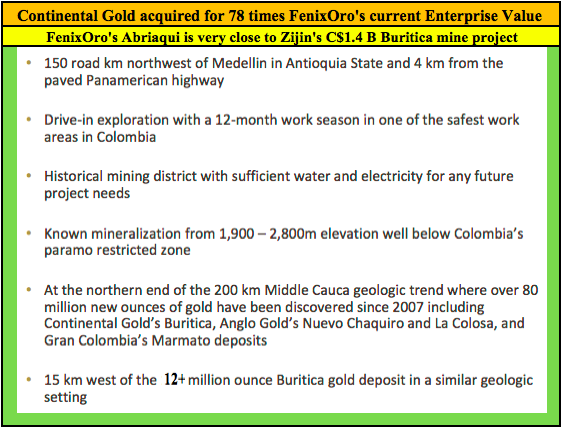

FenixOro Gold Corp (CSE: FENX) announced that its Phase 1 exploration program at the flagship Abriaqui project in Antioquia state, Colombia is well underway. The Company is earning into a 90% Interest, with a fully-funded exploration program. Abriaqui is the closest gold exploration project to Chinese State-backed Zijin Mining’s Buriticá deposit, (Zijin recently acquired Continental Gold for ~C$1.4 billion). Abriaqui is directly on trend, about 15 km to the west, of the 12M+ ounce Buriticá mine construction project.

Both projects are in the Middle Cauca geologic trend, where since 2007 > 90 million ounces of gold has been discovered in epic deposits like Buriticá, AngloGold’s Nuevo Chaquiro & La Colosa, and Gran Colombia’s Marmato deposits. Buriticá is not just a blockbuster project in Colombia or in South America — it’s one of the largest & highest grade construction projects in the world. It’s forecast to have a lowest quintile cost profile. [estimated US$600/oz. All-in Sustaining Cost].

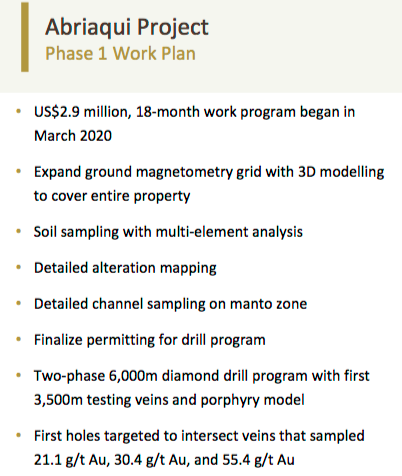

The sizable (US$ 2.9M) exploration program consists of mapping, sampling, ground magnetometry & 6,000 meters [18-20 holes] diamond drilling to test areas of “Buriticá-style,” closely-spaced, high-grade veins. Each inclined drill hole will target multiple veins and test how widespread (size) & uniform (grade) the mineralization is between veins.

On June 9th, the Company announced the discovery of a potential new style of mineralization. FenixOro geologists noticed a different mineralization style characterized by replacement of the sedimentary rocks which flank the intrusion hosting the majority of veins. Recently, a large outcrop of this mineralization style was found. According to the press release, certain zones have been selectively replaced with the principal outcrop, indicating a mineralized thickness of 15-25 meters.

The orientation of these areas with respect to the intrusion suggests that this stratigraphic zone could have multiple occurrences and be present at relatively shallow depths in other parts of the property. Comprehensive channel sampling of the outcrop has not yet been done, but grab samples of representative material assayed up to 4.5 g/t gold with showings of silver, lead & zinc.

FenixOro VP Exploration Stuart Moller stated,

“The discovery of replacement style mineralization at Abriaqui is potentially very important. Even at this early stage, we feel it’s material given the tonnage & grade potential. Rigorous channel sampling will characterize the grade & potential of the body and help us prioritize areas for drilling. Though the high-grade, narrow Buriticá-style veins remain our highest priority, we now have three styles of mineralization to pursue.“

