all $ figures C$ unless indicated otherwise. Li prices are US$. Relative value calculations updated on 6/26/24

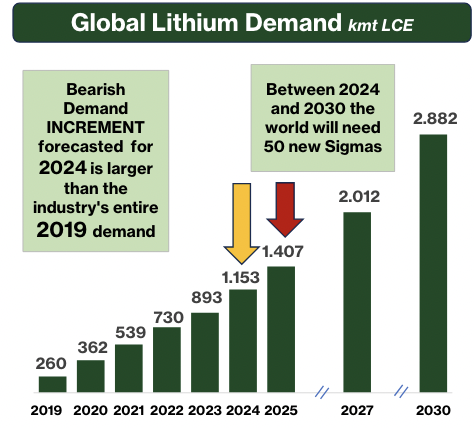

The lithium (“Li“) sector has had a terrible 18 months. Although Li spodumene concentrate (“SC“) prices are hovering around US$1,100/tonne, with a few auction prices reported at up to $1,300/t, I’m confident pricing will improve. Why? For one, angst over EV sales is overdone.

Longer-term projections remain robust. According to Rho Motion, year-to-date global sales through April are +22%, hardly a disaster. Ford announced revamped plans to, “double down” on low-priced EVs while continuing to sell hybrids. Western peers will be forced to follow.

Consider this quote from a recent Bloomberg article,

“For every suggestion of an EV slowdown, another point of view sees an adolescent industry on the verge of its next growth spurt. For most automakers, Q1/24 was a blockbuster for EV sales. Six of the ten biggest U.S. EV makers saw sales grow at a scorching pace, up 56% at Hyundai & Kia, and 86% at Ford.”

Two weeks ago Chile’s Codelco reported interesting news regarding SQM, a quote from Miningweekly.com,

“A week after signing contracts to take a majority (51%) stake in SQM’s sprawling brine operations on the Atacama salt flat in Chile, Codelco indicated that direct lithium extraction, or DLE, probably wouldn’t be introduced for another nine years…”

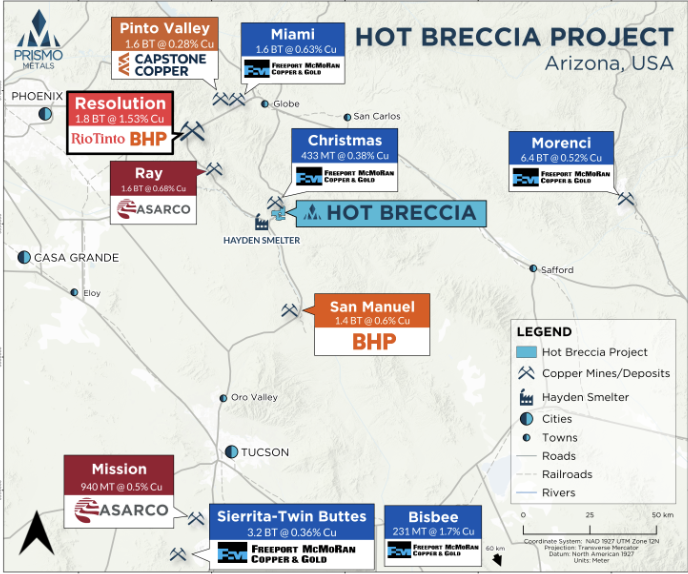

SQM & Albemarle are constrained by how much brine they are allowed to pump. Growth rates in Chile over the next decade (until both companies deploy DLE) could be only +6%/yr. in a Li market growing +12%-18%/yr. See the chart below from Sigma Lithium’s corporate presentation.

Away from transportation, Li-ion battery use in stationary grid-scale energy storage systems is thriving. Wood Mackenzie reported trailing 12-month deployments in the U.S. through 3/31/24 were +106% vs. the 12 months ended 3/31/2023.

