Last month Teck Resources published a 103-page presentation about its copper, zinc, oil & steel-making coal operations. A surprisingly large 24 pages were devoted to its coking coal segment (6 pages) & global coking coal market (18 pages). The two main sections of interest are on pages 51-56 & 87-103.

This is a tremendous resource for investors interested in a recent snapshot of coking coal. Even better, it’s a treasure trove of critical data for investors in Colonial Coal (TSX-v: CAD) / (OTCQX: CCARF), a company with two PEA-stage coking coal projects near Teck’s B.C., Canada operations.

This document contains insights from Teck, but also Wood Mackenzie, CRU, Platts, Argus, MySteel, TSI, IHS/Global Trade Atlas, SxCoal, SteelHome & TCI.

Readers might recall that Colonial Coal has a stellar mgmt. team, board & advisors. And, the most recent news is that giant investment bank Citigroup is now leading the sales process to monetize Colonial’s assets. See my prior articles on Colonial Coal –> April 27 / March 20 / January 8.

Teck’s presentation shows how lucrative the coking coal business is to any company willing to stand up to ESG militants… Teck sold 100% of its coal operations to Glencore (77%) Nippon Steel (20%) & POSCO (3%).

If hard coking coal (“HCC“) has a favorable, decades-long future, especially high-quality HCC sold via the seaborne market to Asian buyers, why has it been four years of trying to sell Colonial’s projects with no bites, not even a nibble (as far as we know)?

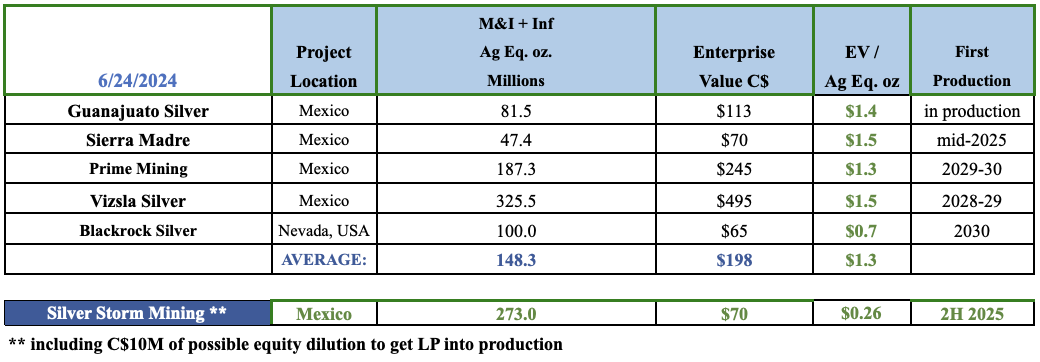

No one has a satisfying answer to that question. Shareholders continue to wait, some excitedly, others resolutely. Will the outcome be to everyone’s liking? Colonial is valued at roughly ~US$0.48/tonne, but most shareholders are waiting for a takeout at US$1.5-$2.5/t. If a deal is consummated at US$1.5-$2.0/t, some will complain it wasn’t $2.50+/t…

Make no mistake, there’s plenty of potential upside as $1.5/t equates to a share price of ~C$7, vs. the current price of $2.42. The purpose of this article is to “mine” Teck’s presentation for tidbits, clues & takeaways that support the potential valuation of Colonial’s projects. Without further ado, let’s get started.

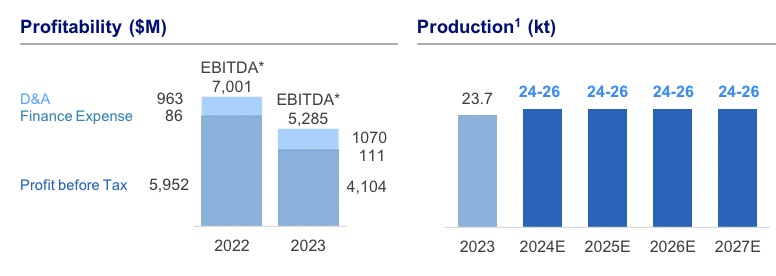

On page 51 –> this chart shows that production from Teck’s operations is expected to be 25M tonnes/yr., and that EBITDA/tonne in 2023 was a whopping C$223! Even slashing that figure by a third to ~C$149/t would be a very attractive margin by historical standards.

