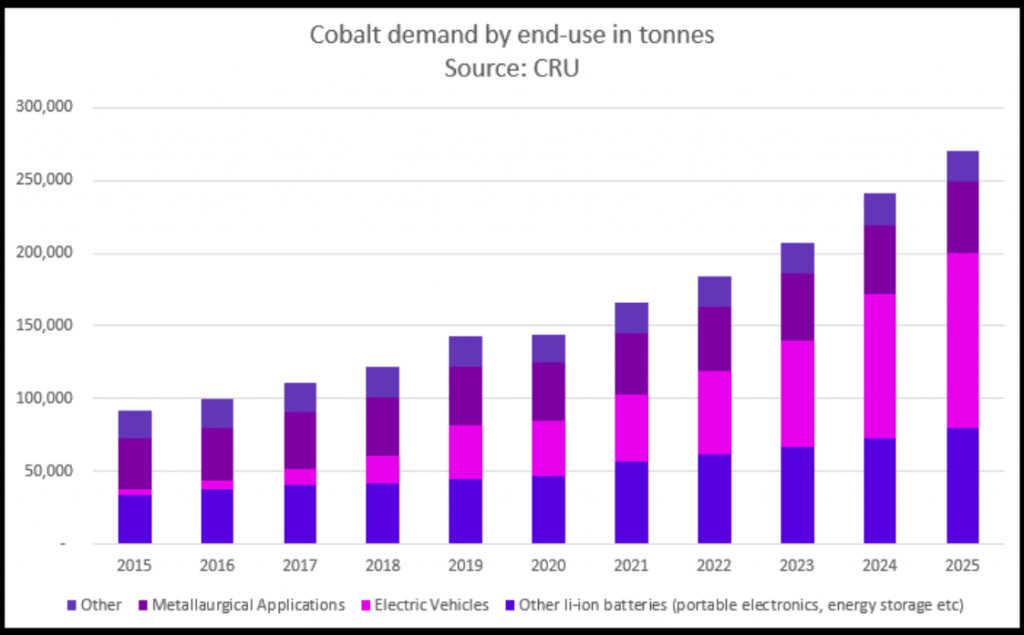

Investors looking for unbiased, current info on battery metals frequently turn to industry expert groups like CRU Group, Benchmark Mineral Intelligence, Roskill, Wood Mackenzie, [note, last month Wood Mac acquired Roskill] S&P Global Platts, and a few others. However, most of the best and timely info is (understandably) reserved for institutional clients who pay for it.

From time to time, industry experts provide a glimpse of their very considerable efforts. The following interview on the topic of Cobalt draws upon the expertise of CRU Group’s senior analyst Harry Fisher. Cobalt is one of the harder metals to keep an eye on without subscribing to the expert consultancies. Like lithium, cobalt is expected by many (but not all) to be in short supply as the global EV market takes off from 2023-24 on.

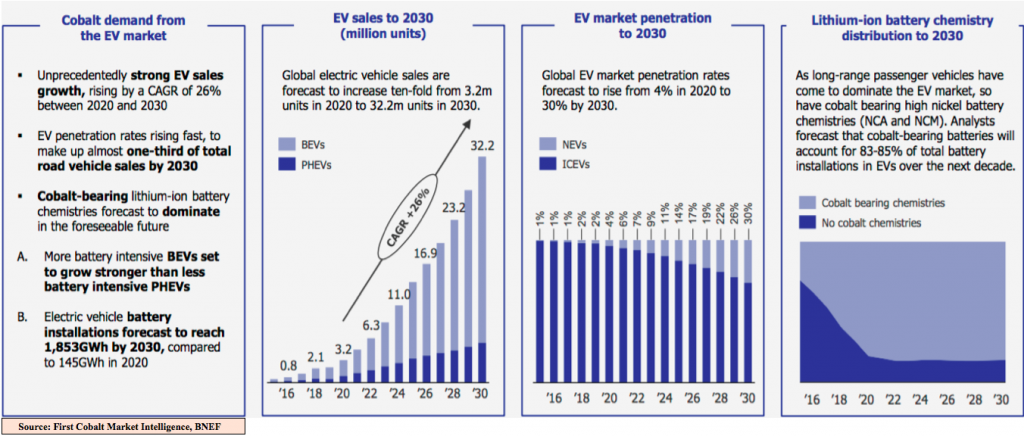

Everyone agrees that the rate of growth in global EV penetration is key for lithium & cobalt demand going forward. Yet, industry estimates of market penetration range from 20%-40%. In this interview we learn about CRU Group’s forecast for EV penetration in 2025 & 2030. Readers will also hear CRU Group’s views on both cobalt metal & sulphate prices.

