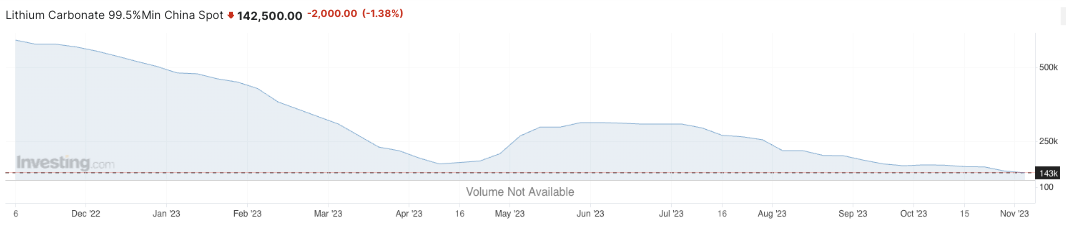

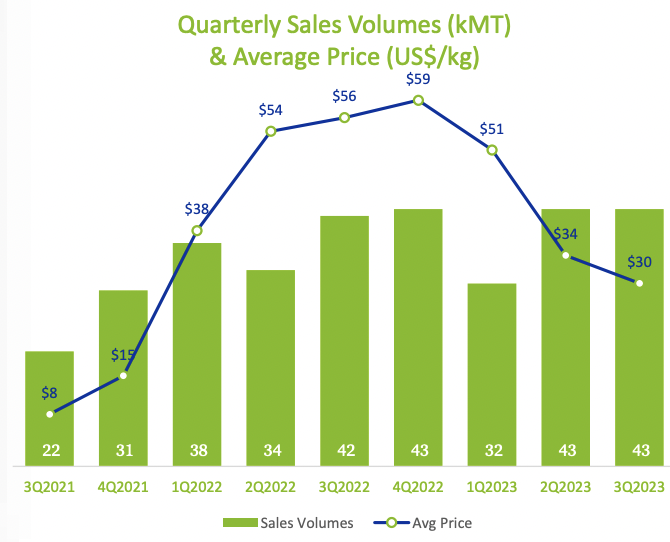

Investors in lithium companies are watching this chart of the battery-quality lithium carbonate spot price [in China] closely. It’s down from 597,500 Chinese yuan/tonne to 142,500 yuan/t (US$19,650/t). However, more representative of the overall market is the quarterly contract price achieved by companies like SQM.

Spot prices, negative commentary from analysts, weak operating results from SQM, Albemarle & Livent and sluggishness in EV sales, has caused major sell-offs in the shares of lithium companies.

Force yourself to look at that above chart once again, an unmitigated disaster, right? But wait… Look at this next chart of SQM’s quarterly contract settlements, not nearly as scary, right?

The average op-ex embedded in recent reports of projects looking to produce hydroxide of carbonate is ~$7k/t. Compare that to the current spot price of ~$19k/t and SQM’s 3rd qtr. avg. of $30k/t. Are lithium prices truly collapsing? In my view, no.

For readers fearing contract prices are headed back to $15k/t for much of 2024/25, lithium stocks are not be for you. Without a lengthly discussion on pricing, consider that today’s pricing enables automakers (like Tesla) to meaningfully lower EV price tags to grab market share from gas-powered cars.

Lower EV prices = more demand, leading to higher lithium prices.

Howard Klein & Rodney Hooper of RK Equity point out that growth in large stationary energy storage systems (“ESS“) is underestimated in analyst models. And, easing prices will boost the sales of ESS systems at the expense of competing technologies such as vanadium-based systems.

Lower prices also increase the number of end uses for Li-ion batteries, making the switch to battery chemistries like sodium-ion, far less urgent. Bottom line: lithium prices are healthy at today’s levels.

