Wow. It was worth the wait! It’s not often lately that PEA/PFS/BFS reports come in stronger than expected. Over the past year or two cap-ex and/or op-ex surprises have sunk many highly anticipated studies. I have been making educated guesses about Thesis Gold’s (TSX-v: TAU) / (OTCQX: THSGF) new, enhanced PEA…

Dr. Ewan Webster, President & CEO, commented,

“With today’s gold price near US$2,500 per ounce, the substantial economic potential of the Lawyers-Ranch Project is clear. As we advance toward key project development milestones, we will continue to explore new targets within our expansive, highly prospective land package. This approach will further enhance a project that is not only straightforward and low-risk but also benefits from high-grade, easily accessible open-pit and underground ounces, combined with proximity to existing infrastructure. This positions the Lawyers-Ranch Project as one of Canada’s most prospective gold projects.”

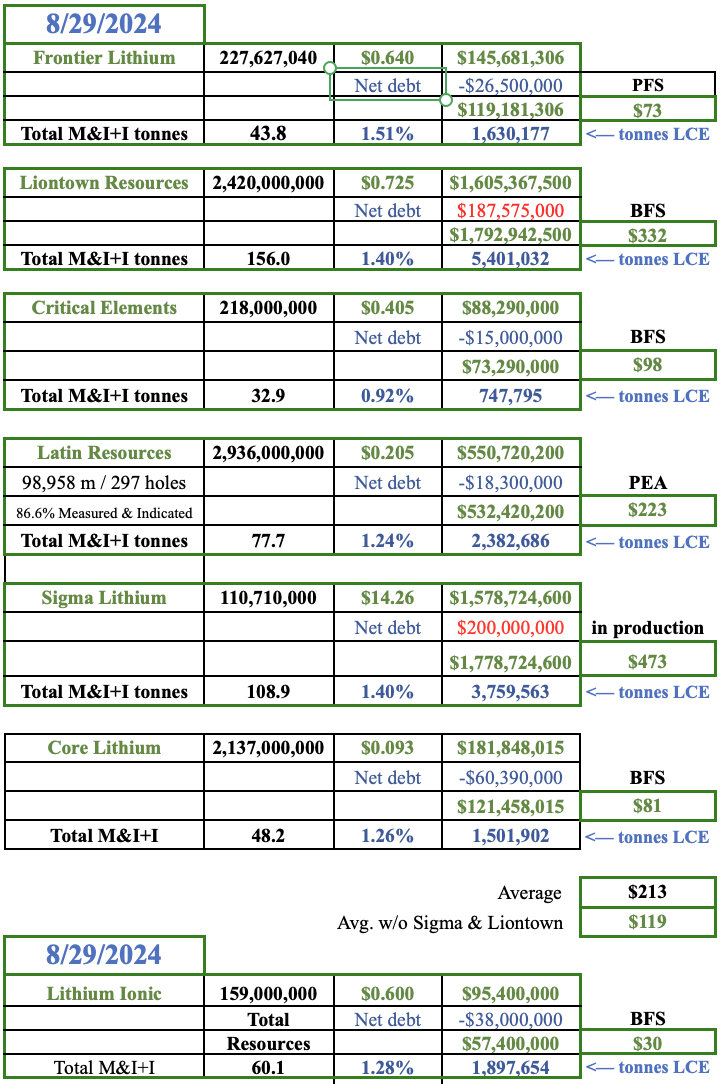

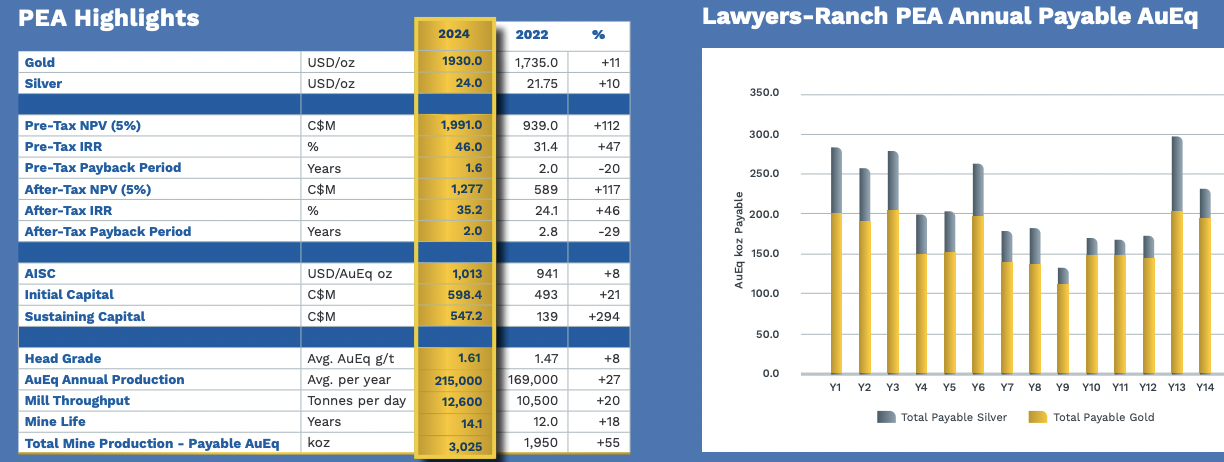

My latest estimate was that at a base case Au price of $1,900/oz., the after-tax NPV would be > C$1.0B, and the IRR > 25%. Compare that to the actual figures shown below. On $1,930/oz, Au, post-tax NPV came in at C$1.28B & the IRR at +35.2%, in large part due to an AISC of just $1,013/oz. The payback period is 2.0 years.

Comparisons vs. the 2022 PEA are compelling. The Au/Ag price is up +10-11%, but post-tax NPV & IRR are up +117% & +46%. Meanwhile, cap-ex & op-ex were up ONLY 21% & 8%, respectively. All of this is at the base case of $1,930/oz. Au, imagine the comparisons at $2,500/oz. The PEA’s economics were done at an Au price 23% below spot!

