Unless indicated otherwise, all $ figures are C$. Metal prices are US$.

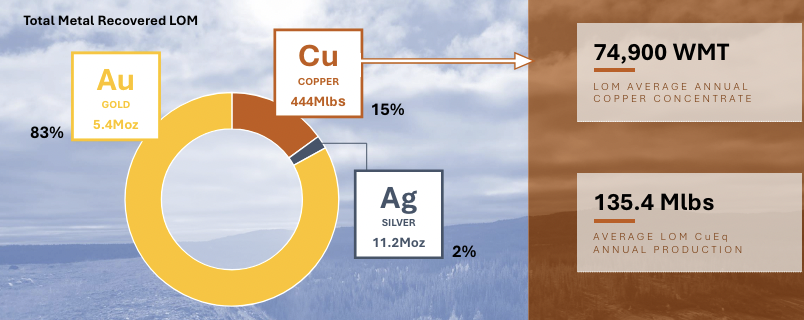

I’ve been watching Troilus Gold (TSX: TLG) / (OTCQX: CHXMF) for years as it continued to find more Gold (“Au“) & Copper (“Cu“) + some Silver (“Ag“). The Company is sitting on an impressive resource of 13M Au Eq. ounces, of which 86% is in the NI 43-101 Indicated category.

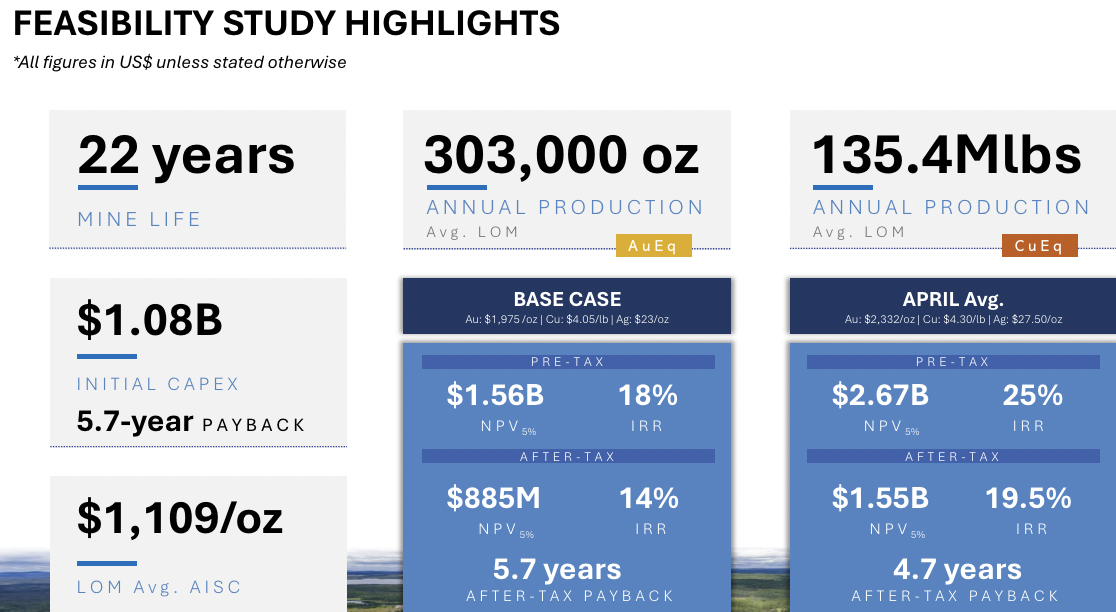

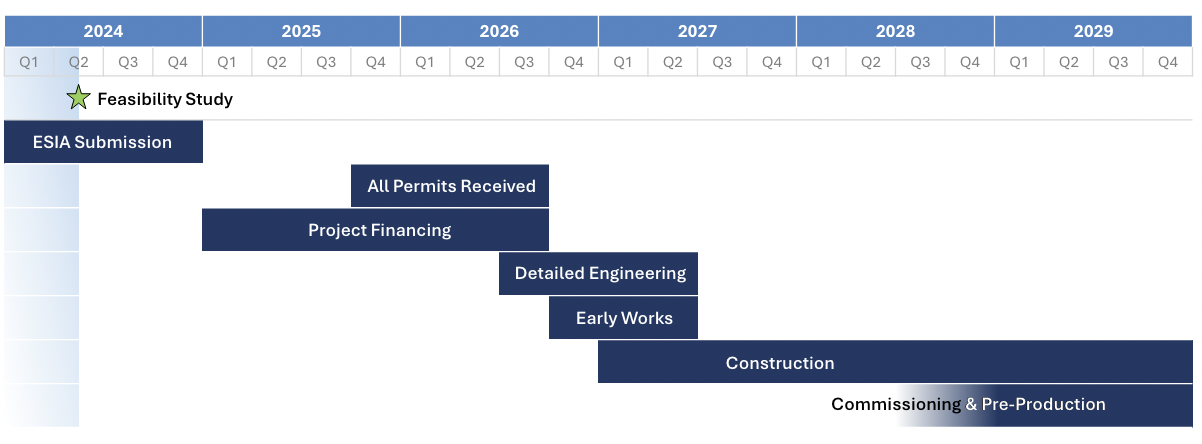

On May 14th, a summary of the much anticipated Bank Feasibility Study (“BFS“) was released on Troilus’ very large, bulk-tonnage