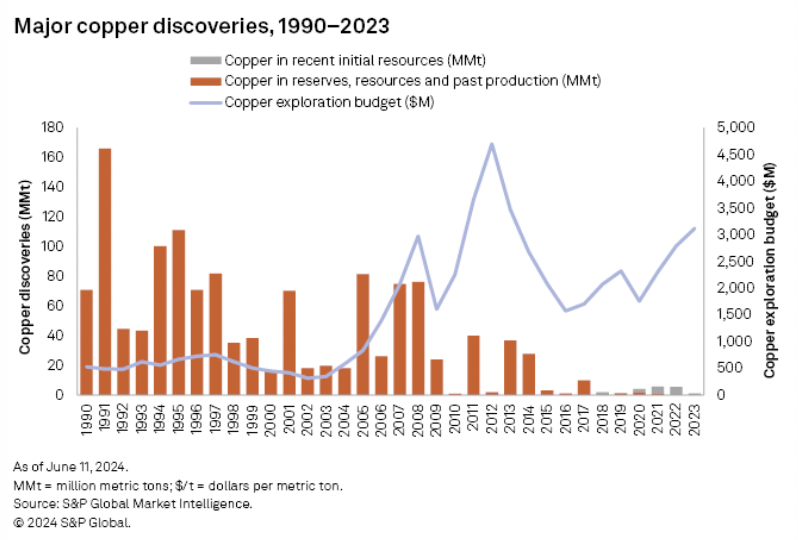

The following chart from S&P Global Commodity Insights was updated last month to include 2023 data. I know of no better appraisal of the Cu market than this. In the 15-yr. period from 2009-2023, “Major” discoveries fell off a cliff compared to 1990-2008, down roughly 80%!

S&P recorded only four Major [> 500,000 tonnes = 1.1B lbs. contained Cu] discoveries from 2019-2023. This, and the recent estimate (also by S&P) that Cu discoveries this decade will not reach production until the 2040s, is quite alarming.

Look at the above chart again. Even as projects from 2009-2023 are commercialized, they’re simply aren’t enough of them to move the needle in the much larger Cu market of the 2030s-40s.

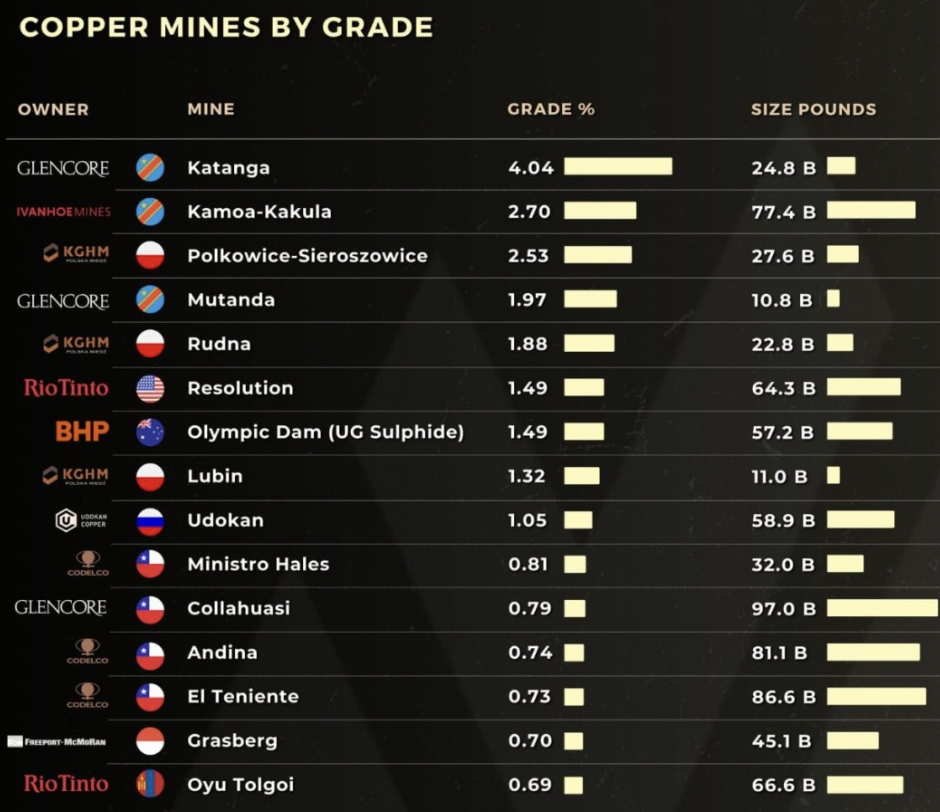

Of the world’s highest-grade Cu mines, 4 are in Chile, 3 in Poland, 3 in the DRC, and 1 each in Australia, the U.S., Indonesia, Russia & Mongolia. Although fairly safe & reliable, the four Chilean mines are an average of 53 years old, costs are rising, grades are falling, and water is scarce.

