Battery metals companies are out of favor, way out of favor. It’s May so, “sell and go away?” However, for anyone that’s not going away, another axiom in the market is, “the time to buy is when there’s blood in the streets.” I feel compelled to share my latest thoughts on the Cypress Development Corp. (TSX-V: CYP) / (OTCQB: CYDVF) / (Frankfurt: C1Z1) story. On May 20th, Bacanora Lithium (“BCN“) announced very significant news. Ganfeng Lithium Co., Ltd (“GFL“) a top 3 vertically integrated global Lithium (“Li“) player, agreed to become a cornerstone investor, taking down new issuance that will make it a 29.99% shareholder. In addition, Ganfeng is acquiring a 22.5% stake in the Sonora clay-hosted lithium project itself, with an option to increase that initial project-level stake to 50% over 24 months.

It’s a straightforward deal. Ganfeng is getting a tremendous bargain, but it’s absolutely a win-win for both companies. In this weak market, Bacanora couldn’t find a check writer. But, they landed perhaps the single best partner to get the Sonora project up and moving forward again. For their investment of roughly C$24.6M, Ganfeng gets 29.99% of Bacanora, plus exclusive off-take rights on 50% of lithium produced at Sonora for life of the mine during Stage 1. GFL can increase its off-take to 75% of lithium produced during Stage 2.

I think this is very exciting for Cypress Development Corp. Will the share price move higher on this news? Who knows, but a thesis I’ve had over the past 18 months was that Cypress (to some extent) would ride the coattails of larger junior’s projects like Bacanora’s Sonora project in Mexico, Lithium Americas’ (TSX: LAC) (“LAC“) Thacker Pass and Ioneer’s (ASX: INR) Rhyolite Ridge Lithium-Boron project (LAC, INR & CYP projects in Nevada) advancing towards production early next decade. However, by 2nd-3rd qtr. 2018, all 3 projects were stalled. One of the only significant movements came in the form of a PFS on Thacker Pass. The only other clay-hosted company action was Cypress charging ahead, delivering a strong PEA.

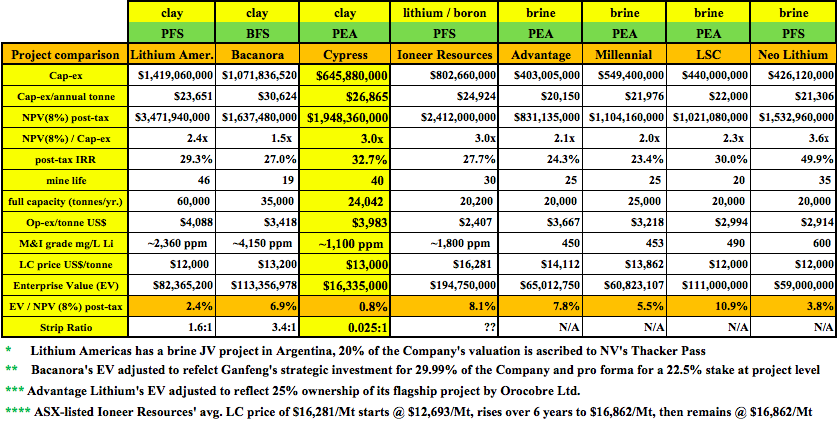

Why is the GFL/Bacanora news so important for Cypress? Because GFL gets things done. The timeline for Sonora was for first production in 2021, but no one was taking it seriously. That date just became real, and it’s only 2 years away! This is much more than a vote of confidence in Bacanora, it’s a another vote of confidence in clay-hosted Li projects, of which their are very few at PEA-stage or beyond. We could start to see increased interest from strategic investors, especially if lithium prices are at or near bottom as was recently suggested in this Financial Times article. In the chart below I compare key metrics found in various lithium company PEAs & PFSs.

