Many investors in lithium (“Li“) companies — both producers & explorers/developers — are wondering if battery-quality Li carbonate/hydroxide prices will recover to bullish levels of say US$20-$40k/tonne, and average $20k+/t across multi-yr. periods (seemingly a given when prices topped $80k/t back in 4Q/22).

Today, China’s battery-quality Li carbonate spot price is ~$11.3k/t after averaging $38.5k/t in the prior 24 months. What gives me confidence that it will rebound? Two things. First, an extended period of relatively low Li prices boosts demand for Li-ion batteries (“LIBs“) outside just passenger EVs.

The market share of LIBs in grid-scale energy storage systems remains ~90%. Readers may recall that lower-cost battery chemistries like sodium-ion were expected to make serious inroads vs. LIBs when Li prices were much higher. So far, that’s not happening.

Data centers needed for AI, cloud & supercomputing need backup power. Tesla’s Li-based home & grid-scale segments delivered extraordinary growth in 2Q/24.

Increased Li demand is coming from drones/UAVs, medical/wearable devices, robotics, power/lawn equipment, construction, mining, highway, warehouse equipment & vehicles, defense applications, and new transportation channels like marine & aviation. These end uses will pick up the slack from a slowing growth rate in EVs.

Many Canadian, Australian & U.S. Li projects are stalled. The number of press releases from Li juniors in June/July was down 67% from June/July 2023. Even if demand grows at 10%-12%/yr. instead of 16%-18%, supply could still come up short. On July 31st Albermarle reiterated its demand forecast for a +16%-17% CAGR from 2024 to 2030.

While Li supply is sufficient today, it could be quite different next year. China recently announced further economic stimulus, including doubling subsidies on EVs.

China’s EV market is far larger than that of Europe or the U.S. and is still growing at 20%+. I believe that juniors with high-quality, low-risk Li projects, especially those in Canada, Australia & Brazil, will outperform.

Li stocks have been decimated, creating a buying opportunity in top-quality names. An undervalued company I continue to like is Lithium Ionic (TSX-v: LTH) / (OTCQX: LTHCF), with a growing high-grade, conventional hard rock Li portfolio in Brazil.

Non-Chinese groups large enough to acquire Lithium Ionic outright, or make a substantial investment into it, include; Rio Tinto, SQM, Albemarle, Mineral Resources (“MinRes”), Glencore, POSCO, Arcadium, IGO Limited, Fortescue Ltd. & Pilbara Minerals.

I exclude Chinese players for geopolitical reasons, but Sigma has reportedly been in talks with multiple Chinese parties including Ganfeng & Tianqi. Given that Lithium Ionic’s assets are in Brazil, I would not rule out giant Vale S.A. (invested in battery metal nickel).

Three Japanese trading houses — Mitsui & Co., Mitsubishi Corp. & Sumitomo — are making direct investments into Li projects, Mitsui into a Brazilian Li play. Lithium Ionic’s flagship Bandeira project is next to rapidly growing producer Sigma Lithium.

