Peter Epstein & Epstein Research have no existing relationship with any company mentioned in this interview. However, Nicola Mining was an advertiser on Epstein Research in the past, and Peter Epstein has stock options (from 2-3 years ago) in Nicola Mining. The following interview was done by Dr. Allen Alper of Metals News. Peter Epstein & Epstein Research had nothing to do with the preparation or editing of this interview, it is simply being reproduced as it appears on Metals News. Please See disclosures at the bottom of page.

Dr. Allen Alper begins….

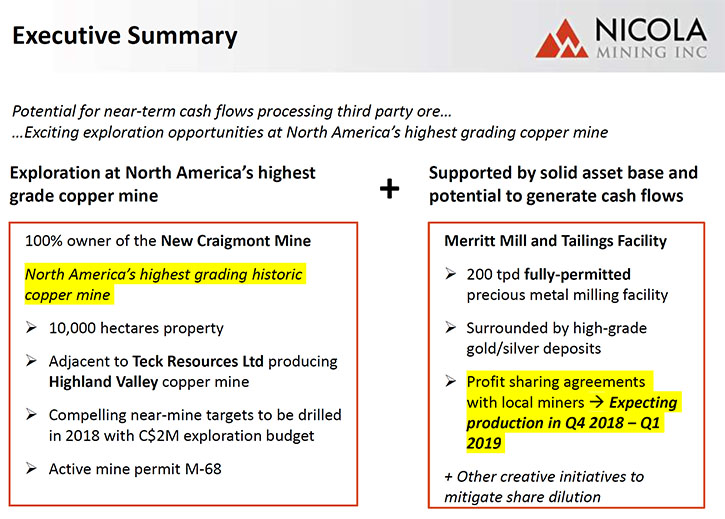

Nicola Mining Inc. (TSX.V: NIM) is in the process of recommencing mill feed processing operations at its 100% owned state-of-the-art mill and tailings facility, located near Merritt, British Columbia. It has already signed four mill profit share agreements, with high-grade gold producers. The fully-permitted mill can process both gold and silver mill feed, via gravity and flotation processes. At the 2019 Vancouver Resource Investment Conference, we learned from Peter Espig, the CEO of Nicola Mining, that they are the only site in British Columbia that is permitted to accept gold and silver material from anywhere in the Province and they will commence gold production in 2019.

The mill is situated, within the company’s 100% owned New Craigmont Project, North America’s highest grading historic copper mine, located ~10 km west of Merritt and 20 km south of the Highland Valley Operation. According to Mr. Espig, the mine should be low-cost, thanks to the developed infrastructure, cheap power and water, and warm weather. Plans for this year include commencing gold production at the Merritt Mill, and releasing a 43-101 resource on the New Craigmont Mine, which will be significant, according to Mr. Espig.

Peter Espig, CEO of Nicola Mining, at the 2019 Vancouver Resource Investment Conference

Allen Alper Jr: This is Allen Alper Jr., President of Metals News. I’m here at VRIC 2019 in Vancouver, Canada, interviewing Peter Espig, who’s the CEO of Nicola Mining, an emerging British-Columbia gold/copper producer, who will commence gold production in 2019. Could you give us a brief overview of your company, Peter?

Peter Espig: We’re the only site in British Columbia that is permitted to accept gold & silver material from anywhere in B.C. We’re essentially the de facto processing site because the smaller projects are not able to come up with reclamation bonds and the required infrastructure. Getting mill approval in B.C. can take over a decade. To facilitate these small projects, moving into operations more quickly, we have the mill site. They produce, they mine the gold and ship it to us. We then process it. They reimburse us, reimburse the gold miner, and then we split proceeds 50/50. So we essentially get half their gold, but it allows them to go into production without having to put up close to $100 million dollars’ worth of required milling infrastructure.

