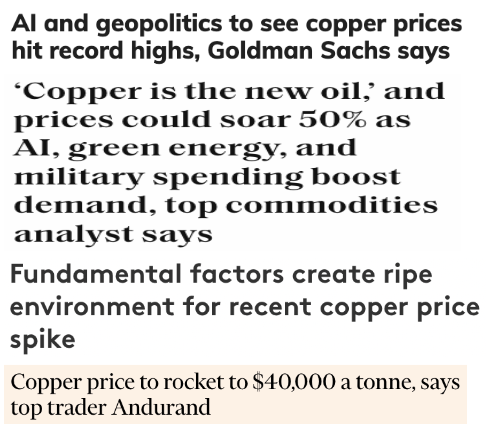

After hitting $5.20/lb. on May 20th, copper pulled back to a still attractive $4.54/lb. Will we see a $3 or a $5 handle next? I believe the price is headed higher, albeit not to US$40,000/t = $18.14/lb., anytime soon — as per“top trader Andurand.” Goldman Sachs is calling for a more realistic $6.80/lb. next year.

Copper (“Cu”) is indispensable for; decarbonization, EVs, renewable energy plants, grid expansions, the “Internet of Things,” data centers, Cloud/AI, supercomputing, robotics, crypto-currency mining, smart homes/cities, and more.

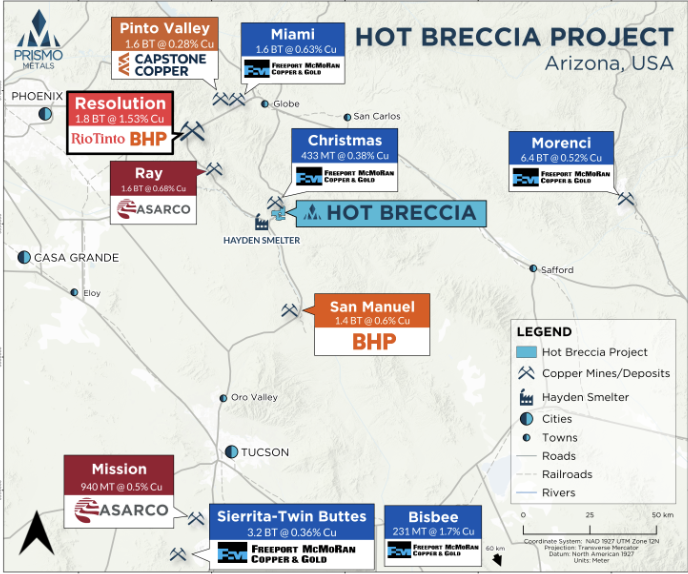

China, Russia, Kazakhstan & Zambia are among the world’s Top-10 Cu-producing countries. For geopolitical reasons, the West cannot continue to rely on countries like these. By far better choices for Cu to supply “the West” are Canada & the U.S.

