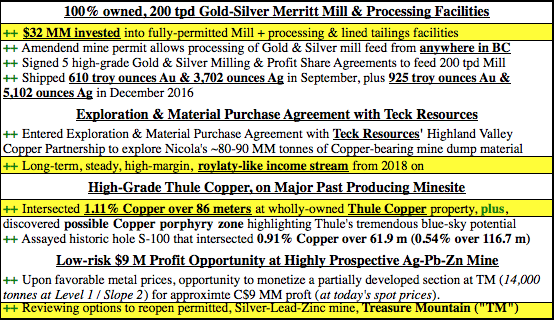

Nicola Mining Inc. (TSX-V: NIM) / (OTC: HUSIF) has three primary, potentially company-making assets, two nearing steady-state cash flow. The third, Treasure Mountain, offers both a shovel ready up to C$9 million profit opportunity (see below) plus, longer term, a possible company-making silver-lead-zinc mine on a past-producing mine site. Regarding the first two assets, there’s the valuable, (virtually impossible to replicate in BC) gold-silver Merritt Mill and processing facility, centrally located near Merritt, BC, and an “Exploration & Material Purchase Agreement” with Teck Resources (NYSE: TECK) / (TSX: TCK) to monetize waste rock from Nicola’s 100% owned Thule Copper project (another potential company-maker). NOTE: {Please see March 8th Corporate presentation video}.

Valuable Cash Flowing & Exploration / Development Assets

Merritt Mill in BC, Canada

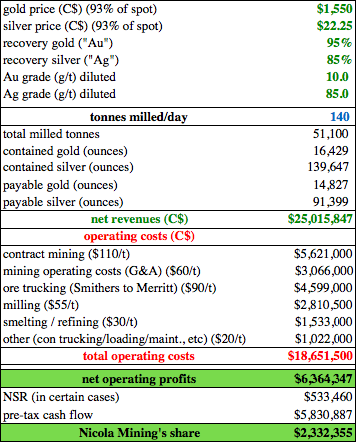

At the current 200 tonnes per day (“tpd”) capacity, grade and precious metal price assumptions, the Mill should be good for about $2.3 million in operating income this year. NOTE: (based on publicly available information, including data from peer toll milling operations). Add to that an additional ~$2.5 million/yr from the Teck Material Purchase Agreement from 2018 on. Combined, Nicola is sitting on two assets that could generate ~$5 million next year, with considerable upside from higher grade ore, higher spot prices and expanded Mill capacity. Importantly, with a larger ball mill and other routine upgrades, the Mill facility building is large enough to accommodate up to 500 tpd throughput.

Below is an estimate of what (I think) milling operations could look like in 2017. This is an indicative model, a composite of various milling & profit share agreements, based on Company press releases.

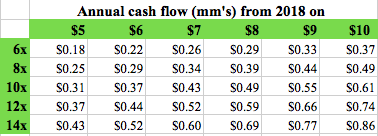

All else equal, if the Company were to process 20% higher grade ore (from some of the profit sharing agreements), annual cash flow would grow from ~$2.3 to ~$4.2 million. In a scenario that also includes 10% higher spot prices, Nicola’s share of operating profits would be ~$6.0 million. Adding ~$2.5 million from the Teck waste material deal, cash flow would approach $8.5 million from 2018 on. Grade and spot price considerations aside, expanded Mill capacity would be a game-changer. NOTE: {this is not a forecast by me or the Company}.

Both earnings streams are high quality and expected to be long-lived, attributes that typically command strong market multiples. For example, precious metal streaming companies Franco-Nevada (NYSE: FNV) and Silver Wheaton (NYSE: SLW) trade at an average 20x Enterprise Value (“EV”) to EBITDA multiple. Unlike FNV and SLW, Nicola has $77 million in tax credits, shielding it from paying cash taxes for years to come. The following chart shows implied share prices across various EBITDA and market multiple scenarios. Nicola is currently at $0.22/share, (down 25% from $0.29 on February 17th).

Thule Copper Project

Nicola has achieved the elusive dream of most junior mining companies, positive cash flow to meaningfully self-fund exploration. Even better, both exploration projects are on past producing sites. They could be, yes I’ll say it again, company-makers. Past production on Nicola’s Thule Copper property featured Craigmont, the largest open-pit copper mine in North America at the time. It operated at about 1.28% Cu open pit, and closer to 2.7% Cu underground.

Thule Copper is located 14km northwest of Merritt, British Columbia and covers 10,084 hectares (~24,920 acres) along the southern end of the Guichon Batholith, shared with Teck Resources’ Highland Valley Copper mine. The Company recently completed a diamond drilling program designed to test 3 distinct zones, the Embayment, Titan Queen, and Eric. Total diamond drilling for the 2016 program was 1,084 meters in 5 holes through the Embayment Zone, located approximately 1 km northwest of the past-producing Craigmont mine. A follow-up drill program will determine continuity of mineralization further west along strike and at depth. Drill results represent an important near-term catalyst.