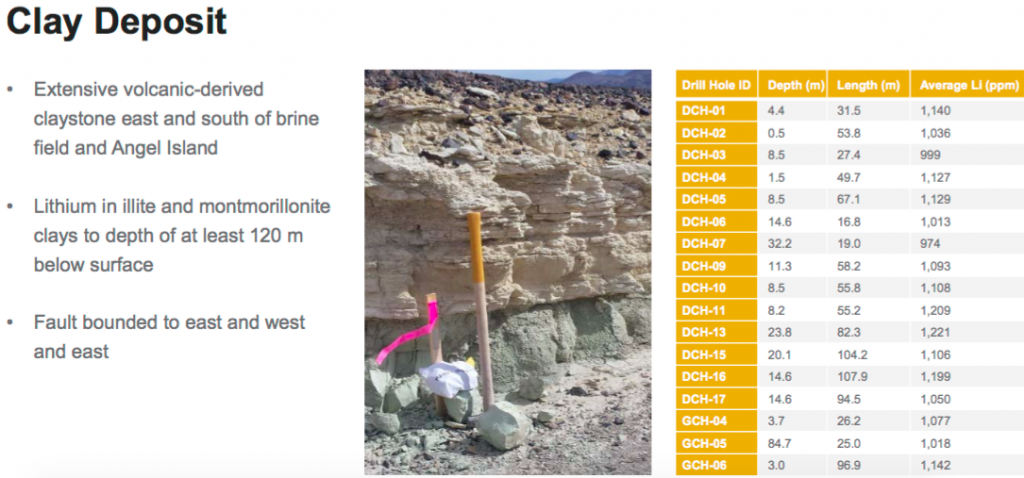

This article is about Cypress Development Corp., so my comments will focus primarily on TSX-V: CYP. Easy things first. People email me about Cypress’ relatively low grade of ~1,100 ppm Li compared to the average grade of Bacanora’s, Lithium Americas’ & Australian-listed Ioneer’s (formerly Global Geoscience) of ~2,770 ppm. However, the mineralogy of Cypress’ deposit is superior to that of Bacanora’s & Ioneer’s who have hectorite & searsalite, respectively in their deposits, which are much harder to work with. Also, the proposed strip ratio of Cypress’ project is < to 0.1 to 1. Compare that to 1.6:1 & 3.4:1 for LAC & BCN respectively.

The combination of an extremely low strip ratio, flat lying land, very consistent grades and more favorable mineralogy, largely offset the grade differential. The next thing that jumps out at me is the average cap-ex of LAC & BCN is twice that of Cypress. Obviously there’s a reason, LAC & BCN are planning to produce a lot more lithium carbonate. However, from a project funding point of view, in this market, sporting half the cap-ex requirement, but enjoying the highest IRR at 32.7%, seems compelling.

Perhaps the most exciting takeaway from the above chart is that Cypress is trading at just 0.8%, less than 1%, of its after-tax NPV(8%). In a better market, Gold juniors at a similar stage routinely trade at 20% to 30% of their after-tax NPVs. In today’s market they’re trading more like 5% to 15% of NPV. But < 1% of NPV for a very reasonable Li Project seems absurd. Less than 1% of NPV for a Project funded through PFS this summer and one that could have a Bank Feasibility Study (“BFS“) on it within 9-12 months. Other lithium juniors are trading between 2.3% and 8.1% of their NPVs. Brine hopeful LSC Lithium was acquired last year at 10.9% its NPV.

Another metric to consider is the ratio of after-tax NPV to total upfront cap-ex. A ratio of 2x or better is very good. However, it differs by sector & region and by project scale. For the 3 clay projects, LAC & BCN average ~2x after-tax NPV to cap-ex. ratio, but Cypress stands out at 3x. This is an important metric for strategic investors. For a player like Albemarle Corp. (NYSE: ALB) to make a move on a clay project, they would want to get a lot of bang for their cap-ex buck. This metric shows that scaling production above PEA levels, say doubling the 24,042/tonnes LCE/yr. is both achievable & affordable (for larger companies). Prospective strategic investors will have a lot more information to work with after Cypress delivers a PFS in 2H July or 1H August.

