It would be easy to point to the latest news on Portofino Resources (TSX-V: POR) / (OTCQB: PFFOF) and say, “look, a gold junior moving into the red hot lithium space!” But, of course Portofino never left lithium, it expanded into gold just before the price soared from $1,500 to over $2,000/oz. (more about that later).

Portofino knows lithium and management knows Argentina

While Portofino is not new to lithium, what I said about lithium being hot is perfectly clear. The top-10 performing lithium companies (all but one pre-production), are up an average of +1,320% from their 52-week lows. These players span hard rock, brine & sedimentary (incl. clay-hosted lithium projects).

Portofino controls a 2,932 hectare brine project in Catamarca province, Argentina, 15 km southeast of Neo Lithium’s very high-grade /very low-impurities project. Admittedly, 2,932 ha is not a giant footprint, but it’s not tiny either.

Portofino’s property is about the same size, or larger than, land packages held by Argosy Minerals & Lithium South Development Corp., who have market caps of $180M & $30M, respectively.

Not only is the lithium sector extremely strong, shares of companies with projects in Argentina are among the leaders of the pack, {Neo Lithium, Lithium Americas, Millennial Lithium, Argosy Minerals & Lake Resources are among the top-12 performers}.

Make no mistake, Yergo is not that valuable today, but it could be after it’s drilled later this year. Lithium Americas is up 870% (even after announcing & closing a $400M private placement) from its March 2020, COVID-19 low. It has a $3.7 billion market cap. Neo Lithium is up 818%.

Most investors are familiar with mining juniors touting nearby mines as examples of possible outcomes of their exploration activities. Sometimes analog mines are past-producers, sometimes they’re 50-150 km away, and sometimes they’re mediocre assets.

By contrast, Portofino’s Yergo project is 15 km from Neo Lithium’s PFS-stage 3Q project, possibly the single best pre-construction lithium brine project in the world.

In the chart above I show most of the lithium players with all, or substantially all, of their lithium properties in Argentina, (POSCO, Lithium Americas & Galaxy Resources also have projects in other countries). By no means do I mean to suggest that any of the larger companies would care about the Yergo project.

However, there are a handful of names on that list that might benefit from acquiring a new brine project, especially one with demonstrated low Mg levels and one that does not share its salar with others.

If drilling hits Li concentrations anywhere near that of Neo Lithium’s project, Yergo could become something fairly significant. Could it be worth $100M? Probably not! But, $5-$10M? Perhaps, especially in the hands of a larger lithium player. Remember, the Company’s current market cap is just $8M.

Although Portofino’s lithium assets (incl. a ~650k share position in lithium junior Galan Resources) hold significant promise, the Company’s primary objectives in 2021 remain in the Canadian (Ontario) gold sector.

Readers are reminded that management has boots on the ground in Argentina, valuable business relationships dating back nearly a decade with people and companies in Catamarca province. These relationships are being leveraged not just for lithium, but for precious metal opportunities as well.

2 gold properties, Gold Creek & South of Otter to be drilled this year

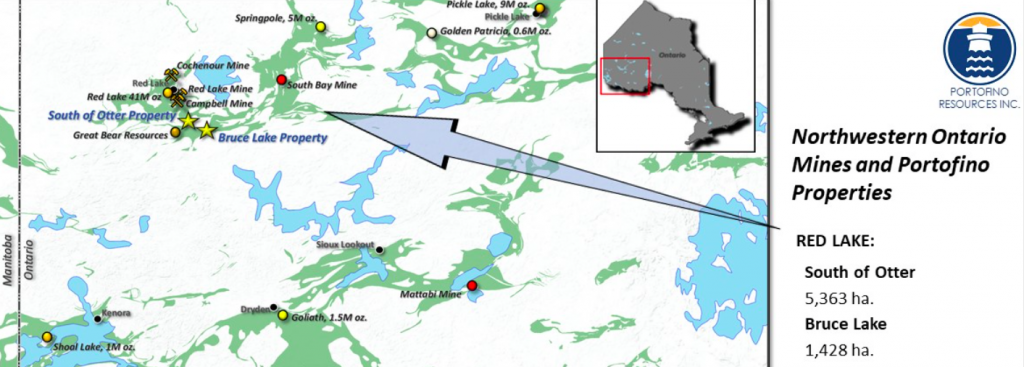

Near Red Lake, Portofino has the South of Otter (“SOT“) & Bruce Lake properties. In Atikokan, Portofino has three more, Gold Creek, Sapawe West & Melema West. All five properties, totaling 12,843 hectares, are in northwestern Ontario and are controlled via very low-cost, multi-yr. options to acquire 100% interests. Gold Creek & SOT are the flagship projects.

