All $ figures US$ unless indicated otherwise.

On September 21st, copper & steelmaking coal producer Teck Resources held its annual investor day, a 3-hour webcast highlighting very robust global demand for steel and the small number of critical materials essential in making it.

Teck is the 2nd largest coking (metallurgical / met) coal producer in the world behind BHP. Anglo American is #3.

Teck’s investor day had been anxiously anticipated. A week earlier there was a rumor that the Company wanted to divest its steelmaking coal business due in part to pressure from shareholders & prospective investors calling for companies to dump coal. Management was not happy about that rumor!

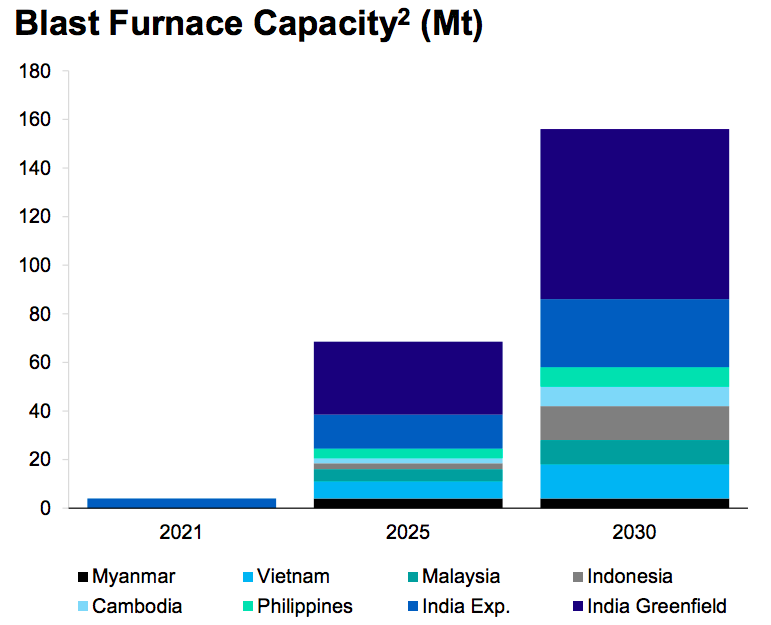

A key takeaway from the event was that seaborne met coal (Teck’s specialty) will likely remain in high demand as several Asian countries, especially India, but also Indonesia & Vietnam, are building a substantial number of blast furnaces that can only be supplied (by sea) from exporters like BHP, Teck & Anglo.

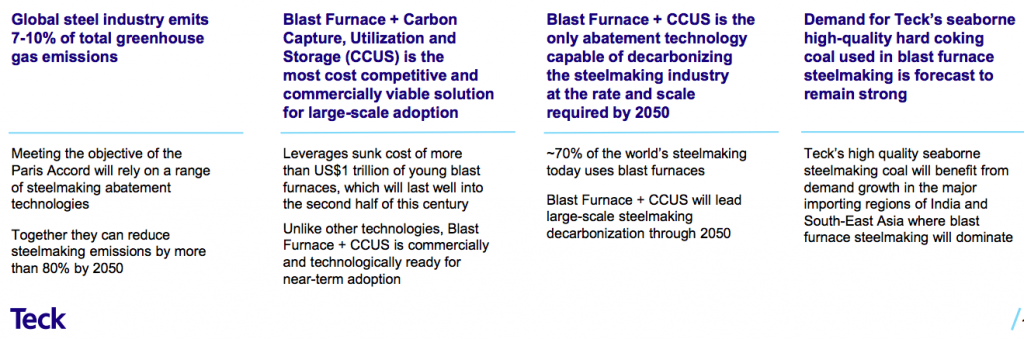

There’s no doubt that burning coal, be it thermal (used to generate electricity) or met (to make steel) is bad for the environment. However, steel is absolutely essential in building the renewable power plants & electrified transportation systems the world needs to decarbonize.

Therefore, in assessing steelmaking coal’s role in global warming it’s imperative to separate it from thermal coal. Thermal coal is already being fazed out, readily & cost-effectively replaceable by nuclear, hydro, wind, solar, biomass & geothermal sources.

