Falcon Gold (TSX-V: FG) / (Frankfurt: 3FA) has performed quite well since my last article in late May, the share price has more than doubled. Gold juniors are the market darlings of Spring / Summer 2020, many have seen their share prices soar. In Canada’s Golden Triangle alone, the top five juniors are up, on average, just shy of +1,000% from their respective 52-week lows.

Gold is at US$1,809/oz., a far cry from the avg. 5-yr. (2015-2019) price of US$1,267/oz. [+43%], it’s at a 107-month high. Think of the hundreds of PEA / PFS / BFS studies done over the years with price assumptions of US$1,200-$1,300/oz. Imagine how much sexier they would look at US$1,600!

With that in mind, I believe we could still be early in this bull market. Precious metal bull markets typically last years, not months. The last four averaged ~4.3 years (51.5 months). We’re in month #22 of this one. One thing that seems very likely is that there will be more M&A this year & next, including bidding wars like we just saw when Zijin Mining beat out two companies to acquire Guyana Goldfields.

Falcon Gold has everything I’m looking for in a junior gold investment; strong team, attractive share count & market cap., tight float, substantial blue-sky potential, past production + significant drill data, a high-grade (including some visible gold) / near-surface deposit. All of that and more in a safe & prolific jurisdiction.

This is a story that new investors can, and are, getting behind. It’s high risk — even in a bull market — but we’re not talking about a low-grade project in western Africa…. We’re talking about high-grade projects in Ontario & BC, Canada!

The higher the gold price, the greater the risk of bad actors appearing. Corrupt governments taking over projects, raising taxes / royalties without warning, giving preference to groups with whom they share close ties…. Falcon Gold does not face these growing global challenges.

Please continue reading to find out what might be in store for shareholders in coming months. With a small equity raise behind them, I’ve been promised a lot of news flow. To learn more, I spoke at length with CEO & Director Mr. Karim Rayani, who’s also the largest shareholder. He’s as bullish as ever on the outlook for gold and the prospects for his company.

Karim, a lot of excitement in the gold space, can you please give readers the latest snapshot on Falcon Gold.

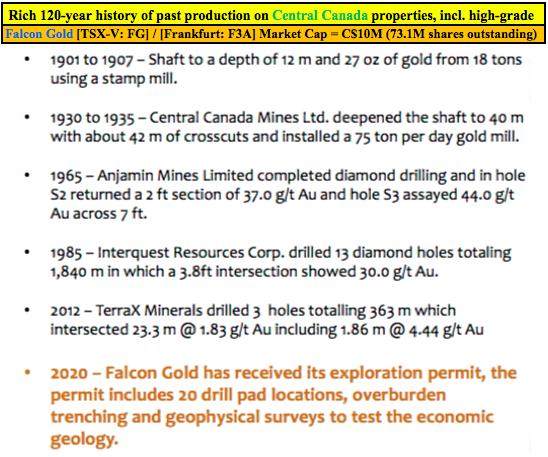

Yes, of course. Falcon’s flagship project, Central Canada, is a company-maker for us, and we may have more than one company-maker. It has evidence of a (non-NI 43-101 compliant) resource from the 1930s of ~230,000 troy ounces.

With modern mining methods we hope to at least double this number in a new maiden resource. We have expanded the strike down hill at a 45 degree dip adding significant tonnage. The deposit grades about 8-10 grams/metric tonne (“g/mt“) gold, with higher-grade pockets up to 18 g/mt, more than half a troy ounce.

We recently locked up highly prospective claims in northwestern BC, near the well known Golden Triangle. Our timing could not have been better. We negotiated the transaction in March-April as gold dipped below US$1,500/oz. Now, with gold above US$1,800/oz., a nine-yr. high, the property’s value has increased before drilling our first hole.

{NOTE: since the April 17th press release on the Falcon’s Spitfire-Sunny Boy claims, GT juniors American Creek, Strikepoint and Teuton Resources are up between +350% to +413%, up an average of +388%.} In the same period, Falcon is up +155%.

