Copper (“Cu”) is indispensable for infrastructure, EVs, renewable energy, grid refurbishments & expansions, the wireless“Internet of Things,” data centers, Cloud/AI, supercomputing, robotics, crypto-currency mining, smart cities, 5G/6G telecom, high-tech electronics, and more.

Yet, with the Cu price under pressure since hitting US$5.20/lb. in May, now at ~$4.20/lb., there has been no rush to write about Cu juniors. However, Aston Bay Holdings (TSXV: BAY) / (OTCQB: ATBHF) has good news. {August 13th press release} / {August 15th press release}.

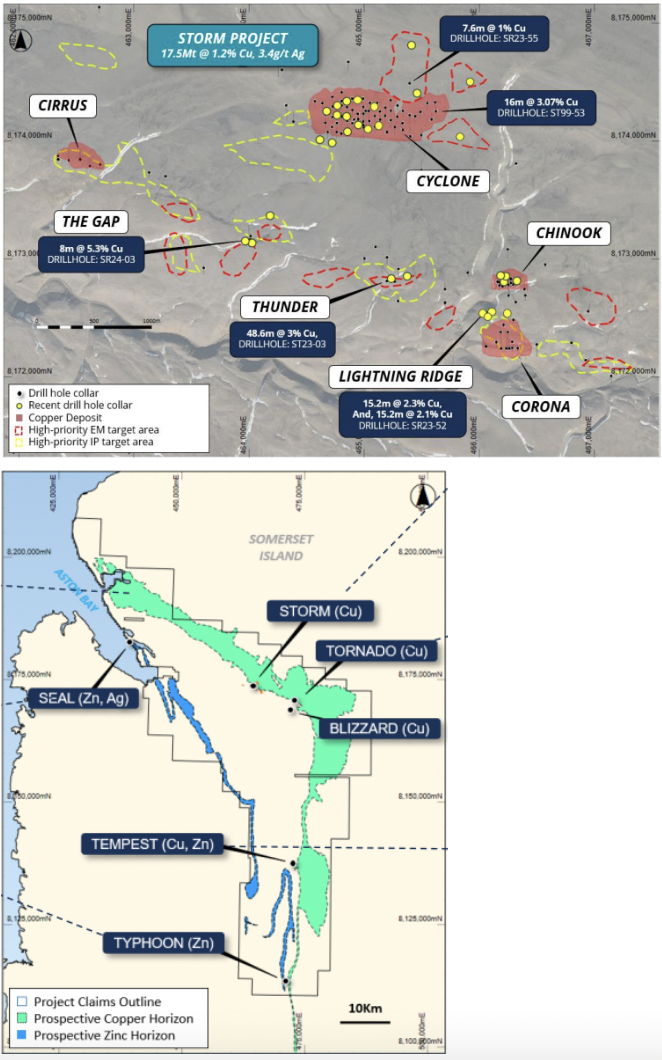

Readers are reminded that the Company has two potentially significant Cu projects in Nunavut, (in northern Canada). Both are high-grade, near-surface, and close to tidewater (somewhat mitigating their northern locations).

