I’ve written multiple articles on NuGen Medical Devices (TSX-v: NGMD) / (OTCQX: NGMDF) this year, here’s one that provides a lot of background –> April article. NuGen remains a high-risk / high-return investment opportunity, but its business is finally moving in the right direction.

Readers have resonated with the Company’s mission to make needle-free insulin injections for diabetics, and eventually for the delivery of other medicines, vitamins, supplements/CBD, vaccines, growth & fertility hormones, etc., commonplace. Even our beloved pets will benefit.

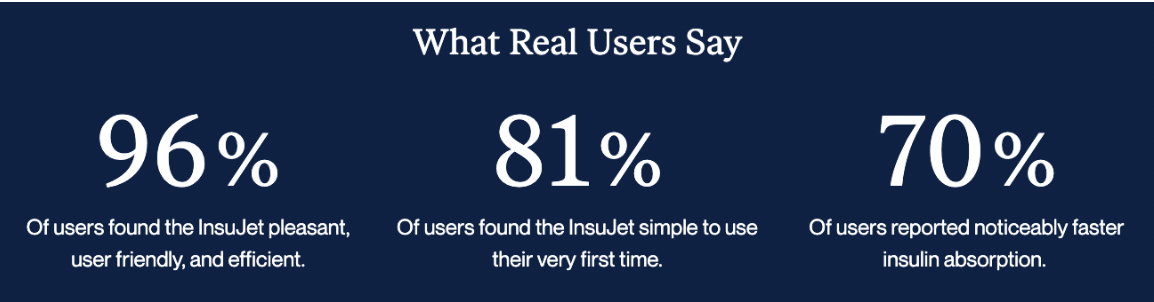

NuGen sells injection devices (InsuJet), that deliver insulin without needles. The devices are simple to use, anxiety-pain-free, and well-designed (durable). The Company sells kits that include the required high-margin consumables like nozzles & adaptors. In most countries, NuGen’s products are free to diabetics.

The needle-free market has been slow to develop because each medicine needs to be approved for delivery via the injection device being sold. Therefore, regulatory approvals are required by country & product customization, with one or more clinical demonstrations of efficacy.

Regulatory regimes provide serious barriers to entry. NuGen & predecessor companies have been at this for over a decade. Its devices are approved in over 40 countries. By contrast, it will take years for new entrants to legally enter the U.S. market, which is why the NuGen/Sol-M partnership is so incredibly important.

With sales of InsuJet + consumables in Mexico & Canada beating expectations, next year’s launch in the U.S. is looking quite promising. When I began analyzing this company, sales of its needle-free injection system (incl. required consumables) were essentially zero.

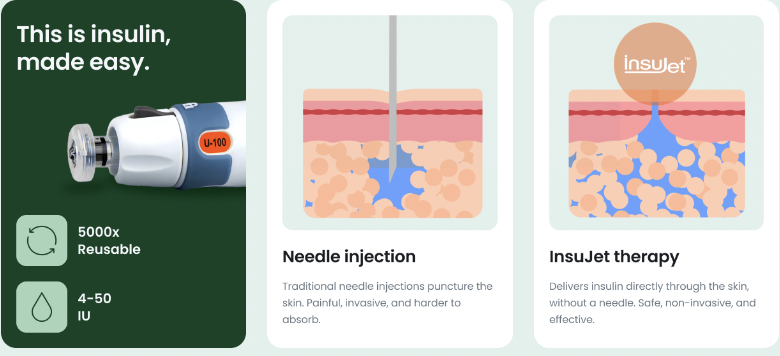

InsuJet™’s jet-injected fluid penetrates the skin through a small orifice of a special nozzle, creating a thin, high-pressure stream. This way, insulin doesn’t remain around the place of injection, like it does with a needle. Instead, with InsuJet™, insulin is deposited into the subcutaneous tissue where it’s easily absorbed and acts faster– saving you time, money, and discomfort.

