It’s been well over a year since I’ve written about Skyharbour Resources (TSX-V: SYH) / (OTCQX: SYHBF). A string of bullish uranium sector news has failed to move the Company’s share price nearly as much as top-performing peers. At today’s C$0.44/shr. the enterprise value {market cap + debt – cash} = C$58M.

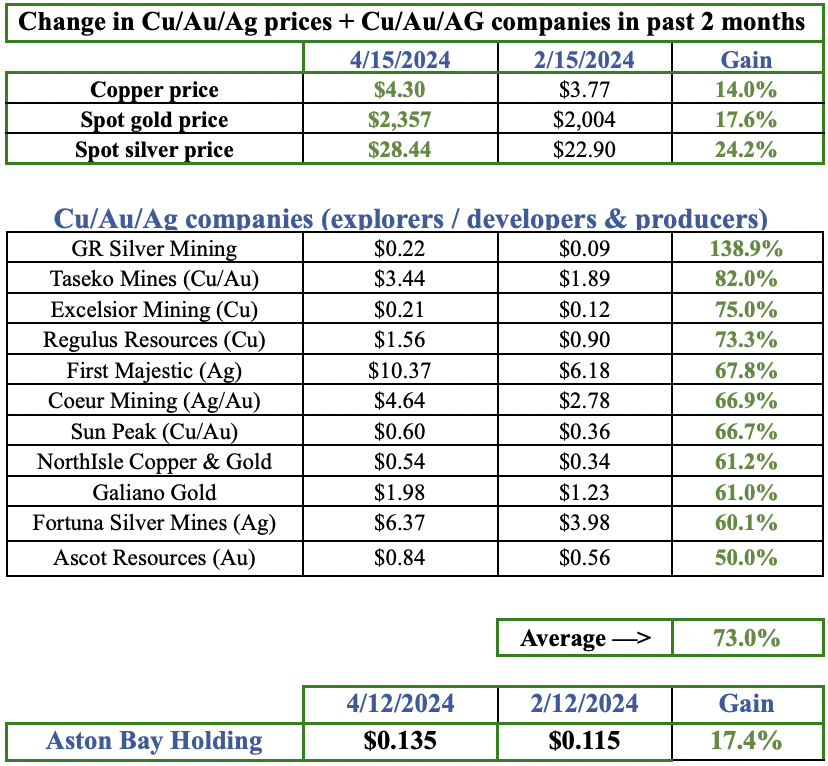

From 52-wk lows, the top-12 juniors have, on average, gained +454% [Jan. 26th]. By contrast, Skyharbour is up 52% even though it has delivered excellent news, {portfolio growth, strong drill results, farm-outs, JVs…}.

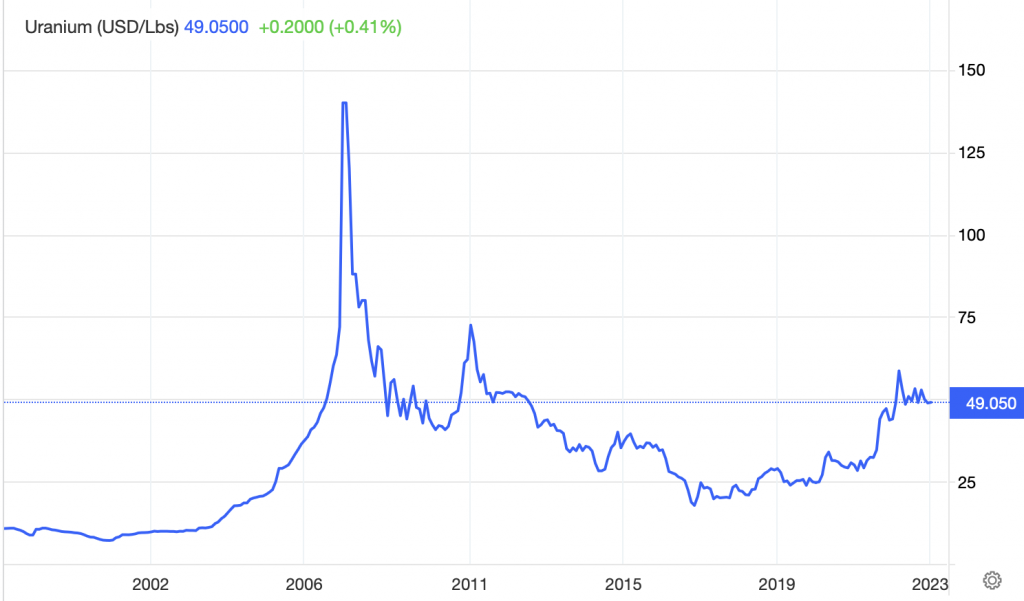

Since my last article, the world learned that inflation is still a thing. In looking at the long-term uranium price, it’s critical to consider inflation-adjusted levels, not necessarily as a predictor of what’s to come, but as a frame of reference.