The DRC is now the 2nd largest producer of Cu, but it’s not a long-term sustainable source for N. America’s growing demand. Most African Cu is earmarked for China. The U.S. is ground zero for data centers & EV manufacturing using enormous amounts of electricity, requiring new, Cu-intensive power plants & electrical grid infrastructure.

Demand growth through 2040 might be 3%/yr., but where will vast amounts of newly mined Cu come from? Even if Cu were to double to $9+/lb., the near-term supply response would be muted. Increased recycling would kick in, but that’s not a longer-term solution in an ever-expanding market.

To recap –> 1) Cu demand is growing 3%/yr. for decades to come, 2) a dearth of Major discoveries points to anemic supply growth into the 2040s, and 3) N. America can’t rely on China, the DRC, Russia, Indonesia, Mongolia & Zambia for its Cu. Therefore, domestic (U.S.) Cu production + Canadian imports will be in high demand.

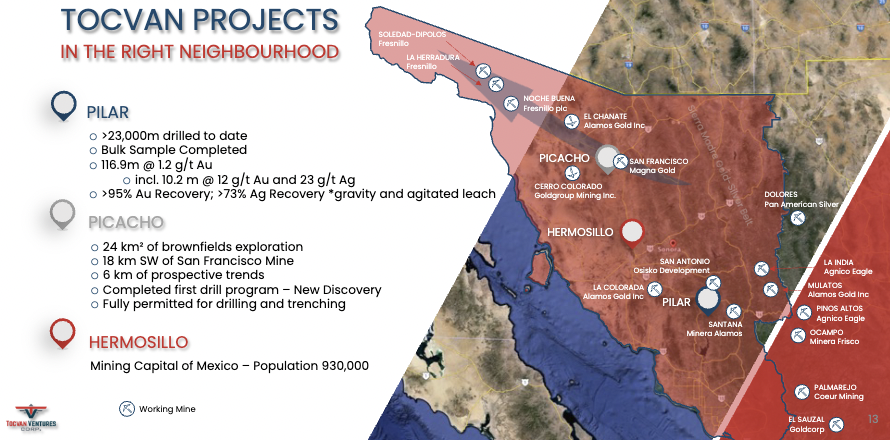

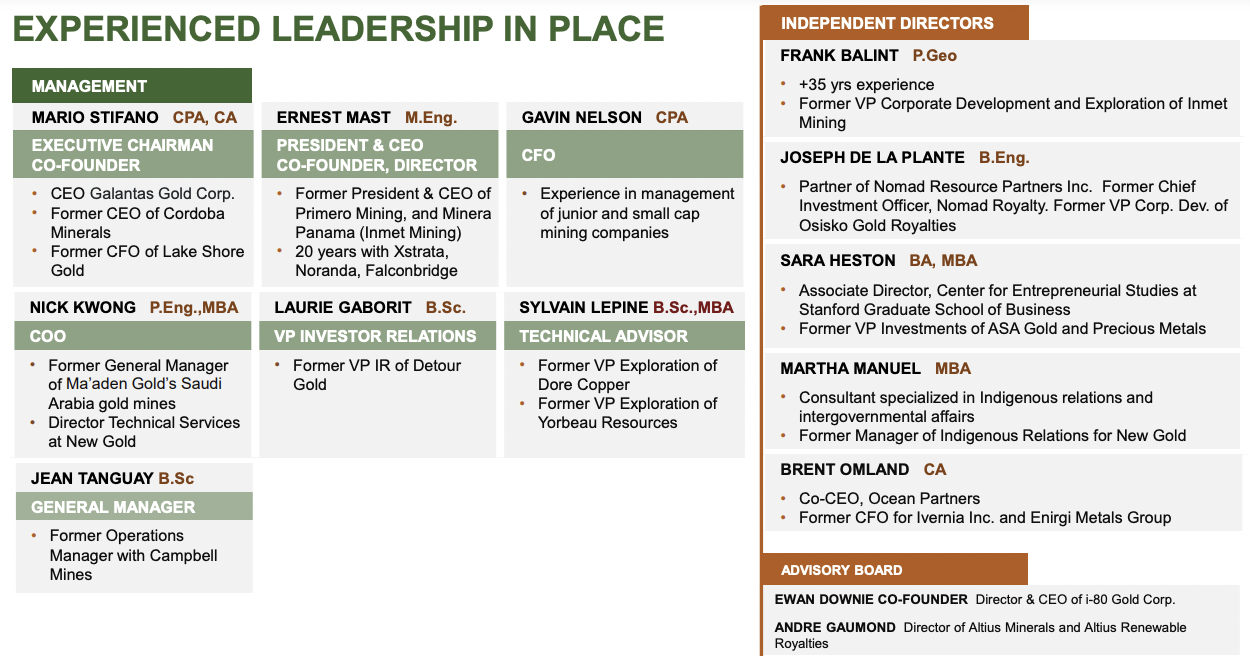

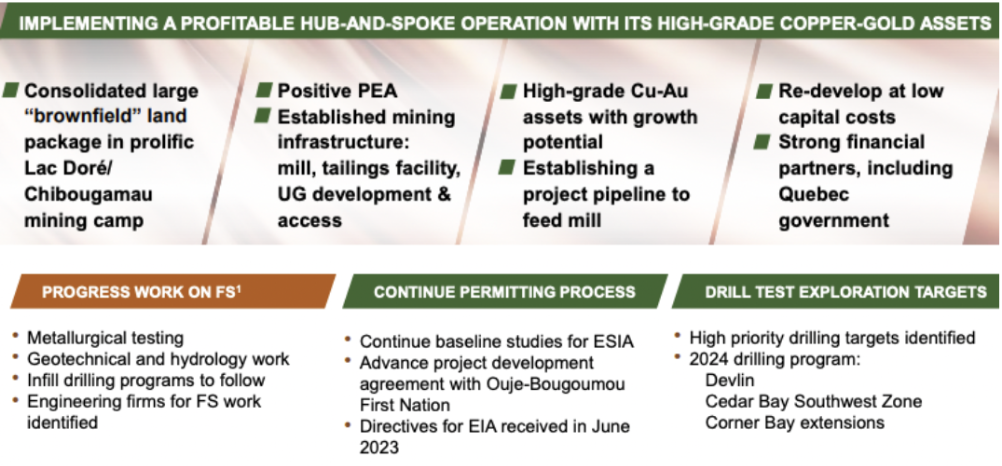

Doré Copper Mining Corp. (TSX-v: DCMC) / (OTC: DRCMF) has a very high-grade Cu/gold (“Au“) [brownfield] project in the prolific Chibougamau mining region of Quebec, Canada. It’s surrounded by crucial infrastructure including; roads, power, water, rail, an airport, labor, equipment & services.

