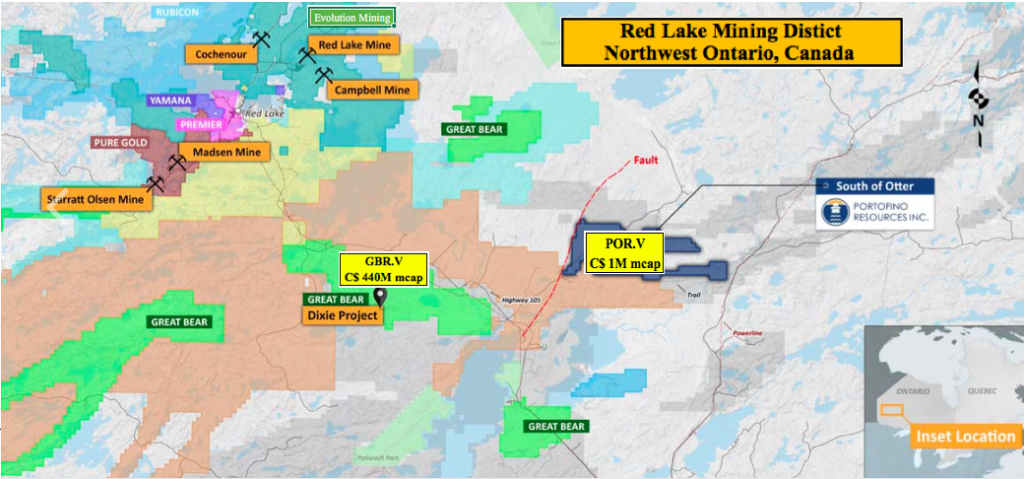

Last September, Portofino Resources (TSX-V: POR) announced a binding agreement for the right to acquire a 100% interest in mining claims in the famous Red Lake mining district of Ontario, Canada. Portofino joins both Majors & juniors including Australian-listed; Evolution Mining and Canadian-listed; Yamana, Great Bear Resources, Premier Gold Mines, Pure Gold, Rubicon Minerals, Pacton Gold, BTU Metals and GoldOn Resources.

Portofino’s block comprises 14 mining claims covering ~5,120 hectares. The claims are near the investment crowd favorite Dixie project, being drilled out by Great Bear (“GBR“). GBR’s latest results from a fully-financed 200,000-meter drill program were quite impressive. One of several blockbuster intervals returned 48.7 g/t gold (“Au“) over 8.7 m, incl. 1.2 m @ 281.9 g/t Au.

The gold price had its best year (2019) in a decade….

So, ultra high-grade Au mineralization, found at shallow depth (under 300 m), across multiple drill programs in 2017-2019. GBR has a market cap of $440 M. Portofino’s 5,120- hectare “South of Otter” property is less than 10 km east of GBR’s 9,140-hectare flagship project. It’s market cap is $1 M.

If South of Otter hosts anything good, which remains to be seen, it might be high-grade Au, like Dixie, or high-grade copper (“Cu“) & zinc (“Zn“) mineralization, like that found on nearby properties.

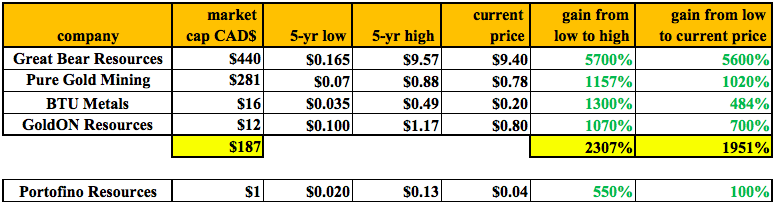

I’m shamelessly playing the close-olgy card here, but only because GBR is one of the best gold stories of the past decade, up ~5,600% from $0.165 in 4Q 2016 to $9.40 today. Several other juniors have also done quite well. Pure Gold Mining is up ~1,020% since 4Q 2015. BTU Metals is up nearly 500% since 3Q 2018. One more; GoldON Resources, is up ~700% since 1Q 2019.

Several juniors, Evolution and Yamana, actively exploring / developing projects & producing mines

That’s four Red Lake juniors with spectacular share price success. Four out of roughly 16 (25%) publicly-traded companies with all, or substantially all, of their gold and/or base metals assets in and around Red Lake, Ontario. Portofino, with a market cap of just $1M is perhaps the smallest player in the entire district. Yet, its under-explored property is both sizable & meaningfully prospective.

South of Otter is located within a geological setting that hosts the past-producing South Bay Mine (1.6 Mt @ 11.1% Zn, 1.8% Cu & 2.1 oz./t silver (“Ag“). GBR’s Dixie project is also on this trend. In addition to being on trend, Portofino’s property lies in a similar geological & structural setting.

