Cypress Development Corp. (TSX-V: CYP) (OTCQB: CYDVF) (Frankfurt: C1Z1) owns 100% of a giant, leachable, claystone-hosted lithium resource, the Clayton Valley Lithium Project (“CVLP“), adjacent to Albemarle Corp.’s Silver Peak brine operations in Nevada. The Company has an Enterprise Value (“EV“) {market cap + debt – cash} of C$17.5M.

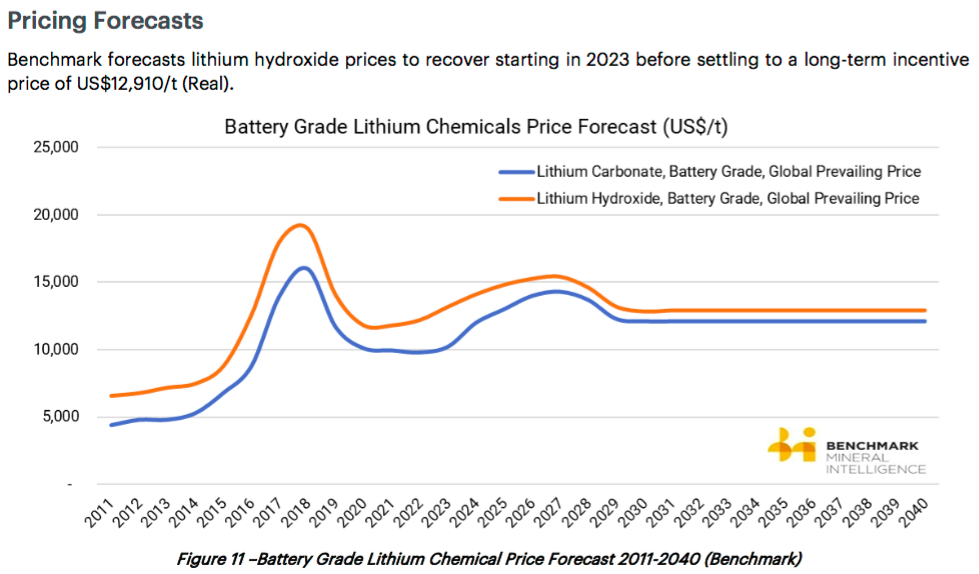

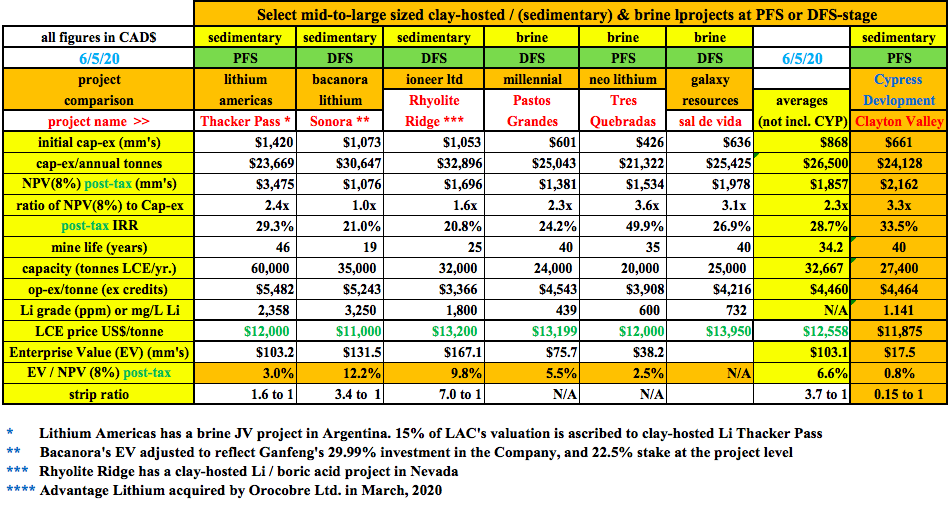

On May 19th, management delivered a highly-anticipated press release summarizing its Pre-Feasibility Study (“PFS“) on the CVLP. Cypress adopted a low long-term price of US$9,500/tonne (“t“) of Lithium Carbonate Equiv. (“LCE“). The LCE price used in a dozen other brine or clay-hosted (sedimentary) project reports in the past few years has ranged from US$11,000 to US$13,950/t, averaging US$12,558/t. As can be seen in the Benchmark Mineral Intelligence price chart from April, hydroxide’s long-term price is forecast to be close to US$13,000/tonne.

Cypress Development Corp.’s PFS, a high-quality, serious report

Admittedly, lithium prices have been falling since 2018, but Nevada lithium + boric acid project developer ioneer ltd. announced, (20 days before Cypress), a Definitive Feasibility Study (“DFS“) with a US$13,200/t LCE price assumption.

