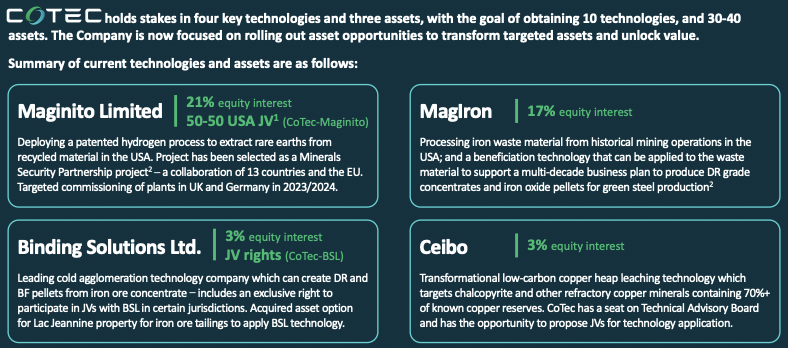

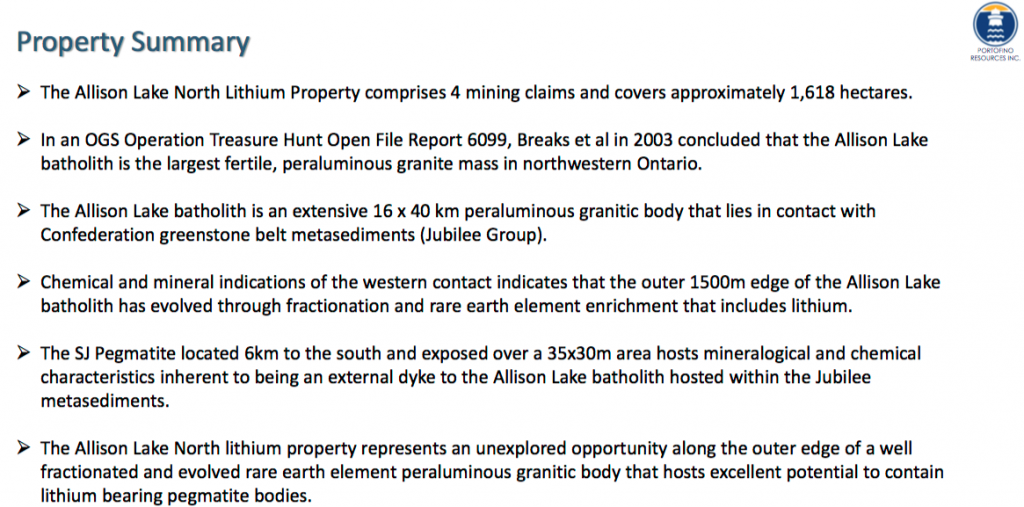

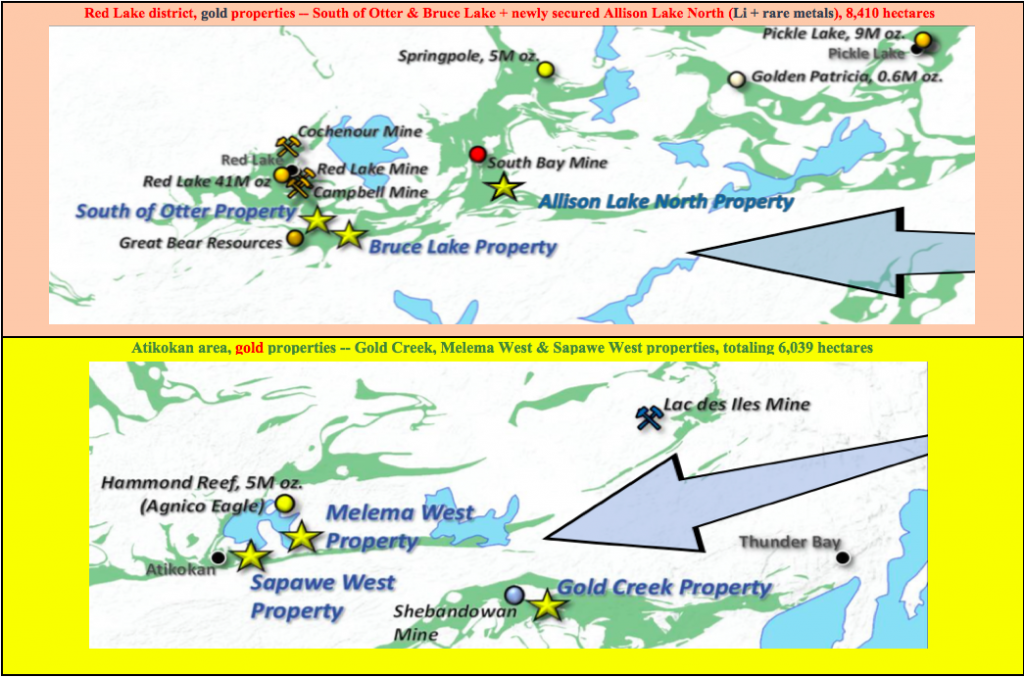

Last week, Portofino Resources (TSX-V: POR) (OTCQB: PFFOF) (FSE: POTA) announced an agreement to acquire the Allison Lake North Lithium Property (“ALNLP”). The Property comprises 1,618 hectares, and is ~100 km east of Red Lake, Ontario. The ALNLP adds to Portofino’s Argentinian brine lithium holdings.