Gold Creek comprises 15 mining claims containing ~4,036 contiguous hectares in the Atikokan area, near Red Lake. Gold Creek is Portofino’s most advanced gold project. Management is planning for a 1,000 m (5 or 6 hole) drill program in the Spring.

Historical data, mostly from the eastern portion of the property, includes multi-ounce grab samples and drill intercepts of 4.3 g/t gold over 41.0 m and 4.36 g/t gold over 20.4 m completed in 1995, and a 1-tonne bulk sample in 2008 that returned an average grade of 9.9 g/t gold.

Although there’s been limited drilling, substantial exploration over the decades included prospecting, mechanical stripping & trenching, geological mapping, airborne magnetic & electromagnetic survey, ground magnetic & electromagnetic surveys, selective radiometric & gravity surveys and geochemical sampling.

Management negotiated the Gold Creek property option at the height of the global pandemic in March-April 2020. I believe they got a very good deal. How many pre-maiden resource properties have had a 1-tonne bulk sample taken?

A tonne at 9.9 g/t gold — that’s US$600/tonne rock! Significant gold mineralization has been traced along a 1.5 km strike length with grab samples as high as 759 g/tonne (~22.2 troy oz. / short ton).

Last Summer & Fall, two prospecting programs were carried out which included 211 grab samples. Historical zones of mineralization were sampled, confirming anomalous & high-grade gold in multiple zones — samples returned up to 45.6 g/t gold.

A Mag Survey was flown over the entire property in late Summer, followed by a property-wide compilation & structural interpretation. This critical work greatly enhanced the geological & structural understanding of the property.

Prospecting & mapping in the Fall led to the discovery of the New Road Zone. Fourteen grab samples were collected, the two best showed 4.1g/t gold and 720 ppm copper.

Management believes its understanding of the mineralization has significantly improved. For example, the locations of historical work are now much better known. Gold zones confirmed in 2020 will be drill-ready — following a detailed review of previous drilling and ongoing structural interpretations.

South of Otter is Portofino’s premier Red Lake project

The 5,363 hectare South of Otter (“SOT“) property is in the same greenstone belt hosting the world-class Red Lake District (“RLD“), including Great Bear Resources‘ high-grade Dixie project in northwestern Ontario. SOT is ~8 km east of Great Bear’s prolific, ongoing gold discoveries.

The RLD is one of the highest-grade gold mining camps on the planet, and has produced > 30M ounces. The regional geology has been compared to top-tier districts such as the Timmins & Kirkland Lake Camps in northeastern Ontario.

In Augus, 2020, management reported assays from grab samples that identified two gold-bearing quartz veins sampling 18.0 g/t & 8.2 g/t gold. Historical exploration at SOT includes prospecting, sampling, geophysical surveys & limited diamond drilling.

A few months ago, a ground VLF/EM survey was done to refine gold mineralization targets of merit and to identify areas for prospecting, trenching & drilling. Three substantial conductors were found over a 1.6 km strike length.

Three earlier-stage gold properties….

Portofino has an option on 100% of the 1,428 ha Bruce Lake property, also in the RLD, ~1.5 km northeast of Great Bear’s Pakwash property, and ~11 km southeast of the above mentioned Dixie project. Bruce Lake hosts gold-in-soil anomalies discovered in 2010. Management believes regional magnetic highs coincident with the gold-in-soil anomalies are significant.