Teck is a prime beneficiary of thermal coal’s demise. According to steelmaker ArcelorMittal’s website,

“Each MW of solar power requires 35 to 45 metric tonnes of steel. Each MW of wind power requires 120 to 180 tonnes. Utility-scale wind farms typically produce 100 to 300 MW, and up to 1,000 MW. ” Before long, hundreds of giant wind farms will be installed annually.

Steelmakers have been trying for decades to diminish the power that met coal, coke & iron ore producers hold by finding alternatives to blast furnace steel fabrication. That initiative has only grown with increased environmental concerns. Yet, ~70% of steel still comes from 20th-century blast furnaces.

Promising carbon capture technologies are on drawing boards, but none are expected to make meaningful inroads anytime soon. New methods have their own carbon footprints to contend with. Instead, technology is being deployed at the steel plant level.

Carbon capture and other approaches (such as the advent of battery-powered container ships) offer no silver bullets, but they’re reasonably affordable & fairly effective. Unsurprisingly, Teck is a big fan of carbon capture & fossil-free shipping!

Tens of trillions of dollars in debt-fueled economic stimulus packages in the 2020s alone will buy a staggering amount of steel, which will require the continued consumption of vast amounts of met coal. There’s no practical, large-scale substitute.

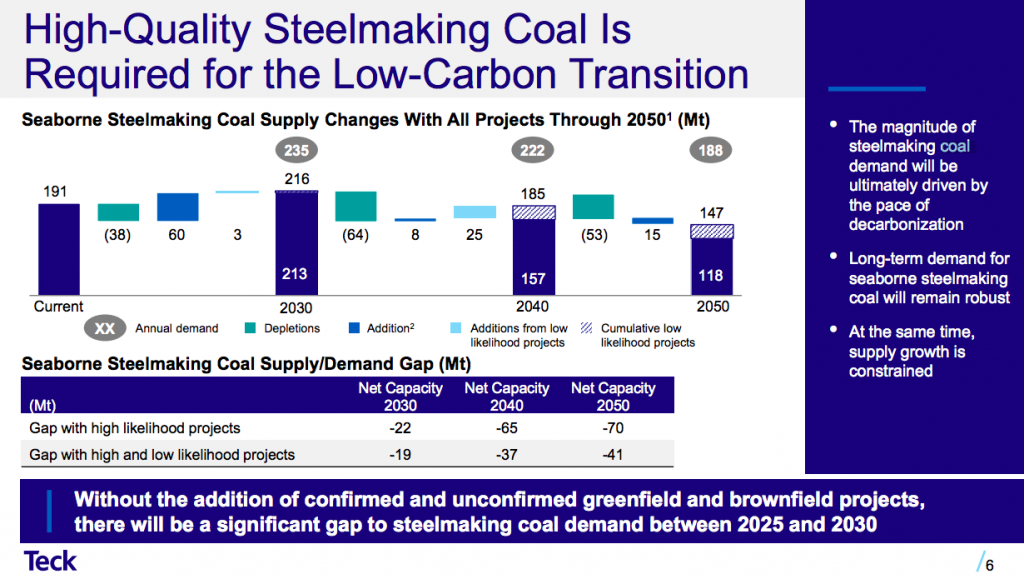

Although I believe met coal should be given much more slack than thermal, some good projects will, inevitably, fail to get funded or die on the permitting vine. This suggests that prices are likely to remain stronger for longer. Teck forecasts the potential of a meaningful deficit in the seaborne market from 2025-to 2030.