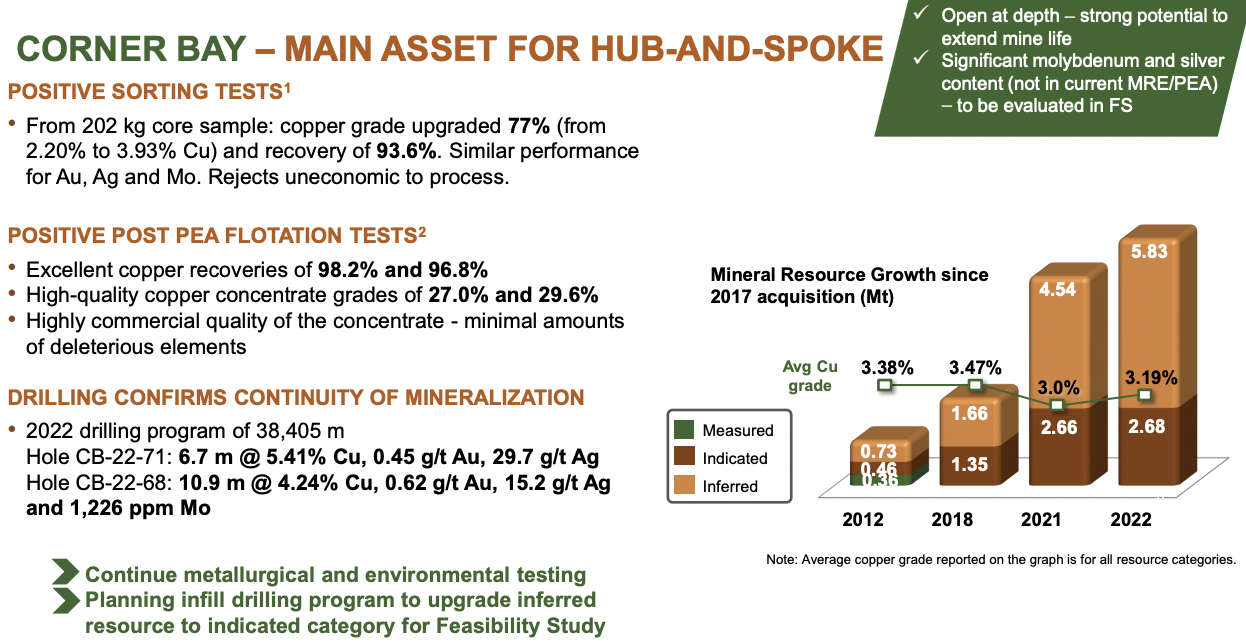

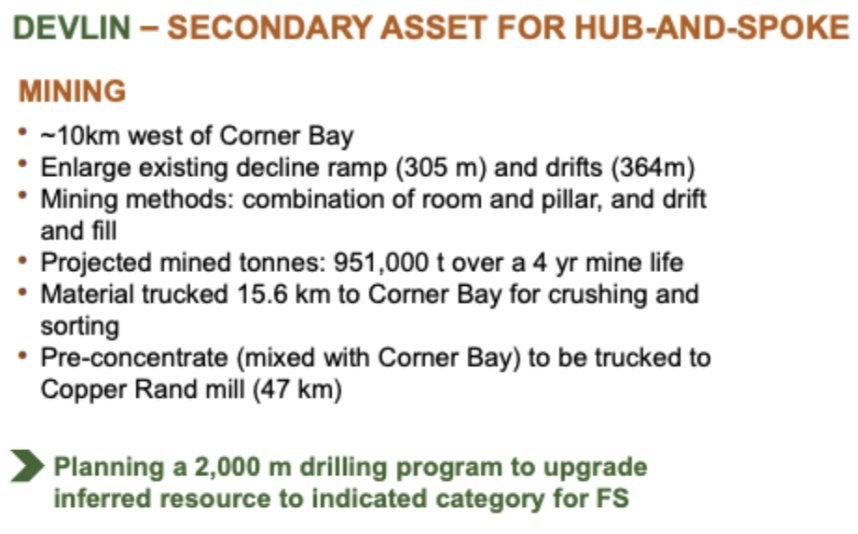

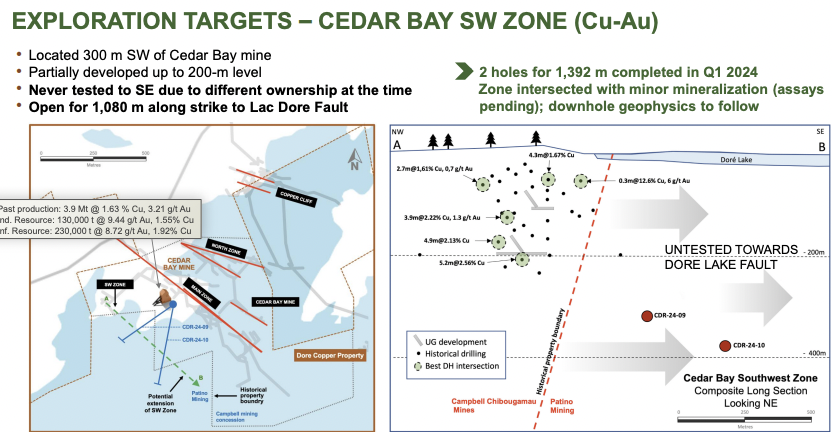

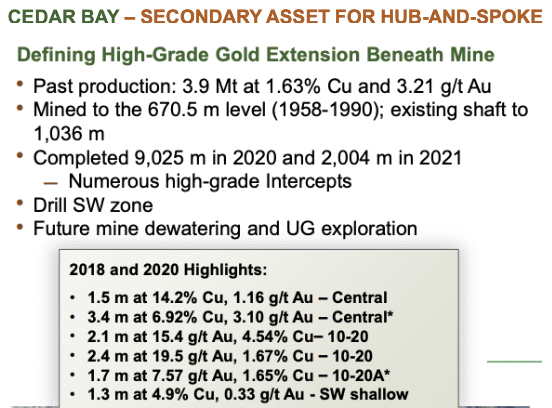

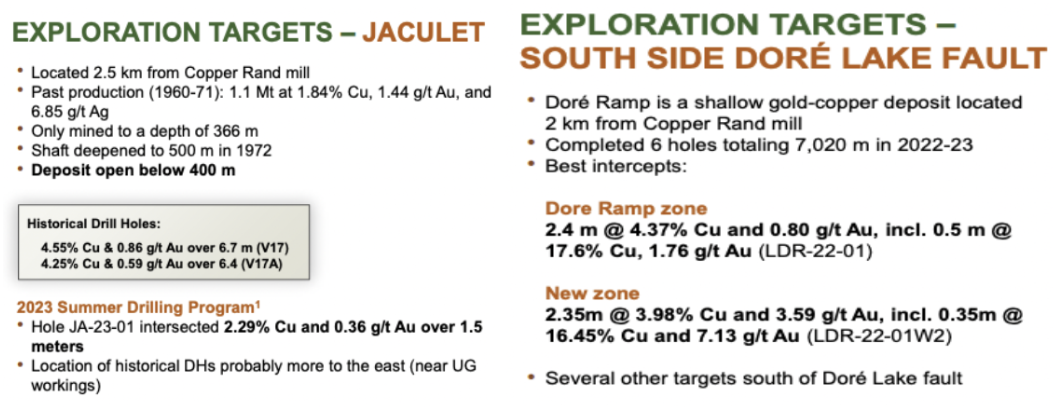

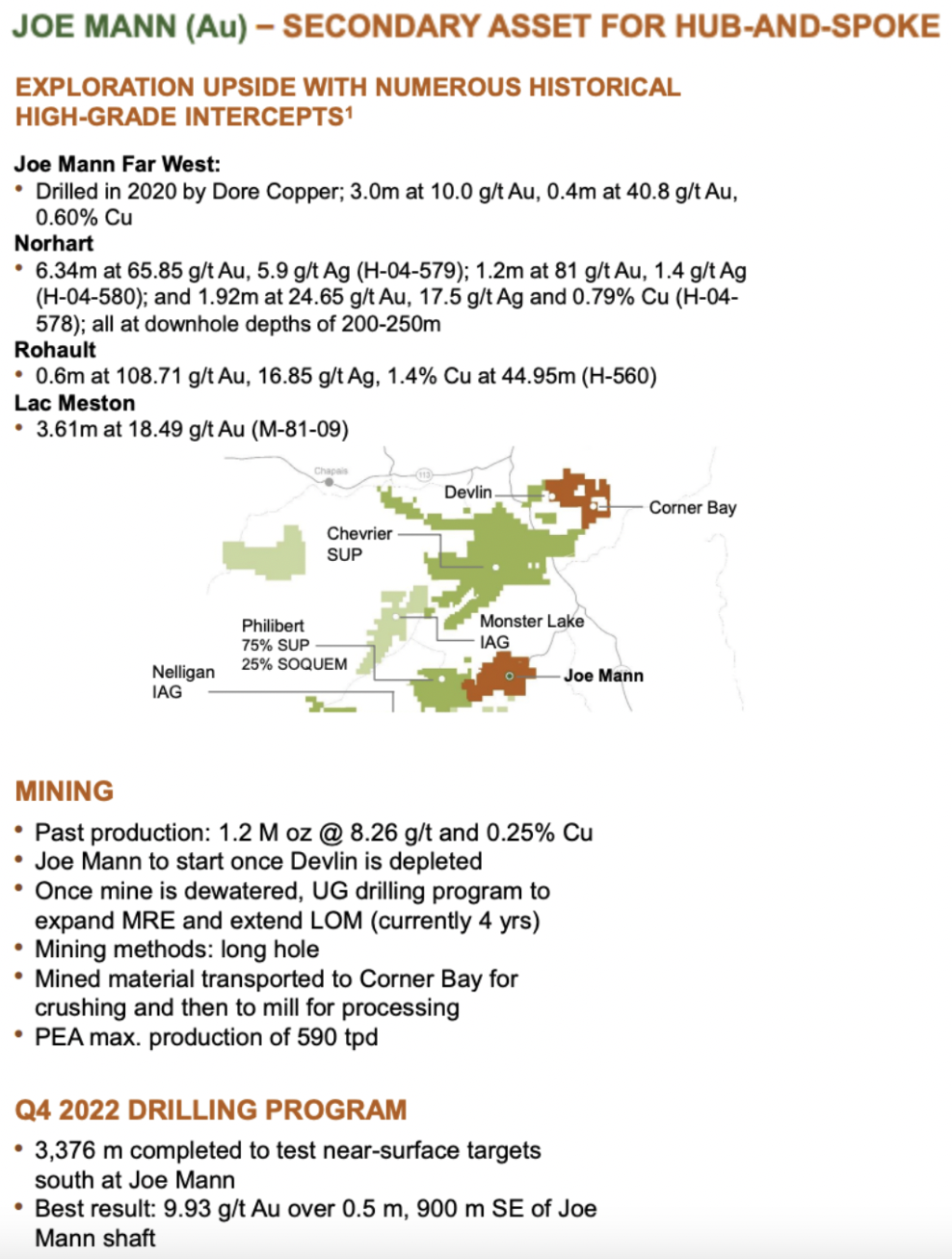

Doré’s land package hosts 13 former mines, deposits & target zones within 60 km