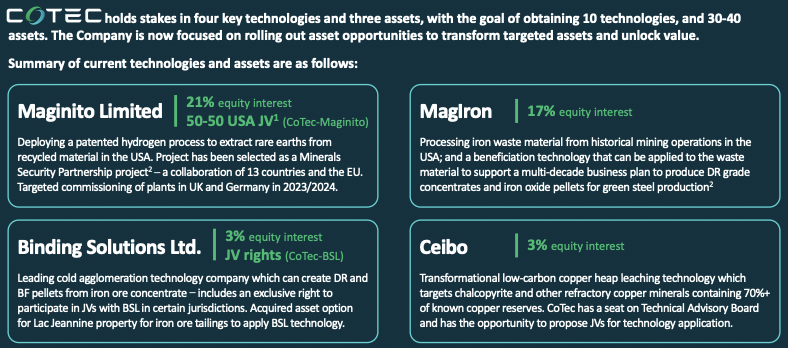

Sassy Resources (CSE: SASY) / (OTCQB: SSYRF) has been killing it since its shares started trading nine months ago, yet the Company’s valuation remains quite low. In addition to Sassy’s flagship Golden Triangle project, its wholly-owned, privately-held subsidiary Gander Gold Corp. (“GGC”) controls eight claims blocks {9,032 claims / ~225,700 hectares} in Newfoundland.

Moving aggressively, boldly into Newfoundland has proven to be very wise. The province is red hot. Neighbor New Found Gold [NFG] announced one of North America’s best assays of the century; {25.6 m @146.2 g/t gold = 3,743 gram-meters}. That 3,743 figure is more than Great Bear Resources’ seven best holes combined!

Bold move into Newfoundland, now a top-3 mineral claims holder

Only a handful of juniors have properties within 50-60 km of NFG’s blockbuster Keats zone. Two sizable blocks (~98k + ~48k hectares) controlled by Sassy’s GGC sit west & east of Keats. Future exploration done by surrounding companies — (combined, hundreds of thousands of meters/yr.) — will provide invaluable insights for Sassy’s technical team. {see map below}

On June 1st., C2C Gold Corp. announced an option on a 100% interest in two non-contiguous blocks totaling 550 hectares, adjacent to and on trend with Sokoman Minerals’ highly regarded Moosehead project. If that option were to be exercised today, C2C would be paying ~C$645/ha. Yet, GGC’s land package has an implied value of just $84/ha.

In other big news, Terence Coughlan, P.Geo joined the Board. Mr. Coughlan was founding CEO of gold-silver producer GoGold Resources. He has 38 years’ experience in exploration, operations & corp. development, and is quite familiar with Newfoundland. Each of the last three public companies he’s been involved in developed a producing mine.

Also in May, Eric Sprott invested (twice) into Sassy’s GGC entity, adding to his portfolio of Newfoundland juniors including NFG, Labrador Gold, Exploits Discovery, Sokoman Minerals, Maritime Resources, C2C Gold, Canstar Resources, K9 Gold, Opawica Explorations & TRU Precious Metals. GGC now has ~C$4.5M in cash dedicated to exploration across the province.

Gold strong heading into summer, some peer valuations have soared

Gold is @ $1,905/oz., the highest since early January. Will we see another explosive gold stock rally like last Summer’s? On May 31st, 2020 gold began an epic 10-week rally from $1,686/oz., to an all-time (nominal) high of $2,073/oz., a gain of +23%. If gold were to repeat that performance this summer, it would surpass $2,300/oz. by early August!

In the past three months, NFG, Exploits, Labrador & Sokoman — all pure-play Newfoundland gold stories — are up from 152% to 259%, (average of +208%). Gold is up +10.4% over that same period. Yet, shares of Sassy Resources have gained 36% ?!?

