Last month, clay-hosted lithium junior Cypress Development Corp. [TSX-V CYP] / [OTCQX: CYDVF] contracted Vancouver based NORAM to conduct additional testing for its 100%-owned Clayton Valley project in Nevada (USA).

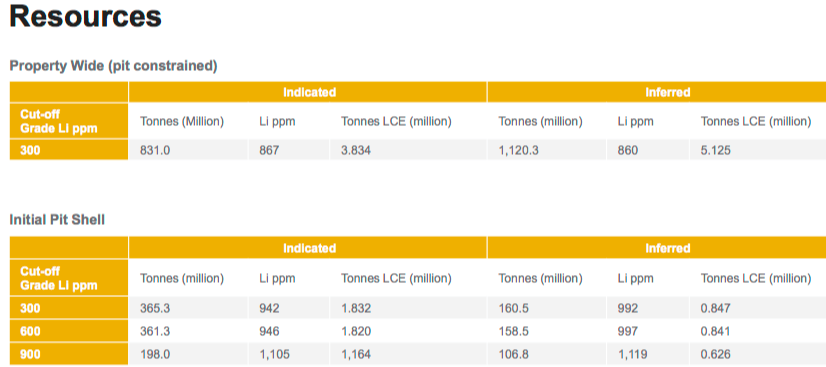

Test work will focus on the downstream portion of the revised extraction flow sheet. This incremental step pushed back delivery of a third-party Preliminary Feasibility Study (“PFS“), until January/February. Readers are reminded that at nearly 9 million tonnes Lithium Carbonate Equiv. (“LCE“), Cypress has one of the largest delineated resources (Indicated + Inferred) in the world.

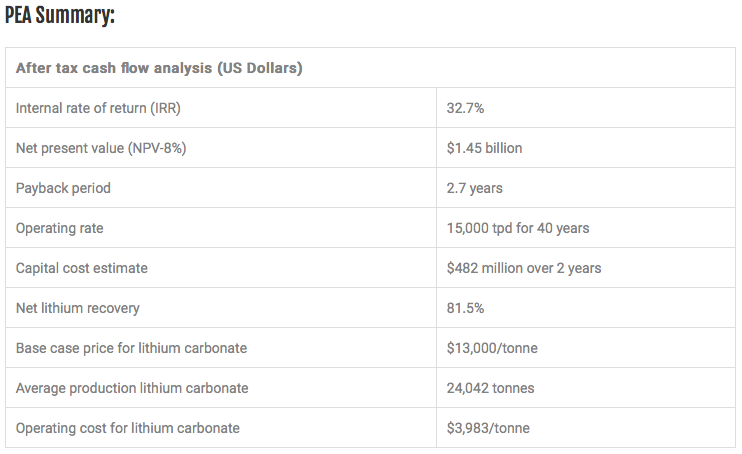

The company’s Preliminary Economic Assessment (“PEA“) shows an after-tax NPV(8%) of C$1.9 billion, 3.0 times the size of the upfront cap-ex figure. Operating costs are about US$4,000/tonne and the IRR is billed at 32.7%. These figures will change with the upcoming PFS.

Some shareholders were disappointed by the PFS being pushed back, but I think the company is doing the right thing. If the delay had been due to running out of cash, bad / inconclusive study results, or some other project setback, that would of have been troubling. I’m content to wait a few months, by which time we could start to see some signs of improvement in the lithium sector.

A lot has changed in the past 3-4 years….

Consider what’s changed since 2015-16. Brine projects in south America were thought to be the cheapest and most reliable way to produce lithium carbonate. Brine was considered by many to be the wave of the future. Fast forward to 2020, it’s proven to be not nearly as cheap or as easy as expected.

Look no further than Argentina’s Orocobre Ltd., a company that’s nearly four years behind schedule and over budget in achieving stated capacity of 17.5k tonnes LCE/yr. It is currently operating at 72% of nameplate. Even giants Albemarle & SQM have experienced very significant difficulties in expanding their large-scale lithium carbonate operations in Chile.

In Australia hard rock producers have had great success bringing on new production. So much so, that the price of spodumene concentrate (6%) (used as feedstock for lithium hydroxide) is down 60%+. There will be meaningful downsizing of hard rock operations in Australia. Non-producing juniors are having, and will continue to have, a very challenging time as existing producers cut costs and streamline operations.

Taken together, south American brine projects coming online much slower than expected, and the curtailment or cancelation of several hard rock projects; these factors open a window of opportunity for non-traditional / unconventional lithium projects. At the very least, industry dynamics suggest higher lithium prices in the 2020s, possibly meaningfully higher.