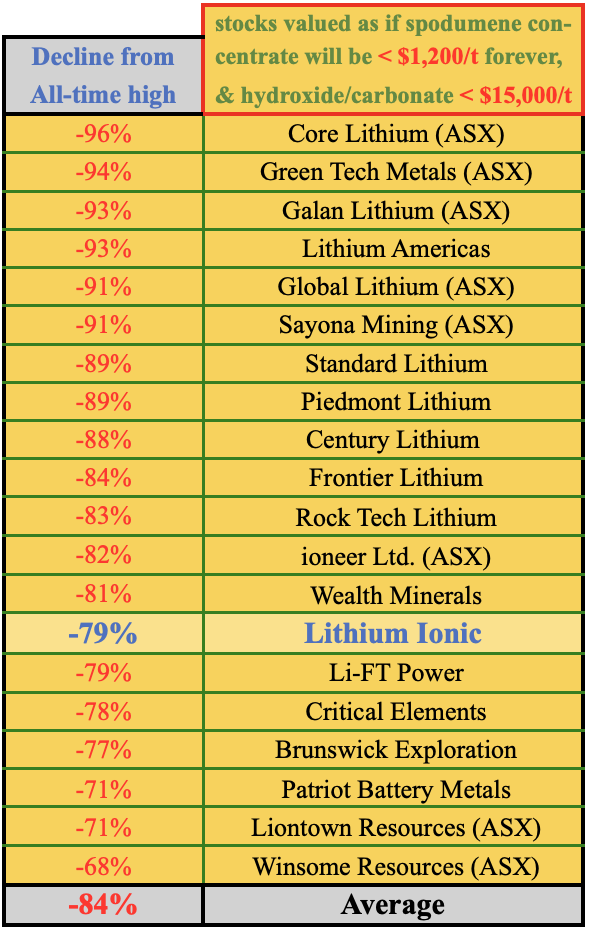

Low-technology risk, easy-to-permit hard rock Li projects are best positioned to meet demand. Yet, companies with Top-10 pre-production hard rock assets are as oversold as higher risk, longer to commercialize DLE, brine & clay-hosted counterparts. Look at the following 20 well-known Li plays.

The sector is trading as if Li will not remain a dominant battery component. Could Li fall by the wayside? Yes. In the next 10-15 years? No! Demand for batteries is so strong that there’s room for sodium-ion & other battery chemistries.

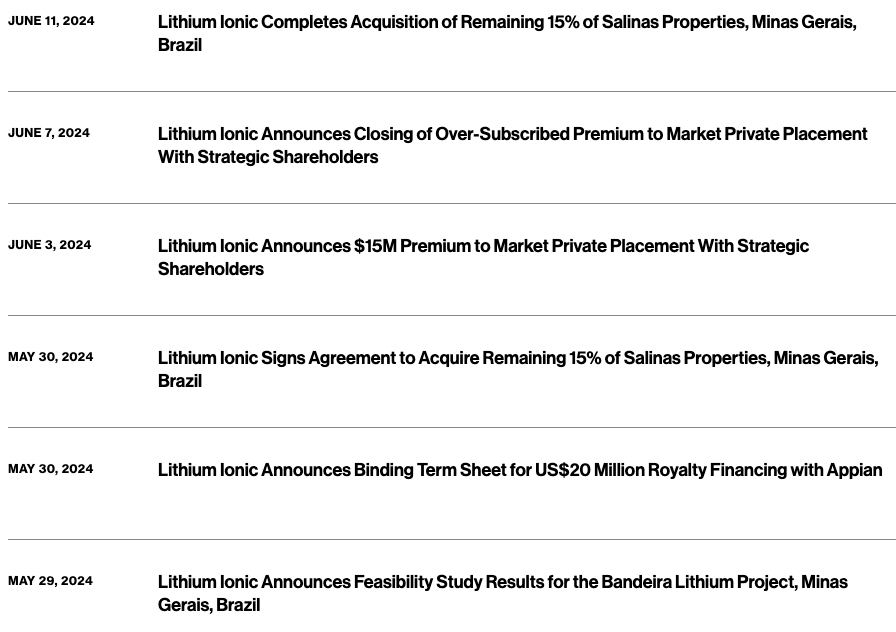

Li juniors are trading as if prices will never recover, but the cure for low Li prices is… low Li prices. While many Li juniors are stalled, Lithium Ionic (TSX-v: LTH) / (OTCQX: LTHCF) is moving full-speed ahead… Six press releases came out over the two weeks ended June 11th… {see corp. presentation}

I’m monitoring > 230 names with at least one Li property in Canada, many won’t exist next year as Li plays. Yet, there are fewer than a dozen publicly-listed companies (market caps > $10M) with Li prospects in Brazil, most notably Sigma Lithium, Latin Resources, Atlas Lithium & Lithium Ionic.

