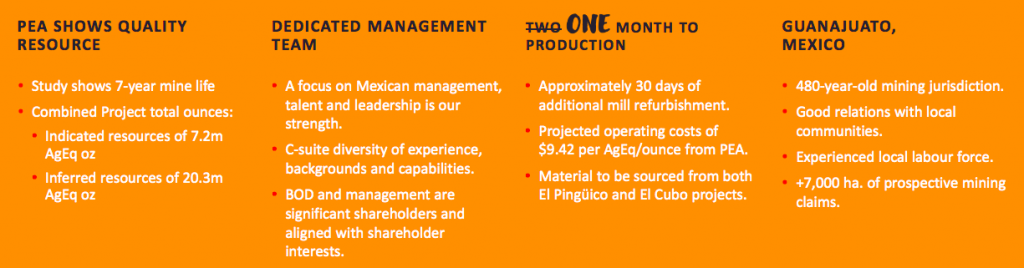

G-Silver (Guanajuato Silver) (TSX-V: GSVR) / (OTCQB: GSVRF) is on time / on budget and sitting on C$10M in cash. Within the next few months, the Company will be running silver & gold ore through its 100%-owned El Cubo mill & mining complex.

Today it was announced that Rockdrill Mining SA was hired for underground infill + expansion drilling at the El Cubo mine (5,200 m, ~200-300 m per hole) and recommissioning of the Company’s primary crusher has been completed.

Blasting at El Cubo started on Aug. 20, 2021. Mineralized material continues to be stockpiled near the processing plant.

El Cubo’s mill refurbishment is > 90% done. Once recommissioned in October, operations will ramp up into 2022 as management (per my read of the indicative PEA mine plan) expects to deliver ~1.5M Ag Eq. ounces.

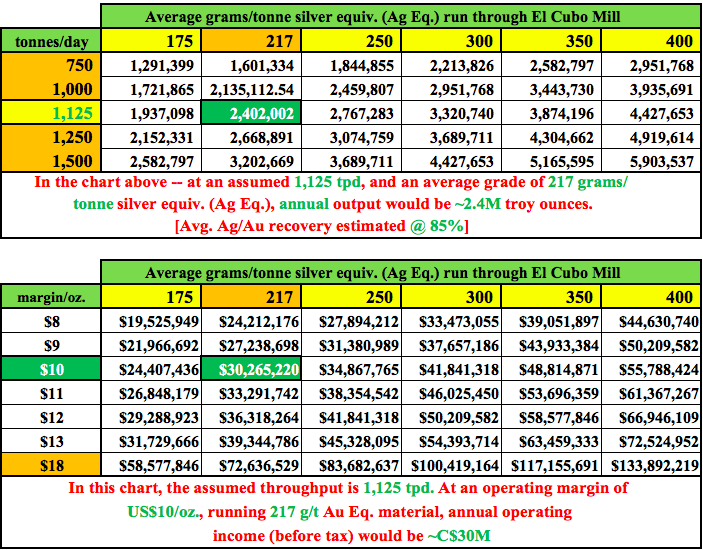

While a good start, 2023 is when things really get interesting, with 2.4M ounces penciled into their financial model (derived from PEA).

If all goes reasonably as planned, it appears that 2023 could be significantly more profitable than 2022 as G-Silver works out operating kinks and optimizes the sequencing of ores through the Mill. Lower grade ore, (incl. the surface stockpile at El Pingüico), will run through the Mill first, followed by higher grade material.

Importantly, I believe that CEO James Anderson will be able to get AISC down to $15/Ag Eq. oz. sometime in 2023.