The all-time (nominal) high for uranium was ~$138/lb. in mid-2007, which adjusted for inflation would be ~$200/lb. today. Does that mean prices will quadruple? Probably not, I certainly wouldn’t base investment decisions on that.

Even if one believes that 2007 was an aberration, consider the more recent inflation-adj. level of ~$98/lb. in 2011, a level taken down by Japan’s Fukushima accident.

Prices for uranium conversion & enrichment services more than doubled in 2022. Some say uranium prices are poised to soar this year. Several commodities are off to the races {nickel, silver, zinc, aluminum, copper}. Is uranium next?

Five years ago the “incentive price” to fund/permit/construct new uranium projects was $60/lb. According to S&P Global Market Intelligence, that level is more like $70-75/lb. now. Developer Bannerman Energy recently said that $80/lb. is needed.

Prices seem destined to rise, the question is how soon and how far. TradeTech & UxC forecast levels reaching $70-$80/lb. by 2027. I believe $80/lb. is possible next year. CEO Jordan Trimble thinks it could happen this year.

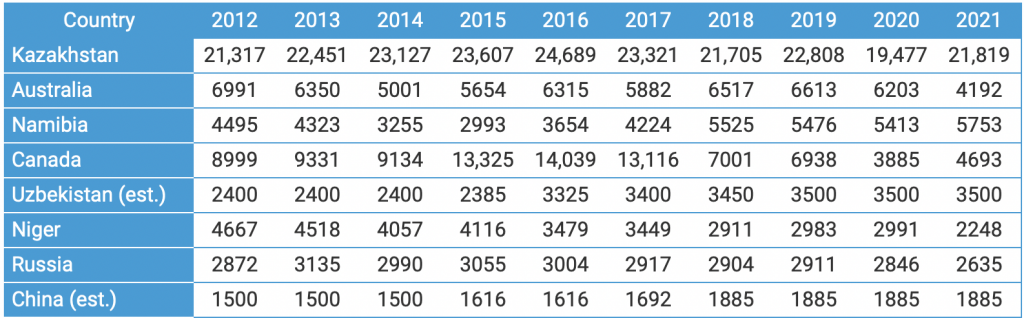

There’s been a lot of talk about the urgent need to “onshore” N. American production for national security. Look below at the top uranium producing countries. How many can be relied upon for long-term supply?

Uranium mines operate in 20 countries, with about half of the world’s production coming from just 10 mines in 6 countries; Kazakhstan, Canada, Australia, Namibia, Uzbekistan & Niger. What could possibly go wrong?

According to World Nuclear Association data, China has a proposed 156 nuclear reactors under consideration, yet India has just 28. This doesn’t add up, India’s population is the same as China’s at 1.4 billion.

China’s GDP is 5x India’s, leaving India no choice but to massively scale up its nuclear fleet to shrink the GDP gap. China & India hold 35% of the world’s population, yet only 5% of China’s & 3% of India’s electricity emanates from nuclear reactors.

Compare that to France at 69%, Belgium 51%, Sweden 31%, S. Korea 28%, and the U.S. at 20%.

The former Soviet republic of Kazakhstan has close economic ties to Russia and shares a 4,750 mile border. If Putin demanded that it halt uranium exports to the U.S./Europe, Kazakhstan would have difficulty denying that request!

Supply is highly uncertain, leading to a bifurcated market of East vs. West, (great news for Canada). What about the demand side?