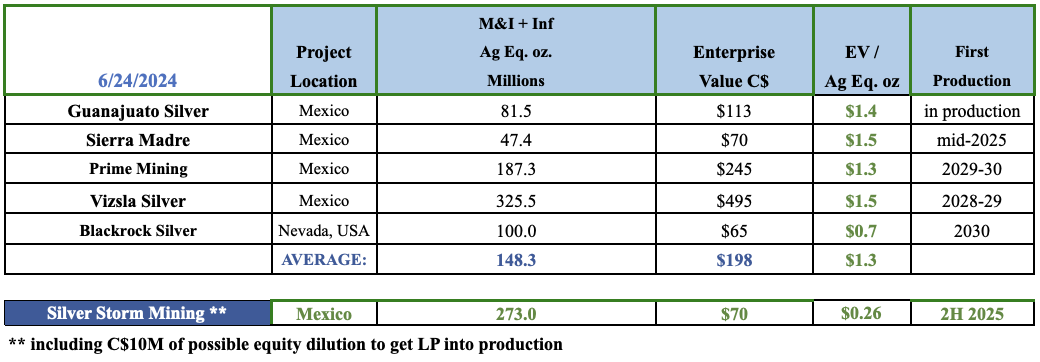

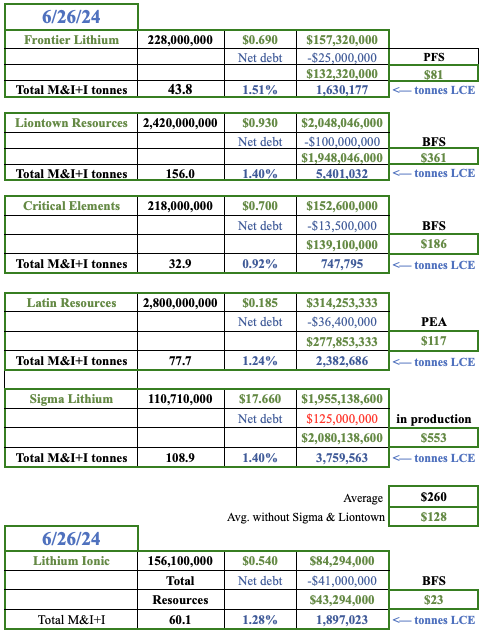

Despite an enterprise value [EV] {market cap – cash + debt} of ~$185M, Atlas has yet to table a maiden resource estimate. Latin Resources’ main project (at PEA-stage) is valued at ~$117/tonne of Li carb. equiv. (“LCE“).

