All $ figures are US$, unless indicated otherwise.

Cypress Development Corp. (TSX-V: CYP) / (OTCQB: CYDVF) / (GERMANY: C1Z1) recently announced an updated mineral resource estimate at its Clayton Valley Lithium Project (“CVLP“) in Nevada, USA. The Company’s Enterprise Value (“EV“) {market cap + debt – cash} = $36M.

The new and improved resource estimate uses the same economic & mining parameters found in the recent Pre-Feasibility Study (“PFS“). All resources are pit-constrained and based on a cut-off grade of 900 ppm lithium (“Li“).

Cypress delivers > 50% increase in its estimated lithium resource

Assays from four new holes, and the inclusion of the entire contiguous property boundary, increased the resource by > 50%. It now contains a combined 930M tonnes at 1,062 ppm Li in the Measured & Indicated categories. That’s 5.2M tonnes of Lithium Carbonate Equiv. (“LCE“).

5.2M M&I tonnes of LCE is a top decile global project. While exciting, the news does not impact the economics of the PFS. However, this substantial increase could potentially enhance the outcome of next year’s Bankable / Definitive Feasibility Study. And remember, 5.2M tonnes of LCE = enough lithium to instead produced up to 5.9M M&I tonnes of lithium hydroxide.

This enhanced resource supports the thesis that the CVLP could be massively scaled up in the hands of a prominent lithium-heavy company like Albemarle Corp., SQM or Livent, or with the deep pockets of a Volkswagen, Tesla or GM, not to mention Li-ion battery makers like Panasonic, LG Chem or CATL.

Regarding the latest events on the ground in Nevada, the press release states,

“Cypress is currently evaluating alternatives for procurement of sample material and a suitable location for the pilot plant recommended in the PFS. The Company is also overseeing ongoing baseline environmental studies and is actively engaged in sourcing funds for the pilot plant.“

How might Cypress fund its upcoming pilot plant?

In a corporate video clip, CEO Bill Willoughby shows where sample material for the upcoming pilot plant might come from, one of many surface outcrops of lithium-bearing leachable clay. In terms of funding the pilot plant, management has submitted applications for government grants. Cash received, if any, would be used to build & operate a one-tonne per day pilot plant.

Additional capital will be needed. Management is pursuing funding options that include enlisting a strategic / financial partner. An investment at the project level would reduce or even eliminate the need to issue more shares this year. Having said that, there’s no certainty that an investment of this nature is imminent.

I believe it’s only a matter of time before major EV or battery markers announce big deals directly with existing lithium producers and development-stage companies like Galaxy Resources’ Sal de Vida, and Lithium Americas’ / Ganfeng’s JV Cauchari-Olaroz projects in Argentina. This could be a notable catalyst for lithium juniors like Cypress Development Corp.

Fast-tracking an improvement of investor sentiment in Cypress would be a blockbuster JV, or some sort of non-dilutive strategic investment. Let’s be honest, a number of fans of the Company, some commenting on CEO.ca, expect this scenario to play out in the next month or two.

If Cypress can fund a pilot plant with minimal equity dilution, (less shares issued or at a much higher share price) I believe it would be difficult for the market to ignore. Investment capital is one of the biggest problems for lithium juniors today. In my opinion, the best projects will not have that problem for much longer.

Quick Read of full PFS on sedar shows a tremendous project….

Most people read the 2-3 page press releases of PEA/PFS/DFS reports that summarize mining project economics. However, it’s often quite enlightening to read the actual technical report filed on sedar. The Cypress PFS is about 150 pages, but rest assured one can skip the geological & technical parts.

Two very important takeaways are 1) the amount of sulfuric acid used by the Company is very low vs. peers, and 2) the economics from the first 10 years of (proposed) operations is truly spectacular.

Regarding acid, Cypress comes in at 126.5 kg/tonne of ore (with room for improvement). That’s a third of the 303-417 (360 avg.) kg/t reported in Lithium Americas’ Aug. 2018 PFS for the Thacker Pass project in Nevada. A June 2018 corp. presentation stated 346 kg/t.

To be fair, Thacker Pass has nearly 2.5x the grade of Cypress’ CVLP, so it can afford to use more acid. On the other hand, its strip ratio is 11x higher than the near-zero 0.15 to 1 of CVLP. All and all, both projects are very promising with Thacker Pass probably 18-24 months ahead.

Cypress’ 126.5 kg/t is a quarter the acid usage of an earlier-stage (pre-maiden resource), clay-hosted lithium company that’s been doing metallurgy testing. BFS-stage Ioneer’s Rhyolite Ridge sedimentary lithium-boron project listed a need of 413 kg/t of ore in its PFS. Acid cost is one of the largest components of both cap-ex & op-ex for all of these companies.