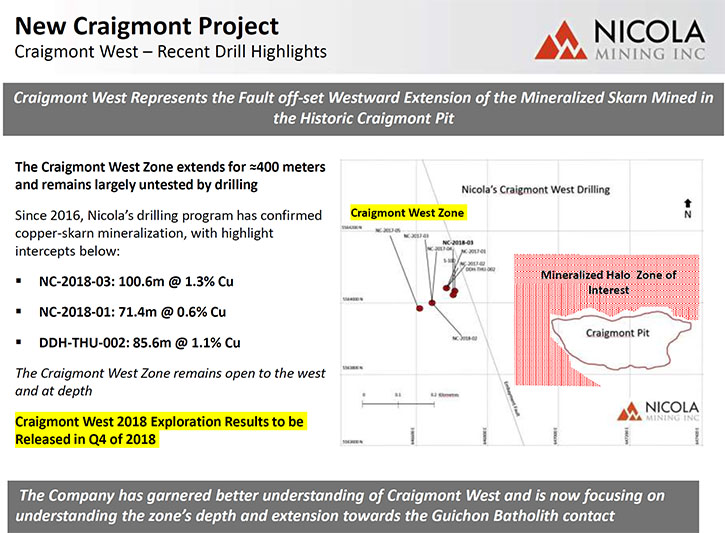

On the copper side, we are on the site of the former Craigmont Mine. We are the new Craigmont property, we refer to it as the highest grade copper site in the history of North America. It was a copper producer from 1961-’82, then they went through the historic tailings & produced magnetite for 21 years. So 42 years of mining on this site, but we’ve now taken it over. There’s an existing halo around it and our goal, this year, is to have a 43-101 resource.

We have 80 to 90 million tons of historic mining terraces. Then there’s a known halo around the pit. Some of our drill results from last year, included having a 100 meters grading 1.33% copper, that’s not the copper equivalent. The magnetite will probably be something more like 100 meters at 2% copper equivalent. Then we had another hole that was 155 meters grading 0.54%, of which the copper equivalent will be closer to 0.8-0.9%. So the grades are very high.

I know there are no other sites, with grades as prolific as ours in North America. Grades are very important, but equally important for mining is the cost of mining and the stability. Our site is in a warm weather environment. We have water. Power is very cheap. Mining in British Columbia is 1/2 to 1/3 of the cost of mining in, let’s say, Brazil or Peru, so we’re blessed with high-grades and low mining costs.

Allen Alper Jr:Okay, so what’re your next steps?

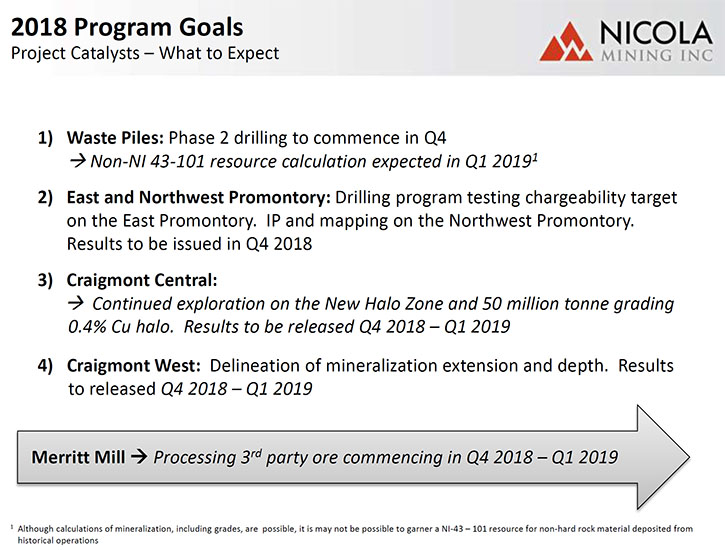

Peter Espig: There are two components in 2019. One is to go into gold production this year and we are looking at an M&A transaction. The beauty of an M&A transaction is because we have the mill, we can do a transaction with the mill being already constructed. If a streamer knows you’re going into production, you’re able to raise those funds required to do the acquisition based on the parameters of that deal.

So we can do it without dilution. The goal, on the gold side, is to go to mine production & processing. The goal on the copper side is to come up with the resource in 2019. We have 50 drill holes on the mine terraces that we haven’t released yet, and we have 6 on the halo that we will be releasing.