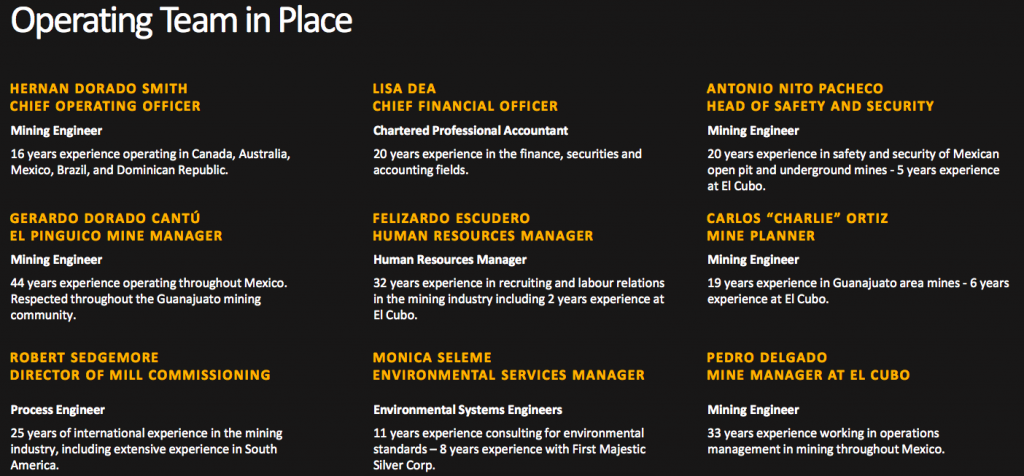

Anderson and his expert Mexican team believe they will be able to run El Cubo more efficiently. In addition, there’s the very real possibility of securing access to stranded third-party owned deposits to exploit via toll-milling arrangements.

Management has not indicated how profitable toll-milling might be, only saying they’re optimistic it has the potential to be accretive. For instance, if high-grade third-party ore of 350+ g/t Ag Eq. could be added to the El Cubo + El P mix, it’s likely that would be an attractive scenario.

Readers are reminded that when Endeavour Silver last operated El Cubo in 2019, silver was in the (US$) mid-teens per ounce. Now, it’s ~$24/oz., and it was $28/oz. just three months ago.

From 2014-2018, Endeavour operated El Cubo at between 1,132-1,860 tonnes per day (“tpd”), despite exploiting narrow veins at El Cubo that arguably called for mining at 600 to 750 tpd to minimize dilution.

Mining more optimally will both increase the profit margin per oz., and decrease the amount of waste destined for the tailings facility. For G-Silver, that means ramping up to ~750 tpd for most (or all) of 2022.

Expanding beyond 750 tpd will be done if/when market conditions warrant, and when the Company can find ample supplies of high-grade ore. Unlike Endeavour, G-Silver also hosts the past-producing, El P mine, plus access to third-party deposits.

Since the Mill was previously operated at or above 1,500 tpd, (it averaged 1,484 tpd from 2014-2018) — they did not seek out third-party ores.

Owning 100% of a 1,500 tpd mill in a safe, prolific part of Mexico offers substantial blue-sky potential. I mentioned the possibility of G-Silver producing 2.4M oz. Ag Eq. in 2023, but in the chart below one can see that under ideal conditions, twice that amount could be on the table (probably not before 2024).

Running at 1,500 tpd, and processing 400 g/t Au Eq. material, the Mill could produce ~5.9M Ag Eq. ounces/yr. (assuming a combined 85% Ag/Au recovery). How realistic is 1,500 tpd in 2023 or 2024?

In 2016 the Mill averaged 1,860 tpd over 365 days! (124% of nameplate capacity). That 1,860 tpd figure was the average, the Mill probably ran at / or above 2,000 tpd on some days. How realistic is finding 400 g/t Ag Eq. ore to process?

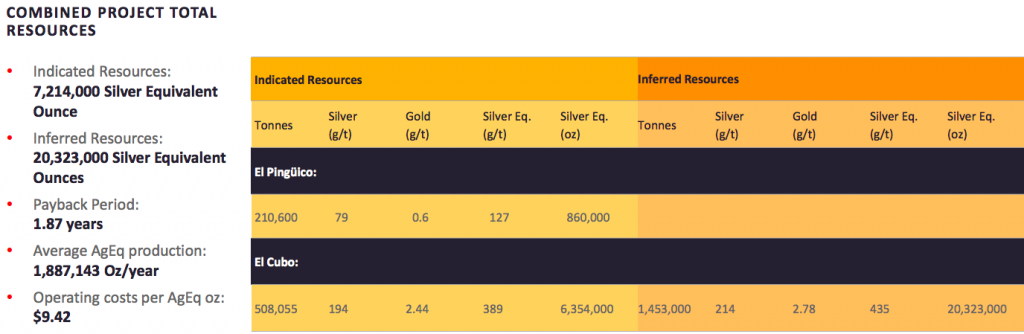

Management has already delineated ~27.5M Ag Eq. ounces (mostly Inferred, mostly at El Cubo) at a weighted average grade of 394 g/t. At spot prices, that equates to ~5.3 g/t gold equiv. In my opinion there’s no doubt the Mill can be run profitably, the goal is to maximize throughput (when precious metal prices are strong) while minimizing waste.