According to the press release, the ALNLP contains significant attributes key to the formation of lithium-bearing pegmatite dykes. All mineral claims that comprise this important property are fully staked. Interestingly, this prospect also contains highly anomalous rare metals mineralization along its outer rim.

Portofino adds hard rock lithium + rare metals property to its portfolio

The outer rim of the Allison Lake batholith produced samples of rare metals, incl. Lithium (“Li”) [190 ppm], Beryllium (“Be”), Cesium (“Cs”) [90 ppm], Niobium (“Nb”), Si2O (Silica) & Rubidium (“Rb”) [587 ppm].

Some of these metals are quite valuable if they can be 1] efficiently separated & 2] refined to high purities — (both of which are not easy to do). Sufficiently pure silica alone (if achievable) would be a game-changer. The blue-sky potential for rare metals is tremendous, but I’m watching for updates before I get overly excited.

CEO David Tafel commented,

“The ALNLP adds to our lithium property portfolio and is a highly strategic acquisition. Canadian & U.S. government initiatives are increasingly focused on securing national supplies of critical minerals. Based on the geological & geographic setting of this property, we see a real potential to expand sources for these minerals in Northern Ontario.”

The hard rock lithium AND rare metal prospects (early-stage, limited work done) are exciting. Portofino now controls four blue-sky opportunities, each a potential company-maker. Gold, [in the high-grade Red Lake & Atikokan camps], hard rock lithium, rare metals — both also in northwestern Ontario, plus lithium brine in Argentina.

NW Ontario contains several promising lithium & rare metals deposits. Frontier Lithium’s PAK project has one of North America’s highest-grade Li resources. PAK has a proven & probable reserve of 9.3M Mt averaging 2.04% Li2O. Frontier’s nearby Spark deposit has 3.3M Mt averaging 1.59% Li2O (Indicated), plus 15.7M Mt averaging 1.31% Li2O (Inferred).

NW Ontario likely to become a lithium hub by 2030

Other deposits in northwestern Ontario include; Avalon Advanced Materials‘ Separation Rapids, with a resource of 9.4M Mt @ 1.35% Li2O; Rock Tech Lithium’s Georgia Lake, 13.3M Mt @ 1.09% Li2O; Infinite Ore’s two historical deposits of 2M Mt @ 1.09% Li2O & 750k Mt @ 1.38% Li2O, and Ardiden Ltd’s Seymour Lake, 4.8M Mt @ 1.24% Li2O.

Intl. Lithium has an interesting project with a new resource estimate expected in July, and Ultra Lithium has a promising prospect in Thunder Bay, Ontario.

By the end of the decade, there will likely be hard rock Li operations in Ontario. If Portofino can delineate a NI 43-101 resource of a few or several million Mt LCE, grading 1.00%+ Li2O, there should be a home for that ore. Readers should note that Rock Tech & Avalon are developing a Li sulphate production facility in Thunder Bay.

Furthermore, if a larger resource can be booked, the Company could find itself in a similar place as some of the above-listed Li juniors with market caps in the tens of millions of dollars. Portofino is looking for additional properties in northern Ontario with hard rock Li / REE potential in order to advance this satellite deposit scenario.

It’s important for readers to recognize that Portofino has been actively involved in Li brine projects in Argentina for the past five years. I expect that the Company’s lithium portfolios in Argentina & Canada will continue to grow.

While it’s difficult to slap a value on these lithium / rare metals assets, the option value alone could be worth millions to a company with the expertise to advance them. Portofino’s enterprise value {market cap + debt – cash} is just C$8M. In my opinion, the Company’s Li assets are worth at least that much.

Prospects for Argentinian brine project (Yergo) looking increasing bright

Early-stage lithium & gold projects are exactly where investors should want to be as prices of these commodities continue to climb. If Li prices return to $15k+/Mt, and/or gold retakes $2,000/oz., juniors with small market caps like Portofino could see substantial share price gains.