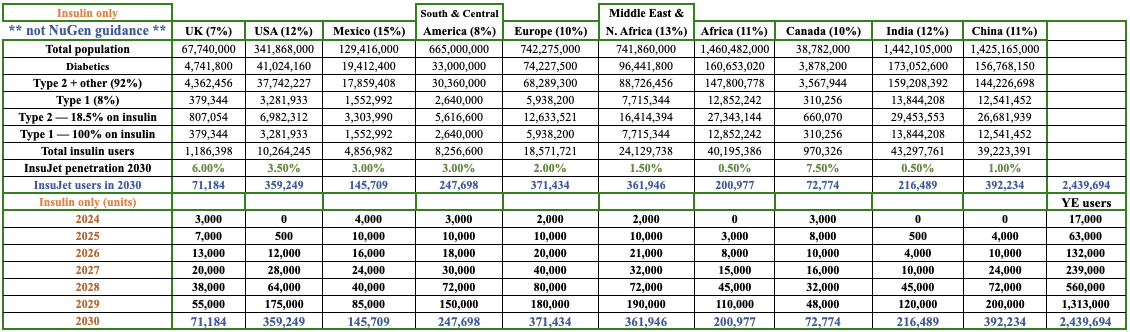

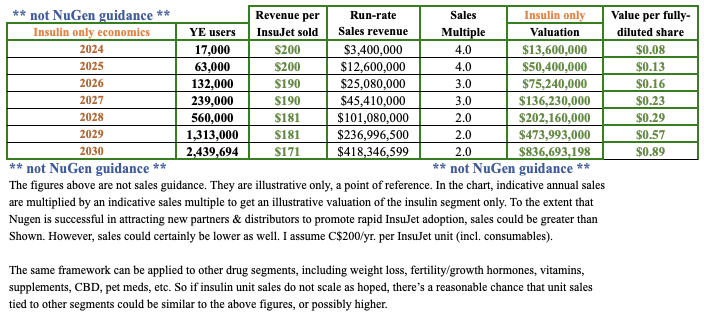

Fast forward six months and the Company’s prospects have improved dramatically in at least 5 of 10 markets I’m tracking (see chart below). NuGen is doing the hard, time-consuming work to get approvals and set up manufacturing, distribution, and product support teams, giving it a long-term sustainable advantage.

I estimate that revenue in CY 2027 could approach $50M from just the insulin segment. The weight loss opportunity is 18-24 months behind insulin, but it could grow faster as InsuJet for insulin blazes a path forward.

Notice that I have China, India & Africa, half the world’s population, achieving just 0.5%-1.0% InsuJet penetration of insulin users by 2030 –> hardly a stretch! Importantly, everything is about to change.

On July 10th, NuGen announced a proposed C$10M 5-yr. secured convertible note (12% non-cash interest), largely if not entirely to be taken up by privately-held, Chicago-based medical supply company Sol-Millennium Medical Group (or its affiliates), a large vertically-integrated manufacturer of needles & syringes, with locations across the globe.

Sol-Millenium (or its affiliates, together “Sol-M“) will become NuGen’s largest shareholder on a fully converted & diluted basis, (see press release). If consummated, this transaction will eventually lead to a lot of equity dilution, but if Sol-M can drive InsuJet sales substantially higher, dilution will be warranted.

Pro forma, fully-diluted shares would be ~546M, (incl. existing options & warrants), and the pro forma enterprise value {market value + debt – cash}, ~$41M at the current price of $0.13. Note: {conversion of the proposed bonds into equity + the exercise of new warrants could be years away}.

This transaction meaningfully de-risks the ongoing rollout of devices and expansion into new countries. In addition, backing by Sol-M is a strong vote of confidence that will help large buyers of InsuJet units feel comfortable placing orders with tiny NuGen Medical.

In my view, Sol-M wouldn’t bother investing in NuGen unless it had very high hopes for InsuJet. And, who other than Sol-M has a better view of the InsuJet rollout? It has been working with NuGen for three years. Sol-M presumably has keen insights into how amenable InsuJet devices might be to weight loss.

Assuming Sol-M can help deliver well more sales than NuGen would on its own, NuGen could eventually be worth $100s of millions. Sol-M will work much harder, faster & smarter on InsuJet once it has a significant equity interest.

I mentioned the large # of pro forma shares, but if existing & proposed options/warrants get exercised, that would bring in ~$28M in cash.

With Sol-M as a very large shareholder, it need not be as aggressive on the margins it earns from distributing InsuJet. It will have major incentives to promote InsuJet (and not competing needle-free products!). Also, Sol-M would likely take over manufacturing, saving Nugen millions of dollars in working capital & cap-ex.

Sol-M brings sales, manufacturing, logistics, branding & marketing expertise across global locations, including important relationships in China. I plugged in a 1% penetration rate for China, but imagine if Sol-M could propel market share to 2%-4% –> 2x-4x the estimate for China in the chart!

As China moves towards needle-free, what does that mean for the rest of Asia? Once Asians are aware of the benefits of needle-free delivery, they will welcome that method for weight loss and their pets.