Can you tell us more about Falcon Gold’s flagship Central Canada Gold & Polymetallic project?

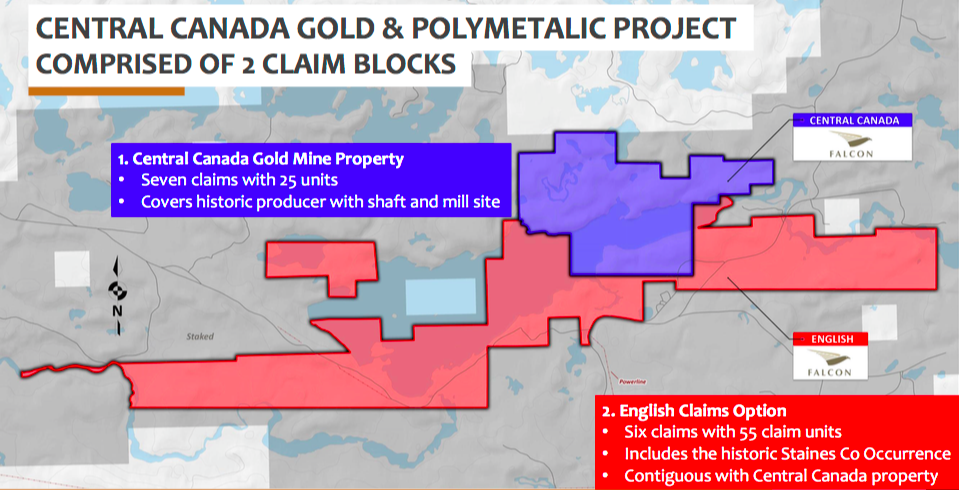

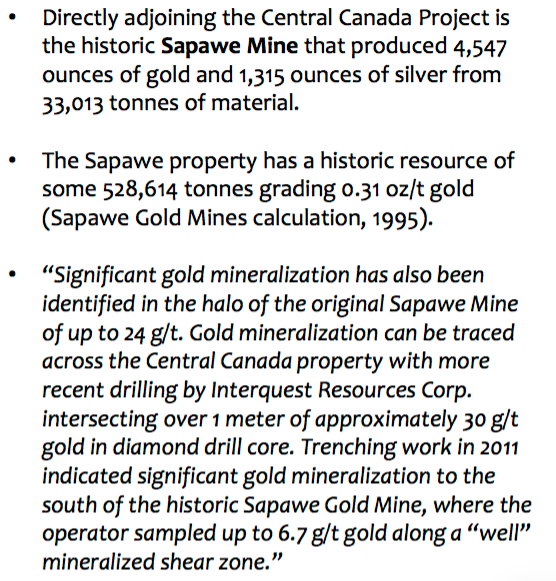

Yes, it’s ~22 km east of Atikokan, and ~160 km west of Thunder Bay. The property has 13 claims and hosts an historic producer with a shaft & mill site. The project is on a parallel system to the one that Agnico Eagle’s 4.5 million ounce Hammond Reef deposit is tied to. Central Canada is ~20 km southeast of Hammond Reef.

We’re close to finalizing a significant expansion of the project. We have a signed MOU for an additional 476 hectares of patented mining claims. The claims cover 8,400m of added strike length, with mineralized lenses varying from less than 10m, to over 40m wide.

Our geological team has performed exceptionally well interpreting past work on our Central Canada property. We have found high-grade veins within, or associated with, a broader halo of mineralization that’s also gold-bearing. Furthermore, and very importantly, recently discovered reports on the old mine indicate the possible presence of high-grade ounces earmarked for production 85-90 years ago.