Sassy has not one, but two potential company-making opportunities. Both are in sweet spots of world-class, mining jurisdictions. Both have tremendous blue-sky potential. Both are prospective for high-grade gold mineralization, plus base metals incl. copper & nickel.

In my view, each opportunity could easily be worth, (subject to fully-funded initial drill programs), as much or more than the Company’s entire (partially-diluted) Enterprise Value [“EV”] {market cap + debt – cash} of $37M.

Note: For the purposes of this article I ascribe a value of $18M to each property portfolio (Newfoundland & the Golden Triangle of northwestern B.C.)

The map tells the story! Sassy’s Gander Gold looks very well positioned

In Newfoundland two of Sassy/GGC’s claims blocks really stand out. Notice in the above map how close Mt. Peyton & Gander North are, (in yellow, blocks #1 & #4), west & east of NFG’s Keats zone. Note again the sizes, ~98k & ~48k hectares. These blocks should be of tremendous interest to NFG, Marathon Gold, Sokoman, Exploits, Labrador Gold & Anaconda Mining!

Not on the map, but southwest of the main story, sits a claims block very near Matador Mining. Matador has an EV of $77M. It hosts a past-producing mine and has an Indicated + Inferred resource of 837k ounces @ ~2 g/t gold.

Sassy’s mgmt. team believes its property shares key geological features with Matador. This 3rd largest block alone (after Mt. Peyton & Gander North) could be worth $5-$10M if found to be mineralized, or more if mineralization is widespread and shows good continuity and depth potential.

There are fewer than 18 publicly-listed juniors (with EVs > $10M) that have all or substantially all of their properties in the province. GGC controls 9,032 claims / ~2,259 sq. km / ~225,905 hectares, making it the largest mineral claim holder in Newfoundland. [Exploits reportedly controls 2,111 sq. km]

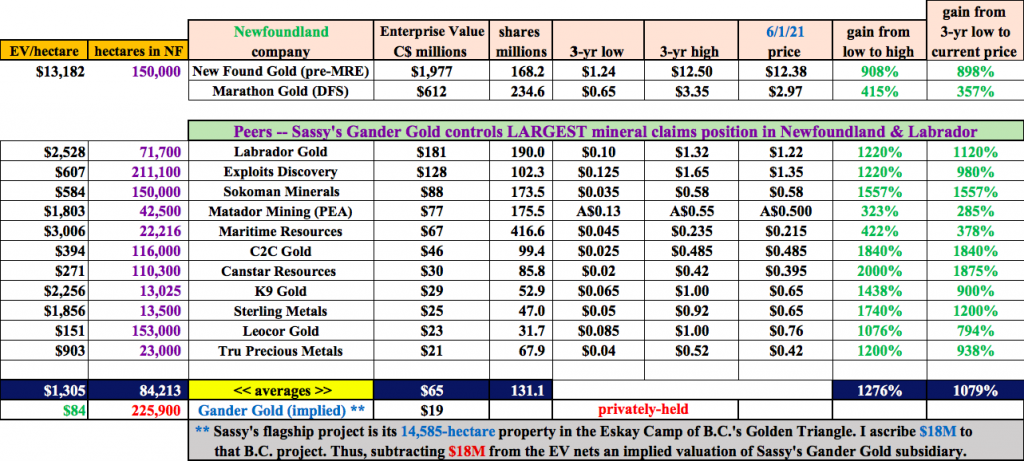

Gander Gold appears cheap vs. Newfoundland peers

Imagine how much GGC’s considerable land package could be worth to a mid-tier or Major wanting to enter Newfoundland? In the chart below, 11 pure-play Newfoundland & Labrador gold juniors are valued in the market at $21M to $181M (average = $65M). Only 2 (Maritime & Matador) have delivered maiden resource estimates.

Bt contrast, the implied value of Sassy’s footprint is $19M. How do I arrive at that valuation? I ascribe $18M of value to Sassy’s well located, high-grade, Golden Triangle project.