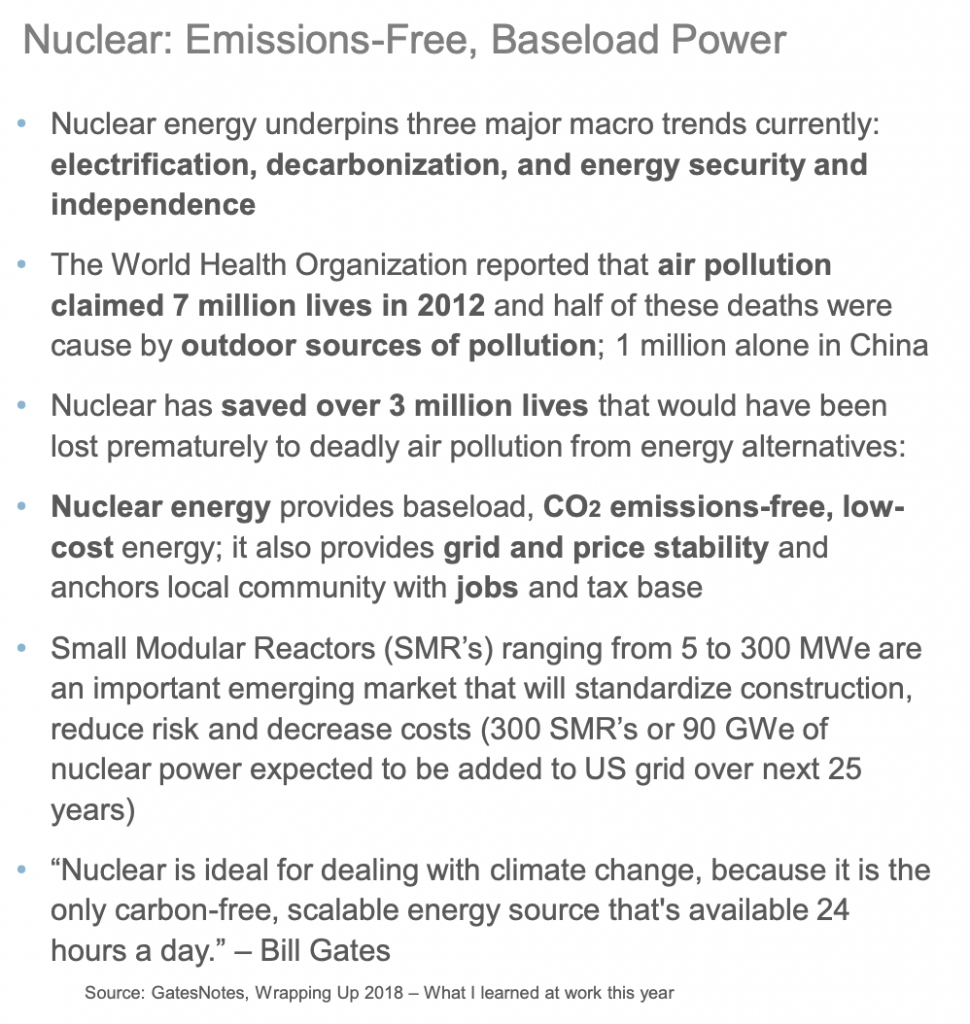

Demand remains strong, underpinned by 1) global energy security & affordability, 2) the electrification of transportation, and 3) green energy initiatives. Few critical materials are as urgently needed as uranium to support all three of these paradigm shifts.

“The West” is finally waking up. The U.S. government signed multi-year contracts with U.S. producers UEC & Energy Fuels at a +20% premium to market.

Long-term demand is coming from China & India, and soon also from Small Modular Reactors (“SMRs”) + [micro-reactors].

SMRs are a crucial part of uranium’s future. They should boost uranium demand from the 2030s on, especially as newly commissioned reactors require extra uranium in their initial years.

SMRs greatly expand the universe of potential users. They can be deployed in more remote locations, powering smaller population centers and can be used in industrial & military energy/power settings. Imagine micro-reactors powering giga-battery factories.

In a world where security of uranium supply is more important than the price paid, Canada is extremely important and well positioned to meet growing U.S. demand.