The ratio of NPV to cap-ex of 2.1x is attractive vs. peer ratios ranging from 0.9x to 2.4x over the past year. And, as strong as the economics are, it’s still a 14-yr. mine life, there’s ample room to extend production into the 2040s. Congratulations to the Thesis Gold team! {see new corp. presentation)

But wait, it gets better… at $2,500/oz. Au the NPV is C$2.25B and the IRR is +52.8%. At $2,500/oz., the ratio of NPV/cap-ex is 3.8x and the payback period falls to 1.3 years. Thesis is valued at 10% of post-tax NPV at $1,930/oz. and just 6% of NPV at $2,500/oz.!

Dozens of mid-tier & Major producers should want to own this very strong project in the world-class jurisdiction of B.C., Canada. Notably, the sensitivity table scales up to $3,000/oz. I won’t quote those economics, but the fact that $3,000/oz. is just 20% above current levels is a reminder of how strong precious metals are right now.

As an aside, at $3,000/oz. Au, the silver (“Ag“) price could be $40-$45/oz. vs. the $35/oz. shown in the sensitivity table. Readers are reminded that the Ag credit at Lawyers-Ranch is huge. Thesis has 4.71M Au Eq. ounces grading a solid 1.55 g/t. Importantly, 87% of those ounces are in the Measured & Indicated categories.

At spot prices, Ag accounts for > 25% of in-situ metal value. Luckily, the outlook for Ag is quite strong. There’s a new narrative forming on solid-state EV batteries. By 2027, Samsung SDI will be selling a solid-state EV battery that lasts 20 years, charges in just nine minutes, and has a 966 km range.

This battery type will likely proliferate, leading to incremental Ag consumption of 100M+ ounces/yr. in what will be a two billion oz./yr. market in the early 2030s. Yet, we’re in year #4 of a mined Ag deficit. New supply is not keeping up, and Mexico, the world’s largest producer, is threatening to ban open-pit mining.