Evolution Mining & Tri Origins compiled a vast amount of geophysical data that mapped structures within the South of Otter claims. Portofino has commenced geophysical & geochemical surveys to further understand the geology & mineralization associated with past discoveries which lie just north of the property but strike onto Portofino’s claims.

Red Lake exploration program started this week

These surveys will provide Portofino with the data required to effectively target both gold & base metal mineralization and identify similar structures for exploration that are being explored along trend by companies including Great Bear and BTU Metals. BTU recently reported an intercept of 44.3 m of 1.14% Cu Eq., with intervals of up to 5.56% Cu, 99.6 g/t Ag & 2 g/t Au.

In a recent press release Portofino’s CEO David Tafel stated,

“We have been able to acquire a very prospective land package in a known gold mining camp proximal to the Dixie project which has recently produced multiple high-grade gold discoveries by Great Bear Resources. This acquisition allows us to diversify our project portfolio while we continue to advance our lithium projects.”

The South of Otter property is ~40 km southeast of the town of Red Lake, Ontario, and less than 10 km east of GBR’s Dixie Lake. Historical work on the claims included prospecting, sampling & limited diamond drilling.

With the gold price up US$300/oz. / (+24%) from the low of 2019, management is wisely seizing an opportunity to conduct meaningful programs that may, in part, be guided by ongoing successes at neighboring projects. Active drill programs are underway on properties in virtually every direction from Portofino’s South of Otter property. In fact, one of the most aggressive drill campaigns in Canada (200,000 meters), is being done by Great Bear.

Portofino Resources’ South of Otter Property

To earn 100% interest in South of Otter, Portofino has agreed to issue 500k shares and make payments over a 4-year period totaling $70,000. The property vendor will retain a 1.5% Net Smelter Return (“NSR“), of which one half, (0.75%), can be purchased for $400,000.

Management has completed a review of all available historical assessment work on the South of Otter property and has announced an initial exploration plan starting this week. According to the press release,

“The first phase of Portofino’s 2020 exploration program consists of ~25-line km of ground VLF/EM geophysics & soil geochemistry surveys. The objective is to delineate mineralized structures related to past gold & base metal discoveries in the region and outline targets for follow-up trenching & drilling. Multiple gold, copper & zinc deposits / prospects have been discovered both immediately to the north and south of the claim boundaries.”

Utilizing historical geological & airborne magnetic surveys has enabled the Company to advance its exploration program rapidly and cost effectively. Combined with the new data to be collected from the upcoming program, the Company expects to delineate mineralized structures related to past gold and base metal discoveries and outline targets for follow-up trenching & drilling.

Portofino’s property contains excellent targets for both high-grade, Red Lake-style Au mineralization as well as gold-bearing high-grade base metal prospects. Historical work includes prospecting, sampling, plus limited drilling, plus airborne magnetic geophysical surveys commissioned by a previous operator.

Portofino’s brine lithium prospects in Argentina are highly prospective

Readers may recall that Portofino Resources is also known as a lithium play. It has locked up (through favorable option structures) three projects in the heart of the Lithium Triangle.

In the first half of 2019, Portofino continued to move the ball forward on two of its three projects. Although it’s too early to know if the Company has good lithium assets, one of its projects, Hombre Muerto West (“HMW“), is in the single best salar in Argentina — salar del Hombre Muerto.

Neighbors in and around Hombre Muerto include Livent Corp. (formerly FMC), Korean giant POSCO and Australian-listed Galaxy Resources. Last year, POSCO famously paid ~$364M to Galaxy for 17,500 hectares, that’s ~$20,800/ha. That land package reportedly had a 2.54 million tonne LCE Indicated + Inferred resource.

Over the past few months, a number of lithium juniors & producers have seen significant rebounds in their share prices. Eight well-known names (Neo Lithium, Advantage Lithium, Lithium Americas, Ganfeng, Livent, Wealth Minerals, Standard Lithium & Bacanora are up an average of 125% from 52-week lows.

Gold sentiment is high and lithium sentiment might be turning. Portofino now has two segments (lithium & gold), each of which is likely worth more than its entire market cap of just $1M.

Depending on exploration results, either or both pursuits could be worth a lot more than $1M. It’s early days, but a bull market in precious metals (underway?) and/or a bounce in lithium prices could draw attention to Portofino Resources (TSX-V: POR) this year and next.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Portofino Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing co-ntained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Portofino Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned shares of Portofino Resources and Portofino was an advertiser on [ER].

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)