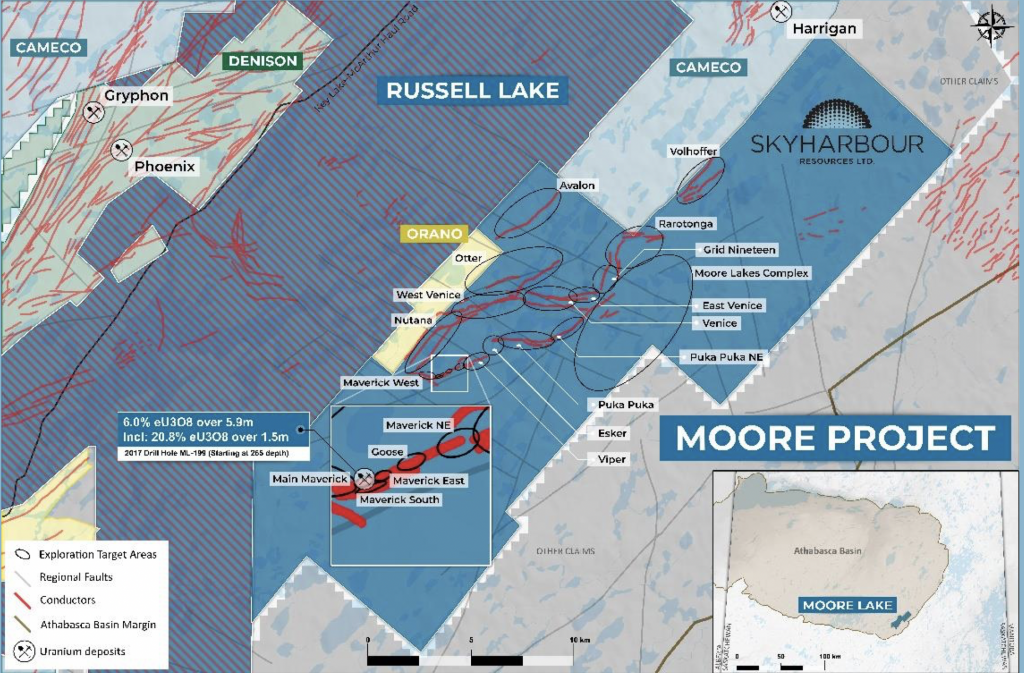

Since 2016 management, the board & advisors have been working hard on the 100%-owned, 35,705 hectare Moore Lake (“ML“) project in the eastern part of the Athabasca Basin. ML has had roughly C$50M invested into it, incl. 140,000 meters of drilling.

ML continues to show promise with high-grade hits extending into the basement rocks. The best results to date; 4.03% eU3O8 over 10 m, incl. 20.8% eU3O8 over 1.5 m, another interval of 9.12% U3O8 over 1.4 m and 5.29% over 2.5 m.