That extra demand for EV batteries is on top of soaring demand from solar panels. Chinese oversupply is driving panel prices down, boosting demand for Ag even more. China is moving into the Middle East to move (excess) panels, allowing it to continue to grow rapidly. China will use > 20% of global Ag next year.

I could go on and on about Ag fundamentals as Ag is an underappreciated part of the Thesis Gold thesis. Instead, switching back to the PEA, the US$1,013 AISC for the 100%-owned Laywers-Ranch project is excellent as producers have been reporting large increases for several years.

The chart below shows 2Q/24 vs. 2Q/23 for 16 companies. The weighted average increase in AISC is +8.5%, and the weighted average AISC is $1,422/oz. If IamGold or Equinox Gold acquired Lawyers-Ranch (as if it was in production today with an AISC of $1,013/oz.), their pro forma blended AISCs would decline by 9% or 15%, respectively.

The last 10 Au project economic studies, dating back about a year, had an average post-tax IRR of ~24% on a normalized Au price of ~$1,900/oz. Lawyers-Ranch stands out vs. peers in several key respects. At 215,000 Au Eq. ounces/yr., (273,000 over the initial 3 years), it will be a substantial mine.

Lawyers-Ranch could be developed into a larger operation, say 300,000+ Au Eq. oz./yr., if acquired by a company with ample cash to aggressively drill & develop it. Significant Mineral Resource growth potential remains across both the Lawyers & Ranch areas.

The underground mineral resource at Lawyers is still open for expansion at depth, while Ranch mineral resource zones also remain open. There are over 20 unexplored targets that hold potential for further discoveries at Ranch.

Bill Lytle, Non-Executive Chairman, added,

“With 301,316 meters drilled to date, 86.9% of the updated 2024 Mineral Resource is now classified as Measured and Indicated. Combined with well-advanced engineering and environmental baseline work, the project is rapidly moving towards Pre-Feasibility and an accelerated permitting timeline, while still offering substantial upside potential and opportunities for Mineral Resource growth.”

Lawyers-Ranch has more operating flexibility (pre-construction) than many mines already in production that are constrained by existing mine plans (permits, tailings, logistics, etc.). At today’s $2,515/oz. Au, the profit margin on Lawyers-Ranch is ~$1,500/oz.!

That would be cash flow of C$610M/yr. per on 300k ounces, and $438M/yr. on 215k oz. The reason this is important is that at 300k oz./yr., any Major miner should be interested, the biggest of the big, Newmont, Barrick, Teck, BHP, Agnico Eagle & Freeport McMoRan.

Now that the new PEA is out, does this start the clock ticking on a takeover? I think the answer is a resounding yes, but I’ve always thought Thesis would be acquired in 2025. Since M&A can take a long time, suitors having the new PEA report in hand, not just the summary PR, can make meaningful progress on due diligence.

At C$0.73/shr., Thesis is valued at just 10% of its after-tax NPV. By contrast, Skeena Resources is valued at ~52% of its NPV. Like Thesis, Skeena is in B.C. Canada, but 2-3 years ahead as it has a Bank Feasibility Study (“BFS“) on its flagship project.

Rupert Resources has a large PEA-stage project in Finland valued at ~40% of after-tax NPV. Perpetua Resources‘ BFS-stage project in the U.S. is valued at ~35%, Montage Gold‘s Pre-Feasibility-stage project in Côte d’Ivoire, Africa at ~36%, and Osinio Resources BFS-stage project in Namibia at ~45%.

Given that this is an updated & enhanced PEA, some of the figures should be at or close to Pre-Feasibility Study standards. I look forward to next year’s PFS which will be based on a larger resource estimate that incorporates this year’s drilling. {see new corp. presentation)

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Thesis Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Thesis Gold are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Thesis Gold was an advertiser on [ER] and Peter Epstein owned shares in the company acquired in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)