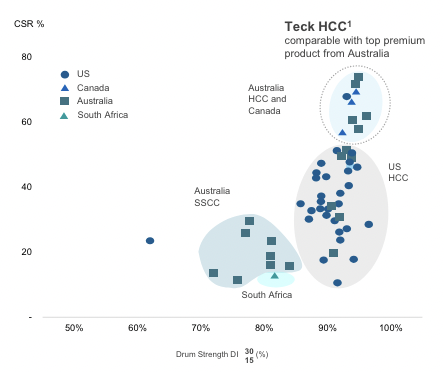

On page 53 –> this is the best chart I’ve seen proving that seaborne HCC from Canada & Australia will be the last ones standing as high-quality means lower emissions & maximum flexibility to blend with lower-quality material.

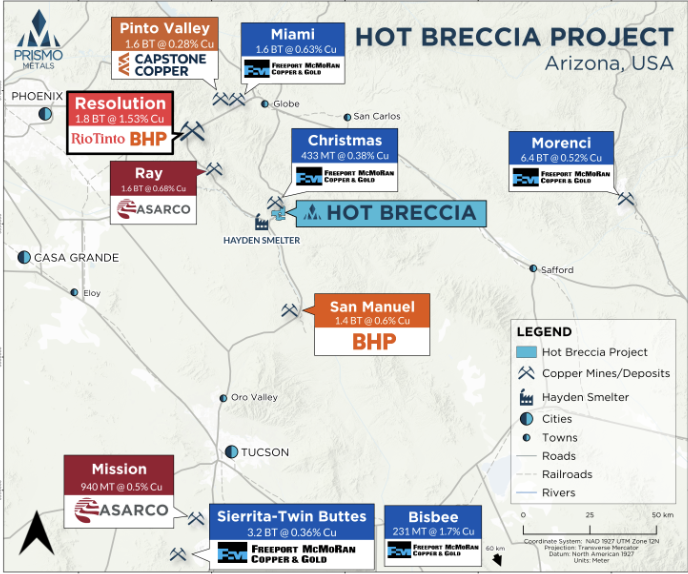

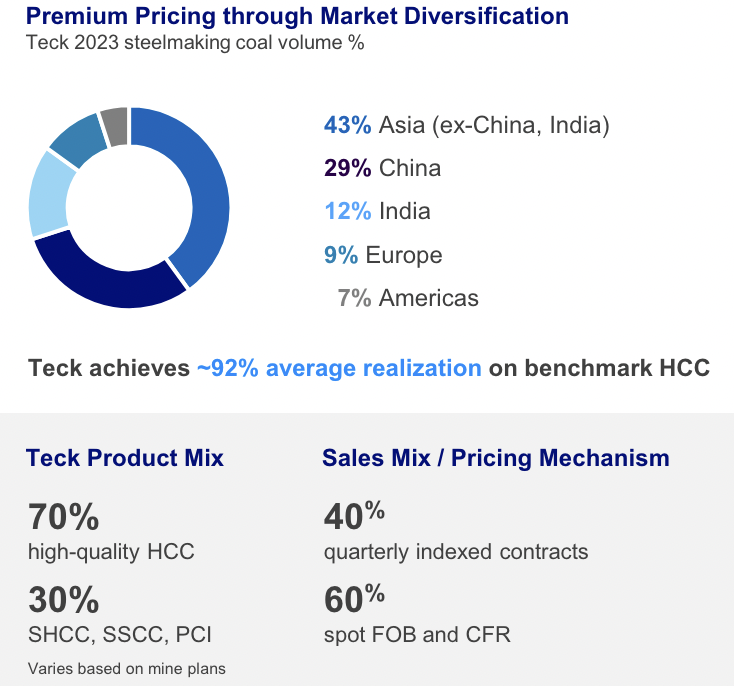

Also on page 53 –> Where is Teck’s HCC going? To Asia. A whopping 84% goes to China + India + “the rest of Asia.” This is important to understand because most giant Asian steel mills are situated near ocean ports to receive seaborne coking coals –> the vast majority of which originate from Australia, Canada & the U.S.

Readers should note that Teck’s steel-making coal mix is 70% HCC / 30% {semi-hard, semi-soft & PCI coals}. By contrast, Colonial’s 100%-owned Flatbed & Huguenot projects have a combined 695M tonnes of resources (not reserves), which are 94% HCC.

Despite that 70/30 split, Teck achieves ~92% of the average of its HCC benchmark price. This is interesting as Colonial’s CEO David Austin & COO John Perry believe Colonial’s HCC could be sold at roughly 95%-97% of Australia’s top-ranked Peak Downs benchmark.