Au/Cu project in Quebec. To say the market did not like cap-ex of $1.471B relative to the after-tax NPV(5%) of $1.212B, resulting in a 14% IRR at US$1,975/oz. Au, would be an understatement.

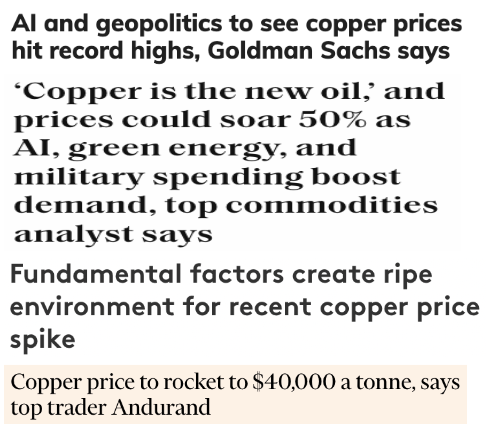

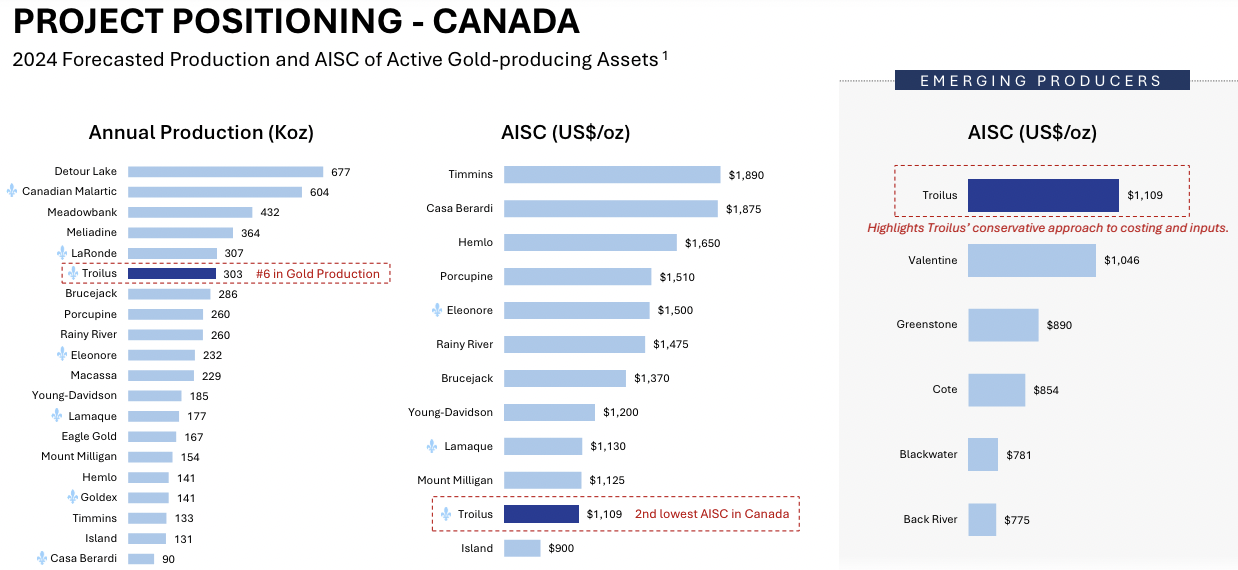

The fact that spot prices on May 29th of $2,340/oz. Au, $4.80/lb. Cu & $32.00/oz. Ag would generate a $2.25B after-tax NPV & 20.1% IRR does not matter (for now). Since mid-May, the share price is down -42%. On a more positive note, all-in-sustainable-cost (“AISC“), net of Cu/Ag credits, came in at an attractive $1,109/oz.