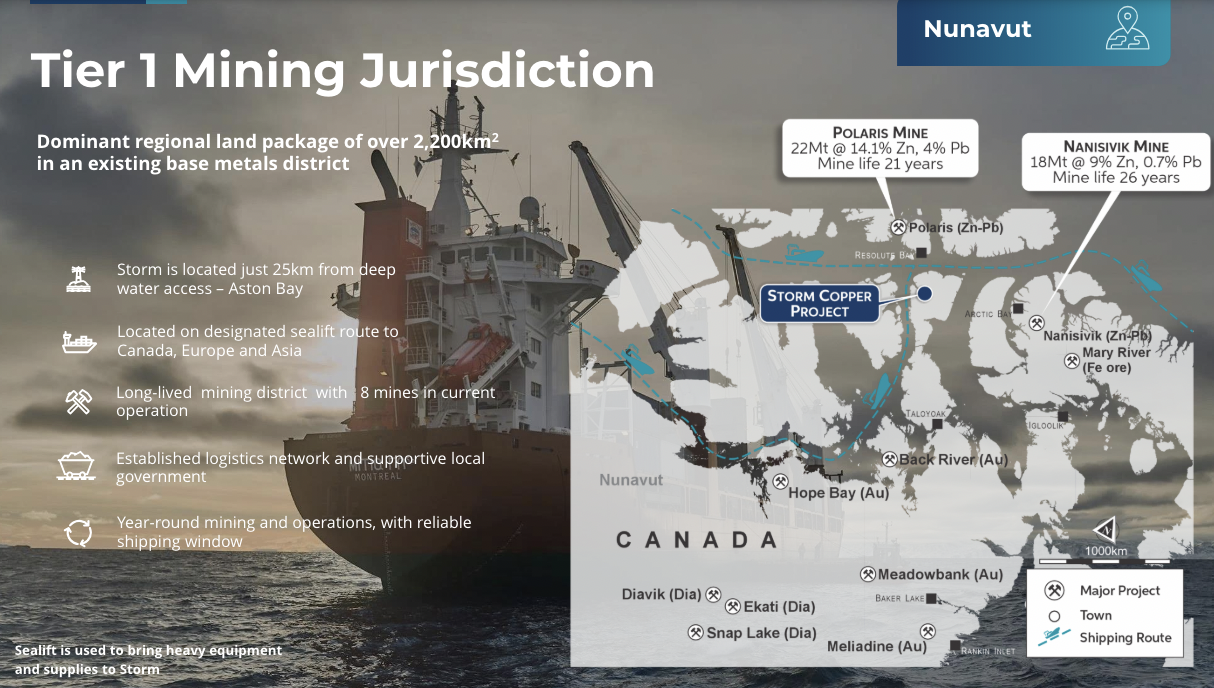

Aston Bay Holdings (TSX-v: BAY) / (OTC: ATBHF) is a favorite Cu play of mine, and it has a high-grade gold (“Au“) kicker. The Company has two potentially major projects in Nunavut, which is in northern Canada. The projects are high-grade, near-surface, and close to tidewater (somewhat mitigating their far north locations).

The Company has recently raised $3.5M in a tough market for junior miners. That cash, plus possibly $500k more in a final tranche to close the private placement later this month, will go a long way as Storm Copper is free-carried.