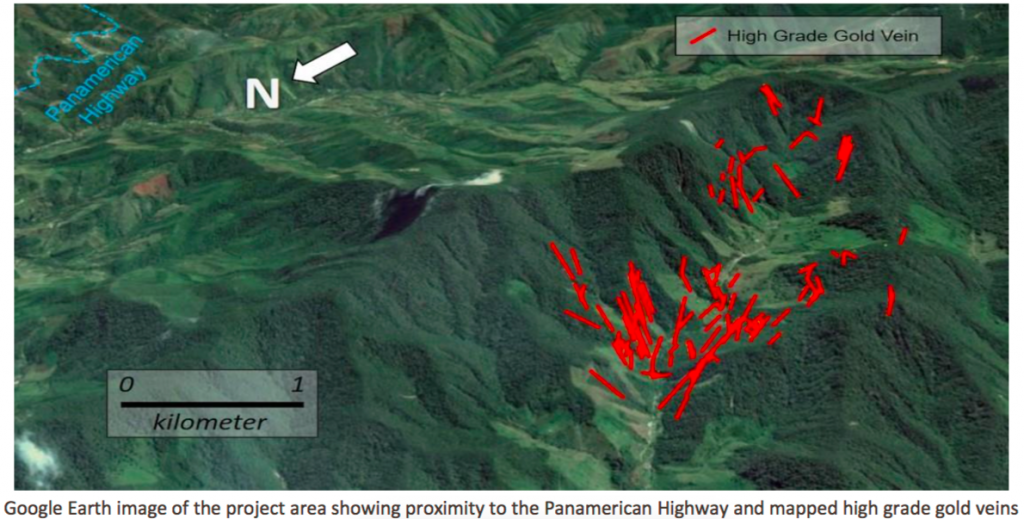

Readers are reminded that FenixOro’s management & technical teams believe their Abriaqui project could be the next billion dollar Buriticá. No one knows if it is, but > 80 narrow, high-grade vein systems have been identified, and more are likely to be found. The secret of the tremendous success at Buriticá is its depth & continuity of mineralization. These same characteristics appear to be present at Abriaqui, giving FenixOro exceptional blue-sky potential.

As mentioned, the technical team has traced narrow, high-grade vein systems over roughly 900 m of vertical extent. By comparison, Buriticá has > 1,200 m of vertical extent and remains open at depth. Over 300 chip or channel samples have been taken with assays up to 146 g/t gold, > 15% of the veins returned samples of 20+ g/t. Hundreds of soil samples are in the lab awaiting assays.

Continental Gold blazed a path forward in Colombia and was handsomely rewarded with a takeout valuation that was 78 times the current C$18M Enterprise Value (“EV“) {market cap. (C$0.31/shr. on June 15th) + funded debt (zero) – cash (~C$3M)} of FenixOro! Buriticá, expected to enter commercial production this year, ensures that regional infrastructure (roads, power, rail, etc.), experienced miners, equipment, services, etc., will be readily available if/when the Company needs it.

These high-grade veins are spaced meters to tens of meters apart and are typically 30-100 cm wide. Several areas of stockwork mineralization grading 1-5 g/t gold have been mapped between veins. How widespread & uniform is this mineralization? What’s the average grade? How does this material compare to the newly identified mineralization styles mentioned earlier? These and other critical questions will likely be answered in a matter of months, not years.

In my last article, I pointed out that Chinese producer Zijin Mining acquired Continental Gold for ~C$1.4 billion. Late last week, it was announced that Zijin outbid Silvercorp Metals & Gran Colombia Gold to takeout Guyana Goldfields for C$323 million. This valuation was three times higher than Silvercorp’s opening bid for Guyana. It was a true bidding war.

Zijin made a total of three gold company acquisitions since November 2019, paying an average of C$745 million. Shandong Gold made two acquisitions in just the past six weeks. How many other Chinese precious metals producers and/or investment entities (sovereign wealth, private equity & other institutional funds) are kicking the tires of mining juniors around the world?

Companies already known to be active in M&A, like Silvercorp & Gran Colombia Gold, should be approached to make them aware of FenixOro’s highly prospective Abriaqui project. Silvercorp could easily afford to pay [C$10 to C$15 million], (depending on FenixOro’s drill results) for a 19.9% stake and a seat at the head of the table in case Abriaqui emerges as monster deposit.

FenixOro might be too early-stage for some, but now is an ideal time to be establishing cornerstone investments in promising exploration plays. Buying call options on the continued strength in precious metal prices is a prudent strategy for companies to adopt in a bull market.

