In Greek mythology, Troilus was a Trojan prince, the son of King Priam & Queen Hecuba. Prophecies linked his fate to the city of Troy, where Troilus was murdered by Achilles around the year 1200 BC. Fast forward 3,217 years –> Troilus Gold (TSX: TLG) / (OTCQX: CHXMF) was founded in 2017.

The Company’s stock price has been under pressure after releasing a Bankable Feasibility Study (“BFS“) with a relatively low after-tax IRR due to higher-than-expected cap-ex. Some fear the Company’s flagship Troilus project only works at US$2,100+/oz. gold (“Au“). Of course, the price is now ~$2,432/oz., so full speed ahead.

On July 17th, the spot price hit an all-time high of $2,484/oz., a whopping $509/oz. [+26%] above the $1,975/oz. assumption in the BFS. I estimate that at $2,450/oz. the after-tax IRR would be ~21%, at $3,000/oz. Au & $5/lb. Cu, the IRR would be ~28%. Unlike most Au projects, the Troilus project has a valuable copper (“Cu“) component.

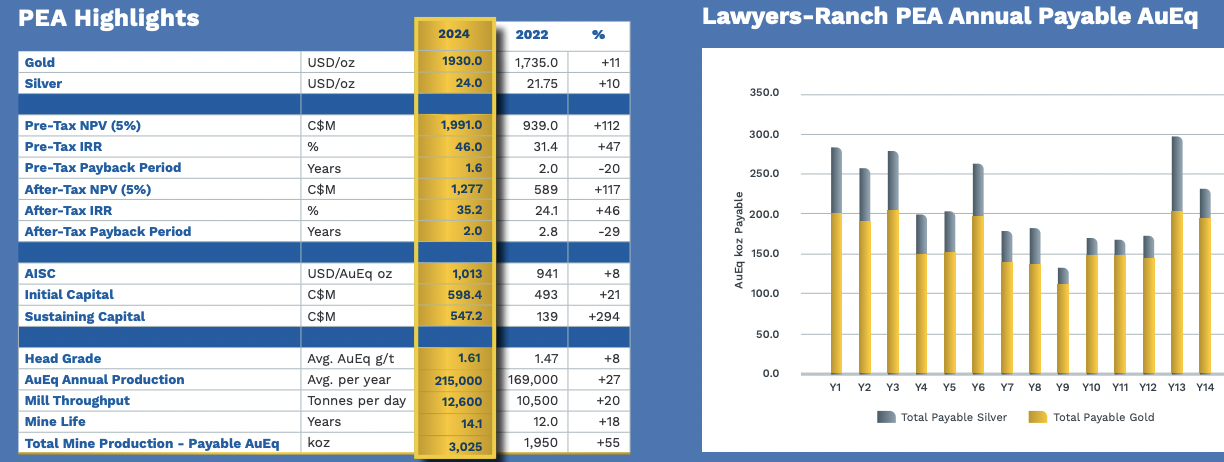

Note: on August 6th, a peer Au junior released a summary of its PEA with a base case Au assumption of US$2,100/oz.. Higher Au prices are working their way into studies…

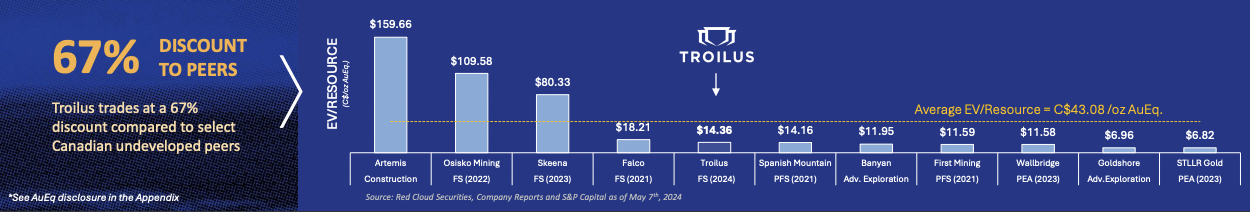

Troilus has been substantially de-risked and is meaningfully undervalued. Today’s enterprise value {market cap + debt – cash} is < 10% of the after-tax NPV in the BFS. Many projects at similar development stages are valued at 25% to 50% of post-tax NPV.