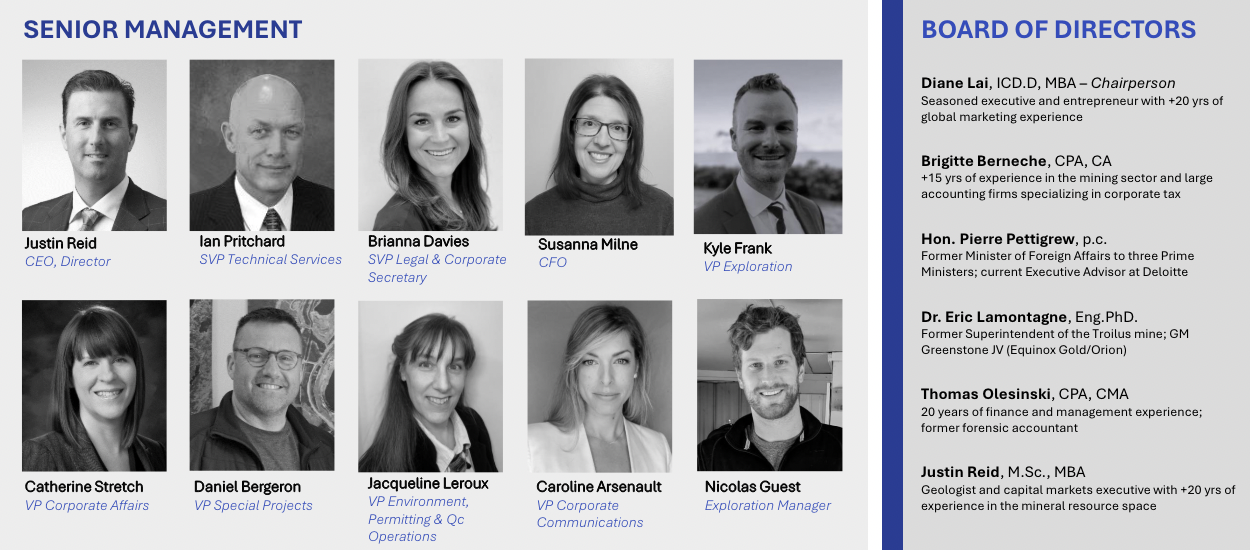

Unhappy investors should consider taking a step back to acknowledge that delivering a BFS is a significant de-risking event. CEO Justin Reid continues to say that interest from Majors, mid-tier producers, smelters & commodity traders is high. Please see {New Corp. Presentation}.

Given the choice between a very large, low technical risk, BFS-stage project in Quebec, or a smaller PEA-stage project elsewhere, with a higher IRR, which might a Major choose? Time is money, especially with Au ~$2,300/oz.

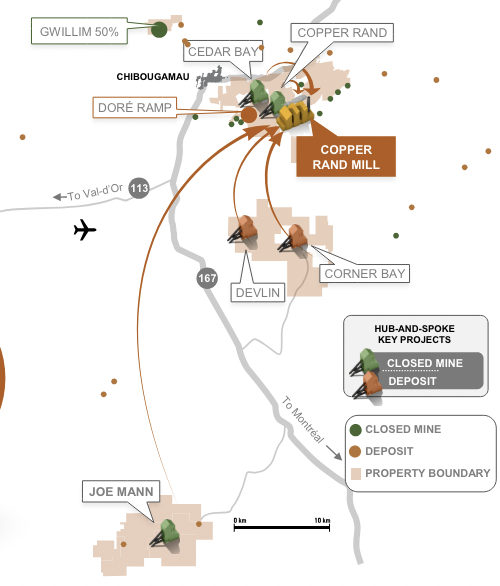

Quebec’s ranking in the latest annual Fraser Institute of Mining Survey improved considerably from 8th best of 64 jurisdictions (top 13%) to #5 of 86 (top 6%). Readers are reminded that the Troilus project is a brownfield prospect. There’s an estimated $657M of in-place infrastructure.

