missed the hole’s significance because, remember, it’s an assay on just one exceptional drill hole. I think the question that investors need to wrap their heads around is, “is that drill hole representative of the property” and, if so, what’s there? In thinking about that, remember, Craigmont was the highest-grade Cu mine in the history of North America.

When the mine closed, it left behind 500,0000,000 pounds Cu grading 0.42% (at the time, the company did not count this ore as reserves because it fell below the mine plan’s cut-off grade), as well as 80-90 million tonnes of waste piles. The mine had a cut off grade of 0.7% Cu, which is unheard of nowadays. We are confident that the market will start to grasp the scale of this project because this year’s Exploration Program will continue to expand the size of the Embayment zone, which is where we had the blockbuster drill result.

Tells us more about the 2017 Exploration Program, what are its primary goals, how would you characterize a successful outcome?

The easiest way to break down the 2017 Exploration Program is as follows:

Embayment Zone: Diamond Drilling:

There were two main goals on the Embayment this year. First, confirm the eastern fault, which is important because mineralization in the historic pit was sliced because of the fault. I am happy to report that we found the fault on our first targeted hole this year. The second goal is to continue step-out drilling to expand the zone and resource.

On a back-of-the- envelope calculation, a 100 m step-out can equate to 60,000,000 – 90,000,000 pounds of Cu. We estimate the zone to be up to 1.5 km in length, so although subject to further drilling and analysis, the overall potential is quite significant.

Titan Queen & Promontory Hill: IP Survey & Diamond Drilling:

The success of the Promontory Hill IP Survey was a very exciting outcome. We announced on July 24th that there is a very clear anomaly of significantly chargeability situated just 100-150 m below surface, 300-500 m in diameter and open at depth. We should note that this is in a known mineralized area and we see traces of pyrite and chalcopyrite at surface.

In short, the Embayment Zone can be thought of as a bridge between the mineralized zones of the historic pit and the Promontory Hill. In the target zone there has never been a drill hole, so that’s going to be a top priority for our 2018 Program.

The Titan Queen target is quite simple. It lies in the exact same Border Phase Zone of the Guichon Batholith, home to our neighbor, Teck Resource’s Highland Valley Copper. The Border Zone is known to host Highland Valley Copper (“HVC”) porphyry pits. Our 2016 Exploration Program indicated mineralization similar to the HVC pits, mineralization in the same neighborhood, that could be the driver of the Craigmont skarn. However, we only drilled down about 80 m. If the IP Survey backs up last year’s program, we will add more holes this year.

Waste Piles: RC Drilling:

I think this might be the most misunderstood prospect in our Company. On September 26th, we announced drill results averaging 2,391 ppm Cu (0.24% Cu) for the first 10 m. Let’s analyse this:

- The Company has known waste piles (around the open pit) of 80-90 million tonnes, depending on method of measurement

- The highest cost of pit mining in the region is the actual mining process of drilling, surveying, engineering, blasting, etc., which can be 50-60% of total mining costs;

- The mine had a known cut off grade of 0.7% Cu

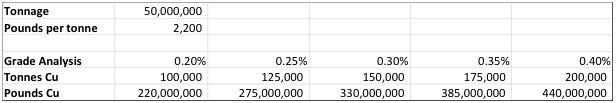

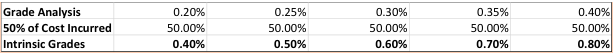

We stopped the RC program because of forest fires but the grades were getting higher – one of the later holes returned 1.03% Cu. Now, assuming there was 50 million tonnes of economic grade material, using a range of potential grades we get the following:

Now, if we understand that 50-60% of the costs have already been incurred, the effective mining grade-equivalent increases significantly. In other words, in terms of mine-level economics, mining a 0.25% Cu grade would be like mining a 0.50% Cu grade, simply because half of the costs have already been incurred.

NOTE: {calculations above are for illustrative purposes only}. This can put significant value on the waste piles. More work needs to be done, but it certainly is exciting.

Which target offers the most potential for a major advancement or discovery? Embayment, Titan Queen, Promontory Hill or Waste piles?

They all do. It’s too early to say which has the most potential, but, high-grade Cu porphyries are more valuable than almost any other mined-metal, including gold. Overall, I love the combination we have that, when pieced together, have a lot of value.

Do you have a view on the strong move in the Cu price, up nearly 30% year-to-date?

I think that, as a metal, Cu represents the global growth in the middle-class and the paradigm shift to green technologies. Cu is a metal of the future, but large deposits in safe mining jurisdictions are increasingly hard to find. This is something that makes Nicola special; we have an active mine permit in a warm weather / low altitude environment, that’s under-explored because we are the first group to have 100% ownership since the 1980’s.

Please give readers an update on the Merritt Mill & Tailings Facility?

This year we invested over $1 million on upgrades to the Merritt Mill, allowing us to increase capacity and cut costs. At the same time, we were unfortunate due to things out of our control. First, our contract with Gavin Mines, which was supposed to start in April / May had a few delays, which is not out of the ordinary for start up mining projects. This was followed by the worst forest fire season in the history of British Columbia, which delayed both Gavin and our exploration by 2 – 3 months.

It was a very frustrating time, we were not able to work in the hills until September. Fortunately, Gavin is working now and has a stockpile of approximately 4,000 tonnes. We have decided to start milling again in 2018 because we want a large stockpile (5,000 tonnes) prior to commencing operations. We will also be announcing another Profit Share Agreement that will provide material next year.

We continue to receive revenues from our gravel pit and signed a 30-year agreement with Merritt Green Energy, which is operated by a global leader in green energy. Unfortunately, we have a CA with Merritt so I can’t comment on the economics of the project other than to say that the revenues significantly cut any cash burn rate we have during periods of an idle mill.

Can you explain the importance of the amendments you have received on the terms of your convertible notes?

Yes. There are 2 key components of the extension:

Debenture: The maturity has been extended 2 years with the same interest terms (5% cash, plus 5% in shares) but the conversion price was lowered from $0.50 to $0.22 because we want everyone to convert. Note that 70% of the debentures are held by insiders. The debentures now expire November 21, 2019.

Warrant: The 7,000,882 expiration date of the warrants were extended to November 21, 2019 and now carry a conversion price of $0.275. We implemented a forced conversion policy so that if the share price trades at $0.34375 or above, holders have 30 days to exercise. We are very confident in our 2017 Exploration Program and 2018 operations. Rather than diluting shareholders with a Flow Through Unit, which would have had a warrant attached, we opted for this as it minimizes dilution and maximizes value. We often see in financings that investors buy the unit and sell the share to keep the ‘free’ warrant, which puts pressure on the stock. We don’t want this.

As always, a lot of moving parts to the Nicola Mining story. To recap, why should readers consider buying Nicola Mining shares?

We have been told the story is intriguing and that we are unique on the TSX Venture Exchange because we have both exploration upside and cash flow; however, the combination is difficult to understand. I would say that after this year’s program, the story will become a lot clearer. We are a cash flowing junior that expects to have positive cash flow – but the upside of our Cu asset could be very significant over the next 12 months. We don’t need to drill to a NI 43-101 resource but, rather, confirm that it’s there.

Thanks so much Peter, a very interesting story! Near-term drill results could be an investment catalyst. Hopefully readers will take a few moments to dig a little deeper into Nicola Mining (TSX-V: NIM).

Disclosures: The content of this interview is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Nicola Mining, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Nicola Mining are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned stock options in Nicola Mining and the Company was an advertiser on [ER]. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic. [ER] may buy or sell shares in Nicola Mining and other advertising companies at any time.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)