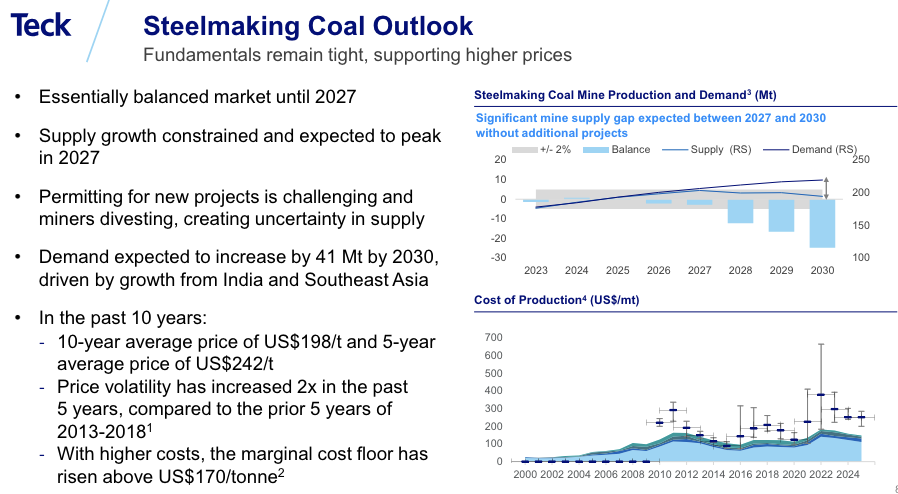

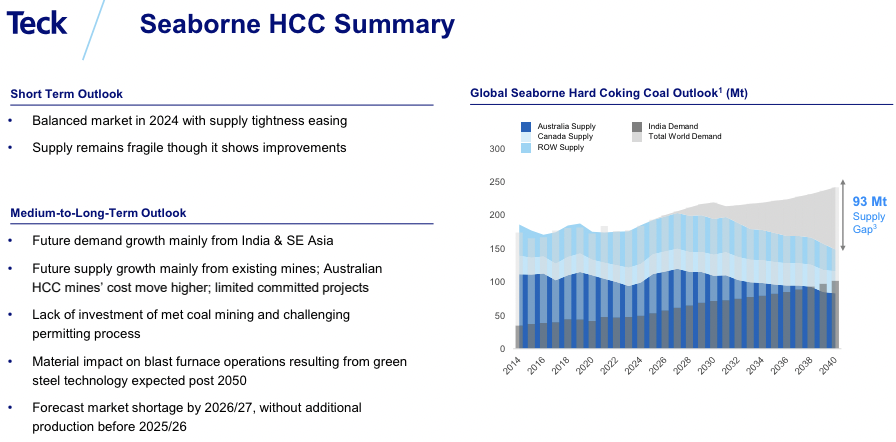

On page 89 –> lots of valuable info to unpack … Teck sees a balanced market through 2027, and a potential HCC shortfall of 25M tonnes in 2030. A buyer of Colonial’s assets could chip away at that deficit. Teck reiterates that demand through 2030 is driven by India & SE Asia.

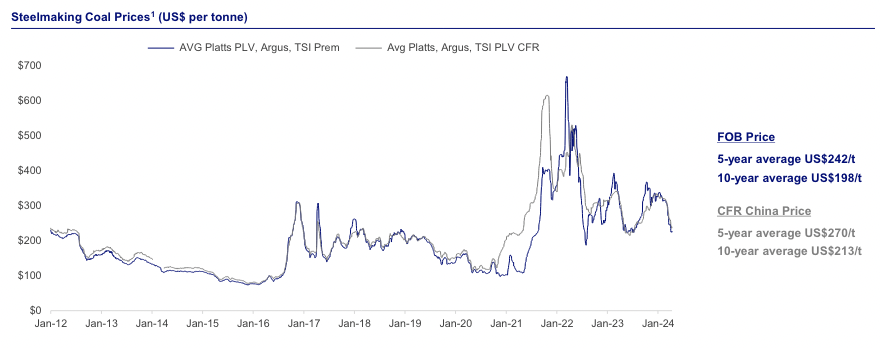

Over the past 10 & 5-year periods, Teck’s average price was US$198/t & US$242/t, respectively. Interestingly, price volatility doubled in 2019-2023 vs. 2013-2018. Steelmakers HATE high volatility, which is why they lock in long-term contracts and look to acquire HCC assets.