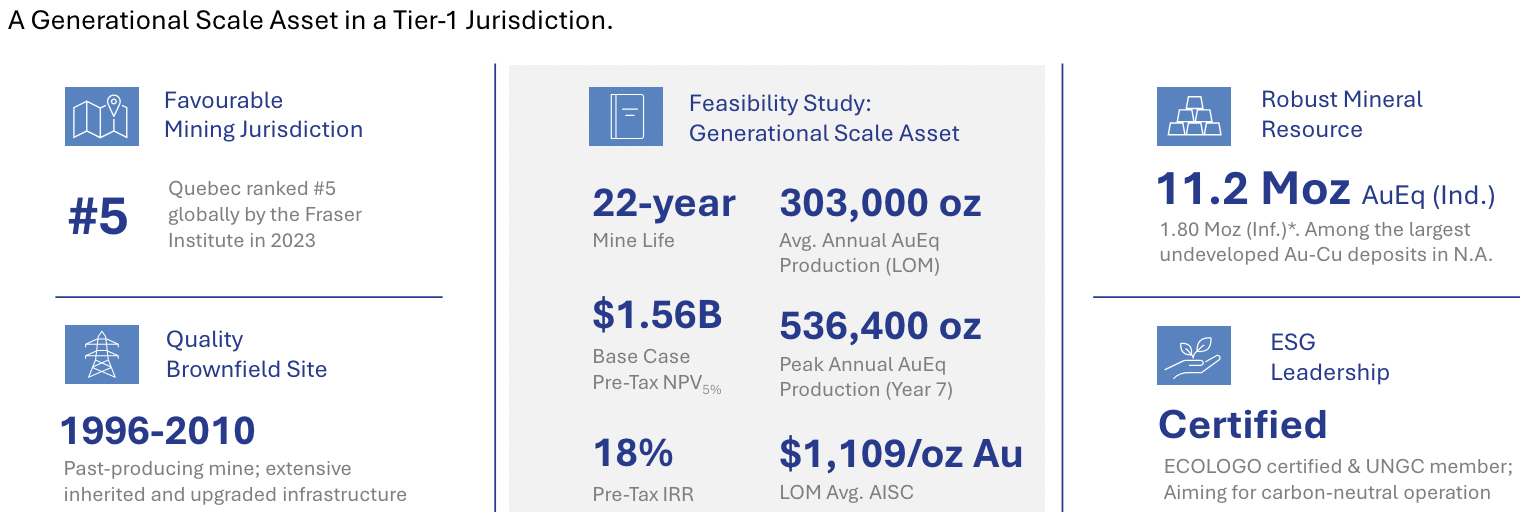

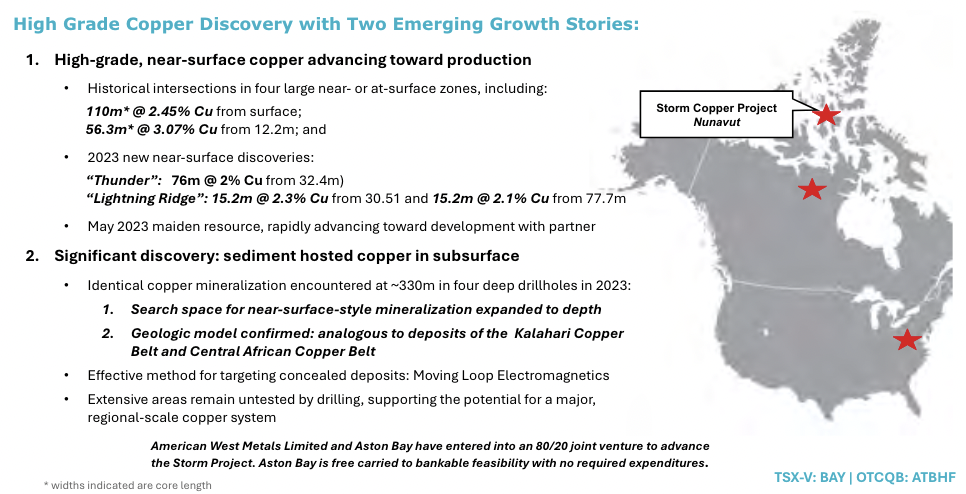

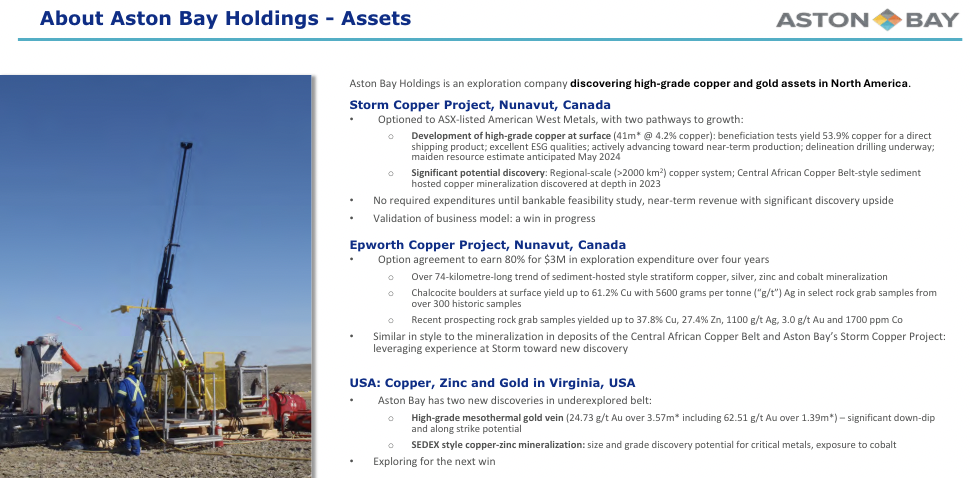

Storm Copper is the more advanced of the two with an Australian JORC-compliant 17.5M tonne Inferred maiden resource estimate at a formidable 1.2% Cu. Importantly, Aston’s 20% interest is free-carried (zero expenditures from Aston) through a Bank Feasibility Study (“BFS“).

Aston’s partner believes an open-pit project could be in production by 2027. In my opinion, Aston’s 20% free-carried interest could easily be worth twice the Company’s entire enterprise value {market cap + debt – cash} of [~$22.5M @ $0.105/shr.] (including the most recent shares issued).

And, that 20% interest could be worth a lot more if/when additional high-grade discoveries are made. While I believe more high-grade discoveries are coming, no one can know for sure.