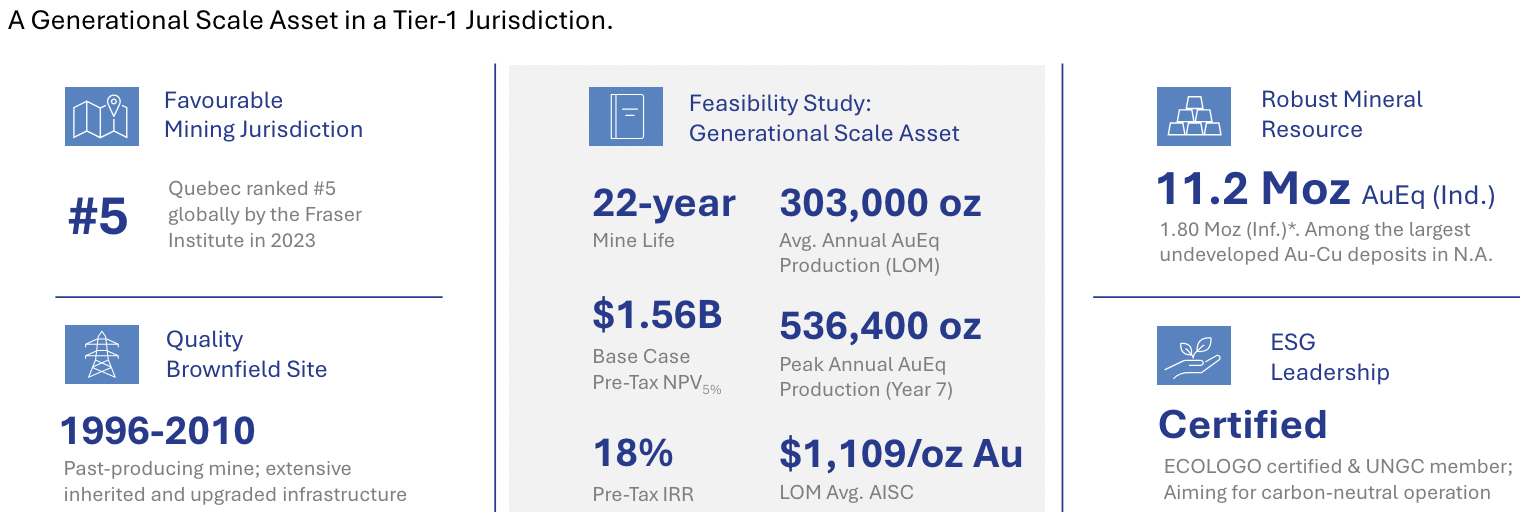

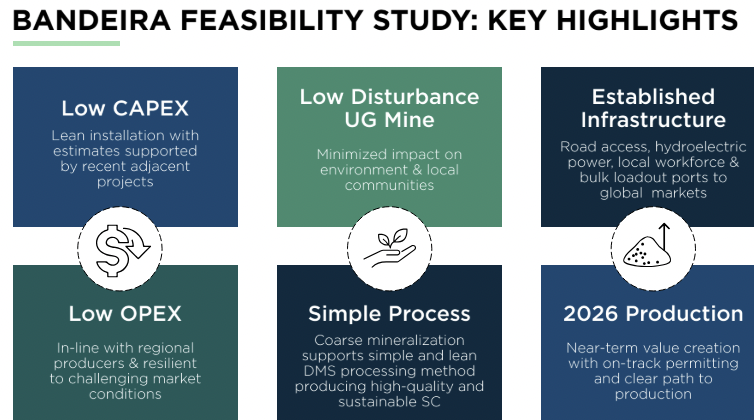

By contrast, despite having recently delivered a Bank Feasibility Study (“BFS”) on its 100%-owned Bandeira project, Lithium Ionic is valued at just $23/t, Please take a moment to review the following bios showing extensive intl. experience in exploration, discovery, development, operations, project funding + M&A.

Lithium Ionic recently raised a substantial sum of cash by selling shares and via a $27M royalty transaction –> it still owns 100% of Bandeira. Pro forma cash is ~$41M. Both Sigma & privately-held, decades-long Li producer CBL are within 5 km of Lithium Ionic. Sigma is a rapidly growing, green operation. It’s already the world’s 6th largest Li producer.

Dozens of companies incl. –> OEMs, battery makers, Li Majors, large mining companies, Japanese commodity traders & others have looked at acquiring Sigma Lithium (SGML), located just 4 km from Lithium Ionic (LTH). LTH expects to reach initial production with similar grades & lower op-ex in 2H 2026, three years behind SGML. Yet, its EV is only 1/48 as large! SGML’s medium-term goal is a run-rate of ~770k tonnes/yr. spod concentrate by 2026. With time and $$$, an acquirer should be able to produce 2x-3x the 178k tonnes/yr. in LTH’s newly-released Bank Feasibility Study.