Craigmont produced high-grade copper in a skarn setting but never encountered what management believes is an underlying porphyry. New evidence of possibly something Big was uncovered during the Company’s aforementioned drilling last year. Results were a success, all holes hit mineralization and blockbuster hole THU-002 in the Embayment zone returned 1.11% copper over a remarkable 86 meter width.

Treasure Mountain

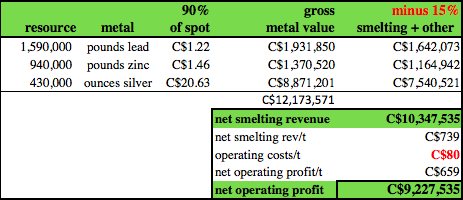

100% owned Treasure Mountain, a former operating mine, has a shovel ready opportunity to mine already permitted Level 1 Stope 2 and ship mill feed to Merritt. Treasure Mountain’s silver, lead, zinc endowment consists of 51 mineral tenures, 21 legacy claims, 100 cell units and 5 crown grants totaling 2,850 hectares (~7,040 acres). The Company maintains the option of reopening Level 1 to extract silver from Stope 2 at any time and could realize indicative economics as shown below. Given that the Company is not starved for capital and that management believes precious and base metal prices are likely to move higher, there’s no rush to exploit this opportunity.

The indicative, up to C$ 9 million, one-time cash flow (over ~9 month mining period) would mitigate (but not nullify) the need for equity dilution. Combined with potential cash flow outlined above, Thule Copper could be robustly explored this year and next.

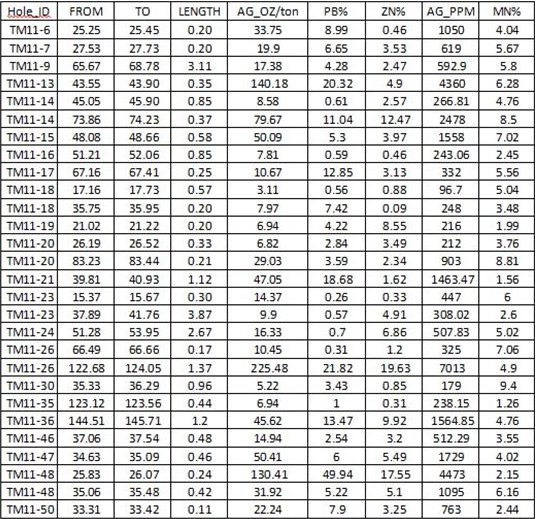

As mentioned, Treasure Mountain has tremendous blue-sky potential. One of the best reported holes is TM11-36, with a 1.2 meter interval containing 1,565 g/t Ag (45.6 opt), 13.5% Pb & 9.9% Zn. Below is more dill data from Treasure Mountain.

Conclusion

Nicola Mining Inc. (TSX-V: NIM) / (OTC: HUSIF) is not a cash-burning, single-asset junior mining company, it can be viewed as 3 junior companies in 1. Importantly, the sum of the parts is greater than the whole. Unlike most green field prospects, Thule Copper & Treasure Mountain are not merely lottery tickets, each is host to significant prior mining, development & exploration activities in a world-class mining jurisdiction.

Nicola’s Merritt Mill is not just a $30 million+ (invested capital) 200 tpd processing facility, it’s the only Mill in BC allowed to accept mill feed from anywhere in the Province, and in many cases the ONLY place otherwise stranded mines can send ore. Therefore, on both an operating basis (cash flow multiple) analysis (see above), and on replacement value, the Mill alone more than covers the entire market cap of the Company. That means an investor today gets Thule Copper & Treasure Mountain for Free. But wait, don’t take my word for it, check out Nicola’s website, click on the “Projects” tab, and review this March 8th Corporate presentation video.

Still not convinced? CEO Peter Espig is happy to hear from prospective investors, please email me at epstein.peter4@gmail.com to discuss.

Disclosures: The content of this article is for illustrative purposes only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research, [ER] including but not limited to, commentary, opinions, views, assumptions, reported facts, estimates, calculations, etc. is to be considered, in any way whatsoever, implicit or explicit investment advice. Further, nothing contained herein is a recommendation or solicitation to buy or sell any security. The content contained herein is not directed at any individual or group. Mr. Epstein and [ER] are not responsible, under any circumstances whatsoever, for investment actions taken by the reader. Mr. Epstein and [ER] have never been, and are not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and they do not perform market making activities. Mr. Epstein and [ER] are not directly employed by any company, group, organization, party or person. Shares of Nicola Mining are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Peter Epstein owned shares in Nicola Mining and the Company was a sponsor of [ER]. Readers understand and agree that they must conduct their own research, above and beyond reading this article. While the author believes he’s diligent in screening out companies that are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. Mr. Epstein & [ER] are not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. Mr. Epstein & [ER] are not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. Mr. Epstein and [ER] are not experts in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)