Silver Storm Mining (TSX-v: SVRS) / (OTC: SVRSF) has an enterprise value {market cap + debt – cash} of ~C$41M at $0.095/shr., (down 47.2% from $0.18 on July 24th). Over the same period, the silver (“Ag“) price is roughly unchanged. In the chart below, nine Ag peers are down an average of –15.2% in the past month while Silver Storm is –40.6%.

Why has $SVRS fallen so much more than the average of its peers? The excess underperformance stems from delayed filings of financials due to questions relating to last year’s acquisition of the La Parrilla (“LP”) mine & mill complex.

I spoke with CEO Greg McKenzie on the night of August 12th. He reiterated that the delay is an accounting/auditing exercise that’s taking longer than expected. It has no bearing on plans for first production at LP in 2H 2025.

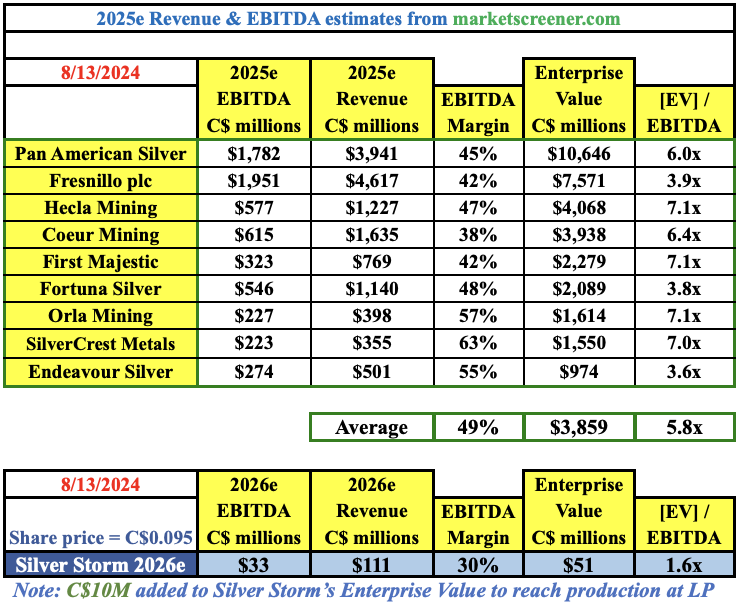

If one believes, as I do, that this issue is not a meaningful concern, shares at $0.095 could offer a compelling buy-the-dip opportunity. The Company is now valued at just 1.6x 2026e EBITDA vs. peers at 5.8x [2025e EBITDA]. See new corporate presentation.

Although Silver Storm’s two 100%-owned projects are primary Ag assets, the price of gold (“Au“) often leads Ag. Analysts at Citi & Bank of America say $3,000/oz. is possible within 12-18 months.

GS & UBS see $2,700/oz. & $2,800/oz., respectively, next year. Importantly, these forecasts come from major investment banks, not random gold bugs on Twitter/X. Readers should note that $2,700 is < 10% above today’s spot price.

Let me quickly dispatch with two other talking points –> the ATH inflation-adjusted Ag price, and the long-term Au: Ag ratio… Silver’s high tick in 1980 of US$49.45/oz. equates to ~$202/oz. in today’s dollars! Compare that to the current spot price of just ~$27.7/oz.

What other precious or base metal prices are -86% below their infl.-adj. highs? Certainly not Au, uranium, or copper. EVs, high-tech (wireless) electronics/telecom & decarbonization were not even things in 1980! Interestingly, the Au: Ag ratio in early 1980 was < 20:1 vs. 88.5:1 now, and a 56-yr. [1969-2024] average of ~60:1.

In the following chart, notice how easily a $40/oz. Ag price could come to pass, especially if/when Au climbs to $2,700+/oz. Many are very bullish on Ag. Readers of my articles know that I can go on & on about industrial demand for Ag in solar panels.

Nothing has changed, solar farms are consuming 15%-20% of global Ag production. Led by China, that figure is expected to grow to 30%-35% by 2027. That would be > 500M ounces/yr. On top of that, there’s a new story forming around solid-state batteries.

On Twitter/X, Kevin Bambrough points out that CATL recently announced a solid-state EV battery for 2027 that will last 20 years, charge in just nine minutes, and have a 600-mile / 966-km range. This battery type is likely to proliferate in many parts of the world.

While Kevin is not sure how many grams of Ag each battery will use, it could be a meaningful amount once 10s of millions are sold each year. In my view, the demand side for Ag is bulletproof, what about mined supply? Since 75-80% of Ag is a by-product of copper, lead, zinc & Au operations, meaning that Ag supply is highly inelastic.

Therefore, if Ag were to hit $40 or $50/oz. next year, meaningful new supply is still years away. Even if one doesn’t subscribe to the grave threat of global warming or the efficacy of intermittent renewable power sources, global leaders are hellbent on delivering us EVs, wind & solar farms!