On May 30th, management announced a newly discovered “West Rim” zone highlighted by an intercept of 1.37 g/t Au Eq. over 11 m starting at 21 meters downhole. In addition, 10.3 g/t Au Eq. over 1.0 m, and 0.8 g/t over 30 m, {incl. 13.8 g/t over a meter}, was intersected in the X22 zone.

This is important as it is outside the mineralized footprint, up to 200 m from the Reserve Pit, and the continuity of the X22 zone’s mineralization is now confirmed to a depth of at least 550 meters. CEO Reid commented,

“After 5 years of systematic exploration, we are still making significant discoveries… The West Rim target is a testament to the prospectivity and opportunity within close proximity to the Troilus project’s mineral reserve pits defined in the recent Bank Feasibility Study.”

Not many BFS-stage juniors in safe jurisdictions can potentially produce 300K+ Au Eq. ounces/yr. for 20+ years. Troilus has booked 13.0M Indicated & Inferred Au Eq. ounces (86% Indicated). Globally, only ~6 junior-controlled, pre-production (BFS-stage) projects have 6M+ ounces.

In speaking with Mr. Reid, he firmly believes the vast majority of Top-10 shareholders have NOT been selling, and that some are adding to their positions. The exodus of retail investors explains most of the selloff. Mr. Reid acknowledges that communication leading to the BFS announcement could have been better.

Recently, Reid has done two video interviews (not counting the one on May 14th). He notes that some investors continued to focus heavily on the PEA’s strong economics even though the flow sheet changed dramatically from an open-pit / underground mine to an open-pit-only operation, (lower-grade / lower IRR).

In my view, shareholders’ biggest risk is equity dilution, not the rule of law, water challenges, regional infrastructure, local opposition, a complex flow sheet, etc. I believe institutions in Quebec that have funded & championed numerous natural resource projects, including groups already supporting Troilus, will stand by the Company.

In this article, I look forward from a share price of $0.38, not backward. I will not exonerate the team — mistakes in managing expectations were made — but I won’t crucify them (mine development cost inflation is an industry-wide problem).

I aim to assess whether the Company’s enterprise value {market cap incl. RSUs + debt – cash} at ~$100M, is attractive relative to future equity dilution and the serious risks the Company still faces in achieving commercial production. Please see {New Corp. Presentation}.

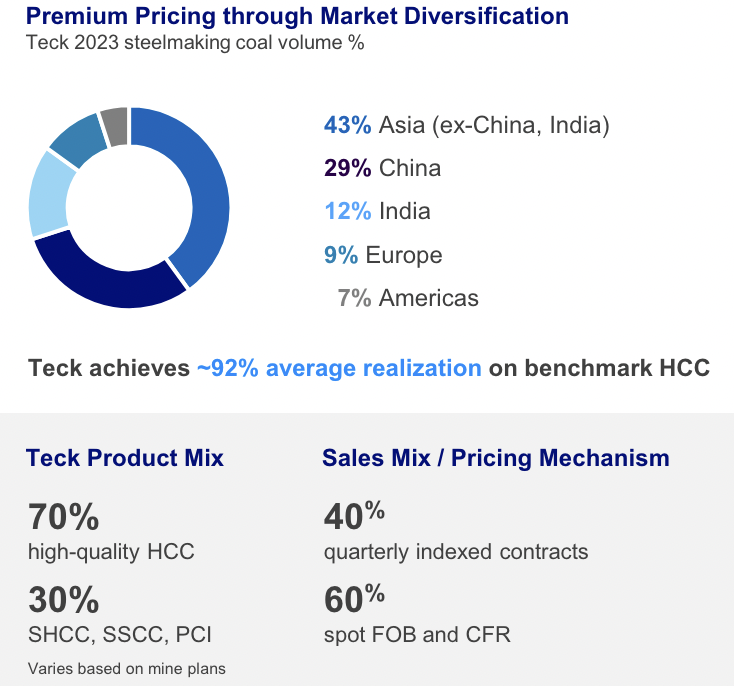

Securing a partner like; Agnico Eagle, Newmont, Barrick, Freeport McMoRan, Rio Tinto, Glencore, Teck Resources, Sumitomo, Gold Fields, Kinross Gold, AngloGold Ashanti, Alamos Gold, Boliden AB, Eldorado Gold, IamGold, Evolution Mining, Lundin Gold or HudBay Minerals, would alleviate some concerns.