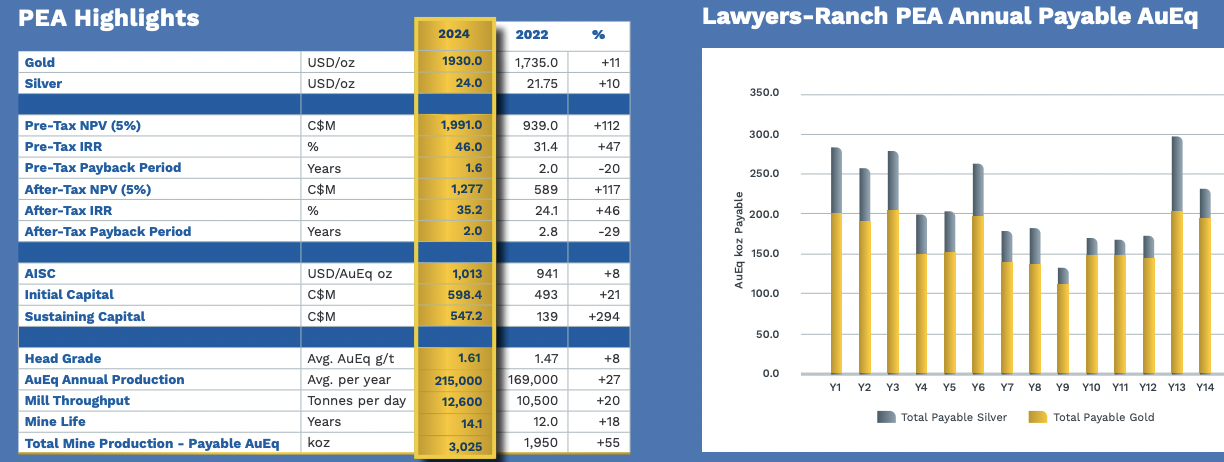

The 20%-owned (free-carried through a BFS) Storm Copper project hosts a JORC-compliant 17.5M tonnes of 1.17% Cu {~204.5k tonnes} + 3.4 g/t silver {~1.9M troy ounces}. 100% of the resource is amenable to low-cost processing & ore sorting in an open pit setting.

Unlike S. American peers, some at elevations of 3,500+ meters, some with water challenges and local opposition, Storm is ~25 km over flat, barren terrain from a seasonal ice-free bay (Aston Bay) on the Northwest Passage. Concentrates from the world-class Polaris & Nanisivik zinc-lead mines were successfully shipped this way.

Detailed metallurgical work on representative Cyclone & Chinook deposit mineralization generated potentially commercial-grade Direct Shipping ore Products (“DSPs”).

According to the PR, “The two-circuit ore sorting & Inline Pressure Jig (‘IPJ’) stream is capable of a range of DSP concentrate grades with excellent yields of Cu”. From Cyclone & Chinook, (2 of 4 deposits in the existing resource) 1.2 to 1.5% Cu feed grades were turned into DSP at an attractive 16-22% Cu concentrate.

Management believes the DSP process can be readily optimized to suit increased processing rates & selective concentrate grades. Ongoing work is anticipated to identify upside potential from continuing variability, comminution, and optimization studies on the Cyclone, Chinook & Thunder deposits.

Excellent ESG outcomes were achieved with a small environmental footprint and no harmful elements. Dilling at Storm is designed to inform an expanded mineral resource estimate and to explore the margins of known deposits for additional resource pounds. From the press release, quote,

“These metallurgical studies demonstrate that Storm can produce a potential commercial-grade DSP from typical mineralization through a simple flow sheet. The proposed ore sorting & IPJ process eliminates the need for a conventional flotation plant & tailings facility. This would be a low-cost, small-footprint operation with minimal surficial impact.”

American West Metals, 80% owner of Storm Copper, spearheaded this de-risking metallurgical test work that 20% JV owner Aston benefits from. Readers are reminded that Aston Bay’s 20% interest is free-carried until an investment decision is made, post a Bank Feasibility Study (“BFS“).

Even once Aston is on the hook for 20% of ongoing cap-ex, the amounts needed are likely to be fairly modest. American West’s work suggests that Aston’s 20% share of cap-ex for the DSO portion of a mine plan might be C$3.5 to $4.2M.

If we triple that amount to include all the other upfront cap-ex dollars needed to commence DSO operations, that would be ~$12M, which, in my view, is quite manageable, especially if the Cu price in 2027 is $5-$6+/lb.

In my view, that C$12M outlay would be spread over 12-18 months, starting no sooner than 4Q 2025. The Company is sitting on ~$6M in [pro forma] cash after it receives the full 20% (in installments) of a royalty payment and a $4.1M equity raise in June.

American West’s test work assumed a midpoint of 27,500 tonnes/yr. of Cu, only from ~82% of the resource (Cyclone, 12.2M tonnes + Chinook, 2.2M tonnes). I believe the production estimate by American West is conservative as it assumes operations over 10 months and 75% capacity utilization during those 10 months.