Readers should note that an important argument for juniors with Mexican precious metal assets is the peso/US$ exchange rate reversal since Mexico’s Presidential election three months ago. The peso/US$ has weakened -16% from its high, great news for investors in junior miners with Mexican assets.

Silver Storm has an Enterprise Value {market cap + debt – cash} of ~$51M (C$0.095 on August 13th) [incl. an additional $10M to get into production].

The Company has the 100%-owned, past-producing La Parrilla (“LP”) mine & mill complex in Durango state, Mexico. Durango hosts 23 operating mines, it’s a mining-friendly jurisdiction. LP was acquired last year from First Majestic (“FM“). FM remains Silver Storm’s largest shareholder at ~36%.

Although FM divested the LP Complex, it maintains considerable leverage to its success. The LP Complex was in continuous operation from 2006 to 2019, producing over 34M Ag Eq. ounces, {67% Ag & 33% lead/zinc/Au}. Management expects to reach initial production at LP in 2H 2025.

LP hosts five underground mines and an open pit, surrounding a 2,000 tonne per day (“tpd”) fully-permitted mill consisting of parallel 1,000 tpd flotation & 1,000 tpd cyanidation leach circuits for oxide & sulfide ores.

Mineral resource estimates have been completed across 23 zones/veins in the Rosarios, San Marcos & Quebradillas areas. So far, LP has booked ~15.5M ounces grading ~258 g/t. An additional estimated 3.8M ounces are contained in pillars, most of which should be exploitable. While owned by FM, the LP Complex produced up to 4.5M oz./yr., averaging ~3.5M/yr. from 2012-18.

Management won’t commit to more than 3M oz./yr., but I think reaching a run-rate of 3.5 – 4.5M oz. is quite possible in 2026, especially if Ag prices remain high. The replacement value of above & below-ground infrastructure at LP, including the fully-permitted 2,000 tpd mill and a “partial mining fleet” is estimated at US$150M/C$206M.

Replicating this infrastructure would take 5+ years of studies, permitting, funding, construction & commissioning. The best intervals to date at LP are; [1,810 g/t Ag Eq. over 14.6 m], and [911 g/t over 13.1 m]. It would be impossible to overstate how important these bonanza grades are.

Several blockbuster Ag Eq. intervals at La Parrilla (LP), like; 14.6 m @ 1,810 g/t Ag Eq.

Two underground drill rigs are operating at LP. Phase 2 diamond drilling of ~7,500 meters will be completed in September/October with the main goal of upgrading Inferred mineralization to Indicated. Phase 1 consisted of 69 holes / 8,868 m. CEO McKenzie commented,

“Phase 1 results exceeded expectations confirming our thesis that the mineralized zones at La Parrilla extend well beyond previous mining areas. The aim is to gain a greater understanding of the extensions drilled to date to convert mineralization classified as Inferred into the Indicated category, and in certain instances, continue the expansion of the zones at depth.“

Assuming US$27/oz. Ag Eq., and an AISC of $19/oz., annual cash flow could grow to ~C$33M in 2026 on 3M Ag Eq. ounces. Some of that cash could be reinvested into the San Diego [“SD“] project.

SD has ~257M ounces, making it Mexico’s third-largest undeveloped primary Ag project. Unlike most companies, Silver Storm’s reported grades are adjusted for estimated recoveries [79.6% for Ag] & smelter deductions.

According to SGS Canada, there could be nearly 400M ounces at SD, making it the crown jewel of Silver Storm. {see pages 21-31 of corporate presentation}. SD is envisioned as a bulk tonnage operation of possibly 10M to 15M Ag Eq. oz./yr.

How large is 257M ounces? It equates to ~3M Au Eq. ounces and is ~100M more than B.C. Canada’s Dolly Varden has booked. Yet pre-PEA stage Dolly is valued at > $280M. The combined LP + SD resource is ~273M Ag Eq. ounces. Silver Storm is valued at just ~$0.19/oz. (EV includes C$10M mentioned above), less than 0.8% of the Ag price.

Compare that to $1+/oz. for peers like; Dolly, Sierra Madre, Vizsla Silver, Prime Mining & Blackrock Silver.

Silver Storm Mining (TSX-v: SVRS) / (OTC: SVRSF) is notably undervalued before considering the SD project. Funding requirements for SD will be $10’s of millions, but not anytime soon. And not necessarily on Silver Storm’s dime if management partners with a larger company.

While there’s substantial execution/start-up risk between now & production in 2H 2025, if operations start reasonably on time & budget, the Company’s valuation could soar. And, if funding is finalized (possibly a debt + equity package), that de-risking event could spark a re-rating.

Investment pros like to say that for those with high-risk tolerances, the best time to invest is when there’s “blood in the streets.“ Silver juniors could continue to fall, but I think we’re close to the bottom. See the latest corporate presentation

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Silver Storm Mining, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Silver Storm Mining are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Silver Storm Mining was an advertiser on [ER] and Peter Epstein owned shares in the company acquired in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)