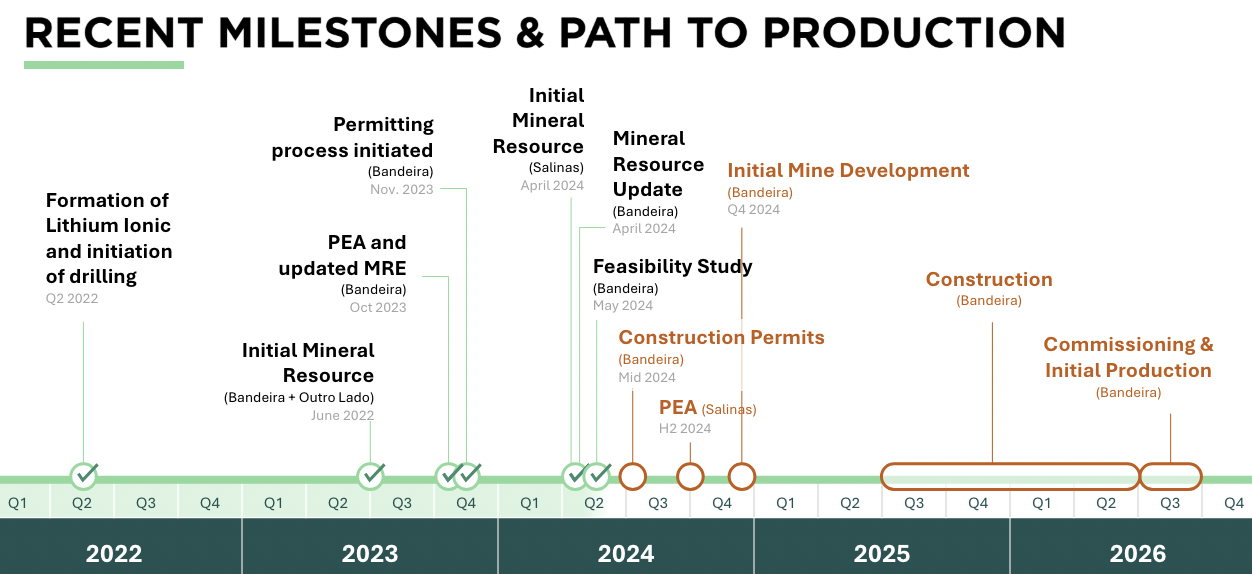

Even if one assumes 100% equity dilution over the next few years, (highly unlikely!) the valuation differential remains way too high at ~16 to 1. Equity dilution should be manageable as the Company has ~$41M pro forma cash, and debt funding should cover 60%-70% of cap-ex. If necessary, LTH could sell a minority interest in Bandeira to fund its share of cap-ex. post debt funding. SGML is NOT overvalued, LTH is absurdly undervalued. Cash liquidity will last into 2025 when Li prices & sentiment are likely to be higher, and LTH’s project is further de-risked. Next year, construction should be underway for production in 2H 2026.

The economics of Lithium Ionic’s BFS are strong, highlighted by an after-tax IRR of +40.3%, op-ex of US$444/t, and cap-ex of only US$266M=$364M. Management believes there’s room for improvement on the already impressive op-ex figure. However, the BFS was not as powerful as last year’s PEA.

Readers should recognize that the longer payback period in the BFS wasn’t due to a cap-ex or op-ex blowout, but rather to lower assumed SC5.5% prices in the initial years.

The headline # of $2,277/t for spodumene concentrate is high vs. current levels, but companies relied on higher numbers last year. For example, a Canadian hard rock Li company is using $2,600/t in its BFS for the initial eight years.

By contrast, the Bandeira project’s opening 8-yr. avg. price assumption is $1,799/t. The average for years 1 to 3 is just $1,192/t, and for years 1 to 6 is $1,559/t.

Mine life in the BFS fell from 20 years at 217.7k tonnes/yr. to 14 years at 178k tonnes. At a price of $1,822/t, the after-tax IRR is +32.5%, and at $1,637/t, it’s ~25%. Additional discoveries & infill drilling will increase the number of Measured & Indicated tonnes, allowing for a longer mine life & higher annual production.