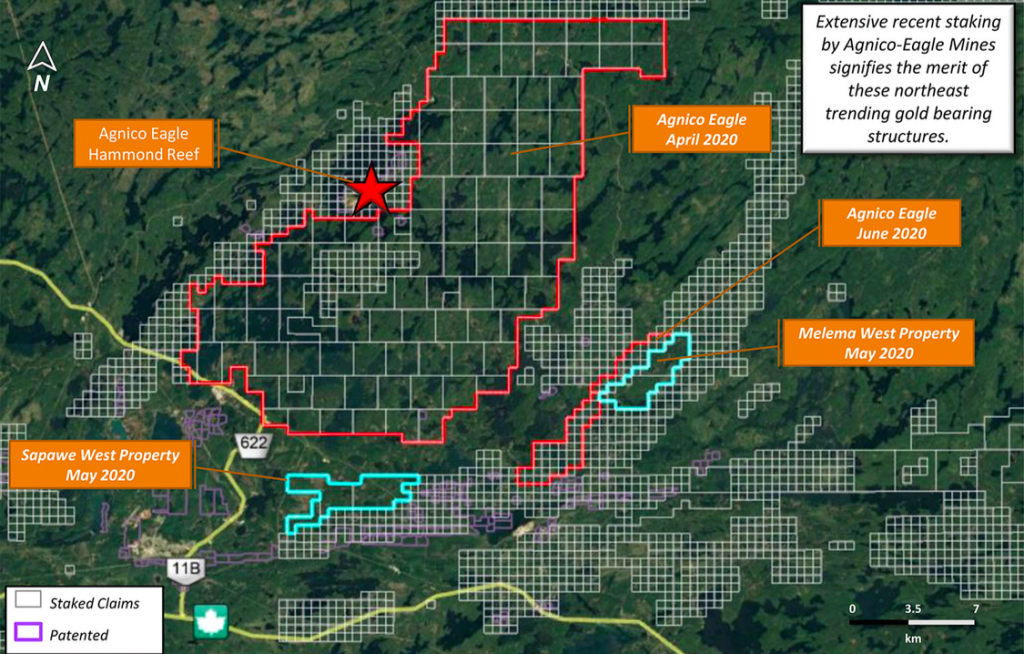

Melema West is a smaller (869 ha), early stage property ~28 km northeast of the town of Atikokan. There are some gold showings in the area and the property is on a structure that’s parallel to Agnico Eagle’s 32,070 ha, 4.5M oz., near-surface Hammond Reef deposit. Lately, Agnico has been staking ground around Melema West & Sapawe West.

CEO David Tafel recently commented,

“Gold-bearing northeast trending structures in this area are extensive, well documented and traceable for over 30 km. Recent claim staking by Agnico in the area, contiguous to Melema West, and around Sapawe West, supports our belief that these properties are strategically well located.”

The Sapawe West property is quite close to Melema West, just north of the Quetico Fault and 2.5 km west and along strike of the past-producing Sapawe Gold Mine. Sapawe West is ~13 km south of the Hammond Reef deposit.

Conclusion

Portofino Resources controls not 2 or 3, but 5 options to acquire 100% interests in promising gold properties in and around the Red Lake district and the Atikokan area of northwestern Ontario. Two of the five, Gold Creek & South of Otter, are flagship prospects near very prominent projects. Both will see drilling this year.

Ongoing, exciting drill results and exploration / development activities advanced by Great Bear Resources & Agnico Eagle should provide positive investment catalysts for Portofino.

In addition, management wisely held on to a 2,932 hectare lithium brine project in Catamarca province, Argentina that (could become, after drilling) fairly significant relative to Portofino Resources‘ (TSX-V: POR) / (OTCQB: PFFOF) tiny C$8M market cap. The Yergo lithium brine project is a long-dated call-option on continued strength in battery metals.

The Company’s projects are all early-stage, but in a bull market for gold, (and potentially for lithium), early-stage offers the most upside potential, albeit with commensurate risk. Having five gold properties spreads the risk and increases the odds that drilling will lead to one or more noteworthy discoveries. I continue to like the compelling risk/reward proposition here.

Disclosures / Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Portofino Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Portofino Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Portofino Resources was an advertiser on [ER] and Peter Epstein owned shares and warrants in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)