At $4/lb., that would be gross revenue of ~C$332M/yr. If one assumes a margin of 25%, EBITDA would be ~$83M –> 20% of which is ~$16M to Aston Bay. Compare that to the Company’s enterprise value {market cap + debt – pro forma cash} of ~$23M @ C$0.135/shr.

I picked a 25% EBITDA margin at spot Cu of $4/lb., but if the price were to rise to $5/lb., annual cash flow to Aston could nearly double from ~C$16M to ~$30M. Why such a large gain? In addition to the higher Cu price, the operating margin would rise substantially.

Note: {the 25% margin is an estimate, NOT that of American West or Aston Bay}. If reasonable, Aston is valued at an EV/future EBITDA multiple of 1.4x. Even if a 25% margin at $4/lb. Cu is too aggressive, I feel strongly it would be AT LEAST 20% and that scenarios > 50-60% are possible if/when the Cu price climbs above $5.5/lb. by 2027.

Assuming Aston could achieve this rough magnitude of earnings, its 20% interest in Storm Copper could be worth a multiple of the $23M valuation.

In looking at the bottom map in the image above notice that the Storm area is just one of several highly promising targets, with additional severe weather names, (Tornado, Blizzard, Tempest & Typhoon).

In the top map, look at — Cirrus, Cyclone, Chinook & Corona — making up the combined 17.5M tonnes of 1.17% Cu. Note, {81.7% of the MRE is ~1.25% Cu, ~3.4x the mean Cu-only grade of 16 multi-billion lb. deposits in S. America}.

A scoping study and/or PEA in 1H 2025 will allocate more detailed costs & operating metrics on a DSO mine plan based on the larger resource estimate. Project economics (after-tax NPV + IRR) could be eye-opening…

Low cap-ex & technical risk, and near-term production of a critical metal in a safe jurisdiction. Nunavut is in a remote part of northern Canada, but in my opinion, is preferable to global Cu hotspots including; the DRC, Zambia, Russia, Indonesia, Mongolia, Pakistan & Serbia.

As exciting as Storm Copper is, CEO Thomas Ullrich believes Aston Bay might have locked down “Storm Copper 2.0”, also in Nunavut, via an 80% earn-in on the 71,135-hectare Epworth (74-km trend, sediment-hosted Cu-silver-zinc-cobalt) project.

Both Storm & Epworth have been compared to giant high-grade projects in central Africa like Ivanhoe Mines’ Kamoa-Kakula (K-K) complex in the DRC. Although early-stage, chalcocite boulders returned up to 61.2% Cu + 5,600 g/t Ag!

Recent prospecting yielded grab samples up to 37.8% Cu, 27.4% zinc, 1,100 g/t Ag, 3.0 g/t Au & 1,700 ppm cobalt. If Storm and/or Epworth could find just 5% of what K-K has — at 1.0% Cu instead of the 2.5% Cu at K-K — that would be ~1.8B lbs. vs. Storm’s maiden resource estimate (at spot prices) of ~464M lbs Cu Eq.

Note, {1.8B lbs. is just 2% of K-K’s 90B lb. endowment}. Regarding Epworth Mr. Ullrich commented,

“The classic tale of exploration starts with high-grade mineralization found at the surface, chased up with geological mapping & geophysical surveys that point to drill targets leading to significant discovery at depth. That is how the major Cu deposits of Central Africa were discovered, and that’s our playbook for Epworth.“

Management is earning an 80% interest in Epworth vs. its 20% [free-carried] interest in Storm. All else equal, if Epworth proves to be half as good as Storm, it could be worth twice as much to shareholders. Having said that, funding requirements for Epworth could be [80%/20% = 4x] higher.

Aston Bay Holdings (TSX-v: BAY) / (OTCQB: ATBHF) is well positioned to sidestep many major constraints facing metals & mining projects today, most notably time & money. By reaching production in 2027 with a modest upfront cap-ex, the Company is ahead of the game.

Adding to that its Tier 1 jurisdiction in Canada, low technical risk at Storm Copper, and robust exploration upside make Aston a very compelling story. {see latest corp. presentation}.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Aston Bay Holdings, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Aston Bay are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Aston Bay was an advertiser on [ER] and Peter Epstein owned shares in the company acquired in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)