Management is earning up to an 80% interest in the Epworth project, also in Nunavut. Both Storm & Epworth have been compared to giant high-grade projects in central Africa like Ivanhoe Mines’ Kamoa-Kakula complex in the DRC.

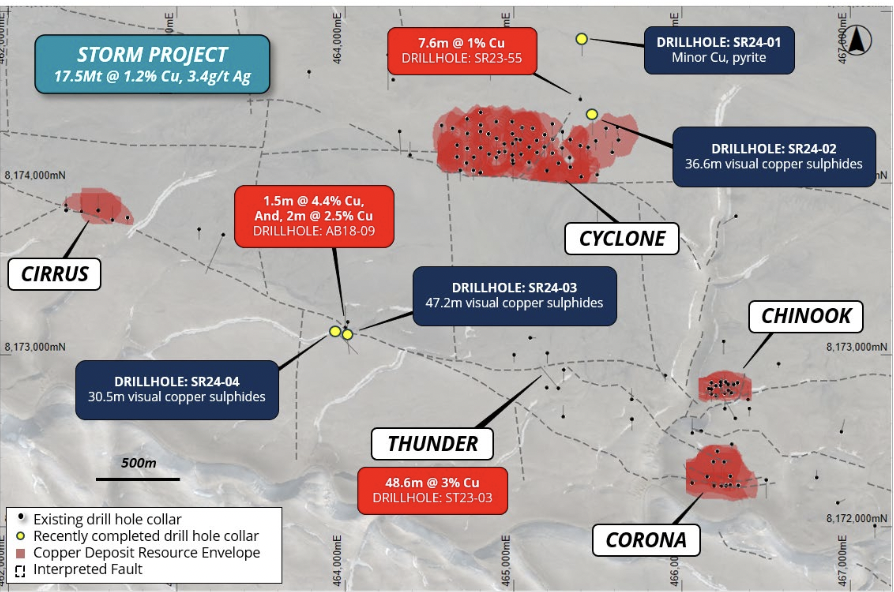

On May 21st, Aston’s 80% partner American West Metals reported three near-surface mineralized intervals of 30.5, 36.6 & 47.2 meters. Assays are pending, but a 10 m section of one hole was compared to Aston’s historical high-grade Cu sulfide interval of 48.6 m at 3% Cu.

Intersection depths & zoning of Cu sulfides indicate that mineralization in the gap area may be relatively flat-lying, with significant potential for lateral expansion.

The new holes are midway along 4 km of prospective structures between the Cirrus deposit and the high-grade Thunder prospect. Importantly, drill results continue to demonstrate a strong correlation between Moving Loop Electromagnetic (“MLEM“) targets and Cu mineralization.