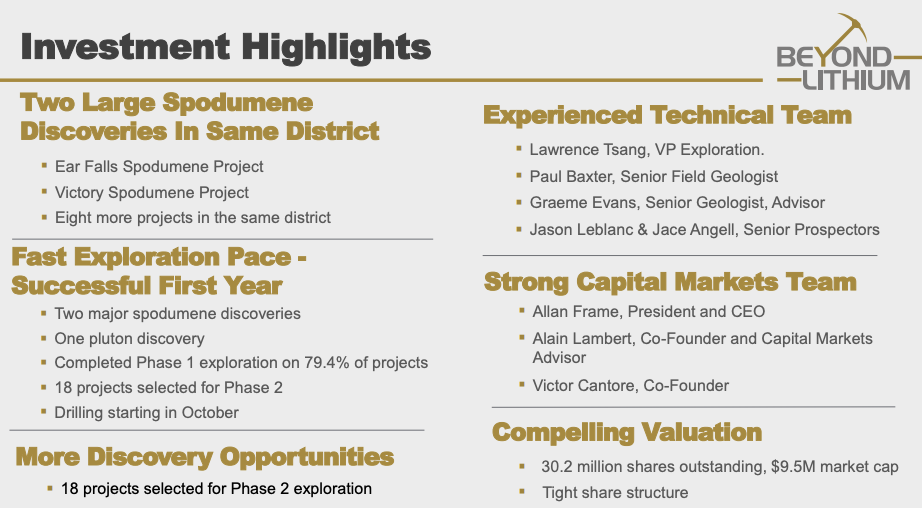

The next 12 months could be great for attractively valued companies with multiple projects in strong jurisdictions, led by experienced management teams. Beyond Lithium (CSE: BY) / (OTCQB: BYDMF) checks those boxes.

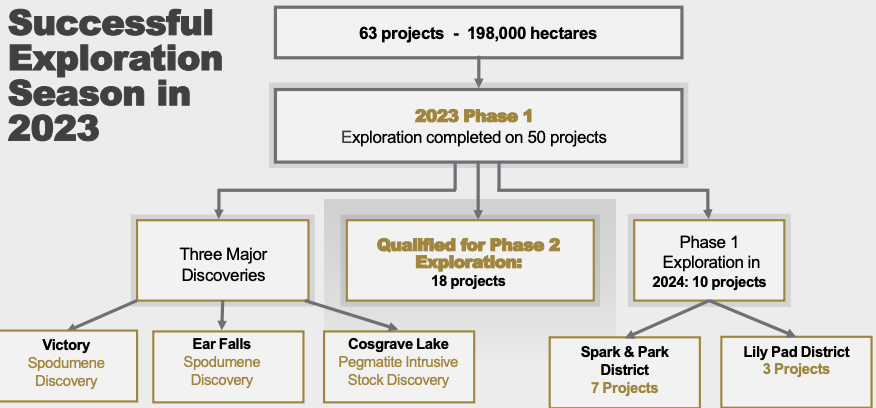

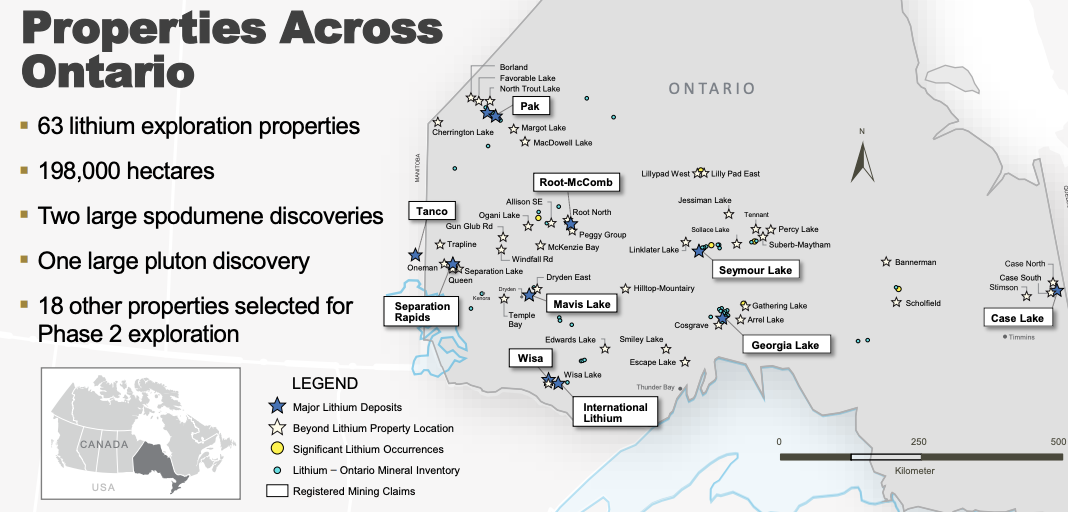

On a tight budget, and with only ~33M shares outstanding (incl. today’s announced closing), management has amassed ~198,000 hectares in Ontario, Canada. Having a huge number of early-stage properties means little unless skilled geologists are conducting old-fashioned fieldwork to move the best prospects forward.