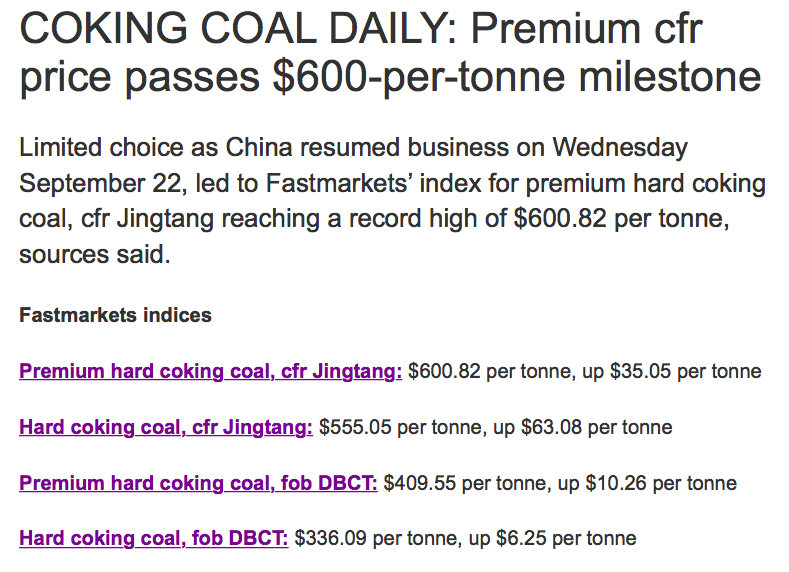

According to Teck’s presentation, the 10-year avg. inflation-adj. met coal price is ~$180/Metric tonne (“Mt”). Fastmarkets lists four hard (and premium hard) met coals ranging in price from ~$336 to $601/Mt (Sept. 22nd), an average of $475/Mt. That average has quadrupled from its 2020 low!

Will prices in the next 10 years average $180/Mt? No, my guess is that prices might return to $225-$250/Mt. However, can steelmakers take the chance of long stretches of $300-$400+/Mt pricing? Vertical integration is a move that all steelmakers should seriously consider.

Teck’s trailing 12-yr. normalized (adjusted) annual met coal EBITDA {from presentation slides} is $2.2 billion. At a “new normal” avg. long-term met coal price of say $240/Mt, EBITDA would be closer to $2.95 billion = C$3.75 billion.

In my view, the valuation of Teck’s steelmaking coal biz. in today’s bull market is > C$12 billion. If a bidding war were to break out, I believe the transaction value could surpass C$16 billion. Note: {Teck had no comment on the coal divestment rumors}.

Which other steelmaking material companies might be poised to benefit from Teck’s bullish vision? One seemingly undervalued company is Colonial Coal Intl. Corp. (TSX-V: CAD) / (OTCQB: CCARF).