of the 100%-owned, 2,700 tonne/day Copper Rand Mill. The flagship Corner Bay [“CB”] project represents ~82.5% of a booked ~835M lbs. [Cu Eq. @ spot prices].

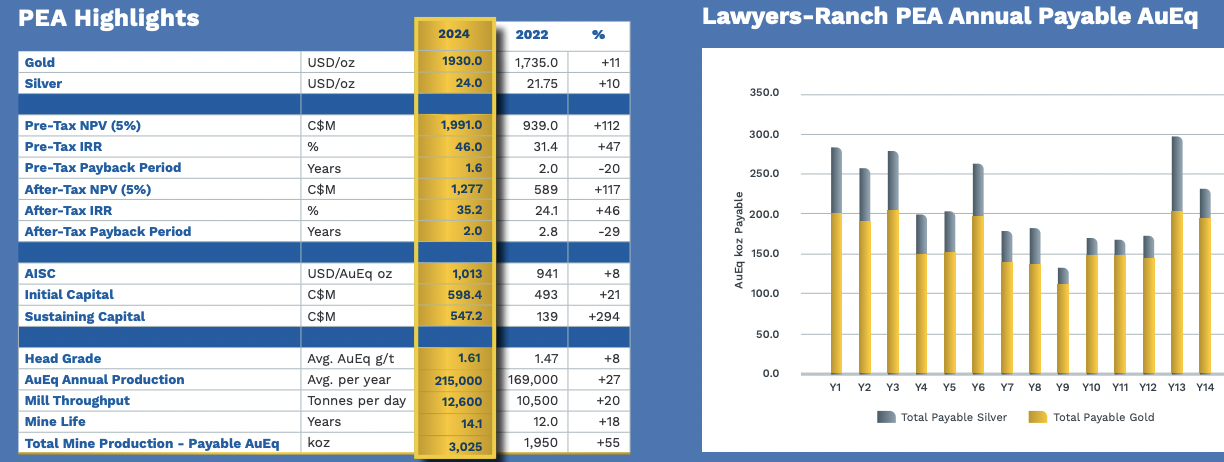

The Company has a tried & true hub-and-spoke development strategy upon which a Preliminary Economic Assessment (“PEA“) was done in May 2022. Yet, that’s just the tip of the iceberg of what a well-funded development effort could deliver.

The PEA demonstrated a robust project with a post-tax NPV & IRR of $193M & 22% for the production of 53M lbs. of Cu Eq./yr. for just 10.5 years. Upfront capital is quite low at $181M and the AISC is competitive at US$2.24/lb.