Beyond is well on its way on at least three exciting projects. Today it announced the closing of a well oversubscribed capital raise for ~$900k, enough to keep the team busy into 2024. I love it that management is so prudent with regard to equity dilution. Turning to today’s press release, CEO Frame is quoted,

“We are awaiting assays from over 500 rock & channel samples and 240 drill core samples, 70% of which come from our Victory, Ear Falls & Cosgrave projects. These results, expected shortly, will help guide our upcoming drill campaign at our Victory & Ear Falls spodumene projects. They will also give us an indication of the next steps at Cosgrave.”

That’s right, drill core samples, management has already drilled seven short holes. Instead of having 1 or 2 stalled projects, like so many juniors these days, Beyond has three advancing rapidly.

A total of 18 properties (and counting) had boots-on-the-ground exploration done by seasoned field crews, and have graduated to Phase 2.

Beyond’s 18 projects are more advanced than most of the hectares listed in peer company presentations. I’m tracking 230 companies with at least one lithium property in Canada. Fewer than 40 have announced a single drill hole assay. As promised, Beyond will soon have drill results and is starting a second drill program soon.

With 230 companies, why so few actual drill results? There’s a lack of; permits, experienced exploration personnel, funding, drills teams/drills. Beyond lacks none of these! That’s why many early-stage juniors are down 70%+ from 52-week highs — more than two dozen fallen angels from my list have plummeted > 80%.

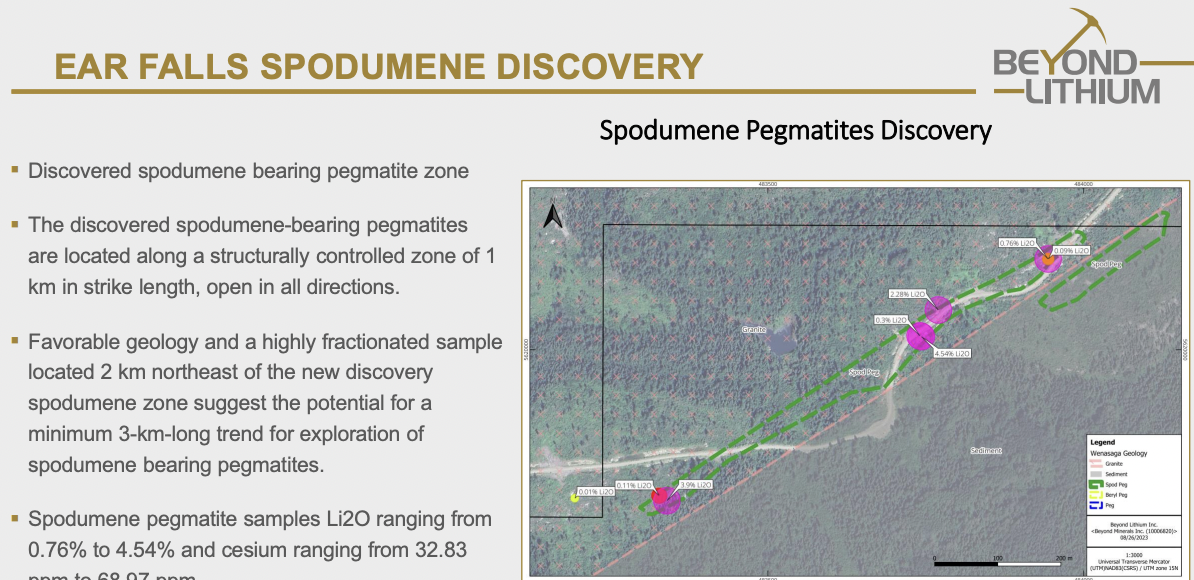

Management discovered a new spodumene-bearing pegmatite zone on its 206 sq. km Ear Falls project. Initial grab samples assayed up to 4.54% Li2O, plus two others averaging 3.09% Li2O, and a minimum 3-km long prospective trend was identified. Post discovery, management expanded the Ear Falls project from 3,375 to 20,623 hectares.