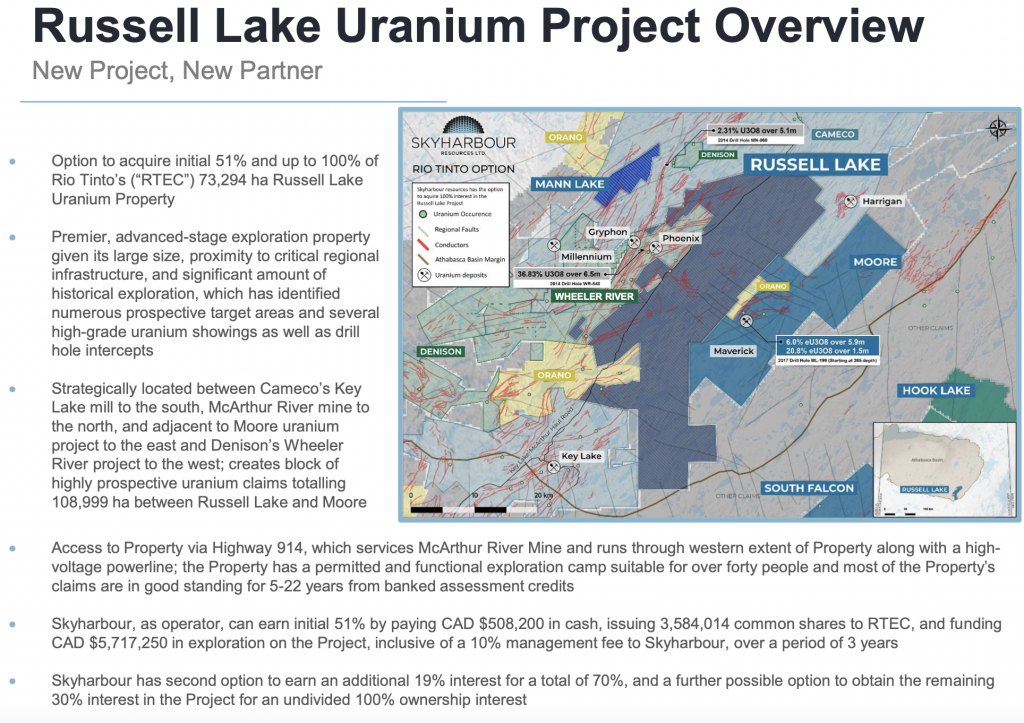

Complimenting, enhancing & expanding upon the ML opportunity is an earn-in agreement to acquire 51%, then 70%, and up to 100% of Rio Tinto’s 73,294 ha Russell Lake project. Russell has been the subject of significant historic exploration, with over 95,000 meters of drilling.

Adjusted for inflation, I estimate that upwards of a combined C$100M has been spent on the ML & Russell projects. As significant as that figure is, the number of years it would take to replicate that work is considerable as well.

Management is focusing the majority of its largest ever drill program at Russell. If meaningful discoveries are made at Russell or ML, that would draw a lot of attention to the story. Either as satellite deposits for a nearby mill or a standalone mine — sizable high-grade endowments would be mined.

Satellite deposits near mills can be quite valuable. Substantial costs are avoided and years saved by not building/permitting a mill & tailings facility. That’s why Skyharbour’s enterprise value {market cap + debt – cash} is so attractive at just C$58M.

Or an acquirer could take out Russell & ML, leaving shareholders with the remaining portfolio assets. Readers are reminded that two of the most successful juniors in the entire basin (IsoEnergy & Fission 3.0) are the result of spinouts.

ML & Russell could be even more attractive if they’re amenable to ISR mining methods. After years of work, Denison Mines made ISR an integral part of Wheeler River’s flow sheet. Wheeler will be the first major project in the Basin to use lower-cost, less intrusive ISR techniques.

The combined footprint of ML & Russell is roughly 8x Wheeler River’s approx. 12,000 hectares. Wheeler has booked 135M Indicated + Inferred pounds of uranium (so far) on those 12,000 ha.

Therefore, ML & Russell have ample room for new discoveries, potentially hosting a combination of ISR and/or conventional hard rock mining deposits like Wheeler River.