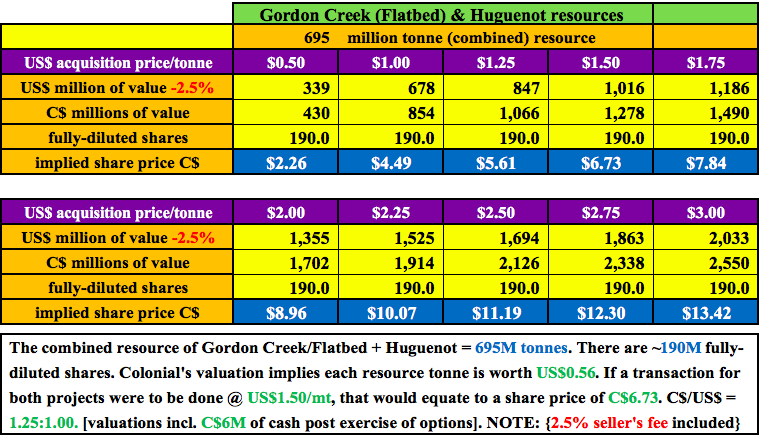

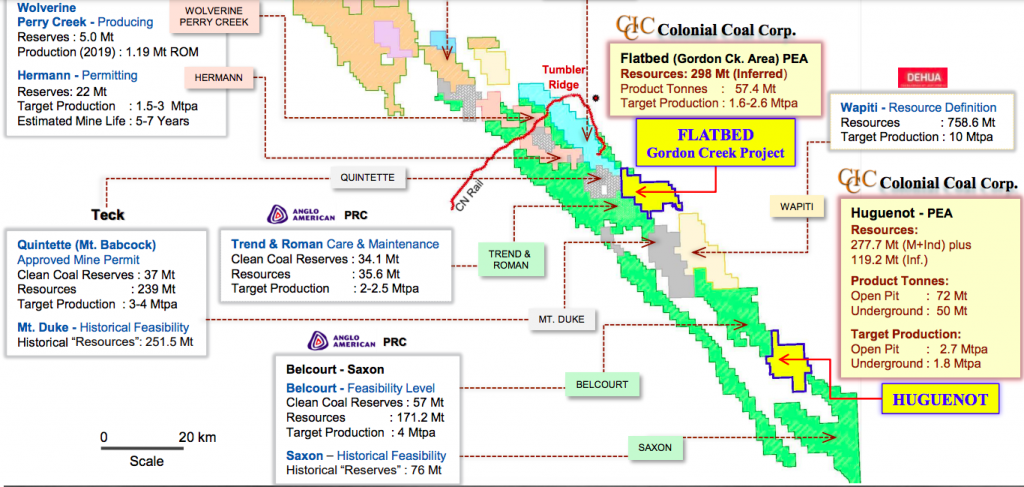

Colonial has two 100%-owned, PEA-stage met coal projects in B.C. Canada. One borders Teck’s Quintette project, the other is sandwiched between two of Anglo American’s projects. While Teck has met coal reserves of ~800M Mt, all in B.C., Colonial has resources (not reserves) of 695M Mt.

The Huguenot project is ~620 km north-northeast of Vancouver, close to the border with Alberta. Huguenot’s PEA contemplates an open-pit only scenario; 27-yr. mine life @ 2.7M Mt/yr., at a cost of $110.4/Mt & upfront cap-ex of $303M. At current prices, I estimate 2.7M Mt/yr. could generate ~C$775M/yr. in EBITDA.

Colonial’s other project, Gordon Creek, is planned as an underground mine; 30-yr. life @ 1.9M Mt/yr., at a cost of $81/Mt & upfront capital of $300M. At current met & PCI coal prices, I estimate 1.9M Mt/yr. could generate ~C$504M/yr. in EBITDA.

Therefore, combined EBITDA could be ~C$1.3 billion/yr. (at currently high pricing). Having said that, it would likely take a buyer at least five years to approach full-scale production.

Assuming a 40% retreat in pricing, the combined projects’ annual EBITDA would still be ~C$774M. If one applies a 4x EBITDA multiple on that C$774M, the indicative future value of Colonial could be ~C$3.1 billion, (less C$766m in initial cap-ex), equals ~C$$2.33 billion. Discounting that figure back five years at 8%/yr., nets ~C$1.6 billion.

I believe a well-funded steelmaker, miner, or commodity trader could afford to pay C$1.5-$2.0 billion for Colonial’s 695M resource tonnes.