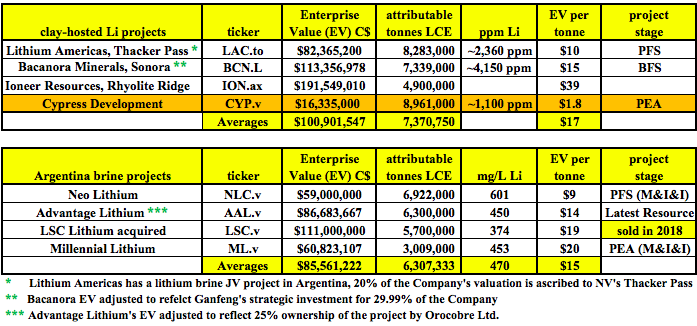

In the chart below, I take another look at indicative valuation based on overall resource size. Cypress has a world-class sized Indicated + Inferred resource of nearly 9 Million “Metric tonnes” (“Mt“) LCE. The Company is trading at an EV/Mt of just C$1.8. That means each Mt of LCE in-situ, (in the ground), is valued at C$1.8, while a Mt of Lithium Carbonate sells for about US$10,000 = ~C$13,400/Mt. Clearly, not all Mt will be mined, and there’s a lot of costs associated with mining, extracting the lithium, disposing of the waste & refining it into salable form. But, comparing the C$1.8/Mt ratio to the peers trading at C$9-C$39/Mt shows again that Cypress looks to be trading very cheap to peers ahead of the release of a PFS this summer.

What to expect from Cypress Development Corp.’s PFS this summer?

How will the PFS turn out? I don’t expect an increase in the after-tax NPV, (the US$13,000/tonne Li price assumption might fall modestly) but we could see improvements in several other metrics. All of the work being done between the time of the PEA & PFS is critical towards delivering not just a good PFS, but an optimized PFS, that stands head & shoulders above the successful PEA. It’s easy to forget, but we should not take for granted, that this work greatly de-risks the project. A strong, detailed, high-quality PFS would make the Project more valuable to shareholders and potential strategic & financial partners, not to mention institutional funds.

Op-ex/tonne could improve from lower acid use & energy consumption, among other things. Upfront Cap-ex could decline if a lower cost acid plant would suffice. In March, Ioneer revisited it’s acid plant design and put the following out in a press release,

“As part of the contract bidding process, SNC provided an updated budgetary cost estimate of ~US$111 M for supply & installation of the sulphuric acid plant, ~US$60 M lower than the US$170 M cost in the PFS completed in October 2018. SNC-Lavalin is a leader in the sulphuric acid industry, with a strong track record working with industry leading technology from DuPont Clean Technologies.“

Ioneer is scoping out a 3,500 tpd acid plant, Cypress a 2,000 tpd plant. The implication here is that the Company could potentially save tens of millions of US$ on its US$105M acid plant. Or, it could upsize to a 3,000 tpd plant for roughly the same US$105M cost. Increasing to 3,000 tpd would be subject to sourcing & delivering more sulfur feedstock to site, but if feasible, annual production could potentially increase from 24,042 tonnes/yr. to > 30,000 tonnes yr.

The resource should grow, and the grade improve, as the Company drilled the project earlier this year. Management is looking at scenarios to selectively mine higher-grade zones, at perhaps 1,200-1,300 ppm Li, for 40 years, at ~20,000 tonnes LCE /yr., and at scenarios as low as 10,000 tonnes/yr., up to 40,000 tonnes/yr. Having a nearly 9 M tonne Indicated & Inferred resource makes higher production figures possible. Bottom line, I think that both op-ex & cap-ex per tonne could be lower if production rates remain around 24,000 tonnes/yr. I think the IRR might increase from an already strong 32.7%.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Cypress Development, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Cypress Development are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned shares in Cypress Development Corp. and the Company was an advertiser on [ER]. Readers should consider me biased in my view of the Company. Readers understand and agree that they must conduct their own due diligence above and beyond reading this interview. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this interview or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)