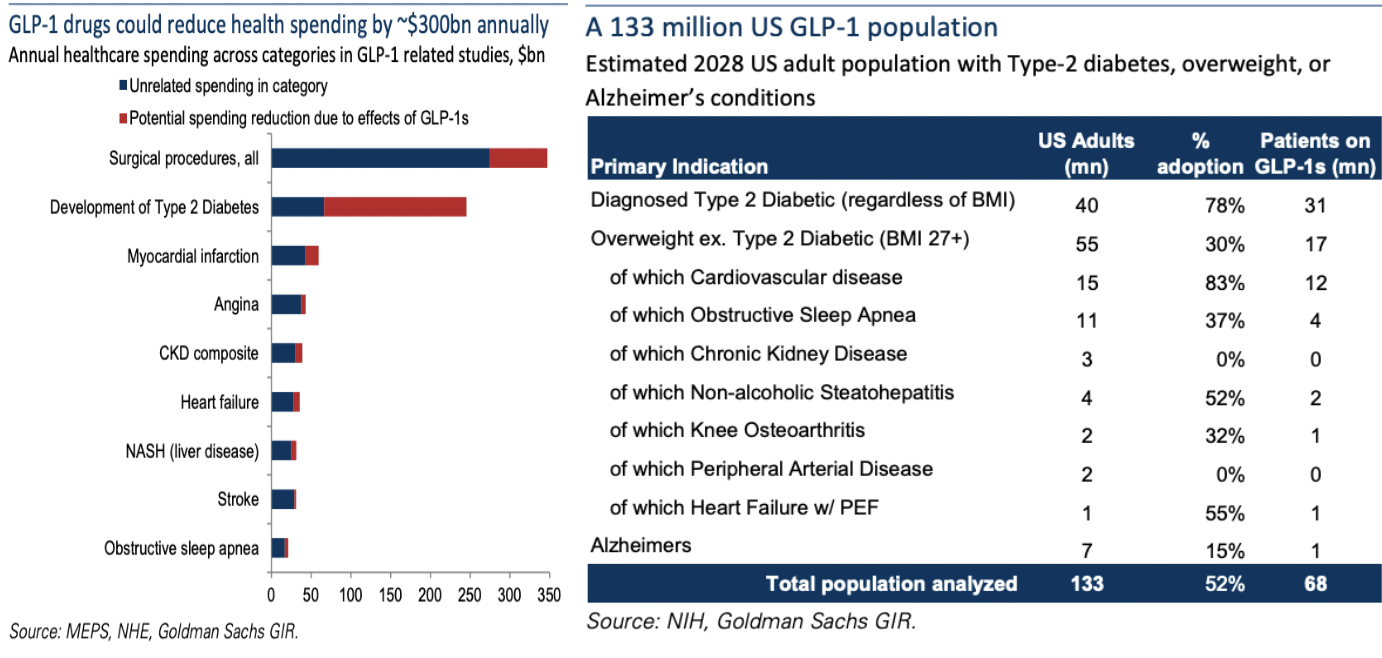

In the following image, Goldman Sachs reports that in the U.S. there could be 133M GLP-1 drug users. Yes, Big Pharma is trying to develop weight loss pills, but the urgency to do so is greatly diminished with InsuJet. In many cases, transitioning from needles to InsuJet will be easier & faster on the regulatory front than from needles to pills.

In speaking with NuGen’s CEO Ian Heynen, he points out another critical consideration regarding injections vs. pills… GLP-1 drugs are in such high demand, with no end in sight, that there are shortages of key molecules. An injection deploys just 5% to 10% of a drug compared to a pill of the same drug.

Therefore, needle-free injection is the best of all possible worlds — painless & anxiety-free, with far less bruising/soreness/infections, etc., reduced medical waste/pollution, and more profitable vs. developing pills that require 10-20x the amount of crucial molecules.