We haven’t released those yet because we needed to know what the copper equivalent is. In order to do a 43-101 report you need to know what your cutoff grade is, and the cutoff grade is based on your cost of mining. So on the copper, we will come out with a 43-101 resource, which will be significant. On the gold it’s production.

Allen Alper Jr:Okay. The cost of mining, is metallurgy involved in that?

Peter Espig:Yes, it’s metallurgy and I think if we look at the copper asset, the two most important characteristics are first; We are a fully permitted mine. As investors know, you can have a mine site in Peru or Chile or Argentina or British Columbia, and from the time you get from concept to production, it takes ten to 15 years, a very long time. As a fully permitted mine, we’re able to go into production very quickly. Don’t confuse the project with these exploration plays, we’re a fully permitted mine.

Secondly, we benefit because the copper that we have is in the form of chalcopyrite or bornite, so all the copper’s in a sulfite. There are conveyor systems that allow you to separate sulfite rocks from non-sulfite, prior to transportation, prior to milling. So why is that important? If you look at the historic mine terraces, we have 80 to 90 million tons. If you have a grade of 0.1% copper, for a mine it is not economic. But it’s very different if it’s already crushed, sitting in piles, and you put it on a conveyor belt.

Because when you have 0.1%, on average over a ton, what that really means is that within that ton, you’ll have 10 rocks or 15 rocks that are containing 1 to 2% copper because they’re in chalcopyrite form. That conveyor will immediately separate that at source, so the waste route goes right back where it was, and the rock that contains the copper and the magnetite is separated.

So we’re only transporting material that is upgraded to a very high form, and that lowers your cost of mining significantly. Especially if it’s in piles, you don’t have a mining cost. All you have is processing and transportation, so. It’s pretty exciting. The mining costs will be very low. We will start educating the market on the magnetite value that it brings to the copper, the ability to separate, and the combined value that we’ll put together in a resource that will be significant. Not necessarily a 43-101 compliant tonnage, but we will be able to indicate the tonnage that we found so far is.

Allen Alper Jr:Mm-hmm. Tell us more about your Management Team and their experience in this area?

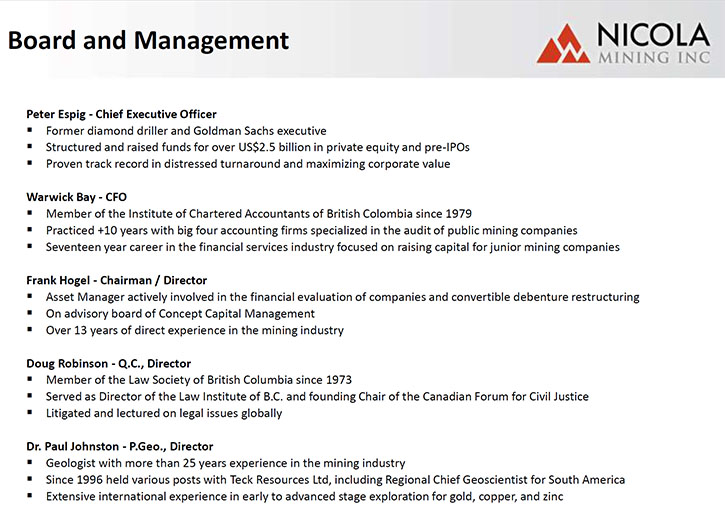

Peter Espig:For myself, as the CEO of Nicola Mining, it’s kind of a full swing. Because in the early 80s, living in Kamloops, British Columbia, I was the youngest diamond driller in British Columbia at the time. I started working as a diamond driller on the rigs, in mines, when I was 16 years old. I went on, graduated from high school, went to UBC and spent my entire summers, winters, vacations, working in the mines. After university, I went to Columbia Business School. After Columbia Business School, I worked for Business Capital, Shinsei Bank, and Goldman Sachs.

