$ figures are C$ unless stated otherwise, metal prices are US$, ounces/oz. are silver (“Ag”) equivalent oz…

Primary silver (“Ag”) mines benefit most from higher prices. However, 80% of mined Ag is a byproduct of other operations, making supply highly inelastic. The price could soar past US$40 –> $50/oz. without a meaningful near-term supply response.

Ag demand is underpinned by EVs & solar panels. Both have proven to be recession & COVID-19-resistant. Even if one doesn’t fully subscribe to the grave threat of global warming or the efficacy of intermittent renewable power, global leaders are hellbent on delivering us EVs & decarbonization!

Many countries incorporate EVs as the cornerstone of economic stimulus packages. Recently, China announced a program of rebates for exchanging internal combustion engine cars for EVs.

Readers are reminded that today’s Ag price of $29.25/oz. remains incredibly cheap, -65% below the inflation-adjusted level of ~$84/oz. for the entire year of 1980. Interestingly, today’s main drivers of demand were nonexistent in 1980. Given that we’re in year four of mined Ag deficits, could fundamentals get any better?

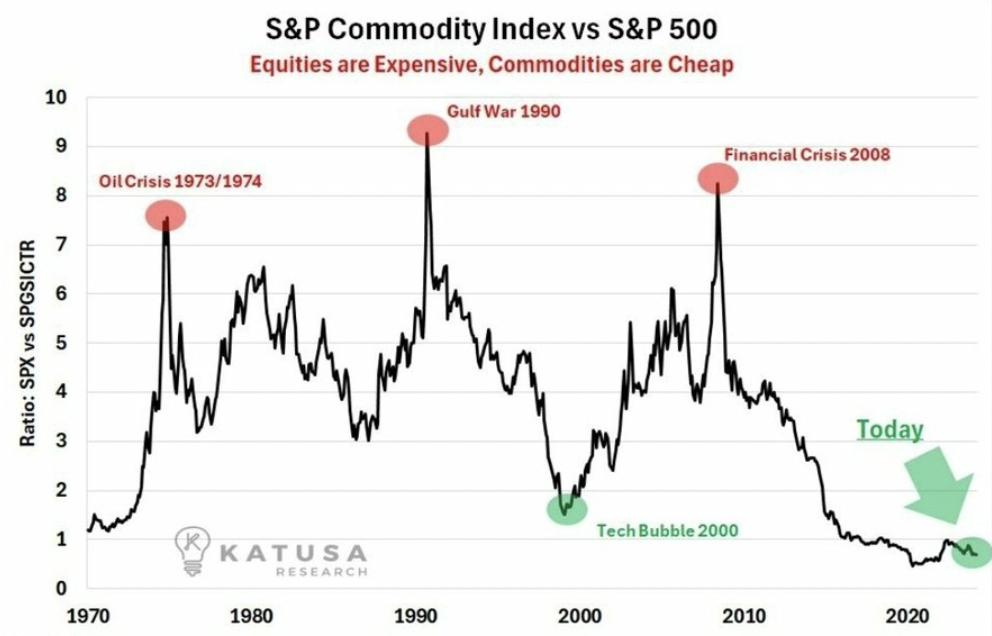

It’s not just Ag, look at the following chart. Commodities are extremely cheap vs. stocks, cheaper than at almost any point in over 50 years. Said another way, Nvidia’s US$3 TRILLION valuation is twice the valuation of all publicly traded metals & mining companies in the world! Yet, Nvidia, Meta, Google, Amazon, etc. need Ag to thrive.