Might a giant royalty/streaming company like Wheaton Precious Metals, Franco-Nevada or Royal Gold be interested in a direct investment in Troilus?

Discussions are well underway with multiple groups. A few negotiations are described as fairly advanced. The goal is to secure a partner this year. Although one or more equity raises will probably be necessary, in my view there’s no dire need to raise cash immediately as the Company has ~$13M + $3M more in accounts receivable.

If management could fund 60% of the $1.471B cap-ex burden with debt, (far from a sure thing) that would leave $588M of unfunded cap-ex. Then, if half of the Troilus project could be sold for half of its NPV-implied valuation, [50% of 50% of $1.212B], that would be $303M –> enough to cover the Company’s 50% share of cap-ex (post debt package), [$588M x 50% = $294M].

That’s a straightforward way to potentially resolve funding, but shareholders would have 50% of the project. Still, 50% of the after-tax NPV = $606M, compared to the current enterprise value of ~$100M. To be safe, selling a royalty/stream on the project’s Ag production probably makes sense. CEO Reid has said that option could raise US$80-$100M.

Assuming the Ag is sold for US$80M = C$110M, and a strategic partner is secured, and debt funding can be arranged, the amount of equity required over the next 12 months could be less than feared.

Troilus has an ace in the hole in the form of a Cu royalty/stream opportunity that is worth more than the Ag. However, selling a Cu royalty/stream upfront would hurt the NPV & IRR, so it might not be pursued as a first choice.

Why does management believe that funding the project is comfortably achievable? First & foremost, they are receiving inbound indications of interest for debt & equity commitments and phone calls from prospective strategic investors.

Think about it, the balance sheets of Majors are so strong (and getting stronger) that funding acquisitions & buildouts of globally significant assets is not a constraint. Majors need larger & larger mines to move the needle. As cap-ex & AISCs are on the rise, producers are driven to buy vs. build.

I believe at least 18 companies (not including Chinese groups) could easily afford to acquire & build the Troilus project. For geopolitical reasons, I exclude Chinese suitors of Canadian prospects, but the Chinese are actively acquiring assets across Africa & S. America.

Therefore, competitive tension for giant N. American Au/Cu projects is growing. Majors need to replenish their pipelines. For example, in looking at Barrick’s annual report, it forecasts zero Au production growth between 2024 & 2033!

A tsunami of M&A is coming. Time is money. Readers are reminded that Troilus would be worth considerably more in a portfolio of assets than as a stand-alone mine. Majors enjoy significant economies of scale, operational expertise, access to capital, and can realize enhanced operating flexibility.

Imagine, the operating & economic synergies Agnico would gain by adding Troilus to its eastern Canada portfolio highlighted by Canadian Malartic & Detour Lake. Thirteen million Au Eq. ounces is a lot, even for Agnico.

Please note, management believes there is considerable exploration upside to the 13M ounce endowment.

The past two weeks have been painful for long-term Troilus Gold (TSX: TLG) / (OTCQX: CHXMF) shareholders, but I believe the risk/reward proposition at $0.38/shr. is compelling for those willing & able to hold on for the next 12 months.

Readers are reminded that as per the BFS, at $1,975/oz. Au, 50% of the project would be worth $606M. That’s 3x the current valuation of ~$100M. Will it be smooth sailing from here on out? No one knows, but probably not. However, today’s valuation arguably incorporates a lot of uncertainty. At $0.38, the Company is trading at just 8% of after-tax NPV.

Make no mistake, Troilus is a high-risk, high-return proposition, but what better time to take on incremental risk seeking outsized returns than in a robust bull market in Au, Cu & Ag?

Please see {New Corp. Presentation}.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Troilus Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Troilus Gold are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Troilus Gold was an advertiser on [ER] and Peter Epstein owned shares in the company purchased in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)