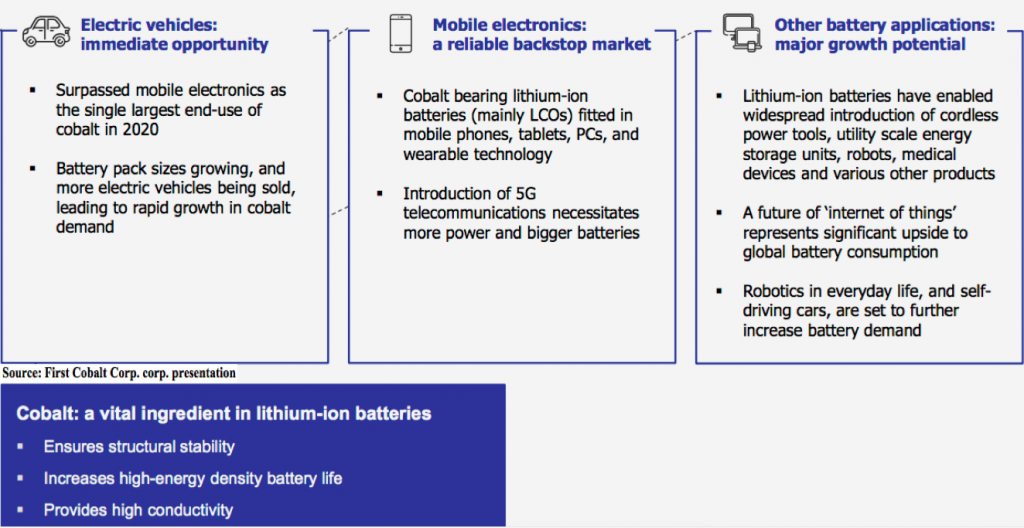

As the EV industry adjusts to less cobalt content [per battery], but the number of Li-ion batteries soar, understanding EV penetration and cobalt pricing is critically important. In Epstein Research’s [ER] view, there’s a sweet spot for cobalt sulphate prices, perhaps from US$25-$35/lb., where end users won’t blink an eye in buying small quantities to ensure battery safety, and cobalt producers can enjoy strong returns.

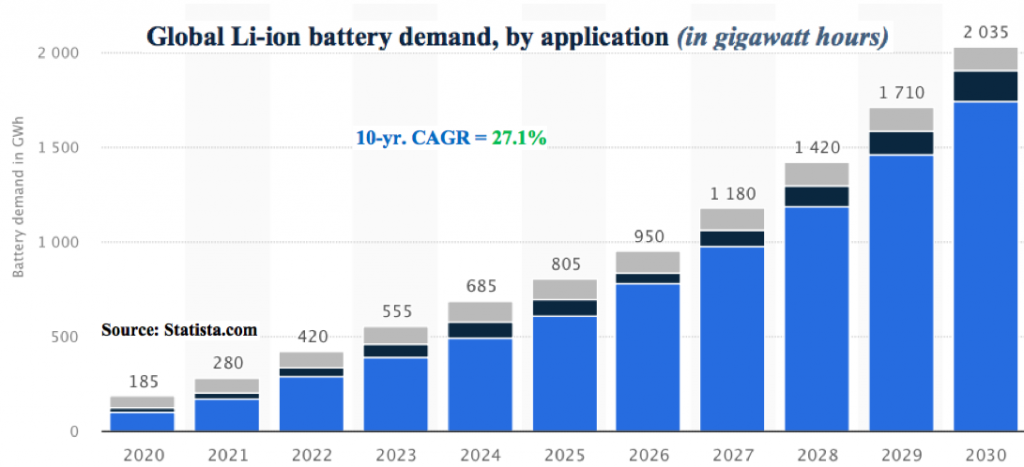

CRU Group, S&P Global Platts, Wood Mac/ Roskill, Benchmark, and maybe some of the others, see a robust future for cobalt over the next 10 years. A recent analysis by the Massachusetts Institute of Technology suggests cobalt demand could rise at a 10-yr CAGR to 2030 of up to 11.8%.