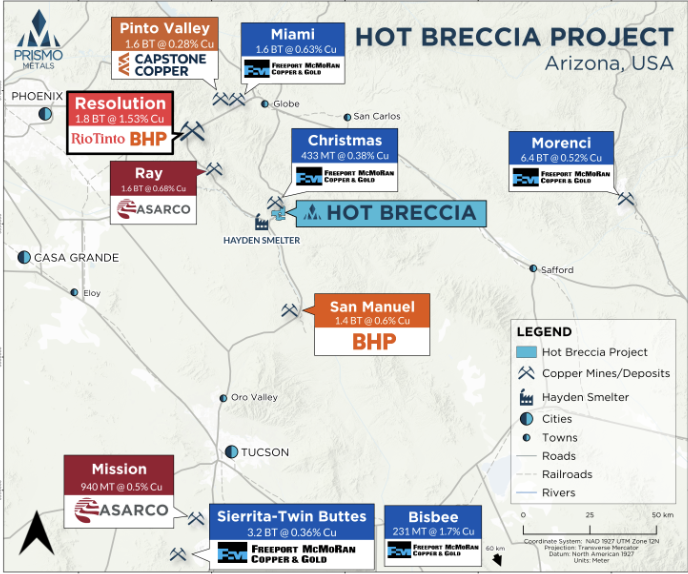

A high-quality primary Ag junior I continue to like is Silver Storm Mining (TSX-v: SVRS) / (OTCQX: SVRSF), expected to reach commercial production in Durango State, Mexico in 2H 2025. The Company has an Enterprise Value of ~$66M (C$0.13 on June 25th) [including $10M to get the company into commercial production next year].

I first wrote on Silver Storm when the share price was $0.135 and Ag was $25.1/oz. vs. $0.13/~$29.25. now, and a high last month of $0.20/$32.52. In my view, with this breakout move since my initial piece, Silver Storm’s valuation should be up 2x-3x as much as the underlying Ag price. {see new corp. presentation}.

Readers should note that a compelling argument in favor of juniors with Mexican precious metal assets is the peso/US$ exchange rate reversal since Mexico’s Presidential election. This month alone the Peso declined more than 10%, before recovering somewhat. Durango has 23 operating mines, it’s a mining-friendly jurisdiction.