I’m a distressed turnaround specialist, this company is the former Holder Silver. In 2012, it had a market cap of 250 million, and it defaulted on its debt. So we came in and restructured the company. We’re about to take this company forward now. We’ve paid off the senior debt. The person leading our geology and our exploration site is Dr. Paul Johnston. He was the principal geologist for Highland Valley and Tech Resources. He left Tech in 2015 and joined our company, immediately after we assumed 100% control.

People ask, “Why does this asset still exist?” The reality is from 1962 to 2015, there were nine owners. When you have nine owners, they are going to disagree. That’s just a reality. So as soon as we consolidated 100% ownership of the assets, Dr. Paul Johnston left Teach Resources and joined our Board. He leads our exploration site. Our Chairman is Frank Hogel, from Germany, who’s the CCM in Gold and Concept Capital, one of the largest investors in junior mining companies.

We have Doug Robinson, who is another independent Director. He’s a lawyer. He’s a QC, Queen’s Council, one of the more prominent lawyers in North America, and he gives us legal advice. I think we have a great team here. Our CFO is Warrick Bay. Warrick Bay’s background was as a chief auditor for PWC. He’s a CA and has been working with us since 2014.

Allen Alper Jr:You mentioned your share structure, could you tell us a bit more about your share structure?

Peter Espig:So what’s unique about our company, is that since 2014, since we did the first raise, management and insiders have put up 70% of all money raised. We clearly believe in Nicola Mining. We, insider’s control about 60% of the company.

Allen Alper Jr:So you have your skin in the game. Tell us, what do you think are your biggest challenges right now?

Peter Espig:There are two parts. The biggest challenge in the equity markets is Canada seems to like big holes, like big hits because it moves the stock price up. The venture exchange is really based on exploration. But, we’re also based on cash flow. The size of our project is bigger, but we’re focused on cash flow, so we are educating the market. For example, only 1.8% of mining companies, listed on the TXS Venture, actually have cash flow.

We’re one of that 1.8%, but the market doesn’t necessarily recognize that or doesn’t reward you for it, so it’s educating the market that you have to look beyond exploration, you have to start appreciating operation. So that’s the market side.

On the operation side, BC is a very difficult place to be a mining company and the regulations are getting tougher, it’s more difficult to get mine permits. I think that because we are a permitted mine site and we are a permitted mill site, that doesn’t mean that we don’t have to apply for certain permits, but we do get them. Because we’re in a jurisdiction, where the market looks at British Columbia as being a difficult place to do business, that’s something that we have to have investors understand that we don’t have to go through all that because we’re permitted, right. Those are the two major hurdles that we have.

Allen Alper Jr:Very good. What are the primary reasons our high-net-worth readers/investors should consider investing in Nicola?

Peter Espig:One of the most important things in a mining company is being permitted and we are. As a permitted mine, we will come out with a 43101. There’s significant upside in that. Then we will have cash flow to support the operations and mitigate dilutions. If you don’t have cash flow, you have 100% guaranteed dilution going forward. If you’re not a permitted mine, by the time that gets to the point of operations, you’re out a decade. We don’t have to wait. We’re a business here and now. We’re going to build this business. So I think this is a great investment now. Hold it as we do create value through the operations.

I think we have the right management team that’s going to be able to maximize those operations.

Allen Alper Jr:But you have drill holes too, so you have it all?

Peter Espig: I think so. That’s why I’m involved.

Allen Alper Jr:So you have drill holes, have cash, have permitting, you’ve ticked off all the boxes and you’re ready to go forward. Is there anything else you’d like to add?

Peter Espig: Just thank you very much for interviewing me for Metals News.

Allen Alper Jr: I’ve enjoyed hearing more about your Company. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

Peter Epstein & Epstein Research have no existing relationship with any company mentioned in this interview. However, Nicola Mining was an advertiser on Epstein Research in the past, and Peter Epstein has stock options (from 2-3 years ago) in Nicola Mining. The interview was done by Dr. Allen Alper of Metals News. Peter Epstein & Epstein Research had nothing to do with the preparation or editing of this interview, it is simply being reproduced as it appears on Metals News.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)