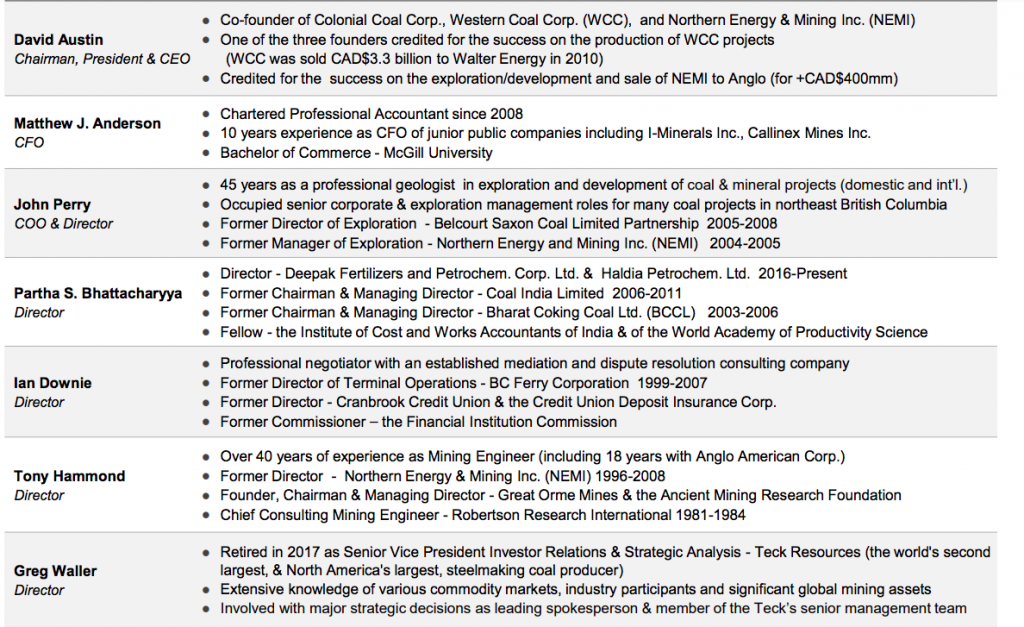

Colonial is run by experts in met coal and in mining, and by people with meaningful work experience in western Canada. For the past two years, the Company has been engaged in a process to divest one or both of Huguenot / Gordon Creek. They retained two investment banks to assist.

Soon after the sales process began, COVID-19 struck. India had a particularly difficult time, and Indian groups are thought to be among the most interested in Colonial’s assets. Indians, along with (possibly) Chinese, Japanese, Australian, Korean, Indonesian, Brazilian, Canadian & American groups!

There could be dozens of interested parties comprised of massive steel companies, mining giants (Rio Tinto, BHP, POSCO, Anglo American), iron ore players (Vale, Teck, Fortescue Metals), & commodity-trading firms (Glencore, Vitol, Itochu, Mitsubishi, Mitsui).

And of course, other coal companies like (Peabody Energy, Exxaro Resources, Sasol ltd., Yancoal, Whitehaven Coal)…

Understandably, COVID-19 has slowed the sales process considerably. It might still take months before one or both projects are sold. However, an opening indication of interest, a bid, even a “stink bid,” could come at any time. That first bid will refocus everyone’s eyes on the size of the prize.

Colonial has 183.4M fully-diluted shares, no debt & ~C$6M of fully-diluted cash. The Company is valued in the market @ US$0.21 per resource tonne.

Some shareholders are quick to point to comparable transactions and record-high met coal prices to suggest > US$2-$4/Mt in the ground is called for. That’s certainly possible, but to be prudent, readers should not base investment decisions on best-case scenarios. US$1.50/Mt equates to ~C$6.75/shr. (NOT a price target)

There are only a handful of high-quality met coal resources of this size (695M Mt in total) anywhere in the world, no less in a great mining / met coal jurisdiction like B.C. Canada, and actively for sale.

It would be unwise for a Major steel company to allow Colonial’s projects to be sold too cheaply to a competitor, giving them a meaningful, long-term cost advantage.

Retail investors have a rare opportunity in Colonial Coal. Trading volume is not consistently large enough to allow institutions to build multi-million share positions. But, investors looking for thousands of shares can get it done.

Make no mistake, an investment in Colonial’s stock offers a high-risk, high-reward, high-volatility proposition. Readers are reminded not to invest more than they can afford to lose.

If one agrees that poor trading liquidity, the drawn-out sales process (largely due to COVID-19), and the word COAL in the Company’s name might be driving significant undervaluation, then it’s time to take a closer look at Colonial Coal (TSX-V: CAD) / (OTCQB: CCARF).

Disclaimer: The author, Peter Epstein of Epstein Research [ER] has no current or prior business or personal connection with any mgmt. or board member of Colonial Coal, nor does he or [ER] have any prior or current business relationship with the Company. Mr. Epstein owns shares of Colonial, obtained in the U.S. market, via routine open market purchases.

Mr. Epstein is not currently, and never was, an investment advisor, stock broker, agent, legal advisor or investment professional of any kind. Nothing contained in the above article should be taken as advice or as an offer to buy or sell any security. All facts & figures, incl. commentary on indicative company valuations are believed to be somewhat accurate & reasonable, but might not be — therefore they are for illustrative purposes only. Facts & figures / calculations / valuations, etc. should not be relied upon without further investigation by investment professionals. Mr. Epstein is not providing any share price guidance or buy/sell recommendation. Mr. Epstein may or may not write about Colonial Coal in the future. He & [ER] are under no obligation to update readers going forward. The shares of Colonial Coal represent a high-risk investment opportunity that may, or may not, be suitable for readers. As such, readers are urged to consult with their own investment advisors before making investment decisions.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)