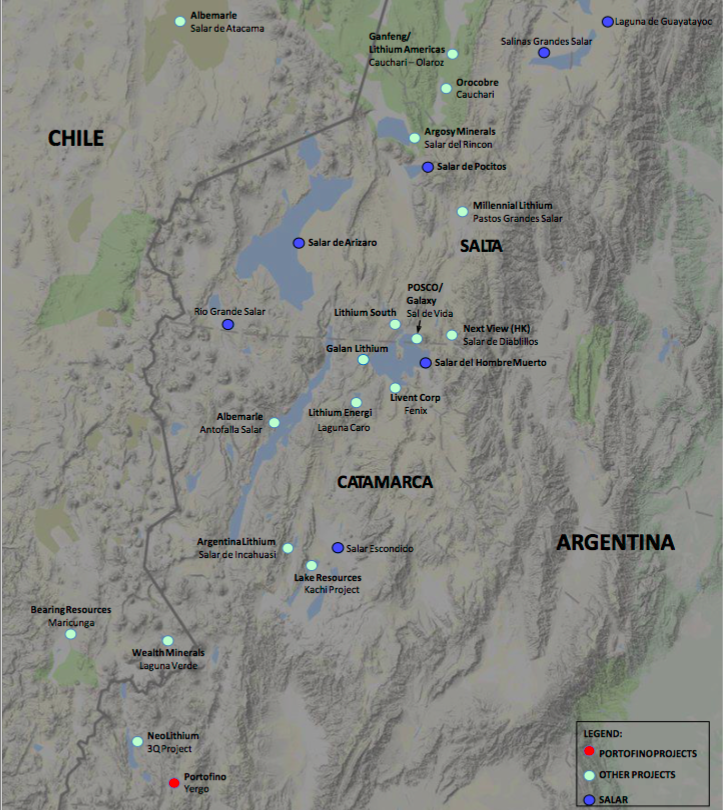

As important as this new hard rock lithium / rare metals position in NW Ontario is, the Company controls an equally exciting 100% interest in the 2,932 hectare Yergo lithium brine project in Catamarca province, Argentina, 15 km southeast of Neo Lithium’s very high-grade / low-impurities project. Admittedly, 2,932 ha is not a giant footprint, but it’s not tiny either. {please see this new Yergo presentation}

Yergo is about the same size, or larger than, land packages held by Argosy Minerals & Lithium South Development Corp., who have enterprise values of $90M & $38M, respectively. Management has owned, and sold, a number of Li assets in Argentina over the years. Yergo remains their favorite. They like that their concessions cover the entire salar.

Importantly, management has applied for a drill permit for Yergo and expects a drill program to start later this year. Phase 1 drilling will enable an initial assessment of the volume & lithium content of the brines & sediments within identified zones.

Direct Lithium Extraction (“DLE”) is believed to be the future of South American brine projects. Li juniors with substantially all of their assets in Argentina, that are pursuing DLE include; Lake Resources, Alpha Lithium, Lithium South, Dajin Resources, Arena Minerals & Lithium Energi. In Chile, Wealth Minerals, Lithium Chile & United Lithium propose to use DLE.

In the lithium stock bull market of 2016-17, eight juniors increased by ~860% to ~4,750%. On average they were up 1,892%. Could we see that magnitude of gains in 2021-22? Portofino shares at C$0.12 are up +140% from a 52-wk low of C$0.05.

Gold properties remain an important focus for 2021….

Although this article is primarily about Portofino’s lithium assets, readers are reminded that the Company also has five gold properties in northwestern Ontario. {Please see this new corporate presentation on just the gold prospects}.

The South of Otter & Bruce Lake projects are in the prolific gold mining district of Red Lake, Ontario. These two are fairly close to the Great Bear Resources’ high-grade, rapidly growing Dixie gold project.

Portofino also controls three other northwestern Ontario gold projects; the Gold Creek property located immediately south of the historic Shebandowan Ni-Cu mine, and the Sapawe West / Melema West properties located just east of Atikokan. At Gold Creek, management is eagerly awaiting drill results.

Readers are reminded that management has boots on the ground in Argentina, valuable business relationships dating back nearly a decade, with people & companies in Catamarca province. These relationships are being leveraged not just for lithium, but for precious & base metal opportunities as well.

Conclusion

Bottom line, Portofino Resources (TSX-V: POR) (OTCQB: PFFOF) (FSE: POTA) has five gold-focused properties in NW Ontario, plus two lithium-focused properties (one in NW Ontario, the other in Argentina).

The newly obtained hard rock Li property in Ontario also has some very interesting showings of rare metals. What will it take for this company to be recognized for all of its valuable assets?

Perhaps next year management will spinout to shareholders, in a newly created publicly-listed company, its gold properties? There are dozens of lithium & gold juniors with half (or fewer) the number of promising assets, that enjoy twice (or more) Portofino’s valuation.

Readers are encouraged to review the Company’s website. Together, all seven of these properties have an enterprise value of just C$8M….. In my view, five of the seven could be company-makers, and drilling on several properties will occur this year.

Disclosures / Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Portofino Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Portofino Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Portofino Resources is an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)