Admittedly, other Au/Cu projects also look a lot better at today’s metals prices, but as long as Au remains in the $2,000s/oz., Troilus is a go and investors can turn to other attributes that make it attractive to a strategic partner or acquirer.

The Troilus BFS was the first done on a major N. American Au project this year. Understandably, there was some sticker shock on cap-ex inflation. However, in my view, peer studies announced 12-36 months ago understate both cap-ex & op-ex by 10% to 25%… Look at the following chart. Notice the dates of each study.

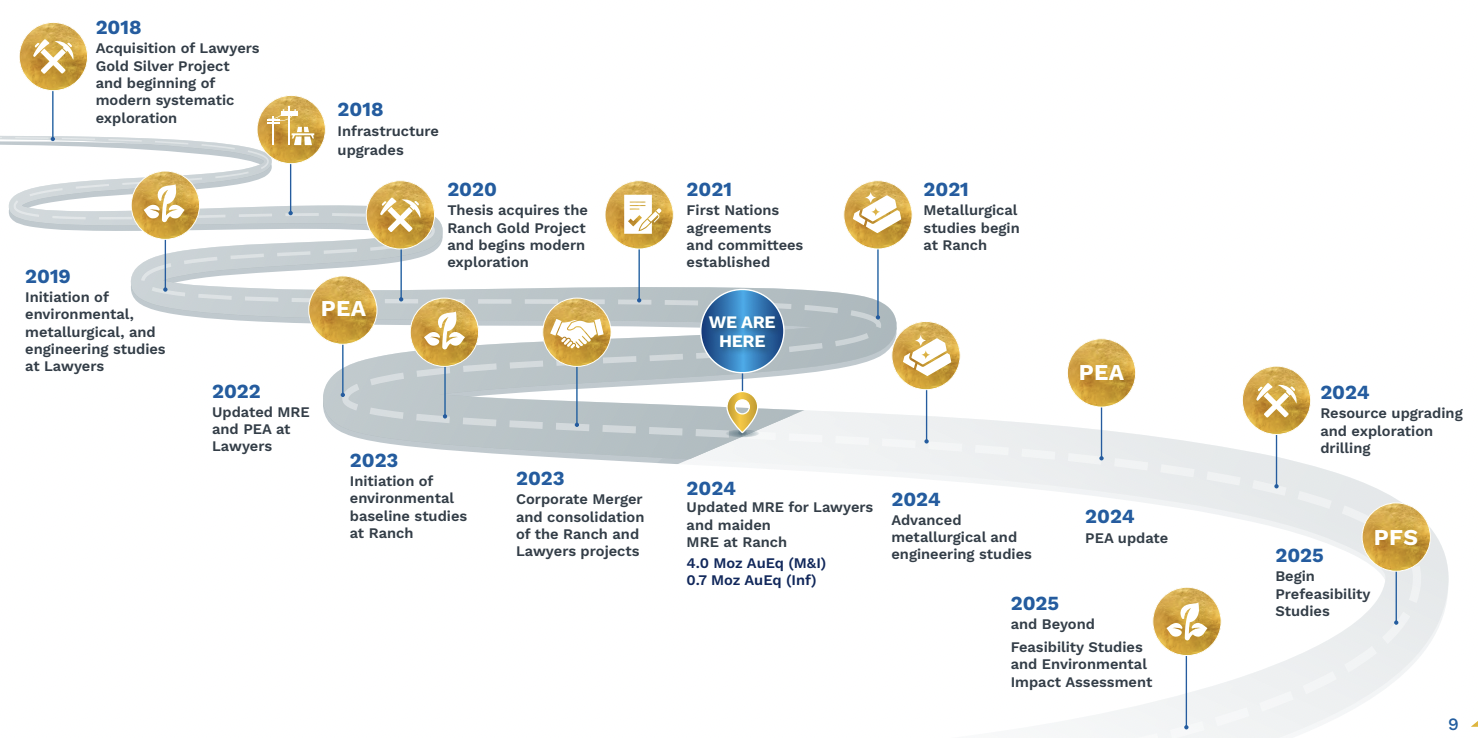

Troilus could reach initial production within five years. By contrast, many large (> 6M Au Eq. ozs.) peers are 5-10 years away, making them at higher risk. At 13.0M Au Eq. ozs., Trolus is one of the largest undeveloped Au/Cu assets in N. America.