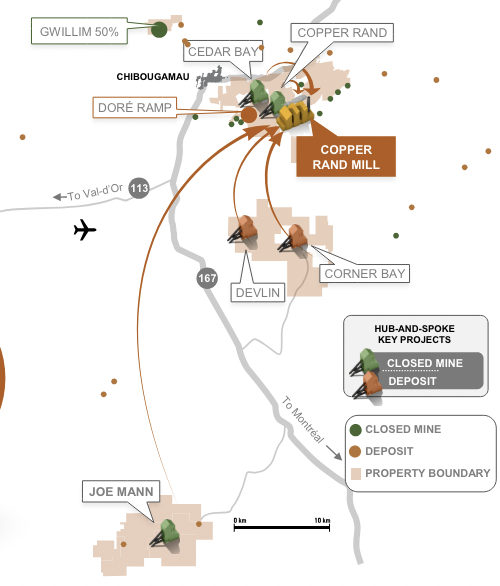

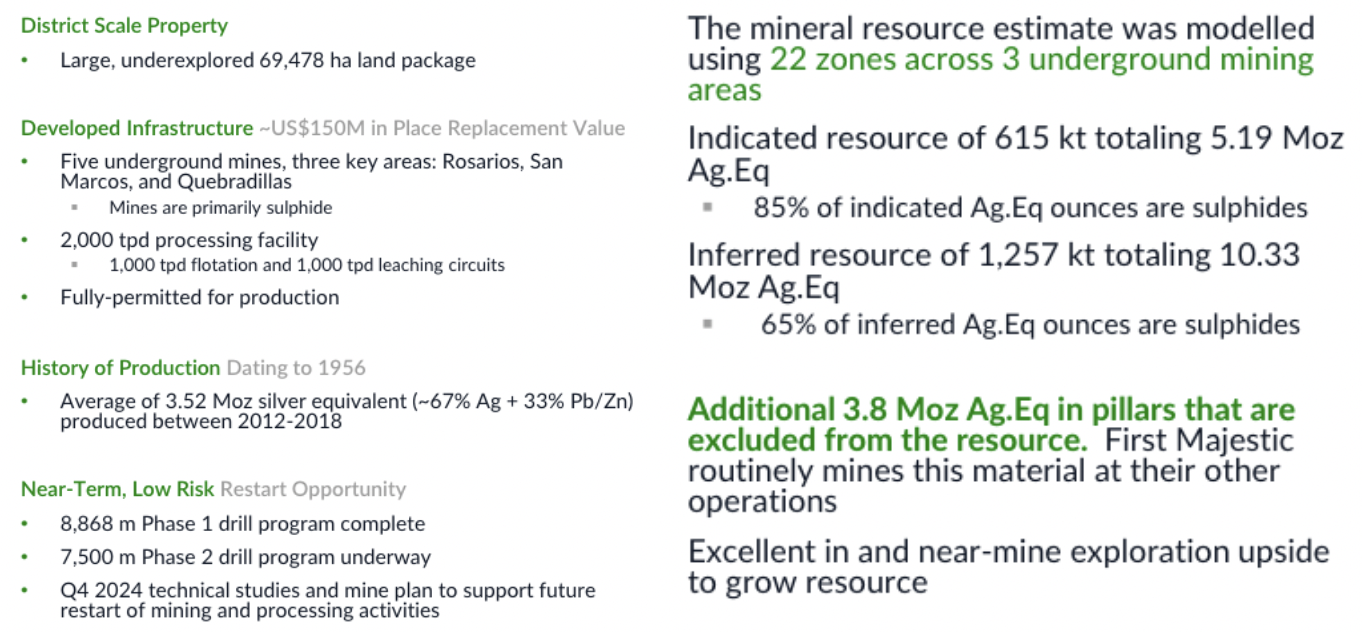

Silver Storm has the 100%-owned past-producing La Parrilla (“LP”) mine & mill complex acquired from First Majestic, who remains Silver Storm’s largest shareholder at ~36%.

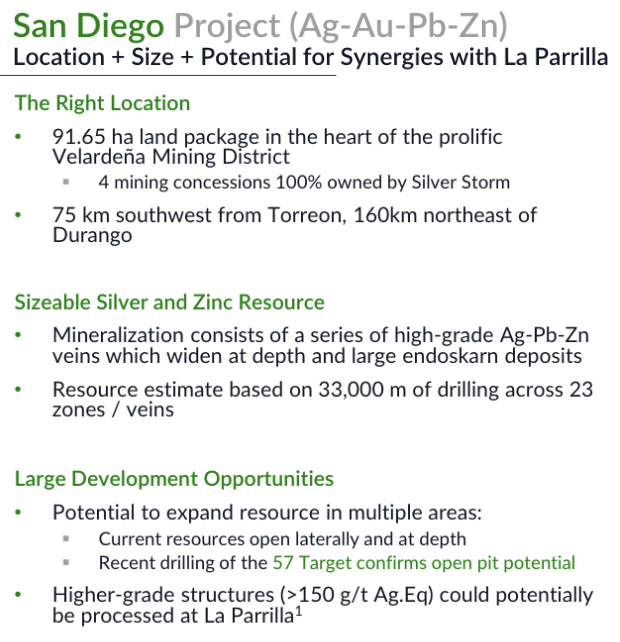

By divesting the too-small LP, FM maintained some upside to its success, and a free option on the much larger, crown jewel, San Diego (“SD“) project. Silver Storm gained a near-term producer in LP to help fund SD.

The LP complex was in continuous operation from 2006 to 2019, producing over 34M Ag Eq. ounces, 67% Ag & 33% lead/zinc. LP hosts five underground mines & an open pit, surrounding a 2,000 tonne per day (“tpd”) fully-permitted mill consisting of parallel 1,000 tpd flotation & 1,000 tpd cyanidation leach circuits for oxide & sulfide ores.

Mineral resource estimates have been completed on 22 veins in the Rosarios, San Marcos & Quebradillas zones. So far, LP has booked ~15.5M ounces grading ~258 g/t. While owned by First Majestic, the LP complex produced up to 4.5M oz./yr., averaging ~3.5M/yr. from 2012-18.