Hard rock juniors are pursuing lithium hydroxide, but brine projects have lithium carbonate in their plans. Cypress plans to make battery-quality lithium hydroxide. In Cypress’ PFS, nameplate capacity is 27,400 tonnes LCE/yr. However, it takes less lithium to manufacture hydroxide than it does to make carbonate.

If the CVLP project were to deliver 100% hydroxide, it would be operating at an average of 31,141 tonnes /yr., (+13.65% more finished product). Even better, hydroxide typically sells at a premium to carbonate, about 15%-20% higher, although the spread is closer to 30% at the moment.

With that in mind, some investors are wondering why management didn’t use a higher long-lerm lithium price. I believe there are two reasons. First, that’s not how CEO Bill Willoughby rolls. Dr. Willoughby is a PhD in Mine Engineering & Metallurgy, making him the polar opposite of a Vancouver promoter, and the best choice imaginable to be leading Cypress.

Second, I suspect that Cypress is in talks with entities led by serious engineers, metallurgists & experienced mining experts like Dr. Willoughby. A detailed, highly accurate PFS was called for. Please note, management has never revealed to me the names of anyone they’ve spoken with in the past or presently.

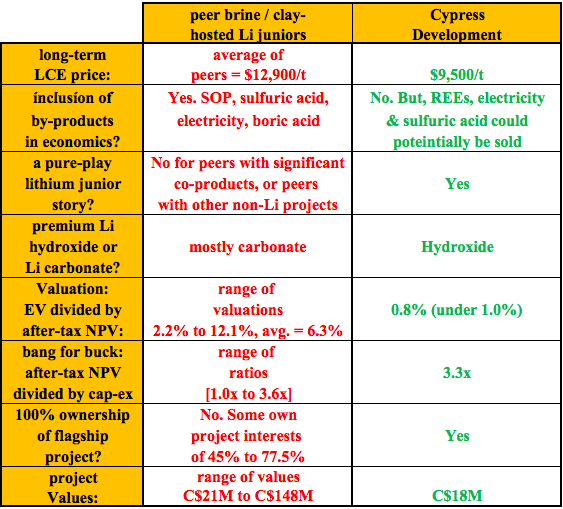

Cypress is very attractive in peer comparisons & valuation

Unlike peers, Cypress did not incorporate by-/co-products in its PFS economics. By contrast, Lithium Americas’ Thacker Pass project PFS includes revenue, equal to 11% of the total, from the sale of excess electricity & sulfuric acid. Cypress might also have surplus sulfuric acid to monetize, but management did not use it in their model.

Rare Earth Elements (“REEs“) [scandium, dysprosium & neodymium] are present at the CVLP, but zero credit was ascribed to this potential cash flow. If economically recoverable, the un-discounted value of the REEs is in the hundreds of millions. REEs will be studied & reported on in next year’s Definitive Feasibility Study (“DFS“)

By-/co-products are included in the economics of some peer company projects. I mentioned Thacker Pass (electricity + sulfuric acid). Bacanora proposes to produce potassium sulfate (“SOP“) alongside lithium carbonate. In addition to lithium, ioneer ltd. expects to be the world’s 3rd largest producer of boric acid.

In order to more accurately compare projects, I adjusted the lithium price assumption in the CVLP PFS. Taking the midpoint between the base case of $9,500/t and the “upside” case of US$14,250/t, I interpolated key metrics at an implied LCE price of US$11,875/t, (5% lower than US$12,558/t peer average).

Cypress’ PFS compares quite favorably to the projects shown below. The average cap-ex was C$868M vs. C$661M for CYP, upfront capital intensity; C$26,500/t vs. C$24,128/t for CYP, ratio of after-tax NPV(8%) to upfront capital; 2.3x vs. 3.3x for CYP., and IRR; 28.7% vs. 33.5% for CYP. One last thing, the CVLP has a strip ratio of just 0.15 to 1. The other sedimentary projects have strip ratios ranging from 1.6 to 7.0 to 1, averaging 3.7 to 1.

Is Cypress a takeover candidate?

Could Tesla be looking at acquiring Cypress? With an EV of C$224.4B (12,824 times that of Cypress) it could easily afford to. However, I have no idea if Tesla is interested. However, I imagine that a few auto and/or Li-ion battery makers are kicking the tires. More importantly, I suspect that lithium / specialty chemicals giant Albemarle is carefully reviewing the PFS.

Why would a C$15B company like Albemarle care about tiny Cypress? Simple. In a larger company’s hands, the CVLP would be worth a lot more than C$17.5M. A larger company could comfortably afford the upfront cap-ex of C$661M. Financially strong players can borrow at very low interest rates.