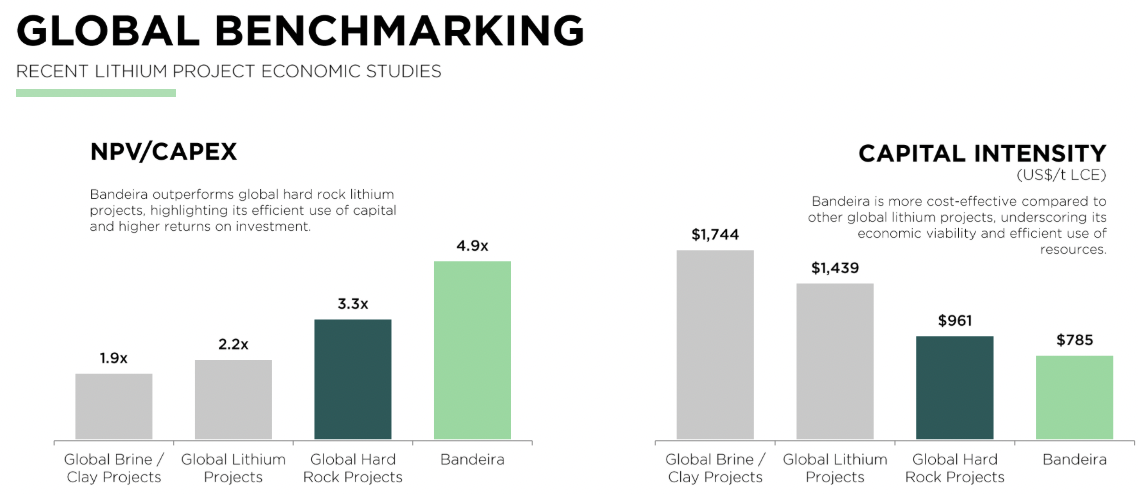

Compare Lithium Ionics’s IRR of +40.3% [or +32.5%] to two large clay-hosted Li projects in Nevada, USA, both using a $24,000/t Li carbonate price vs. $12,771/t spot. They have after-tax IRRs of 17% & 21%.

Lithium Ionic is next door to Sigma, shares the same geology, low impurities, has a similar grade, and expects to reach production in 2H 2026. The Company is arguably worth a multiple of its current enterprise value of ~$44M. Importantly, equity dilution to fund the $364M of cap-ex might not be as much as feared. Up to 2/3s could be satisfied with debt.

The Company has ~$41M in pro forma cash. After debt funding is secured, it would need to raise [1/3 of $364M = $121M] to reach production. Or, management could sell a 25% stake in Bandeira for say $125M to fully cover what would be its [$121M x 75% = $91M] remaining share of cap-ex.

A clear vote of confidence in Minas Gerais was received last year when Lithium Royalty Corp. invested US$20M into Atlas Lithium via a royalty transaction despite Atlas being a pre-maiden resource company.

Regarding the 14-yr. mine life at 178k tonnes/yr., if/when a strategic investor comes on board, mine life & annual production could be enhanced by much more aggressive drilling. There remains substantial exploration upside, yet Sigma’s EV at roughly $2.1 billion is 48x higher than Lithium Ionic’s!

3.3x NPV/Cap-ex ratio for global hard rock projects overstated due to cost increases since studies were done…

That 48x differential could collapse to 6-8x once Lithium Ionic enters production, and even further once ramped up. Note the following from the BFS press release,

“This study mine plan is based on a smaller estimate of 20.95Mt grading 1.35% Li2O (697kt LCE) M&I, and 16.91Mt grading 1.40% Li2O (584kt LCE) Inferred.” The resource is 13% larger than what was reflected in the BFS. Including that extra tonnage would extend mine life by ~ 1.5 years. {see corp. presentation}

Many projects are experiencing op-ex and/or cap-ex blowouts, driving after-tax IRRs below 20% and NPV/Cap-ex ratios below 2 to 1.

This is happening at a time when project timelines are extending, the cost of capital is elevated & project execution & geopolitical risks are rising. Only higher Li prices can reliably alleviate these factors.

When comparing Lithium Ionic’s BFS to studies completed 6-36 months ago, remember that op-ex & cap-ex are too low, and Li price assumptions are too high. Bottom line? An after-tax IRR of +32.5% using a $1,822/t SC5.5% price, is quite attractive.