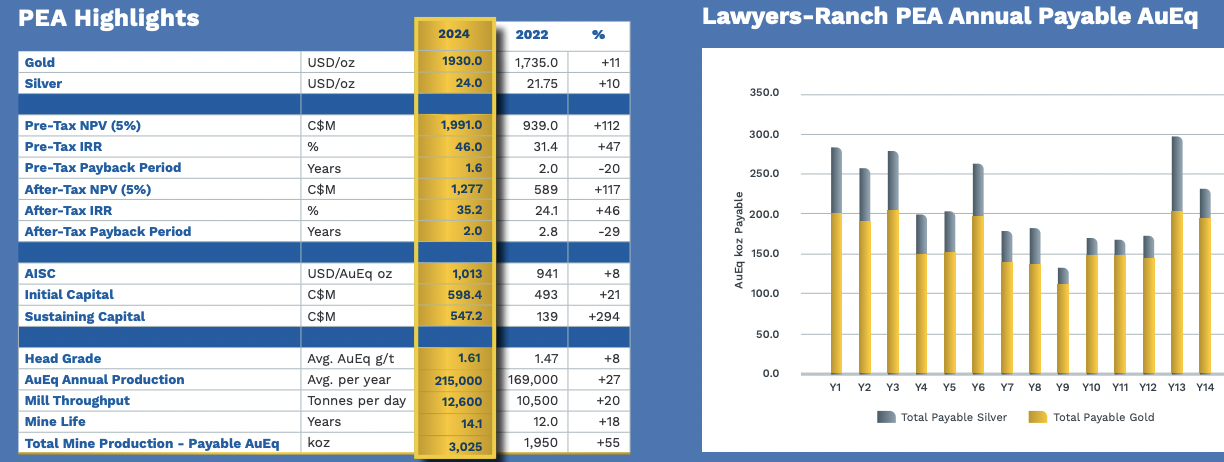

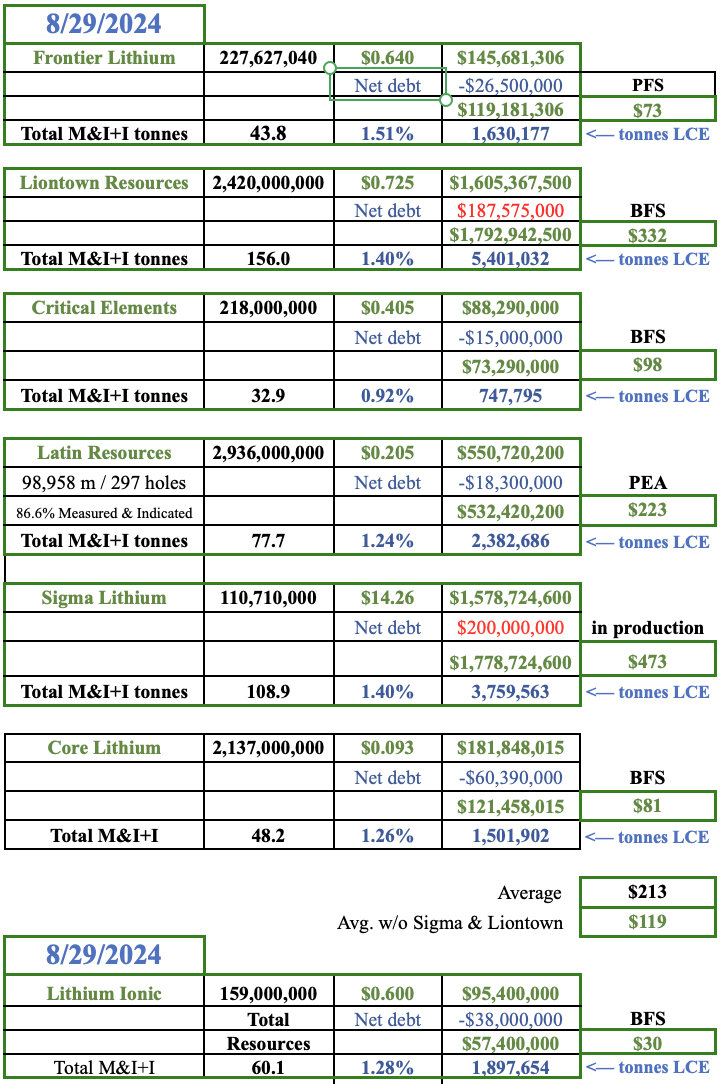

Why might Lithium Ionic be a prime takeover target? Management expects to be in production in 2H 2026, following roughly three years behind Sigma, yet Sigma’s valuation is 39x higher! Lithium Ionic is valued at a 75% discount to representative hard rock peers. {see chart above}

Why such a huge valuation discount? Late last week I interviewed Lithium Ionic’s CEO Blake Hylands to learn more about this exciting story.

Are there misconceptions about Li prospects in Brazil, or Lithium Ionic specifically?

The main issue is building appreciation for Brazil’s Lithium Valley as an emerging world-class Li-producing region. The infrastructure, workforce, and mining-friendly government are in place to support new producers including Lithium Ionic.

This region will be competitive on a global scale with low-cost operations from 100% renewable energy & high-quality concentrates. Sigma Lithium’s Grota de Cirilo mine is < 5 km away. It boasts “Quintuple Zero Green Chemical Grade Coarse Lithium.”

We share many of Sigma’s green credentials, the same or very similar geology, geochemistry (low alkalines & low iron oxide), hydroelectric power, transport routes, water usage/recycling profile, dry stack tailings, etc.

Any takeaways from the recent Fastmarkets Li conference in Las Vegas?

Although we saw some negativity around near-term Li pricing, there was strong interest from downstream converters to secure long-term, secure supplies of spodumene concentrate. Particularly concentrate coming from areas where production isn’t already earmarked for the Chinese. Much of Africa’s Li resources are headed to China.

Several groups are strategizing long-range plans to be prepared for the inevitable increase in Li consumption and rebound in pricing & market conditions.

How much pro forma cash does Lithium Ionic have? How long might it last?

With our $15M equity raise + $27M royalty deal, we are in a comfortable position to execute our initiatives through 2025. Given our very low enterprise value {market cap + debt – cash}, pro forma cash is ~47% [8/1/24] of our market cap.!

Cash liquidity is of paramount importance for Li juniors. We are pleased with the ongoing support from shareholders and our royalty partner Appian Capital Advisory LLP.

Lithium Ionic recently closed a US$20M royalty deal. What’s the significance of this transaction?

This was a very significant transaction for us, a true vote of confidence in our Bandeira project. The US$20M/$27M will allow us to ramp up engineering & pre-development activities.

We’re expecting to receive a construction permit in the coming weeks, allowing us to maintain momentum on our site development while full project financing is obtained.

Importantly, we retained an option to fully buy back the royalty anytime in the first five years. In a strong Li price environment, we can recapture significant upside from the tonnage tied to the royalty.

What can you say about the Company’s ability to raise non-equity capital, most notably debt, but also via partially pre-paid offtake agreements?

Yes, there’s strong interest from off-takers for partially pre-paid arrangements. The Company is weighing these options in parallel with other non-dilutive opportunities to meaningfully support the Bandeira project.