In [ER]’s view, the number of cobalt juniors is small, and the number of primary cobalt juniors is fewer than 20-25. Compare that to the number of U.S. & Canadian-listed gold-focused juniors at > 700. Investors will benefit from learning as much as possible about the cobalt market. In this interview, CRU’s Harry Fisher provides keen insights for readers to consider. https://www.crugroup.com

Harry, thank you for sharing your expertise with my readers. Please tell readers about CRU Group.

CRU Group is an international data & analysis business providing insights on metals & mining markets through our Analysis, Consulting & Events divisions. In the battery metals space, we publish quarterly market outlooks and other analysis on cobalt, lithium & nickel, as well as covering the other commodity markets impacted by the EV & green energy transitions.

I’m a Senior Analyst at CRU in charge of cobalt market analysis and I also work across EV & battery metals markets. https://www.crugroup.com

At a high level, please explain which factors go into CRU’s Cobalt market analysis on supply / demand & on forecasting Cobalt prices?

We have comprehensive databases covering all the key parts of the cobalt market. On the demand side, we forecast by end use market and have a detailed understanding of key demand drivers for both cobalt metal & chemicals.

On the supply side, we have asset-level forecasts for both mined & refined supply (metal & chemical). This is combined with our forecasts on demand to understand the total, and metal vs. chemical, market balances and the impact this will have on prices.

What can you tell readers about CRU’s expected Cobalt price in the next 5-10 years?

With demand growth gathering pace and supply growth limited, a market deficit will likely open up from 2024 on, without any new supply investment. Prices are expected to increase to incentivize new investments over the next few years. We forecast cobalt metal & sulphate prices will rise from the low-to-mid $20s/lb. currently, to a peak in the low $30s/lb.

What can you reveal about CRU’s expected Cobalt market growth over the next 5-10 years?

To 2025, cobalt demand is expected to increase by 127,000 metric tonnes, a 5-yr. CAGR of 13.6%. EVs alone will account for around 65% of cobalt market growth, with EV demand expected to accelerate in the mid-to-late 2020s, as more and more models reach cost parity with conventional internal combustion engines.

What is CRU’s global EV penetration forecast for 2030?

We believe EV penetration will reach around 13.5% in 2025, rising to close to 30% by 2030. China has led EV penetration in recent years, but Europe started to catch up in 2020, with the U.S. accelerating in 2021. Going forward, the EV transition will be driven by all three of these major markets. By 2025, we expect penetration to reach around 20%, 24% & 13% in China, Europe & N. America respectively.

How much has CRU’s supply / demand model changed over the years? Has the demand side risen steadily?

Cobalt demand increased at a CAGR of 9.4% from 2015 to 2020, and is forecast to increase more quickly, at a 13.6% CAGR to 2025. EV demand continues to gather pace and our medium-term forecasts have been steadily upgraded over the years with growing momentum in the EV market.

Is there one, or perhaps more than one, Cobalt supply-side risk that could really surprise the market in the next 5-10 years?

There are two key supply-side factors to monitor in the cobalt market; Mutanda in the DRC and the Indonesian HPALs (high pressure acid leach capacity). Mutanda has been on care & maintenance for the last couple of years, but is expected to come back online in 2022 and gradually ramp up to 2025. The ramp up progression will be important for the cobalt market balance.

There are also a number of new nickel-cobalt HPAL facilities in Indonesia expected to start in the next several years. However, HPAL production is notoriously complex. Projects are often delayed and go over budget — so again the timing of this new capacity is important for the cobalt market. Note: [ER] adds that environmental & ESG concerns could prevent some of the HPAL projects in Indonesia from advancing.

Is there one, or perhaps more than one, Cobalt demand-side risk that could surprise to the upside or downside in the next 5-10 years?

Cobalt demand growth is strong even under a number of different technology scenarios for EVs. The popularity of various battery cathode chemistries will determine the magnitude of growth – this is likely to be one of the key drivers of cobalt demand, other than overall EV uptake of course.

Which is a bigger risk to CRU’s Cobalt sector analysis — supply can’t keep up with demand, or an oversupplied market?

At the moment it seems more likely that supply will be constrained. Demand continues to grow quickly, but supply is unlikely to keep pace due to a lack of investment and also cobalt’s position as a by-product. Often, decisions for new cobalt supply are dependent on other primary metal markets such as copper & nickel.

Thanks Harry, you have delivered excellent Cobalt market commentary to my readers. Very much appreciated.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)