Like many of the Company’s prospects, Ear Falls has good access key infrastructure, including highway & logging roads, rail, power lines, services & labor. Two of the most important projects (so far) are Ear Falls & Victory.

At Victory there’s spodumene mineralization of up to 50% of the pegmatites in certain areas. The project has a 6 km long structural corridor open to discoveries of similar-sized spodumene pegmatites. Over 140 mapped pegmatites were logged by the Ontario Geological Survey.

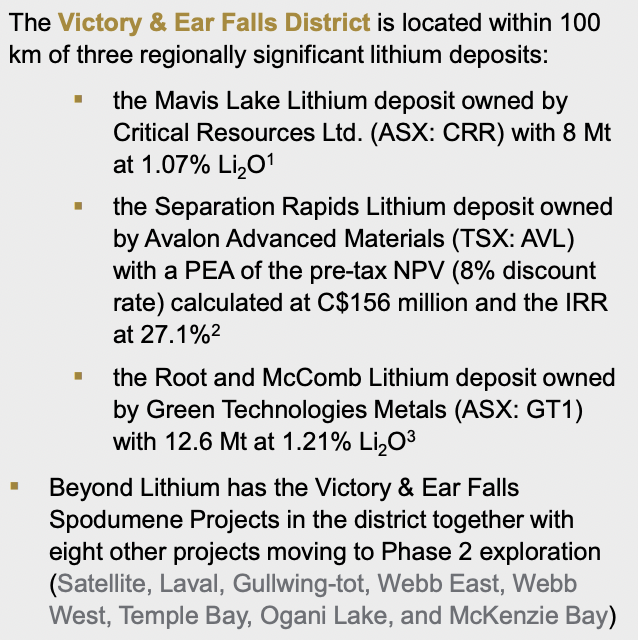

Victory hosts at least two large spodumene bearing pegmatites measured over 40 to 50 meters in width and 200 to 300 meters along strike. Both Victory and Ear Falls are within 100 km of promising projects owned by Critical Resources, Avalon Advanced Materials & Green Technology Metals.

Cosgrave’s Allen Graeme Pluton is > 320 hectares in size, and a source of LCT fractionation & mineralization. This high-profile target was expanded to 9,424 hectares in total. Phase 2 work to date has mapped an additional of 55 new pegmatites and collected 71 more samples.

Beyond is earlier stage than companies like Green Technology Metals, Brunswick Exploration, Avalon, Critical Resources and Power Metals, but those five pre-PEA companies have an average valuation of ~$86M. Brunswick & Power Metals are still pre-maiden resource estimate.

I believe that after next year’s drill results, Beyond will be at a similar Pre-PEA stage as some of those companies are today and on its way to delivering maiden resources on multiple projects.

Of the 230 companies I’m tracking, less than 5% have had as many impactful discoveries and developments in such a short period of time.

Given all the work done, several projects (not necessarily Cosgrave, Victory or Ear Falls, which may be retained 100%) should be quite attractive to companies wanting to establish footprints, or expand, in Ontario. Management is ramping up efforts to find partners to provide non-dilutive capital for the Company.

Instead of picking through companies that have crashed below $0.10/shr., readers are encouraged to take a closer look at Beyond Lithium. Despite impressive share price outperformance, the Company’s enterprise value {market cap + debt – cash} is only ~$11M.

Instead of waiting months between press releases, choose a company with 500 rock chip/channel samples in the lab and a second drill program starting this month. Stick with a team that has delivered strong results to date, on time & on budget.

Beyond Lithium is executing well beyond my expectations, especially compared to lithium junior peers with prospects in Canada. News flow will continue to be strong for many months to come — drill results, new discoveries (possibly), farming out projects to lower cash burn.

With an enterprise value of just C$11M ($0.39/shr.) it would not take that many farm out transactions to bring cash burn close to zero. That way management could focus entirely on 2-3 exciting projects and have millions of dollars per year of exploration & development work done — at no cost to the Company — on a handful of others.

I’m not sure which companies management is in discussions with, but it they could land a partner like Australia’s Winsome Resources or Green Technology Metals, or Canada’s Lithium Royalty Corp. or Li-FT Power, the share price could be off to the races.

I strongly continue to believe that Beyond Lithium (CES: BY) / (OTCQB: BYDMF) offers a compelling risk/reward proposition.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)