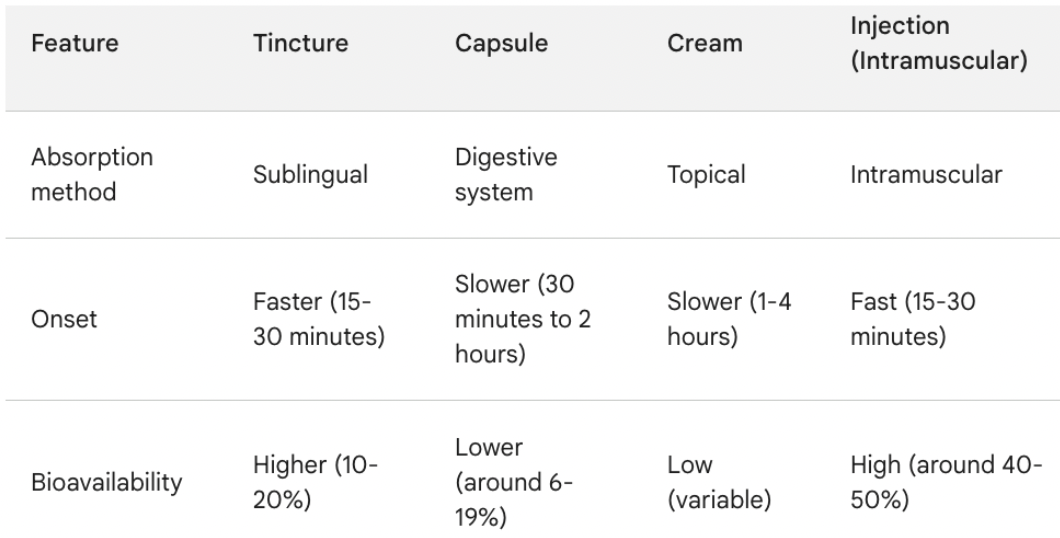

Importantly, CBD supplementation (for example) is estimated to be 2.0-3.6x more effective (40%-50% bioavailability) via injection. Needle-free delivery of most drugs should enjoy similar efficacy.

The marketing potential of a CBD brand — administered via InsuJet — clinically proven to have 100%-260% of the bioavailability of capsules/tinctures/creams would be enormous.

Switching back to weight loss, Eli Lilly & Novo Nordisk dominate the market, but Amgen, Roche, Pfizer, Merck & Sanofi, and others are pursuing this generational opportunity.

Over 100 drugs are in various stages of clinical trials. There will be dozens of small, medium & large pharma companies looking for a marketing edge, companies that could partner with NuGen/Sol-M.

Some consultants believe that GLP-1 drugs could become a trillion-dollar industry as applications beyond weight loss, first in diabetes, heart, liver, and kidney diseases, then cancer, Alzheimer’s, Parkinson’s, and other neurogenic diseases get approved.

As these injectable drugs become mainstream, treating more conditions, and used as preventive measures, insurance companies, employers, and government programs like Medicare & Medicaid will be forced to cover their costs.

In a trillion-dollar market, imagine how valuable having a needle-free option to promote a blockbuster drug like Wegovy would be. Annual GLP-1 sales for weight loss alone could be US$200B/yr. by the early 2030s.

Pharma companies could sell GLP-1 drugs with [InsuJet + consumables] as an accessory, or perhaps even free to their customers. The market is so large that there will be ample room for competitors, but NuGen has a meaningful headstart.

All this talk of weight loss is making me hungry… To recap, insulin sales are a stepping stone to weight loss (and other) substances being delivered pain/anxiety-free. Since NuGen is gaining traction and has attracted a major investment from Sol-M, the chance of a BIG WIN in weight loss is considerably higher.

I hesitate to guess how impactful it could be, but one can’t rule out needle-free delivery of GLP-1 drugs being 2x to 4x as large as the insulin opportunity. The numbers start to get silly, which is why I don’t provide a chart showing what they could be.

With Sol-M as a highly motivated partner instead of merely a distributor, the sky’s the limit on InsuJet sales in existing/new markets like China where NuGen has limited connections… until now. Speed to market is key. Sol-M will turbocharge NuGen’s global roll-out.

It’s important to note that NuGen’s team made this transaction possible. Tireless work over the past decade, including a few false starts, has led to a bright path forward. Presumably, Sol-M could have taken this step with NuGen a year ago, but NuGen wasn’t ready. Now both companies are ready, willing & able!

The stars are aligned for NuGen/Sol-M to make needle-free delivery of drugs, (for humans & pets), ubiquitous. Make no mistake, the downside on the share price remains the same, (-100%), but that outcome seems far less likely now with the addition of Sol-M’s highly valuable capabilities.

The upside if Sol-M delivers its expertise in manufacturing, branding, marketing & distribution, and GLP-1 weight loss drugs delivered via InstuJet takes off, is a multiple of the current share price of $0.135 (even on a fully-diluted share count).

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about NuGen Medical Devices, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of NuGen Medical Devices are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, NuGen Medical Devices was an advertiser on [ER] and Peter Epstein owned shares and/or stock options in the company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, or reported facts.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)