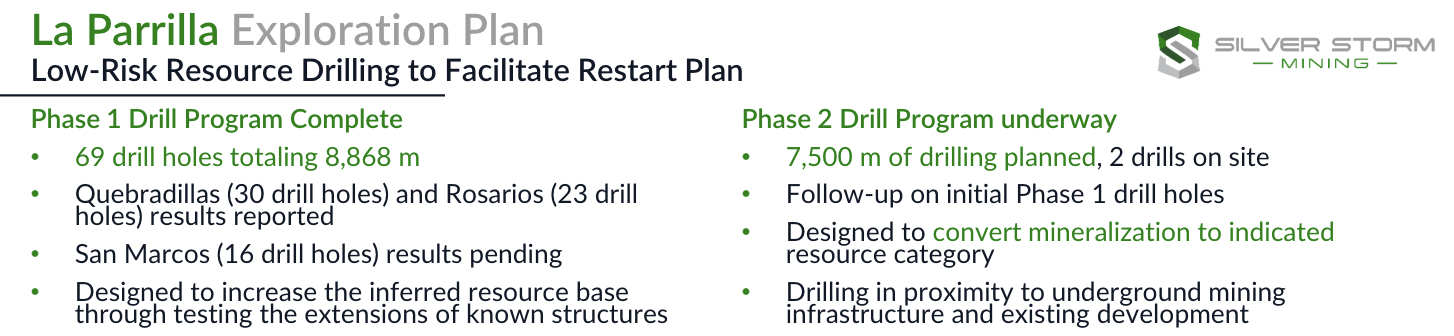

Two underground drill rigs are operating at LP. Phase 2 diamond drilling of 7,500 meters will be completed in September with the main goal of upgrading Inferred mineralization to Indicated. Phase 1 consisted of 69 holes / 8,868 m. Assays from 16 holes are pending. An updated resource estimate is expected next year.

Management won’t commit to more than 3.0M oz./yr., but I think a run-rate of 3.5 – 4.5M oz. is possible in 2026. The replacement value of above & below-ground infrastructure, including the fully permitted 2,000 tpd mill and a “partial mining fleet” is estimated at US$150M/C$205M.

Replicating this infrastructure would take 5+ years of studies, permitting, funding, construction & commissioning. The best intervals to date at LP are 1,810 g/t Ag Eq. over 14.6 m, and 911 g/t over 13.1 m. Greg McKenzie, Pres. & CEO commented,

“Phase 1 results exceeded expectations confirming our thesis that the mineralized zones at La Parrilla extend well beyond previous mining areas. The aim is to gain a greater understanding of the extensions drilled to date to convert mineralization classified as Inferred into the Indicated category, and in certain instances, continue the expansion of the zones at depth.“

It would be impossible to overstate how important these bonanza grades are. President & CEO Greg McKenzie talks of 3.0M oz./yr., but if ultra-high grade runs deeper and/or wider, all bets are off.

Assuming US$26/oz. Ag, and an AISC of $17.5/oz., annual cash flow could grow to ~$35M in 2026 on 3.0M Ag Eq. oz./yr. Some of that cash could be reinvested into the SD project. Using the same metal prices for SD used in the LP resource, SD has ~257M ounces, making it one of Mexico’s largest undeveloped Ag projects.

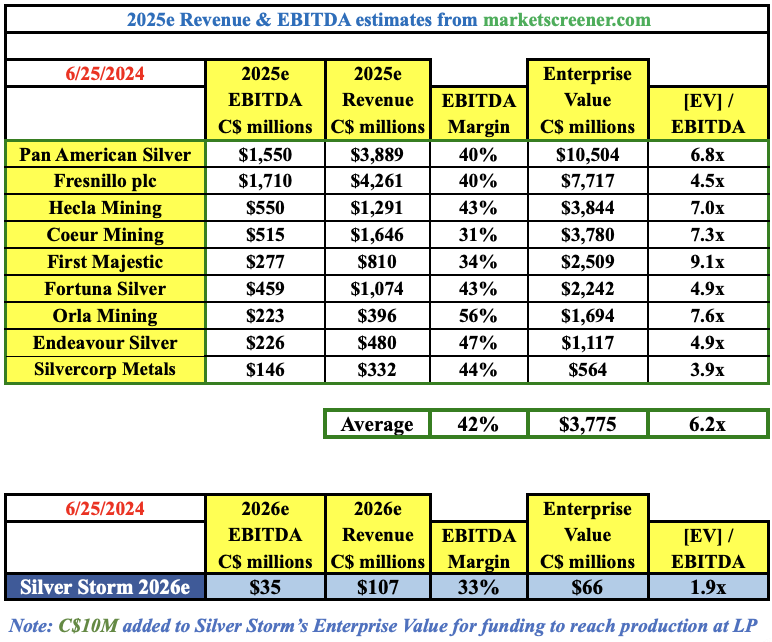

The chart below shows nine Ag-heavy producers valued at an average 2025e EV/EBITDA multiple of 6.2x. By contrast, Silver Storm is valued at 1.9x [2026e] EBITDA. Note: {I add C$10M to Silver Storm’s EV for capital needed to reach production next year}.