To achieve optimal results, stockpiled and then mined ore from El Cubo & El P will be run through the Mill, but only at prudent rates. Third-party ore might be added to the mix, but only if doing so would provide better economics at acceptable incremental costs.

A significant hurdle for the region is turning out to be tailings capacity. G-Silver has four years of capacity left at El Cubo, and management believes extending the life of its facility will not be a problem.

I’m estimating that management is shooting for ~2.4M Ag Eq. ounces in 2023, but readers might want to consider the blue-sky potential at the El Cubo Mill. Referring back to the chart, at a $13/oz. margin, cash flow could jump to > C$54M, @ 300+ g/t Ag Eq.

Why $13/oz.? Silver was at $28/oz. three months ago, and I believe that G-Silver can lower its AISC to $15/oz. sometime in 2023. Many analysts & pundits see $30+/oz. silver as soon as next year.

I’m not saying that G-Silver will generate C$54M+ in 2024, or ever. Still, it can’t be denied that the El Cubo Mill is large enough to be a money printing machine with the right ore + elevated precious metal prices.

An 85% blended Ag/Au recovery assumption is fairly conservative, it should be between 84%-88%. And, G-Silver owns 100% of the Mill. With an $18/oz. margin (a silver price of $33/oz.), cash flow could surpass C$100M/yr. Yes, I know that sounds crazy, but it’s just where the math leads us.

Make no mistake, a lot can still go wrong in coming months and years! However, management has de-risked the El Cubo Mill restart a great deal, they’re 90%+ done refurbishing it.

They have ample cash, and operations are expected to start in October, followed by positive cash flow sometime in the first quarter of 2022.

An exciting part of the G-Silver story is the exploration upside. Not just at the 7,000+ hectares surrounding El Cubo, but at El P as well. Readers are reminded that El P was the highest-grade operation in the entire district 110 years ago.

CEO Anderson has talked about the Mother Vein (“MV”) crossing through El P. We know that it was mined to within 250 meters of G-Silver’s border. It almost certainly continues onto the Company’s claims.

Later this year, or early next, management will drill to see if a sufficiently wide portion of the MV can be mapped (at a depth of several hundred meters), and if grades are potentially economic.

Management believes that a possible intersection of El P structures with the MV could deliver blockbuster drill intercepts, but there’s no way of estimating widths or grades without drilling. Note: {there might turn out to be little of interest}.

Even without success at the MV, El P has very considerable exploration upside around known veins & mineralized zones. The Mexican team has been drilling at El P with a drill that they purchased. Management is excited with what they’re finding. So much so, they’re acquiring a second drill later this year.

Small precious metals producers trade at an Enterprise Value (“EV”) / EBITDA ratio of roughly 4x-6x (many without strong EBITDA growth ahead). G-Silver’s EV is about C$110M. If the Company can generate C$30M of EBITDA in 2023, it would be trading at a multiple of ~3.7x 2023e cash flow.

However, if in 2024 G-Silver could generate C$54M of EBITDA, it would be trading at a 2x multiple of 2024e cash flow. One can imagine the cheapness of today’s C$110M valuation if we get line-of-sight to even higher cash flow scenarios.

Peers trade at 4x-6x with modest-moderate EBITDA growth prospects. G-Silver could see very substantial cash flow growth from 2022-2024.

I remind readers that the blue-sky upside in cash flow from C$30M to C$100M+/yr., comes in large part from the acquisition of El Cubo for just $15M. Ten years prior, the same Mill changed hands for $200M.

Since G-Silver got such a great deal, there’s fairly modest debt on the balance sheet, which should be largely paid off by 2023.

Conclusion

A great asset in the 100%-owned El Cubo Mill, plus tremendous exploration upside, plus strong EBITDA growth from 2022-2024 (not fueled by debt). Over C$10M in cash, and very limited need (if any) to issue new shares.

Most of the operational risk of the Mill has been sorted out (there wasn’t much to begin with). Expert third parties have reviewed the Mill and an initial PEA was delivered. Commercial production is starting in October. The valuation at C$110M could prove to be an excellent entry point ahead of upcoming production.

Disclosures / disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Guanajuato Silver, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Guanajuato Silver are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned stock in Guanajuato Silver and the Company is a (recent), but former advertiser on [ER].

While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will be (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)