As the largest mineral claims holder in Newfoundland, and with two sizable blocks very near NFG, and the best parts of Labrador Gold, Sokoman & Exploits, one could argue that GGCs valuation should be headed towards the top of the chart (subject to success with the drill bit}.

Mid-tiers & Majors operating in the Timmins, Kirkland Lake, Abitibi Greenstone, Golden Triangle, Red Lake districts are no doubt closely watching developments in Newfoundland.

In the peers table above, the average EV/hectare ratio is $1,305/ha. Sassy’s GGC is trading at an implied ratio of $84/ha. To be fair, most of the peers are more advanced, but even still, should GGC be valued at a 94% discount on this metric?

It seems very likely that in addition to Marathon Gold entering production in a few years, multiple gold mines will be built in Newfoundland. The same dynamic is at play in B.C.’s Golden Triangle.

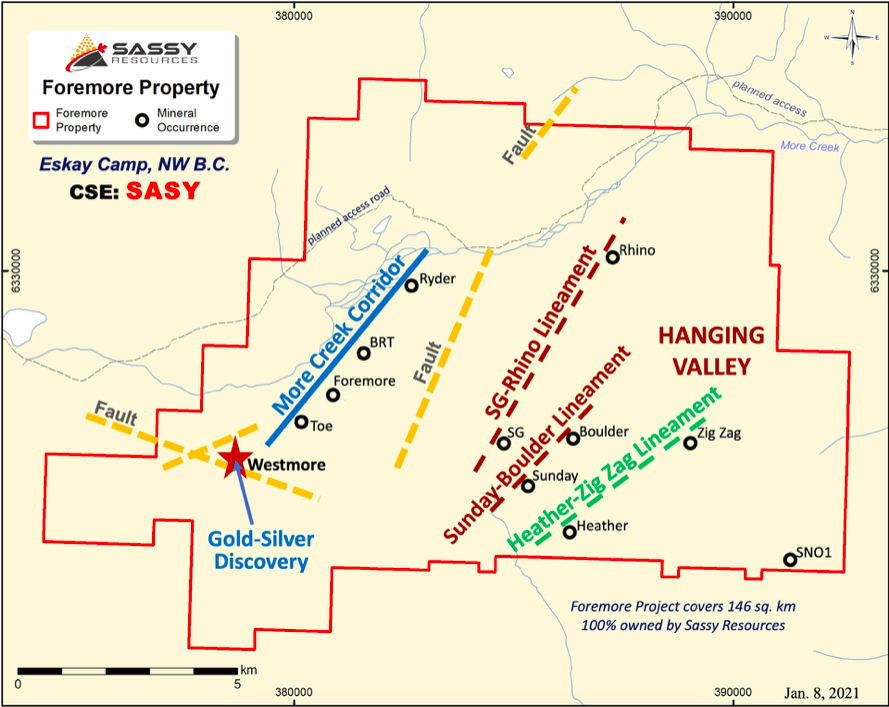

Drilling starts soon at Flagship Foremore project in the Golden Triangle

Turning to the Golden Triangle (“GT”), Sassy has a very exciting & substantive, 14,585-hectare project in the Eskay Camp, the heart of the GT. The Foremore project is Sassy’s flagship asset, although GGC is clearly gaining traction.

By way of comparison, Sassy’s 14,585 ha footprint is similar in size to other high-profile projects like; Skeena Resources’ Eskay Creek at 6,151 ha or Ascot’s Red Mountain (17,125 ha). Tudor Gold owns 60% of the (17,913 ha) Treaty Creek, and Benchmark Minerals has the (14,000 ha) Lawyers project.

Mgmt. remains optimistic about the dozen promising zones at Foremore. Not all 12 will be drilled this season, but Westmore is high on the list. Aside from Westmore, phase II drilling will be in the Hanging Valley. CEO Mark Scott wants to “map & ground-truth a number of potential drill targets in the Hanging Valley, especially around the SG, Sunday & Boulder showings.”