Renewed interest in non-brine / non-hard rock lithium sources

Circling back to Cypress’ recent news, readers may recall that the company announced positive results (see press releases in Feb. & July) from the first two phases of its PFS-stage metallurgical program. On Aug. 29, the company reported another milestone; a commercially viable process was identified, based on filtration, to deal with the separation of clay particles from leach solutions.

This achievement should enhance project economics and lead to improved, more efficient recoveries. Equally important is the more effective use of sulphuric acid (a large component of op-ex). These changes have been deemed by management as, “significant” and have been incorporated into the PFS.

As per the press release, “The results represented a major milestone in the project that simplifies the process flow sheet.” Further, according to CEO Dr. Bill Willoughby,

“Cypress identified a commercially-viable process that takes solid-liquid separation from bench-scale, to operational scale.” Importantly, “Cypress now has a greater understanding of this portion of the process.”

In the most recent press release CEO Willoughby commented,

“We are pleased to work alongside NORAM during this stage of testing. It lays the groundwork for pilot-scale testing & a full Feasibility study we plan for late 2020”

After delivery of what I hope will be a robust PFS, management will start pilot-scale testing of the flow sheet and work on a Bank (Full) Feasibility Study (“BFS“). Pilot-scale testing will start well before delivery of a BFS. Cypress has roughly C$1.4 million in the bank, enough to carry them comfortably into 2020.

The PFS could potentially deliver both lower cap-ex & op-ex

Work over the past year points to the real possibility of being able to lower both op-ex per tonne & upfront cap-ex in the upcoming PFS. In addition, CEO Willoughby indicated that pilot-scale testing, which could start fairly soon, is typically not done until BFS-stage. Therefore, Cypress should have a head start in that important undertaking.

Armed with a PFS — 100% project ownership, (subject to a modest NSR) a giant resource, a great location (USA / Nevada) [vs. civil unrest in Chile, and a less mining-friendly (new) President in Argentina] — Cypress should be in a very strong position. Even more so if/when the lithium price & market sentiment rebounds later in 2020 or 2021.

Based on the large number of global EV platforms and over 100 battery mega-factories coming online (according to Benchmark Mineral Intelligence). I expect lithium prices to move higher, perhaps trading between US$10k-$16k per tonne, for much of the 2020s. A price around US$10k/tonne is all that Cypress needs to thrive, as management believes op-ex will be around US$4k/tonne.

Looking beyond the PFS and pilot-scale testing, in 12 to 18 months management should have a BFS demonstrating 100%-ownership of a great project at a long-term assumed lithium price of US$10k/tonne. Or, a tremendous project at US$12k-14k/tonne. Or, a spectacular, top-decile, mining project at US$16k+ per tonne.

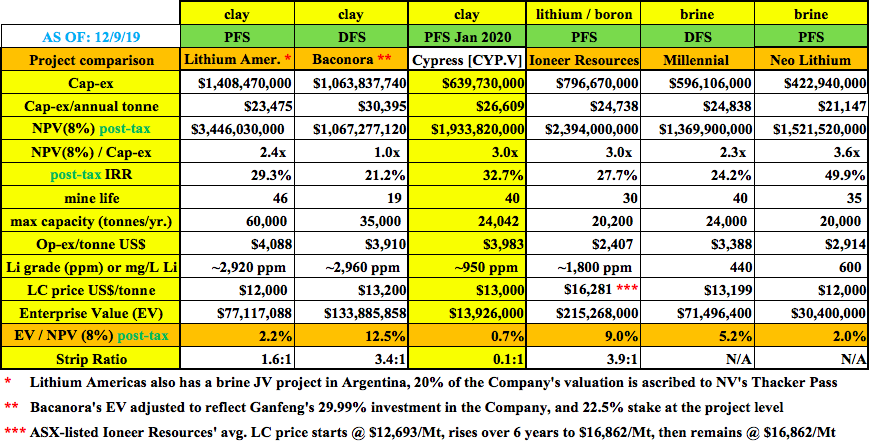

At C$0.17 per share, Cypress Development Corp.’s [TSX-V CYP] / [OTCQX: CYDVF] valuation appears cheap compared to peers and to its after-tax NPV(8%). The Enterprise Value (“EV“) is less than 1% of the PEA-derived NPV. Compare that to a range of 2.0% to 12.5% (average of 6.3%) among peers on the chart above.

Make no mistake, almost every lithium junior is trading cheaply, but most will never make it past PFS-stage. Cypress has an excellent chance of moving beyond PFS-stage, especially if/when it finds a strategic / financial partner to share development costs.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Cypress Development Corp., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker / dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Cypress Development Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this interview was posted, Peter Epstein owned shares of Cypress Development Corp., and the Company was an advertiser on [ER].

While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any future events & news, or write about any particular company, sector or topic. [ER] is not an expert in any company, sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)