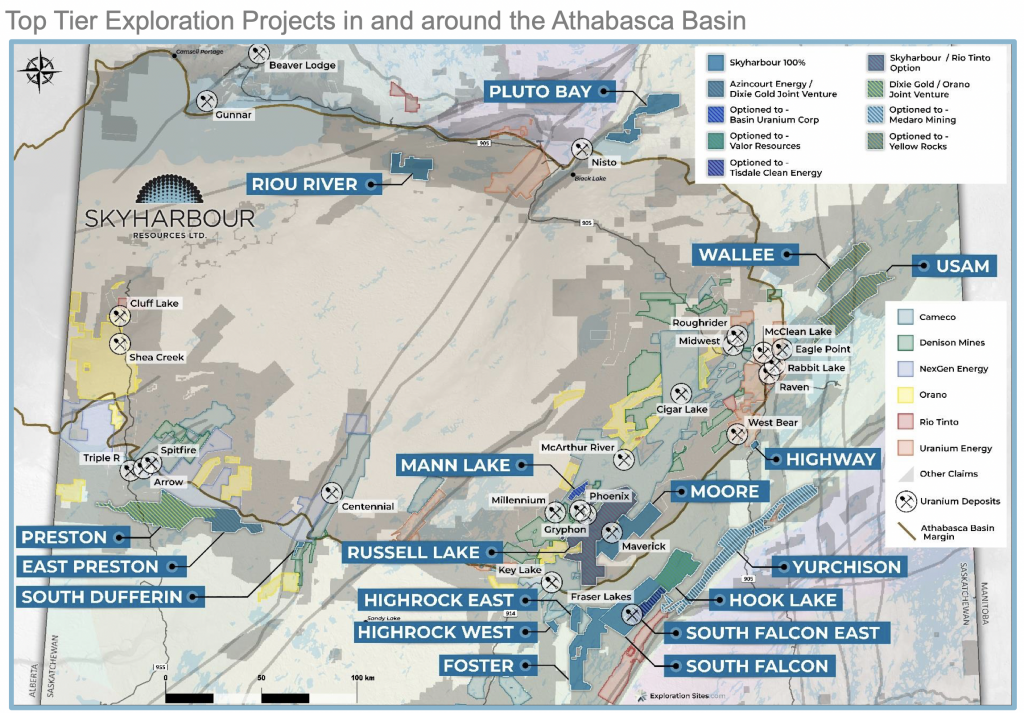

As exciting as the expanded ML/Russell project footprint is, Skyharbour owns/controls 16 other properties/projects in its project generator portfolio. Some are moderately advanced exploration plays.

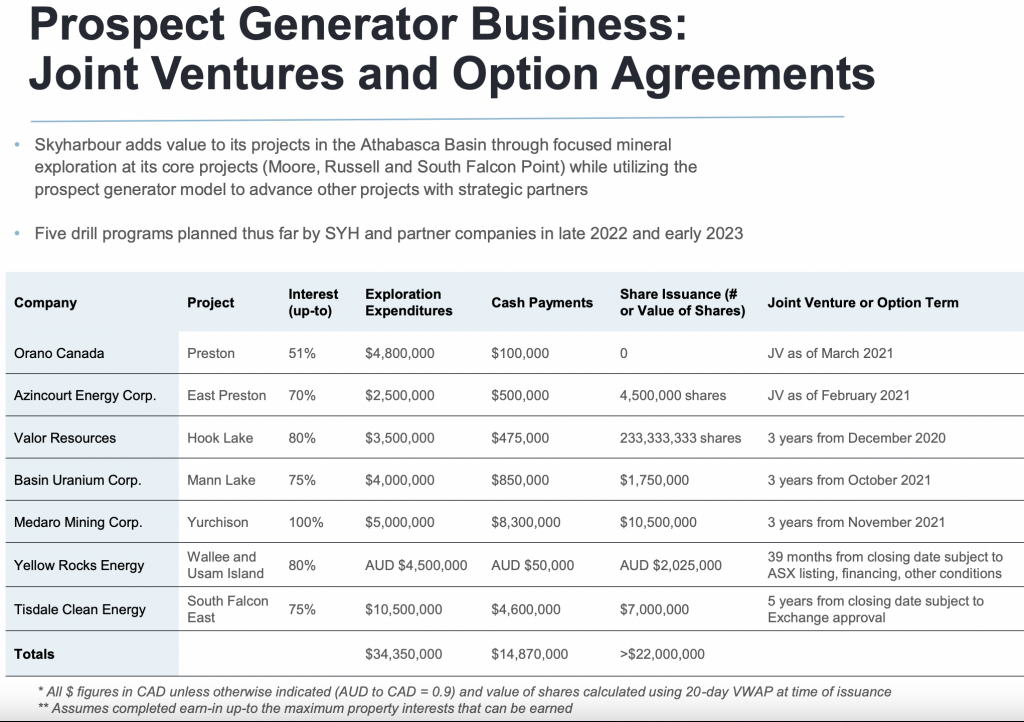

In the image below, notice that the Company has partnered with seven companies that (combined) need to deliver a total of $70M (over several years) in exploration, cash payments + share issuances. Compare that $70M to the Company’s $58M valuation.

How much might those seven JVs/farm-out agreements be worth? It’s hard to say, but arguably a lot more than when the uranium price was at $30/lb. vs.today’s $50/lb. Now imagine what the portfolio would be worth at $80/lb.

In a bull market, Skyharbour’s partners will be able to fund, explore & develop projects faster. That means more discoveries and higher share prices all around.

I’m tracking ~100 uranium juniors listed in Canada, the U.S & Australia. There are 400+ lithium juniors. If the uranium price makes a decisive move higher, many uranium juniors soar.

Skyharbour Resources (TSX-v: SYH) / (OTCQX: SYHBF) is attractively valued (C$58M) with two ‘co-flagship’, high-grade projects benefiting from up to C$100M (in today’s dollars) already invested.

In addition are 16 properties/projects with C$70M of work commitments, cash payments & share issuances tied to them. In the early days of a bull market, the best place to be is in high risk/high reward names like Skyharbour.

Disclosures / Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Skyharbour Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Skyharbour Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Skyharbour Resources is an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)