Holes will be added to the Phase II program if early-season exploration results warrant it. The scope of the planned program will be roughly the same as last year’s, a base case of ~3,000 m of drilling. In addition, prospecting, surface sampling & mapping of additional intrusive rocks elsewhere on the Foremore property will be ongoing.

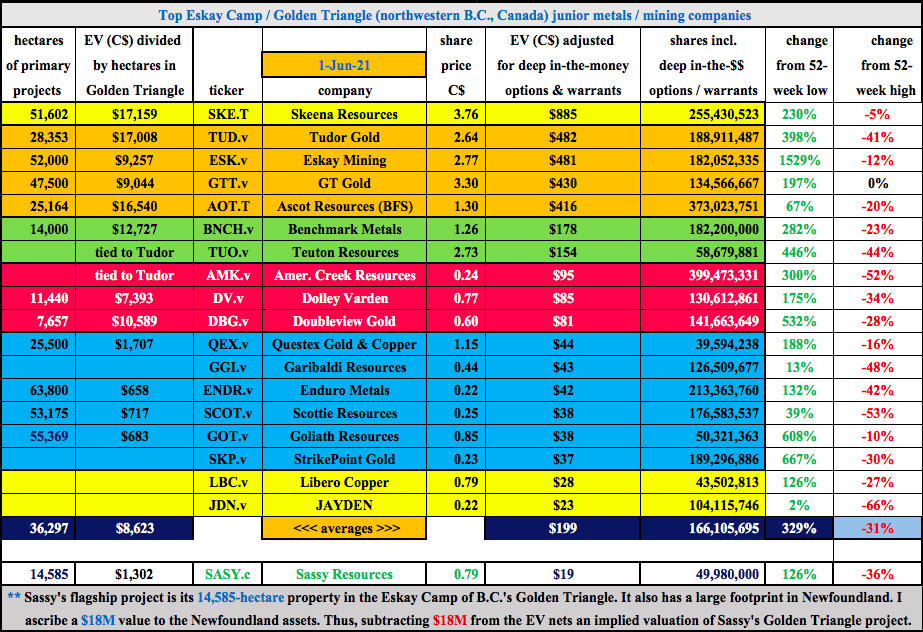

Sassy appears cheap vs. Golden Triangle peers

Above is a chart showing the top 18 pre-construction juniors in the GT. Five have current mineral resource estimates, one has a PEA and another a DFS. This peer group is trading at an average EV of $199M. The average (partially-diluted; includes deeply in-the-money warrants + options) share count = 166M shares vs. just 50M at Sassy.

Good drill results from peers in BOTH jurisdictions will be good news for all. Early-stage exploration in top area plays, seeking high-grade mineralization, in safe locations, led by expert teams, in a bull market for gold, silver, copper & nickel — it’s hard to beat that combination of factors!

CONCLUSION

It’s now June. Exploration & drilling in the GT will heat up this month, with assays released from August on. If one believes in gold & copper prices remaining stronger for longer — then one should consider digging deeper into Sassy Resources’ portfolio of properties in Newfoundland & the Golden Triangle.

There will be a few dozen more hugely successful companies like Great Bear, New Found Gold, Skeena Resources, Eskay Mining, Filo Mining minted in the next few years. This could be a once in a generation-type investment opportunity for select natural resource juniors.

Sassy Resources (CSE: SASY) / (OTCQB: SSYRF) has multiple compelling shots to strike it rich and see its valuation potentially soar above $100M. Consider that Sassy traded as high as $1.24 BEFORE mgmt. secured its first property in Newfoundland. Shares last traded at $0.79, 36% below the high. I believe this Company is twice as valuable today as it was when shares topped out at $1.24.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Sassy Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Sassy Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Sassy Resources was an advertiser on [ER] and Peter Epstein owned shares & warrants in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)