Importantly, 86% of booked ounces are in the NI 43-101 compliant Indicated category. Globally, not including places including; Russia, Indonesia & Pakistan, I know of nine junior-controlled, pre-production projects with 6M+ ounces.

A company like Barrick Gold or Agnico Eagle could comfortably afford to acquire & commercialize multiple Troilus Golds! Those two Majors have BBB+ bond ratings and an average net debt / EBITDA ratio of under ~0.4x (extremely low!).

I strongly believe that securing a partner like; Agnico Eagle, Newmont, Barrick Gold, Freeport McMoRan, Teck Resources, Sumitomo, Gold Fields, Kinross, AngloGold Ashanti, Alamos Gold, Boliden AB, Eldorado Gold, IamGold, Evolution Mining, Lundin Gold or HudBay Minerals is a reasonable expectation in the next 6-12 months.

Mining cost inflation is running rampant. That, and extended timelines to reach production, suggest a tsunami of M&A will be rolling in. This is an important consideration as Troilus is worth considerably more as part of a portfolio of assets than as a stand-alone mine.

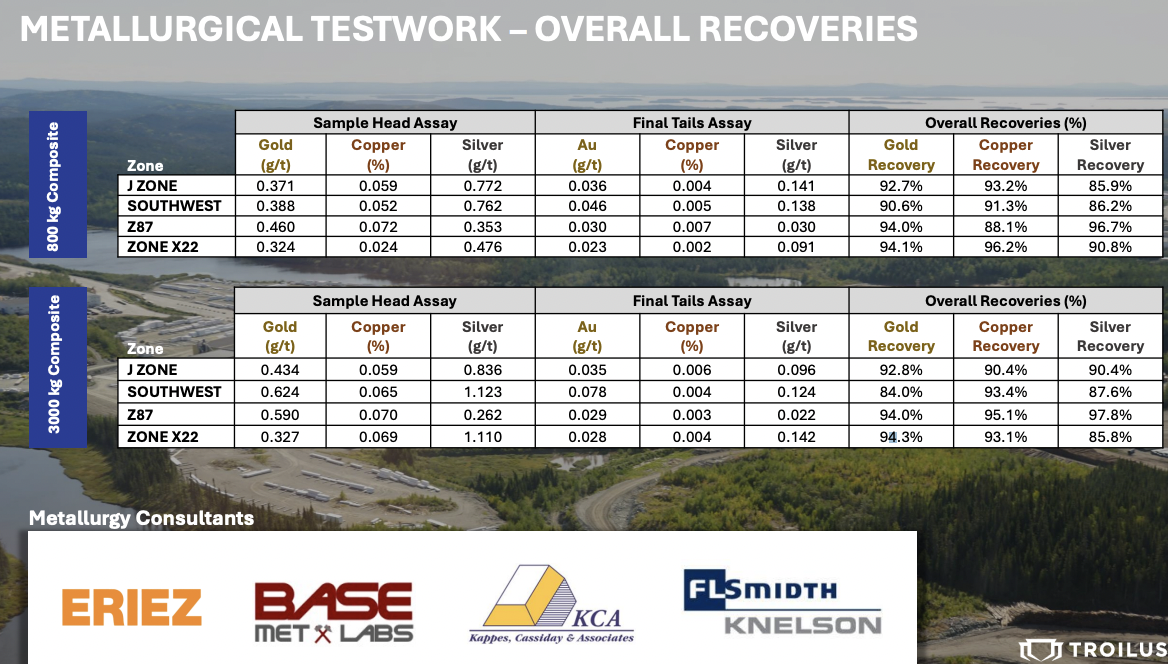

Majors enjoy significant economies of scale, operating expertise, and access to low-cost capital. They can capture substantial synergies & enhanced operating flexibility. Metallurgical testing to date shows promising overall recoveries.

