Critical Elements Corp. (TSX-V: CRE) (US OTCQX: CRECF) (FSE: F12) is an emerging specialty metals company focused on its Rose Lithium-Tantalum (“RL-T”) project near James Bay, in northern Quebec. Last year the Company signed a strategic Collaboration Agreement with a leading global chemical company that includes 100% take-or-pay off-take for all products produced, at market prices.

Critical Elements Corp.’s (“CEC”) PEA highlights a 99.98% purity, low-cost, hard rock lithium project with a pre-tax NPV(8%) & IRR of C$488 million & 33%, respectively (assuming a US$6k/Mt Lithium Carbonate (“LC”) price). The RL-T project benefits from a source of very low-iron spodumene concentrate, ideally suited for the glass & ceramic markets. Both technical & battery-grade lithium production is planned, with technical grade likely available in 2018 and battery-grade 12-18 months thereafter. If successful, this would allow CEC to generate cash flow to support development and commercialization of battery-grade lithium products. [See: Corp Presentation]

CEC began drilling the RL-T property in late 2009 and has been prudently advancing it towards full Feasibility ever since. Over the years, the Company has been meaningfully de-risked. So much so, that management believes it is within 6 months of nailing down project financing. As part of the above mentioned Collaboration Agreement, CEC’s strategic partner has the option to acquire a 25% interest in the equity capital of the project. A 100% take-or-pay off-take agreement with a large, creditworthy counter-party, should facilitate the Company’s efforts in obtaining debt financing.

Critical Elements Corp (“CEC”) on the Move

If the strategic partner invests at the project level for 25% of the equity, and debt financing is obtained for 60%-65%, that would leave the Company with 10%-15% to fund itself. In May, CEC raised gross proceeds of $6.2 million from a placement that CEO Jean Sébastien Lavallée explains went to a group of institutions, led by JP Morgan Management UK. Institutional ownership is key to the story moving forward, both as a vote of confidence in the Company’s progress and as an ongoing source of capital to fund the Company. In addition, CEC continues to pursue a modest non-dilutive cash injection.

This lithium player chart represents my perspective only, I produced the image myself. CEC, with a promising Preliminary Economic Assessment (“PEA”), is in the 2nd tier, “Nearest to Production,” with 5 other prospective producers that are likely, or at least could, commence operations this decade. Among the members of this group, Critical Elements Corp. is perhaps least well known, for example the 5 peer developers have an average market cap nearly 4x the size of CECs.

Assuming that the Company obtains clear evidence of the availability of proper funding, it’s significant discount to peers could shrink. The Company is likely to attract a lot more attention as its business plan unfolds. In my view, CEC has the single best strategic off-take agreement in the developers space.

Its strategic partner has agreed to a take-or-pay arrangement for 100% of production, no matter what’s produced, while paying full market price. The partner is also contributing valuable technical assistance and market intelligence. This is a tremendous deal to sign with a Major global chemical company. A true vote of confidence in the project and management team.

June to date, an average daily trading volume of $1.5 million has traded, compared to $580k in May and $190k in April. Trading volume approaching $2 million/day meaningfully expands the universe of prospective investors.

More than meets the eye… Critical Elements Corp. has well established infrastructure

Beyond the obvious benefits of a world-class jurisdiction in Quebec and a blockbuster strategic off-take partner that seems amenable to taking down 25% of the equity capital in the project, CEC also has tremendous infrastructure and logistics in place. When management talks about extensive access to infrastructure, it’s worth listening. In addition to a considerable amount time & capital invested to secure water, power, roads, rail, port, labor, airport, equipment, etc., infrastructure and logistics can tie-up a very substantial portion of managerial resources. Management has stated that upwards of C$200 million in cash outlay can be avoided due to the in-place infrastructure.

Another attribute of the RL-T project worth reiterating is its high purity, low-iron spodumene concentrate. With only minimal processing, technical grade lithium carbonate will be well placed to serve the glass & ceramics markets. Currently, that segment is overly reliant on Talison’s Greenbushes lithium operations in western Australia. End users would likely appreciate and benefit from sourcing lithium from another supplier. Importantly, all CEC need do is deliver the product, the strategic partner is tasked with marketing, selling and distributing it. Not many lithium peers have the luxury of being able to bypass such important functions to focus entirely on production, costs, quality & growth.