A US$3.75/lb. Cu price was used, but if Cu rallies as much as some investment banks expect, ($5.44 to $6.80/lb.), next year’s BFS could potentially incorporate a $4.50+/lb. assumption. Management is skipping a PFS because CB is a brownfield site and many economic trade-offs & flow sheet decisions have already been made.

Skipping the PFS introduces a bit more execution risk, but it will save time & money — a reasonable approach given that Doré will likely be acquired long before initial production.

The Company has a strong shareholder base. Ocean Partners’ & Equinox Partners’ combined ownership of 53% have provided tremendous support. Importantly, those ownership stakes do not box out strategic investors. A third large shareholder could get involved, or a minority interest at the project level could be sold.

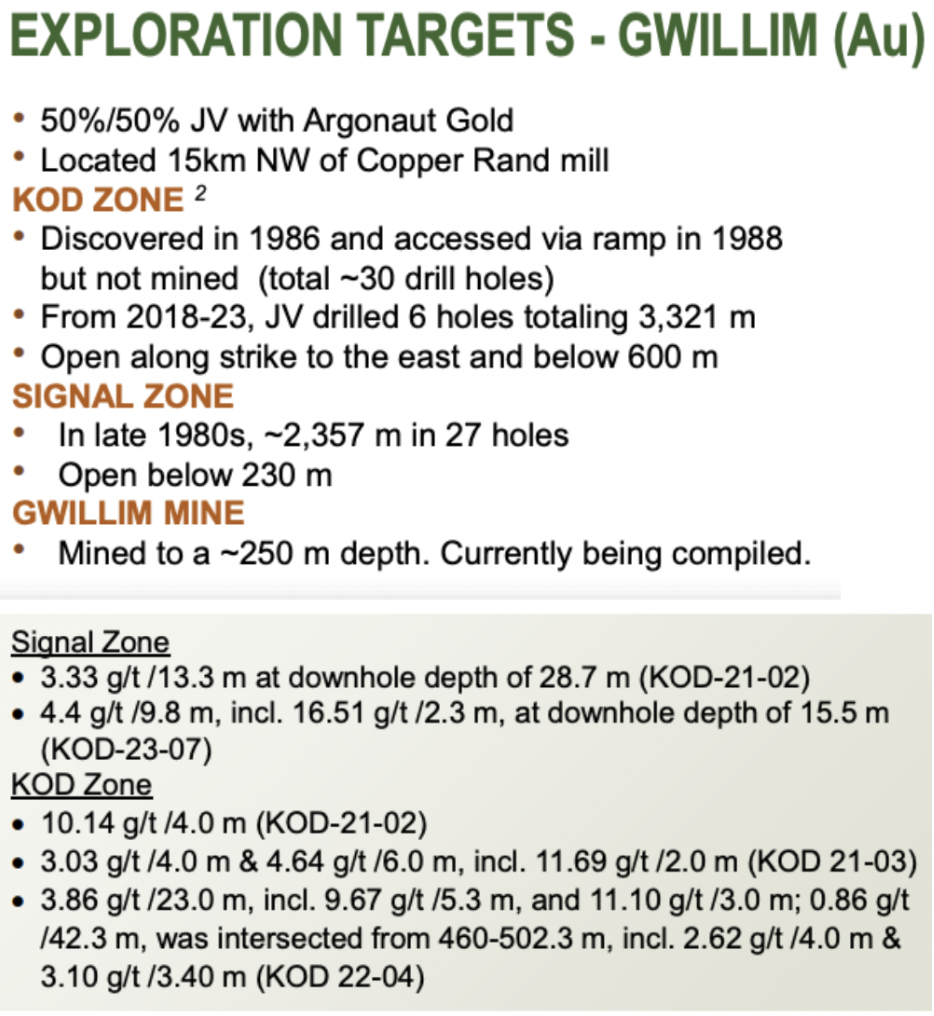

The Company owns 100% of its assets, except for 50% of the promising GWILLEM Au target in a JV with Alamos Gold and a newly acquired 56.4% stake in a property tied to CB, with the other 43.6% owned by Pan American Silver. Another multi-billion dollar producer with projects close to Doré is IAMGOLD Corp.

Last week management entered an agreement with SOQUEM to acquire a 56.4% interest in contiguous claims immediately north & east of the CB project. The claim group, totaling 446 hectares, had ~7,610 m of drilling in the 1970s and ~5,327 m in the 1990s.