Competitive tension for large-scale N. American Au/Cu projects is growing by the day, majors need to replenish their pipelines. Excluding “conceptual” Au/Cu contributions from Reko Diq in Pakistan and the Lumwana Super Pit in Zambia, Africa, Barrick forecasts zero organic growth of Au Eq. ounces through 2033 for its current portfolio!

Discussions are well underway with multiple strategic groups, a few negotiations are described as fairly advanced. The goal is to secure a partner this year. Although an equity raise could be necessary, there’s no dire need to raise cash as the Company has ~$12M + $3M in accounts receivable.

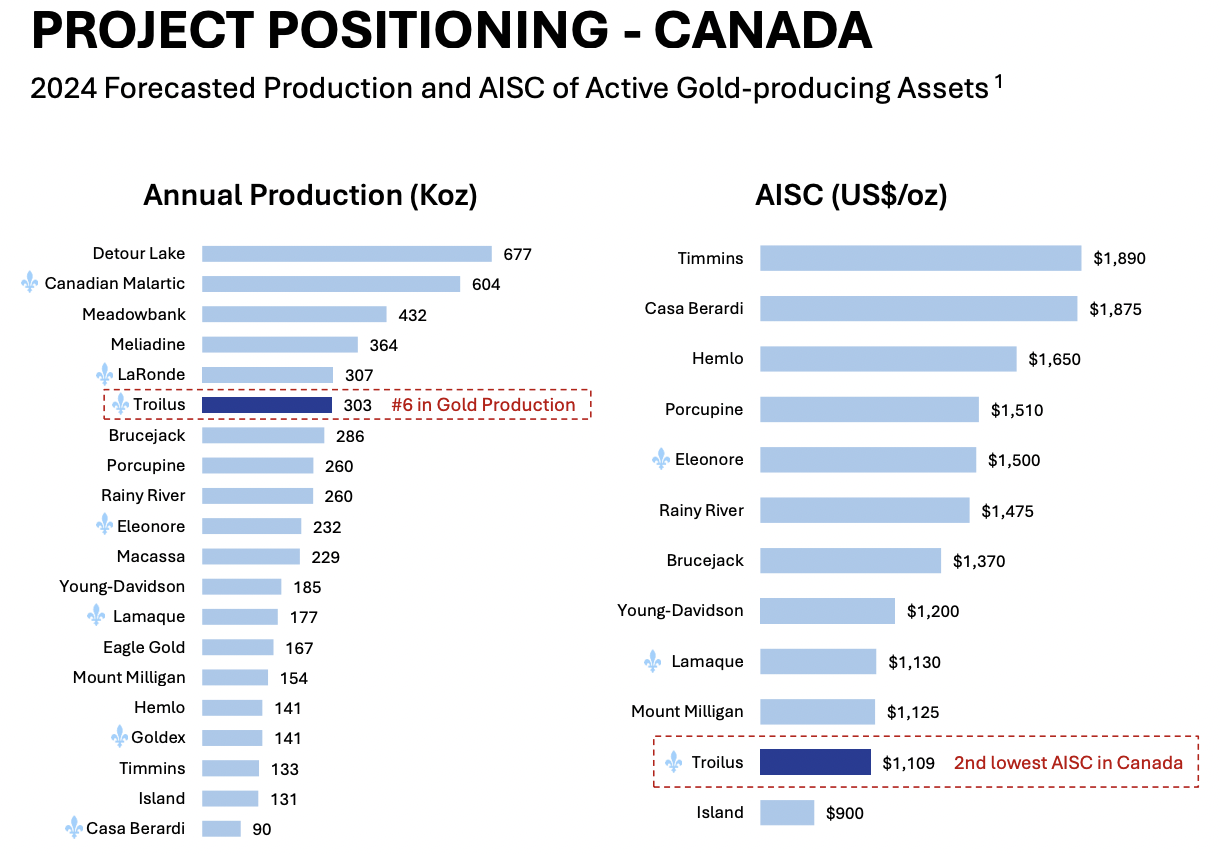

Over a 22-yr. mine life, average annual production in the BFS averages 303k Au Eq. ozs., peaking at ~536k/yr., and ~453k ozs./yr. in years 5 to 8. Yet, that’s on about half the total resource. CEO Justin Reid thinks a strategic partner could extend mine life to 30+ years, (and *in my view* increase annual production).