Is Critical Elements undervalued due to an overly conservative PEA?

As one can see, despite being less well known, Critical Elements Corp has a lot more going for it than some market participants realize. Like the other developers, CEC, stands to benefit greatly from soaring lithium prices. Marking-to-market the Company’s PEA for lithium carbonate prices that are now well above the base case price assumption of US$6k/Mt, would double the NPV.

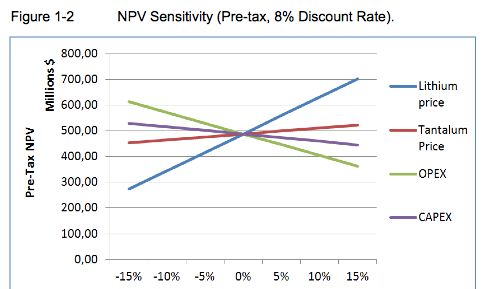

Perhaps less recognized, but amazingly important, is the impact of the large move in the C$/US$ FX rate, from parity (C$1/US$) in the PEA, to about (C$1/US$0.77) today. Only a move in the LC price has a greater impact on the NPV than a move in the FX rate. Yet, the PEA did not include FX in the sensitivities data and charts, like the one on the left. All else equal, I believe recasting the PEA with the current FX rate would add hundreds of millions of C$s to the C$ NPV8%.

It’s worth noting that away from the RL-T project, CEC controls a considerable portfolio of early-stage lithium-bearing properties available to be farmed out. Two recent announcements demonstrate the proactive steps the Company is taking to advance prospects with minimal capital commitment. 1) a deal with Platypus Minerals on the Lemare lithium project 2) a deal with Lomiko Metals on the Bourier project.

Arguably, the Company could spinoff its non-core assets into a distinct, TSX-V listed prospect generator vehicle. There are dozens of early-stage lithium juniors with market caps in the C$10 mm to C$25 mm range. A hypothetical C$15 mm valuation of a SpinCo would equate to about 10c per CRE share. To be clear, I have no reason to believe that the Company is contemplating doing that.

CONCLUSION

With heavier trading volume, an expanded universe of investors and both positive technical & fundamental catalysts, I believe a new set of (larger) investors is probably accumulating positions. The average share price of late has been between roughly 60c-75c. It seems reasonable that, for the most part, sophisticated investors (not traders) paying 60c-75c/share, are not likely to be sellers below a $1/share. This is not a share price prediction or advice to buy shares, the lithium space is very speculative, so investment hurdle rates are high. Critical Elements Corp. (TSX-V: CRE) (US OTCQX: CRECF) (FSE: F12) offers an attractive opportunity to potentially ride the lithium wave higher, but with less risk of an epic wipeout.

Disclosures: Readers fully understand and agree that nothing contained in this article authored by Peter Epstein, or on EpsteinResearch.com, [ER] including but not limited to, interviews, analysis, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered in any way whatsoever, implicit or explicit, investment advice or guidance. Further, nothing contained herein is a recommendation or solicitation to buy, hold, or sell any public security. Mr. Epstein has never been, and is not currently, a registered or licensed financial advisor. His article(s) on Critical Elements Corp must be considered carefully in this context.

Any comparison between or among stocks is purely for illustrative purposes and should not be taken as fact or relied upon. Readers understand and agree that they must conduct their own investment due diligence. An investment in any small cap stock, including Critical Elements Corp, can deliver a 100% loss. While the author believes that he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. Mr. Epstein is not responsible for any perceived, or actual, errors including, but not limited to, analysis, commentary, opinions, views, assumptions, reported facts & financial calculations, or for investment actions taken.

At the time this article was posted, Critical Elements Corp. was a sponsor of EpsteinResearch.com and the author had stock options in the Company, The shares of Critical Elements Corp. are highly speculative, not suitable for all investors. Readers are urged to consult with their own licensed or registered financial advisors before making investment decisions.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)