There are hundreds of companies large enough to look at strategic investments in FenixOro. A number of interesting M&A transactions this year include i) SSR Mining & Alacer Gold ii) Perseus Mining & Exore Resources, iii) an affiliate of Shandong Gold & TMAC Resources, iv) SEMAFO Inc. & Endeavour Mining, v) Titan Minerals & Core Gold.

All five deals involved gold assets in countries outside the jurisdictions of Canada, the U.S., Australia & Mexico. These were takeouts of projects in places like Africa, Ecuador & Turkey. Is this a sign that companies are taking on incremental risk in this nascent gold / silver bull market?

Imagine how many mid-tier producers & development-stage gold companies alone could comfortably write a check for C$15 million to gain an inside track on one of the few players that could be sitting on the next billion dollar Buriticá project.

There are at least four ways to win with FenixOro Gold Corp. First, assuming that permits are granted, high-impact drill results from 18-20 holes should be released by this Fall. Second, M&A activity is picking up in select jurisdictions, with Zijin placing Colombia higher on the lists of financial & strategic investors.

Third, the i) strong gold price, ii) weaker (non-US$) currencies & iii) lower energy costs are tailwinds for established producers & junior explorers alike. Fourth, Zinjin expects to start commercial production at Buriticá later this year, Gran Colombia Gold is actively developing gold / silver mines across the country, and Colombian precious metals junior Outcrop Gold just landed Eric Sprott as a cornerstone investor. These are positive headlines that are supportive of FenixOro’s (fully-funded well into next year) plans.

It’s important to recognize that taking on more risk in a bull market can be extremely rewarding. I don’t know which companies will generate returns of 5x or 10x or more, but I’m confident there will be several huge winners if the gold price remains above US$1,700/oz. (currently ~US$1,730/oz.) or marches higher.

And, the very best metals / mining performers will not be the mid-tier or Majors, but the highly regarded exploration / development plays that make big discoveries or take substantial strides towards production. History shows that significant de-risking in a high gold price environment can create tremendous shareholder value.

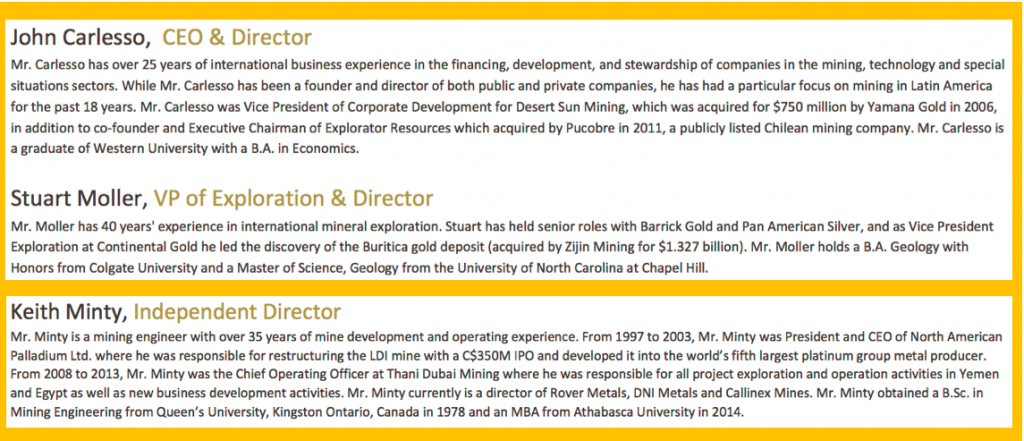

FenixOro is in an under-explored mining jurisdiction. It has a very promising project with a fully-funded drill program expected to delivery results this Fall. The management & technical teams are strong, especially for a company with an enterprise value of just C$18M.

Many companies require multiple drill programs (and capital raises) to get any idea of what their properties might hold. However, due to the nature of FenixOro’s project, near giant Buriticá, and given that the two projects share some geological characteristics, upcoming drill results should give investors good visibility on the Company’s prospects.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about FENIXORO GOLD CORP., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of FENIXORO GOLD CORP. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, FENIXORO GOLD CORP. was an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)