Regarding the first 10 years’ economics, the average life-of-mine production rate is 27,400 tonnes LCE/yr. However, as I described in my last article on Cypress, if the Company were to produce only lithium hydroxide (which is the plan), the average number of tonnes/yr. over the first 10 years would be 37,736. {see page 114 of PFS}.

Note: my commentary on PFS economics assumes that 100% of production is battery-grade hydroxide. In reality, there will likely be a mix of lower margin products + battery-grade hydroxide in the initial years.

First 10 years’ production could generate prodigious cash flow

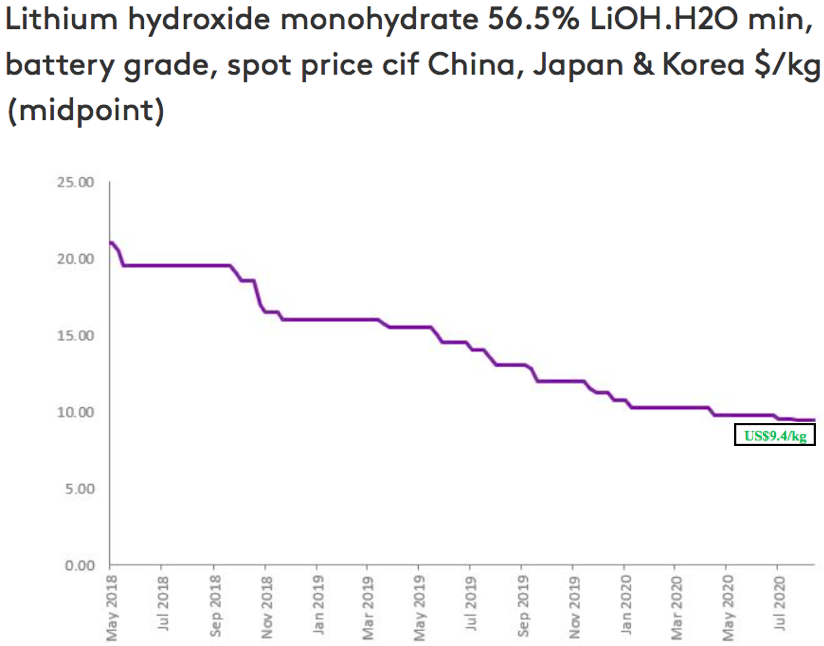

As can be seen in the chart above, 37,736 tonnes/yr. of Li hydroxide would generate average annual gross revenue of $452.8M (assuming a $12k/tonne Li hydroxide price). As a frame of reference I assume that first production is in 2025, if a financially strong strategic partner gets involved and a lithium price recovery gaining traction in 2021 and 2022.

The average EV/REV multiple of Albemarle, SQM, Livent & Orocobre Ltd. = 4.4x. {Note: Ganfeng & Tianqi trade at much higher multiples}. Although likely five years away, and with plenty of hurdles yet to clear — Cypress could potentially be generating average annual revenue of about C$600M, yet its current EV = C$36M.

Readers are reminded that PFS economics do not include possible cash flow from the sale of excess electricity or sulfuric acid, or identified Rare Earth Elements (“REEs“) [scandium, dysprosium & neodymium]. Cypress is trading at just 1.7% of its PFS-derived, after-tax NPV(8%) of C$2.1 billion (assuming an extrapolated LCE price of US$11,875/tonne).

Should Cypress Development Corp. trade at 77% discount to Li peers?

Compare 1.7% to similar-stage lithium juniors that trade at an average of 7.3% of their after-tax NPV(8%) figures. At 1.7% of NPV, Cypress is trading at a 77% discount to the peers in the chart.

Some near-term events expected in the peer group include; project funding announcements from Millennial Lithium, Neo Lithium & Bacanora, and a BFS on Lithium Americas’ Thacker Pass project.

Big news from any of these companies could draw a lot of attention to Cypress. There simply are not that many publicly-traded companies that have attractive PFS-stage (or more advanced) projects. By my count, fewer than 10 meaningful, (new) high-quality projects, anywhere in the world, are being actively advanced.

Likewise, big announcements from auto and/or battery makers investing large sums into lithium projects would also be quite bullish for the sector. Anyone invested in the lithium space should consider deploying a portion of that allocation into Cypress Development Corp. (TSX-V: CYP) / (OTCQB: CYDVF) / (GERMANY: C1Z1).

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Cypress Development Corp., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Cypress Development Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Cypress Development Corp. was an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)