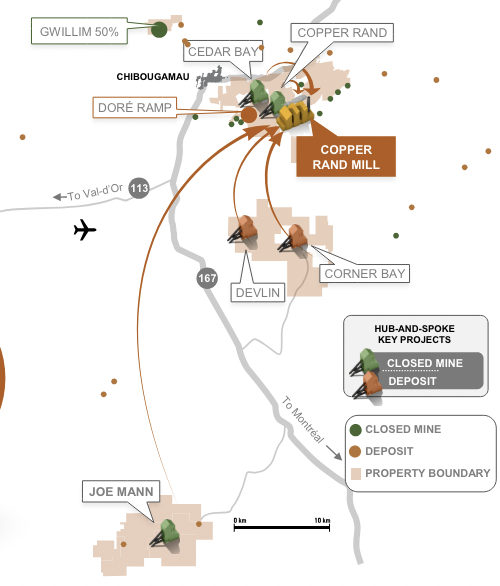

In the map below, look at the green-shaded areas — Cirrus, Cyclone, Chinook & Corona — making up the 17.5M tonnes of 1.2% Cu. (Note, 65% of the MRE is > 1.5% Cu, –> 3-5x the average grade of bulk tonnage deposits).

Compare them to the dotted-line blobs representing high-priority EM & IP target areas outside the MRE. There are numerous MLEM targets yet to be drilled, and only ~5% of a 100-km-long prospective Cu belt has been explored.

The following interview of Aston Bay’s CEO Thomas Ullrich was conducted in the week-long period ended June 12th. Please continue reading to learn why Aston Bay’s shares could be a steal at $0.105, down from a 52-week high of $0.34 in mid-August 2023, when the Cu price was $3.66/lb.!

Why are you so excited about Aston’s 20% interest in Storm Copper?

We have a 20% free-carried interest, through the delivery of a Bank Feasibility Study, on what could be a world-class asset. Our free-carry is only as strong as our 80% partner’s ability to advance the project. Luckily, American West Metals has demonstrated the ability to raise & deploy funds, ($9M raised in March).

100% of the near-surface resource at Storm is fresh Cu sulfide, amenable to low-cost processing & ore sorting in an open pit setting. Subject to economic studies, we think cap-ex for a direct ship operation should be very low compared to billion-dollar+ figures across S. America.

Unlike S. American peers at elevations of 3,500+ meters, with water challenges, and/or local opposition, Storm is ~25 km over flat, barren terrain from a seasonal ice-free bay on the Northwest Passage. Concentrates from the world-class, past-producing Polaris & Nanisivik zinc-lead mines were shipped this way.

American West thinks Storm’s MRE of ~450M Cu Eq. pounds could double by year-end as Cu mineralization is open in all directions and at depth, and host stratigraphy & structures are laterally & vertically extensive.

Last year’s discoveries at Thunder (48.6 m @ 3% Cu), and Lightning Ridge (15.2 m @ 2.3% & 15.2 m @ 2.1%) are not in the MRE. Only ~5% of a 100-km-long prospective Cu belt has been explored. Our partner believes year-round mining could produce a Cu concentrate for seasonal shipping from the Aston Bay waterway as soon as 2027.

What can you tell readers about Aston Bay’s new Epworth project?

We have an exciting opportunity to earn an 80% interest in the 71,135-hectare Epworth project, also in Nunavut, ~70 km from tide water. We need to invest $3M into exploration over four years, but there are no minimum annual requirements.

Since the deal announcement on March 1st, Cu is up +17%. Mineralization is similar to deposits in the Central African Copper Belt (“CACB“). There’s a 74 km trend that’s prospective for Cu, silver (“Ag“), Au, zinc & cobalt.

Although early-stage, chalcocite boulders returned up to 61.2% Cu & 5,600 g/t Ag. That Ag grade equates to ~71 g/t Au. Recent prospecting yielded rock grab samples up to 37.8% Cu, 27.4% zinc, 1,100 g/t Ag, 3.0 g/t Au & 1,700 ppm cobalt.