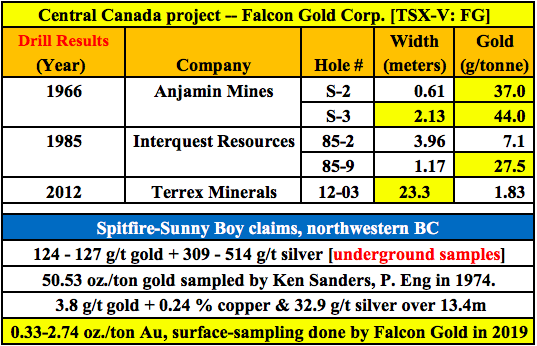

This work from 1930 to 1935 included 1,829m of drilling and a 45m vertical shaft. In December, 1934 the mine reportedly outlined ~230,000 ounces of gold at 9.9 g/mt. We now believe that the 3m interval of 10.17 g/mt Au in our first hole at 67m depth may be confirmation of the prospective mine resource from the 1930s.

How soon before you might deliver a maiden NI 43-101 mineral resource estimate on Central Canada?

Depending on permitting and other factors, I think we’re looking at 1H 2021 for an Inferred resource. We’re currently drilling (first assay announced last month; 10.2 g/mt gold over 3m). The assay also showed a new mineralized zone starting at 104m, which hit 18.6 g/mt over 1m. We will report two more holes later this month.

How important are the Spitfire-Sunny Boy claims to the overall Falcon Gold story?

We were very fortunate to acquire these claims. Our plan is to be drilling in September, 6-8 holes, maybe more if results and the weather warrant it. We’re in the field now conducting soil sampling, EM & IP geophysics & structural mapping to identify new mineralized structures and generate drill targets.

We have over 1.1 km of strike along the Master Vein, where an historical sample in 1974 returned a whopping 50.3 oz./short ton (1,725 g/mt) gold. Narrow high-grade veins have been trenched, pitted, blasted & drilled, but never commercially mined. Values of 124 – 127 g/mt gold & 309 – 514 g/mt silver were found in quartz vein material from underground workings. The big opportunity here lies in that fact that this is a very under-explored area.

We tested the historical values in our due-diligence last year and confirmed gold mineralization along the Master Vein over a 300m strike length. Samples ranged from 0.33 to 2.74 oz./short ton (93.2 g/mt) gold.

A lot of eyes are on the Golden Triangle now. Blockbuster drill results and new discoveries play well in any market, but if we hit something big this season, in a bull market, Spitfire-Sunny Boy could be another company-maker for us! We’re not actually in the Triangle, which is a good thing, our drilling costs are a lot lower! But our blue-sky upside potential is as big.

Last week it was announced that you’re assuming the roles of Pres., CEO & Director of Intl. Montoro Resources (IMT). What is the thinking here?

Well, of course I’m going to say it’s a win-win for both IMT & Falcon Gold. And, if things go reasonably as planned, it should be very good for everyone. Falcon & IMT already have a JV, and both companies are micro-cap juniors with projects (mostly) in Ontario & BC.

We’ll be partners on Red Lake / Atikokan properties, but hopefully on other new & existing opportunities as well. My network of business associates, combined with great professionals at IMT, can benefit both companies. We’re sister companies now. I hope to leverage each company’s strengths and mitigate weaknesses.

Falcon Gold shares have more than doubled in the past six weeks. What near-term catalysts & ongoing shareholder value creation makes Falcon Gold (still) a compelling investment?

I might be biased, but I think the market cap remains extremely undervalued. As mentioned in your introduction, many companies have seen their share prices soar. I agree that this bull market has legs.

We have assays on holes #2 & #3 coming out in the next week or two. And, we have a lot of corporate initiatives in the works, some of which we should be able to announce this summer. Finally, drill results from our BC claims could provide for some fireworks in the 4th quarter.

Our share price has done quite well this year, but the bottom line is that the enterprise value {market cap – cash + debt} is just C$9M. My team thinks there’s ample room for the valuation to grow substantially on continued strong industry & company-specific news. That’s why I’ve been buying shares in the open market.

Thank you Karim, I look forward to seeing drill results from Central Canada later this month and assays from your BC claims later this year.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Falcon Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Falcon Gold are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Falcon Gold was an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)