That’s of course in addition to non-dilutive debt funding, which could amount to 60% to 70% of cap-ex. Total upfront cap-ex of US$266M is quite manageable compared to many peer projects around the world needing a multiple of that amount.

Lithium Ionic is often compared to Brazil’s Sigma Lithium. In what ways are the comparisons accurate?

Lithium Ionic & Sigma Lithium are in the same spodumene-rich pegmatite area of Brazil’s Lithium Valley. Our Bandeira project will utilize the same simple, low-cost, low-tech Dense Media Separation (“DMS“) flowsheet to produce a clean, green 5.5% Li2O concentrate.

Bandeira will utilize an underground mining method to best exploit the deposit while minimizing surface disturbance, dust, noise, and environmental interactions. We will develop Bandeira with speed to market in mind through the use of an expedited permitting process and a simple mine site layout.

How soon might Lithium Ionic reach production? What steps need to be taken to achieve that goal?

We intend to be in production by 2H 2026. With the completion of the BFS, we’re now mobilizing basic & detailed engineering. With the receipt of a construction permit in August, we will mobilize early site works for improved access, drilling & pre-development.

In parallel, we are working through multiple project financing initiatives to support full-site construction starting next year.

Recent news flow is mostly about Bandeira, but your Company also has the Salinas project. What’s the latest snapshot of Salinas?

Salinas is ~100 km north of Bandeira & Outro Lado within the Li-rich Araçuaí Pegmatite District in the northern region of Minas Gerais.

Although the main focus has been Bandeira, drilling has resumed on Salinas. The intent is to continue to utilize the successful Lithium Ionic exploration team to expand our understanding of this promising deposit. As we continue to expand the resource size, Salinas could attract a lot more attention.

How would you characterize the risks, costs, and logistical challenges of Lithium Ionic’s hard rock prospects vs. brine/DLE projects around the world?

Good question. Processing & mining methods for the Bandeira project are proven, well understood, and currently on display at neighboring private company CBL, less than 1 km away. CBL has been operating for 33 years.

The coarse mineralogy of our deposit allows for a simple, low-cost processing flow sheet that does not require large evaporation ponds, or (unproven at commercial-scale) DLE technologies. Projects utilizing DLE are coming, but each is unique and will require considerable time to commercialize.

Our lower-risk operating flow sheet allows us to be globally competitive, with an on-site cost of US$444/t, making us cash flow positive even at today’s spodumene con price under $1,000/t.

What can you say to readers who might be disappointed by the economics in the BFS vs. those found in the PEA?

There remains significant upside from updating our project to the latest resource published in May 2024. Furthermore, we are infill drilling to upgrade near-surface Inferred resources to Measured & Indicated.

When comparing our Project’s cost between the PEA and the BFS, we remain largely in line, with improved accuracy & appropriate contingencies in place. In reviewing our two-month-old BFS, readers should note the dates of peer project studies. Op-ex & cap-ex have increased substantially over the past several years.

Some look at Lithium Ionic’s 178,000 tonnes/yr. of spodumene concentrate and compare it to larger plans at Sigma, Pilbara Minerals & Liontown Resources. Could that 178,000 tonnes/yr. be increased?

In our permit application, we maintained 1.3M tonnes/yr. of processing capacity. However, there’s room for expansion(s) with additional mine declines & expanded processing facilities. The key is to reach production & positive free cash flow and then grow from there.

Please describe in greater detail the exploration upside of Lithium Ionic’s properties.

There are numerous opportunities across our properties for additional exploration/development. Our team has established a list of priorities based on extensive mapping of soil geochemical anomalies.

We are focused on the future and the acquisition of additional targets as can be seen in our recent announcement of an option to acquire a 90% interest in an additional 2,893 hectares in Minas Gerais.

How does the regional infrastructure (power, water, roads, rail, ports, workforce) in Brazil’s Lithium Valley compare to hard rock Li regions in Western Australia, Africa & Canada?

Brazil’s Lithium Valley is well supported with paved roads, hydroelectric power delivered by overhead transmission, a local workforce based in Aracuai, Itinga, and Salinas, and bulk loadout available at the ports of Vittoria & Ilheus.

Elo Horizonte is a mining supply & engineering hub supporting our field offices & project locations. This region presents a unique combination of established infrastructure, with a mining-friendly government and low cost structure –> facilitating speed to market, and competitive unit costs.

Mining labor costs in Brazil are < 20% that of Canada & Western Australia. Some African Li projects are 1,000+ km from the nearest ocean port and need 100s of kms of road and/or rail to be designed, approved, funded & built.

As the world sees continued success, sustainability & growth in Li production out of Brazil, we believe Lithium Ionic’s valuation will revert to levels more in line with peers, especially as we enter production in a little over two years.

Thank you, Blake, very interesting commentary. I hope Li prices start to recover in the coming quarters. In the meantime, Lithium Ionic is well-funded to weather the storm!

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Lithium Ionic, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Lithium Ionic are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Lithium Ionic was an advertiser on [ER] and Peter Epstein owned shares in the company purchased in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)