An airborne electromagnetic (“EM“) program is planned for June/July, a mapping program this summer, and possibly a modest drill program in the 4th qtr. We feel Epworth could be Storm Copper 2.0.

You have compared both Storm Copper & Epworth to deposits in the Central African Copper Belt (“CACB”), why is that important?

It’s very important as the CACB hosts some of the world’s most impressive Cu-heavy deposits, most notably Ivanhoe Mines’/Zijin Mining’s Kamoa-Kakula in the DRC. That 90B lb. mining complex, with Cu grading 2.5%, is expected to produce a billion pounds of this year alone.

The critical thing about Storm Copper & Epworth in Nunavut, vs. Kamoa-Kakula in central Africa, is that they were produced by the same process. We see similar rocks highly enriched by similar Cu minerals indicating the same very efficient mineralizing process at play.

There was a time when Kamoa-Kakula was just high-grade Cu rocks scattered across the surface. Ivanhoe’s success was in determining where the Cu mineralizing process occurred subsurface with sufficient thickness & lateral extent.

If Storm or Epworth could find just 5% of what Kamoa-Kakula’s has — at 1.0% Cu instead of 2.5% Cu — that would be ~1.8B lbs Cu Eq. vs. the maiden resource estimate of ~450M lbs Cu Eq. Note, 1.8B lbs. would be just 2% of Kamoa-Kakula’s 90B lb. endowment.

I asked you about your two Nunavut projects, what about your prospects south of the Canadian border?

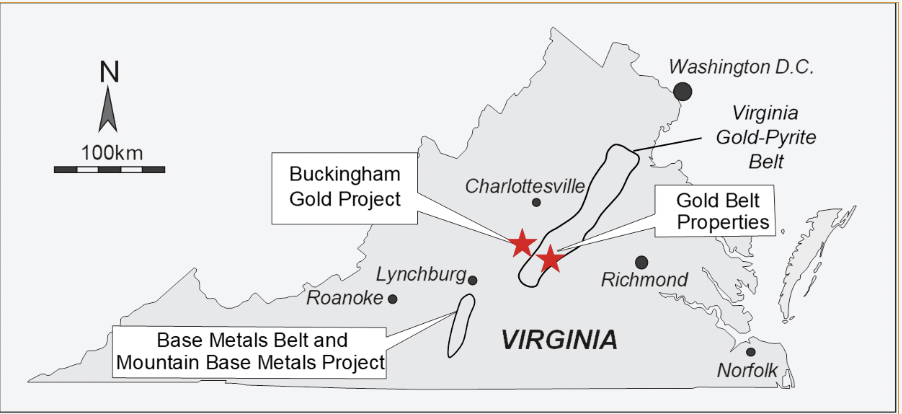

Yes, as excited as the team is about our Cu assets in Canada, we also have high-grade gold & base metal prospects in Virginia, USA. Our Buckingham project hosts surface samples grading up to 20.4 ounces per short ton and drill intervals of 2.0 m @ 35.6 g/t Au and 3.6 m @ 24.7 g/t, incl. 1.4 m @ 62.5 g/t Au.

We are in negotiations to sign a new base metals project in Virginia in an area that has a drilled intercept of 2.8% Cu, 0.9% zinc, 0.5% lead, and 9 g/t Ag over 5.0 m as well as up to 0.24% Co.

Circling back to Nunavut, our main focus this year is Storm Copper & Epworth. We think with a potential doubling of the resource size at Storm and a scoping study funded by American West, investors will see the blue-sky potential there.

If/when Storm is shown to be a significant asset and near-term producer, investors will have reason to view Epworth with more confidence as a possible repeat of Storm. As mentioned, we’re earning up to an 80% interest in Epworth.

Thank you Thomas for the helpful & enlightening commentary. I look forward to updates on both Storm Copper & Epworth.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Aston Bay Holdings, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Aston Bay are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Aston Bay was an advertiser on [ER] and Peter Epstein owned shares in the company acquired in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)