With substantial financial wherewithal and unrivaled, decades-long, expertise in specialty chemicals & lithium — Albemarle could bring a sedimentary project, especially one adjoining its Silver Peak brine operations, to fruition faster than Cypress ever could. Silver Peak has been operating since the mid-1960s. Assuming its current 6,000 tonnes LCE/yr. capacity, (recent production has been less) Albemarle says it has ~20 years of remaining mine life.

Think about the synergies that could be gained by adding the CVLP to Albemarle’s neighboring lithium complex. Silver Peak has all manner of industrial / chemical property, plant & equipment, and of course — lithium processing facilities. Equally important, it has 50+ years’ expert knowledge & experience with lithium compounds and local & state permitting requirements.

Adding 27,400 tonnes/yr. LCE (or 31,141 tonnes/yr. hydroxide) to Albemarle’s 6,000 tonnes LCE/yr. would move the needle for Albermarle. Cypress did not release EBITDA figures in its PFS, but the op-ex is US$3,329/t. So, at an interpolated lithium price of US$11,875/t, the operating margin before taxes would be US$8,546/t.

Therefore, 31,141 tonnes hydroxide, multiplied by a US$8,546/t operating margin, equates to C$362M in cash flow/yr. (FX rate: 1.36 to 1.0). Compare that to Albemarle’s 12-month EBITDA thru 3/31/20 of [US$1.007B = C$1.37B]. All else equal, I estimate Albemarle’s lithium segment EBITDA margin could jump from 37% to about 45%, by acquiring Cypress.

Importantly, extending the mine life of Silver Peak several decades would push back reclamation expenses into the 2060s. Can these two companies find a way to combine resources?

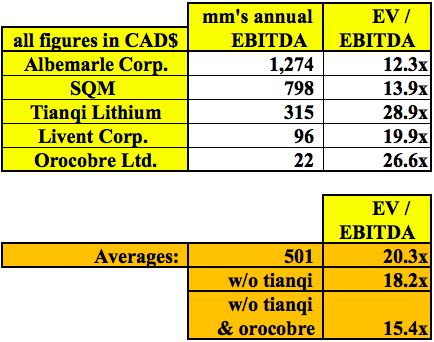

There are not that many lithium producers (of meaningful size), and SQM / Albemarle are not pure-play lithium investments. In the chart above I show that EV/EBITDA multiples are fairly strong even with lithium prices less than half 2018’s highs. Lithium producers trade at 15x+ EBITDA multiples.

Although there’s still a lot of execution risk ahead, imagine what a potential cash flow stream of C$362M/yr., for 40 years, might be worth. A 15.4x multiple, times C$362M = C$5.6B. Discounting that figure back six years at a 20% discount factor, it’s still a NPV of C1.87B.

Next Steps

The authors of the PFS recommend additional testing & studies be done in the areas of processing, mining, permitting & infrastructure. Further work is needed to confirm the flow sheet and determine recovery & reagent uses. A confirmation of the process & equipment in the leaching & filtration functions is sought and there’s further work to do on enhancing solid-liquid separation to further reduce acid consumption.

Management must determine if there’s any lithium or acid losses in the processing plant and optimize solution handling. Another important step will be to assess the economic viability of potassium, magnesium, REEs or other elements that might have commercial value.

Drilling (limited test-mining) is required to obtain material for metallurgical testing. Regarding permitting, a field program will be necessary to determine if any protected species of plant or animal are present and to gather environmental & other data to prepare a mine Plan of Operations.

Finally, infrastructure — Feasibility-level designs for the mine, plant & tailings storage areas can now begin. A better understanding of power & water supply & sourcing is being developed. These are big ticket items that need to be sorted out over the next 12 months, before a DFS can be completed.

Capital will have to be raised to fund a pilot plant, various reports & studies and a DFS. Importantly, funding need not come solely from equity raises. I suspect that a farm out or JV is possible before yearend. Management is confident that these and other critical factors can be addressed. Readers should remember that first commercial production is probably not until 2025, there’s plenty of time to address any challenges.

CONCLUSION

There are simply not that many 25,000+ tonne/yr. lithium hydroxide projects in the world at PFS-stage, (or more advanced), that could be in production by 2025.

Once car & battery makers see lithium projects getting acquired, or have their production capacities tied up by off-take agreements, we could see a rush of M&A activity. Cypress Development Corp. (TSX-V: CYP) (OTCQB: CYDVF) (Frankfurt: C1Z1), — with a world-class project in a world class location, an EV of just C$17.5M — owning 100% of a globally significant project with cap-ex < US$500M, should be high on the lists of prospective suitors.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Cypress Development Corp., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Cypress Development Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Cypress Development Corp. was an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)