Imagine, the synergies Agnico could gain by adding Troilus to its east Canadian portfolio highlighted by Canadian Malartic & Detour Lake. Thirteen million Au Eq. ounces is a lot. I presume that Agnico, with a pristine balance sheet, is actively looking to make acquisitions, especially after rival Newmont acquired Newcrest.

One of my favorite parts of the Troilus story is its strong Cu kicker. The Project has 382M lbs. Mr. Reid believes an Ag royalty/stream on 9.9M Ag ounces could be sold for US$50M-$100M.

What might that mean for the potential value of a Cu royalty/stream? I’m confident management could get > US$500M, but they don’t want to monetize Cu {deemed a critical metal} in this way unless they have to.

Combined, Ag + Cu royalty/streaming deals could cover > 50% of upfront cap-ex. And, debt funding should be good for 60%-65% of cap-ex… One can see where I’m going here –> the Troilus project is highly financeable without onerous equity dilution. This mitigates a major risk factor.

Debt funding could come from Quebec, elsewhere in Canada, the U.S., or Europe. With global interest rates expected to decline as the U.S. Fed cuts rates, a loan package could get done at attractive levels.

The Project’s life-of-mine operating cost, as captured by All-in-Sustainable Costs (“AISC“) is US$1,109/oz. Compare that figure to the industry-wide average in 1Q/24 of ~$1,380/oz., or the average of the companies shown above at $1,420/oz. Newmont just reported its 2nd qtr. AISC at $1,562/oz.

If in production today, Troilus would be the sixth largest mine in Canada ranked by 2024e production, (see above chart) but it could climb to a pro forma #3 as there are ~5.4M Indicated ounces in the latest resource estimate that are not in the BFS.

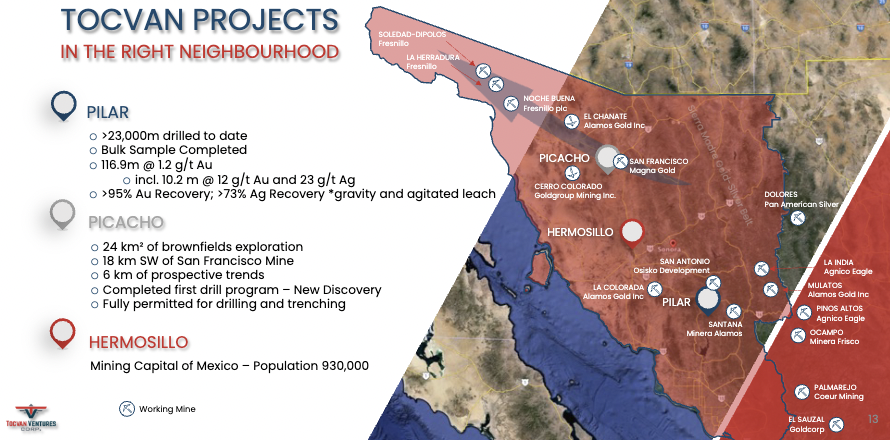

Readers must also consider jurisdiction. Quebec’s ranking in the latest annual Fraser Institute of Mining Survey improved considerably from 8th best of 64 jurisdictions (top 13%) to #5 of 86 (top 6%). Notably, some peers are in more challenging places like Côte d’Ivoire, Africa, Namibia, Africa, far north Nunavut, Alaska, Guyana & Mexico.

Management routinely touts the US$500M of in-place infrastructure as an attractive narrative. I value it more for the logistical & operational de-risking it provides. Metallurgical test results have been solid, this is considered a fairly low-technical risk project.

So many risks have been addressed, and many more are well understood & under control. Ultimately, it comes down to Au prices remaining strong, obtaining permits & funding the buildout. Management believes all permits could be in hand by 4Q/25 or 1Q26.

If one feels funding (on attractive terms, without onerous equity dilution), and securing a strategic partner is reasonably likely, then Troilus Gold’s valuation is way too low. With Au near its all-time high, perhaps worries about funding & strategic interest are overblown.

Please see the latest corporate presentation to learn more.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Troilus Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Troilus Gold are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Troilus Gold was an advertiser on [ER] and Peter Epstein owned shares in the company purchased in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)