{Please see disclosures at bottom of page}

Cypress Development Corp (TSX-v: CYP) / (CYDVF) is following through with everything it said it would, largely on time and on budget. Recall, Cypress is funded through a PFS, which is expected within the next 3-4 months. Infill drilling, further metallurgical testing and the initiation of baseline studies are prudently advancing the project. Metallurgical results have the most potential for upside.

Metallurgical tests are especially important as there’s room for improvement, but also room to better understand how it will impact the operational flow sheet. All of the work being done is critical towards delivering not just a PFS in the next 3-4 months, but an optimized PFS that stands head and shoulders above the successful PEA.

All of this work de-risks the project, making it more valuable to potential investors, but also to prospective strategic and financial partners.

The Company is performing infill drilling in the pit area. This is key as it will provide additional material for larger-scale tests. More about the infill drill program is contained in the following quote,

Cypress has prepared an application to modify its existing drilling permit for its infill program. The program is planned for up to 1,500 metres of drilling within the area between previous holes GCH-06 and DCH-10, which is identified as the higher-grade centre of the deposit. Drilling is expected to begin in early 2019 and will provide information to upgrade resource categories, further define a production schedule for the PFS and provide additional material for further metallurgical tests.

And here’s a quote about metallurgical testing,

Metallurgical testing for the PFS is already under way using sample material from the existing drill core. The metallurgical program is focused on optimizing leaching conditions with respect to acid concentration, residence time and other parameters as well as subsequent steps in concentrating lithium in the leach solutions leading to the production of lithium carbonate. As more material is obtained from infill drilling, tests will focus on composite samples of the individual clay units within the pit area and on larger composites representative of the PFS production schedule.

Cypress is working on other steps related to the project and completion of the PFS, including preparation of a plan of operations and the initiation of environmental baseline studies.

This is not sexy stuff! A bit boring, but this is exactly what the Company needs to do, it’s exactly what management said it would do and it’s what strategic and financial investors need to see.

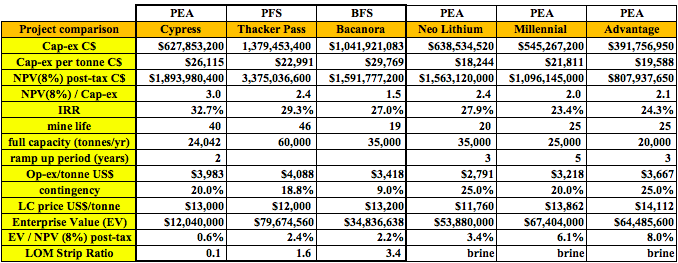

The sexy part comes when the PFS is delivered! Readers should not forget the compelling PEA metrics. The after-tax NPV(8%) was US$1.454 billion, with an IRR of 32.7%, a 0.1 to 1.0 strip ratio and the cap-ex was US$482 M — that’s a NPV to cap-ex ratio of 3:1, the best among its peers, including among brine projects.

The junior miners are in a funk, especially lithium juniors. But, it’s worse than that, a number of lithium juniors are dead in the water. They have little to no cash to advance their projects, so they sit tight and suffer share price declines.

How many lithium stories have a big catalyst in 3-4 months? Not many.

And who knows what that PFS might show? There could be improvements to the economics, but even if it just show more certainty on various aspects of the project, that would play an important role in de-risking.

Things are so bad in the lithium space that a number of projects globally will cease to exist. This is bad news for them, but good news for the rest of the sector. It also suggests to me that lithium pricing will stay higher for longer, which is good for survivors.

Cypress Development continues to move at a rapid but prudent pace. When sentiment improves for lithium juniors next year, Cypress could be a prime beneficiary.

So, no, nothing to sexy to report here, but important de-risking events are taking place. Cypress is doing things that many peers can’t afford to do or are not in a position to do.

Think about it, there are a lot of lithium PEAs out there, but far fewer PFS. As the market improves, investors and other key stakeholders will notice the difference!

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Cypress Development Corp., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Cypress Development Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned shares in Cypress Development Corp. and the Company was an advertiser on [ER]. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)