Teck states that the marginal “cost floor” is now > US$170/t. Asian steel companies could lock in a steady, long-term price of +/- $150/t by acquiring Colonial’s Huguenot & Flatbed.

On page 90 –> a current long-term (12-years) HCC graph. Again, look at the extreme volatility in 2021-22, from a low near $100/t to $660/t.

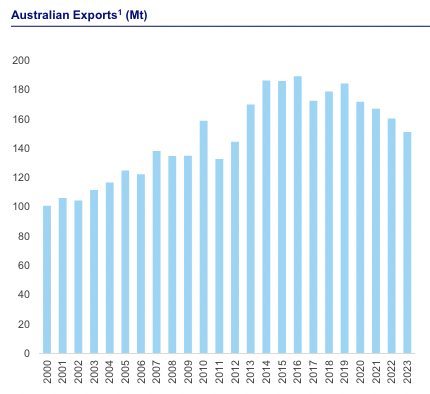

On page 92 –> In my articles on Colonial Coal, I say that Australia’s dominant role in the seaborne market is faltering. Instead of growth (see 2000-2010), in the past seven years coking coal exports are down 20%. Compare that -3.2% CAGR since 2016 to India’s imports growing at +6%/yr.

On page 97 –> A supply gap of 93M tonnes of HCC in the global seaborne market is expected by 2040! Does the above chart (on the right) include Colonial’s two projects? Management believes that Flatbed & Huguenot could ramp up to a combined 8-12M or even 16M tonnes/yr. from the 2030s on.

BONUS –> While researching this article, I came across this busy S&P Global infographic from May 6th. I continue to believe that one or more Indian group(s) could be the primary acquirer(s) of Colonial’s assets. India aims to raise its steel capacity to 300M tonnes/yr. by 2030, up +71% from 2023.

This infographic supports the thesis that India needs more seaborne supply. Since 2017, India has imported > 400M tonnes of seaborne coking coal, 23% more than China and 14% more than Japan.

The graph of “Platts key met coal prices” (bottom right of the infographic) is instructive. Prices for HCC have calmed, recently in the US$200-$400/t range, from a high of ~$660/t. Readers should note that India has been talking about reducing imports of HCC for many years, but imports keep rising. Why?

India does not have a large, and growing, amount of higher quality HCC to blend with lower specs. And, logistical bottlenecks (trucking/rail) make it difficult to reliably transport [coking coal + thermal coal] over long distances.

In the above commentary, I hope that readers are reminded that Colonial Coal (TSX-v: CAD) / (OTCQX: CCARF) is well positioned with not just coking coal, but valuable & increasingly scarce high-quality HCC, and that Tier-1 supply via the seaborne market is critically important.

Furthermore, India & SE Asia are the key markets in the coming decades, regions heavily reliant on the seaborne market. Australia’s HCC exports are stagnating, the best chance to pick up the slack is in western Canada.

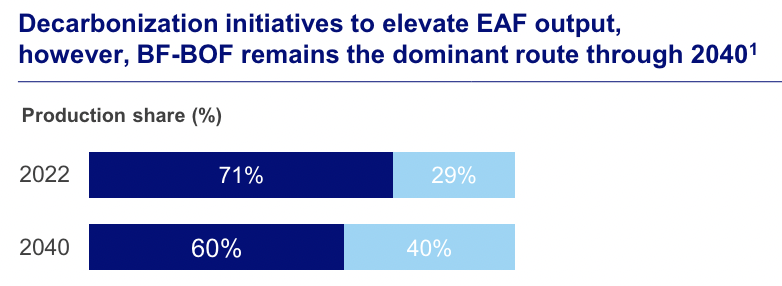

Finally, a long-term, cost-permissible, scalable replacement for coking coal remains decades away. And, as steel made with coking coal gets replaced by more steel made in Electric Arc Furnaces, or hydrogen, or other remedies — the lowest quality, highest cost, most logistically challenging coking coals will be retired first.

The world’s best quality, least polluting HCC from Australia & western Canada will be the last ones standing! Colonial’s two projects (a combined 695M tonnes of resources, 94% HCC) are in the Top quartile — possibly closer to the Top decile — of seaborne HCC.

Disclosures: The content of this article is for information only. Readers understand & agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Colonial Coal, incl. but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Colonial Coal are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Peter Epstein owned shares in Colonial Coal and the Company was an advertiser on [ER].

Readers should consider me biased in my view of the Company. Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)