Significant, drill intercepts on the new claims included:

13.2% Cu over 0.6 m, 5.5% Cu over 2.4 m, (incl. 13.9% / 0.8 m), 15.3% / 0.8 m, 9.8% / 1.3 m, and 12.4% / 0.9 m. Although narrow widths, this is very high grade. 1M mineralized tonnes at a 3% (diluted) Cu Eq. grade would add ~66M lbs.

If grades are strong & intercepts are wider at depth, and depending on how deep mineralization goes, there could be > 1M tonnes. The market did not react to this low-cost, low-risk acquisition, despite a modest Cu price rally of ~7% month to date.

From the recent press release,

“The current northern limit of the Corner Bay mineral resource is ~430 m south of the property boundary. Access to the claim group would provide an additional 800 m along strike to test the possibility of a northern extension. In addition, a target of interest is the area of intersection between the north-south Corner Bay shear zone and the NW-SE shear zones of the claim group.”

I believe Doré is oversold on fears of equity dilution down the road, but with funding from gov’t grants & loans, Quebec institutions, commercial lenders, equipment financing, off-take agreements & royalty/streaming opportunities, production could be reached without excessive dilution.

Subject to drilling/discoveries –> all else equal, if mine life could be doubled to 21 years AND throughput doubled to nameplate Mill capacity of 2,700 tpd, production could be [4 x 53 = 212M lbs. Cu Eq./yr].

To be clear, that would require years of successful exploration + $10s of millions, but an easy ask for a mid-tier producer.

Potential suitors are not just Cu players. Agnico Eagle, Newmont, Barrack, Franco-Nevada, Wheaton Precious Metals, Centerra Gold & B2Gold have been expanding into Cu from Au/Ag, while companies like Freeport McMoRan & Teck Resources have expanded from Cu to Au.

Detailed flotation test work on a composite CB sample determined that a clean 28% Cu concentrate could be delivered vs. the 24.7% concentrate grade in the PEA. An increase in concentrate grade would lower smelter treatment terms, increase payment of Cu, and lower transportation costs.

This meaningful enhancement would mitigate some of the op-ex inflation since the PEA. Regarding upfront cap-ex of $181M, the PEA included $25M for an extension to the concentrator and installation of two filter presses.

That figure could come down as an existing part of the Mill can probably be used to avoid the need for new construction. And, it should be possible to operate with one filter. Extending mine life and/or mill throughput (including the possibility of toll-milling third-party ores) — would boost project economics.

In addition to operating on a brownfield site and being supported by strong shareholders & the Quebec government, there remains tremendous upside potential in/around explored, underexplored, and never-explored areas.

Importantly, CB does not have a royalty or stream, making it highly attractive to royalty/streaming players. Considerable time, probably 5 or 6 years, would be required to select, study, permit, fund & construct an area for tailings disposal.

The cost to design, permit, fund, build & commission a new 2,700 tpd mill & tailings facility would be ~$125M. High-grade projects have far less environmental impact — less waste & energy per pound of Cu produced, and lower capital intensity than large, low-grade projects. These factors mean less project execution risk.

Although at PEA stage, a BFS is expected in 1H 2025. Depending largely on nearness to production, high-quality BFS-stage mining projects are valued at 25% to 70% of after-tax NPV. For example, gold juniors Ascot & Skeena trade at 55% & 40%, respectively, of NPV.

In stark contrast, assuming $4.20/lb. Cu, (vs. spot at $4.65/lb.) Doré is valued at ~5% of its PEA-derived NPV (NPV includes a 15% increase in cap-ex & a 10% in op-ex). This is a low-risk, high-grade restart story in a world-class jurisdiction. Canadian Cu (and uranium, but I digress) will be highly sought after in the U.S.

For those who have read this far, thank you… Please take a moment to review the images, charts, maps, and graphs contained in this article. Notice how many exciting expansion opportunities there are. Here’s the latest corporate presentation.

I believe shares of Doré Copper Mining Corp. (TSX-v: DCMC) / (OTC: DRCMF) at C$0.11 offer a compelling high-risk/high-reward proposition with fairly limited downside (especially if one’s bullish on Cu).

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Dore Copper Mining, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Dore Copper Mining are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Doré Copper Mining was an advertiser on [ER] and Peter Epstein owned shares in the company acquired in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)