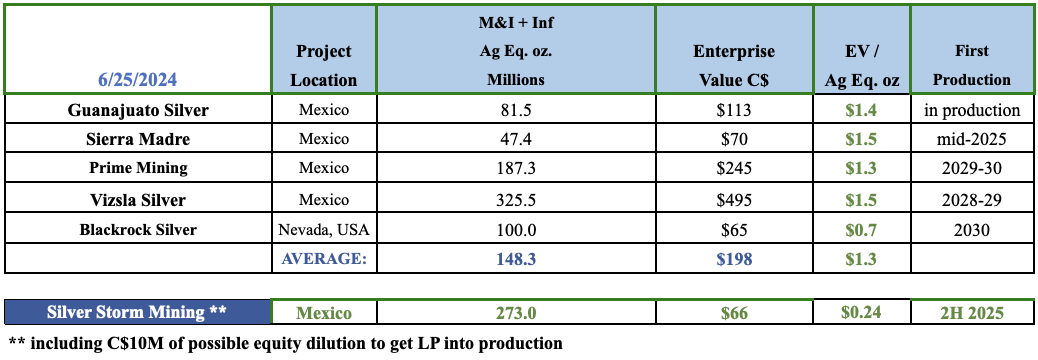

The combined LP + SD resource is ~273M ounces. Silver Storm is valued at just ~$0.24/oz. (EV includes the C$10M addition mentioned above). By comparison, many Ag-heavy juniors are valued at over $1.00/oz. in the ground. For example, pre-PEA companies Vizsla Silver & Sierra Madre both trade at $1.5/oz.

SD is envisioned as a bulk tonnage operation of possibly 10M to 15M oz./yr. Management believes SD has serious potential as a low-cost, long-lived mine. Mineralization consists of a series of high-grade Ag-lead-zinc veins that widen at depth. Higher-grade structures (> 150 g/t.) could potentially be processed at LP.

Importantly, SD is open laterally and at depth. Unlike most companies, Silver Storm’s reported grades are adjusted for estimated recoveries [79.6% for Ag] & smelter deductions.

According to SGS Canada, an additional 20-50M tonnes at 100-150 g/t could be found from “existing structures + lateral & depth extensions.” The mid-point is ~141M ounces (before adjustments for recoveries & smelter deductions). That would boost SD to just shy of 400M Ag Eq. ounces. As a frame of reference, at spot prices 400M Ag Eq. = 5.0M Au Eq.

With Ag prices reportedly trading at a +10% premium in China vs. COMEX quoted levels, solar demand having another strong year, the Chinese economy stabilizing/recovering, and Chinese citizens told to invest in Ag instead of real estate, all roads lead to higher prices.

Silver Storm Mining (TSX-v: SVRS) / (OTC: SVRSF) plans to be in production in 2H 2025. Assuming an Ag Eq. price ~12% below the spot price, the Company could generate C$35M in EBITDA in 2026. If achieved, that’s a 1.9x EV/2026e EBITDA ratio vs. peers at 6.2x [2025e EBTIDA].

Silver Storm is notably undervalued before even considering the SD project. Compared to peer EV/oz. ratios, SD at just half (the average) valuation is worth over $130M. In the chart below, the average EV/oz. is $1.3. By contrast, Silver Storm, with an EV = $66M (incl. C$10M of future equity capital raises to launch LP), values SD + LP ounces at just $0.24/oz.

Make no mistake, funding requirements for SD could total $10’s of millions, but not anytime soon, and not necessarily on Silver Storm’s dime. Hopefully, cash from LP, debt financing, securing a strategic partner, and/or royalty/streaming can cover a large portion of start-up costs at SD.

While there’s substantial execution/start-up risk between now & production in 15-18 months, if management starts operating reasonably on time and on budget, the Company’s valuation could soar. And, if funding is finalized (possibly a debt + equity package) this year, that de-risking could also spark a meaningful re-rating.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)