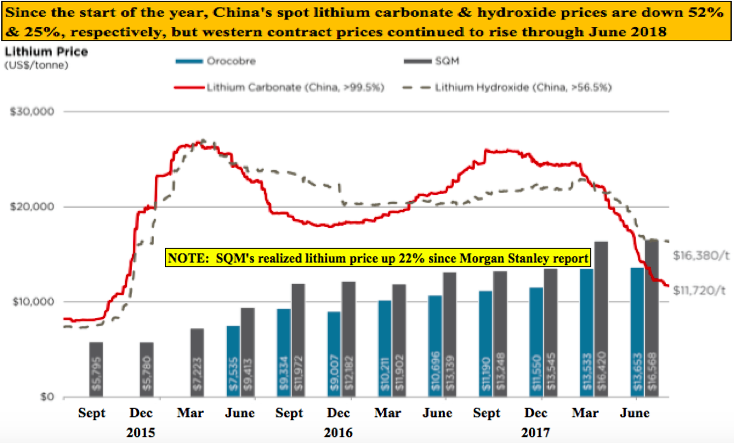

Cypress is not a last cycle clay project from 3-5 years ago…. it’s new, it’s not hectorite, and lithium prices are no longer around US$5,500/tonne. Lithium contract prices have roughly tripled! (Note, SQM’s latest quarterly price was ~ US$16,500/tonne) and the entire process flow sheet being pursued by Lithium Americas at Thacker Pass & Cypress at Clayton Valley is less complex because the clay host is less difficult to work with.

2) For Bacanora’s EV, I ascribed 15% to another clay project they have and 85% to the main Sonora Mexico clay project.

3) Unconventional junior, Australian-listed Global Geoscience, has a clay-hosted lithium / boron project in Nevada. It’s not included in the chart. A highly-anticipated PFS (there’s no PEA) is coming out on October 23rd.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Cypress Development Corp., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Cypress Development Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned shares in Cypress Development Corp and the Company was an advertiser on [ER]. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic. [ER] may buy or sell shares in Cypress Development Corp. and other advertising companies at any time.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)