Even more impressive is the ratio of NPV/cap-ex of 4.9x, (or 3.3x at $1,822/t). Compare that to two of the world’s best copper projects owned by Filo Mining & SolGold at an average NPV/cap-ex ratio of 1.4x.

Lithium Ionic expects to be in production within 3-4 years. Construction permits are expected next quarter. The risk of a big surprise in costs is fairly low. As mentioned, the Company is valued at $23/t (an 82% discount) vs. an average of $128/t from projects owned by Frontier Lithium (PFS), Critical Elements (BFS) & Latin Resources (PEA).

Three other Canadian hard rock projects at pre-PEA stages are, (on average), valued at ~3x Lithium Ionic. That makes no sense!

Admittedly, Brazil is less established as a Li hub than Western Australia [WA], but it produces about the same amount of LCE as Canada. And, Sigma permitted, constructed & commissioned its mine a lot faster than mines being built in WA & Canada.

Although Brazil is ranked below WA in the latest Fraser Institute Mining Survey, it ranks above Chile. There will almost certainly be one or two Li hubs in Brazil. With Sigma blazing a path forward, the jurisdictional risk for Lithium Ionic is diminishing.

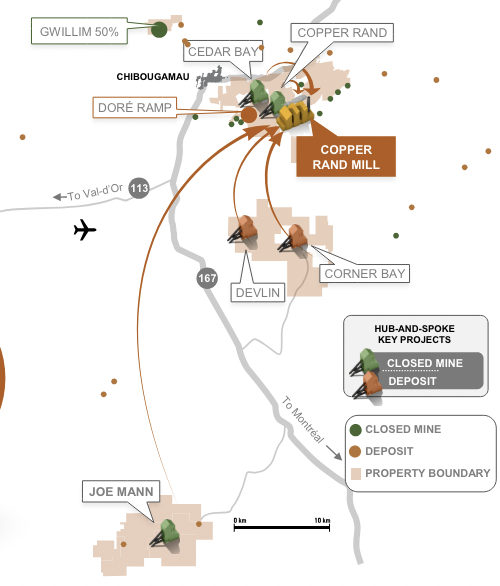

The Company has an extensive 14,182-hectare land package in Brazil’s “Lithium Valley“, an area of global significance for hard-rock Li. Minas Gerais, the region where Sigma & CBL operate, and Lithium Ionic is developing projects, hosts > 300 mines.

Combined across three projects, Lithium Ionic has 60.1M tonnes at an average grade of 1.28% Li2O, equal to ~1.9M tonnes LCE. This figure is expected to grow.

Coastal ports are ~400-500 km away over paved roads. Power is clean, green hydroelectric. There are skilled labor & mining services. Local community relations and water are NOT concerns. Labor costs in Canada & WA are roughly 4-5x higher than in Brazil.

Sigma has largely hit key milestones, is rapidly expanding, and operates in an ESG-friendly manner. I heard that over 50 prospective acquirers kicked the tires, but just one will prevail if Sigma still wants to sell. That would leave many others to consider the next big (potential) Li operation in Brazil.

I asked CEO Blake Hylands if he’s in discussions with a lot of companies. He said that his team has spoken with, “nearly everyone”. With $41M in pro forma cash, management is in no dire need to secure a partner. He assured me there’s a lot more interest than one might imagine given industry-wide share prices.

An eventual acquirer of Sigma might also want to take out Lithium Ionic, situated just 4 km away. Non-Chinese companies large enough to acquire Sigma & Lithium Ionic include; Rio Tinto, SQM, Albemarle, Mineral Resources (“MinRes”), Glencore, POSCO & Pilbara Minerals.

With Li prices under slow but steady pressure, investors are in no hurry to build positions, even in the world’s best names. However, it’s often a good time to buy, for those with strong stomachs –> when there’s blood in the streets. Lithium Ionic (TSX-v: LTH) / (OTCQX: LTHCF) offers a compelling high-risk/high-reward proposition.

{see corp. presentation}

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Lithium Ionic, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Lithium Ionic are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Lithium Ionic was an advertiser on [ER] and Peter Epstein owned shares in the company acquired in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)