Severe shortages of critically important commodities are highly likely this decade. For instance, there are legitimate concerns about the supply of copper & lithium. If demand is too strong, prices will reach a point where users try to substitute less expensive materials. Either that, or higher prices will get passed on to consumers.

Admittedly, not being able to buy an all-electric Ford F-150 pickup truck is not the end of the world. However, reliable access to some commodities can mean the difference between life & death. Water & food, for example. Or, consider the case of fertilizers. NPK stands for Nitrogen, Phosphate, Potash.

While farmers can fiddle with the ratios applied each season, all three are essential macronutrients. Reduced yields or diseased / failed crops due to deficient levels of NPK can lead to food shortages, famine, starvation. Soaring food prices can spark violence & food riots.

Readers might be familiar with giant agriculture / fertilizer companies like Nutrien or Mosaic. They, and several others are vertically integrated, controlling an estimated 85% of all NPK production. In the past year, several trends have come together to make that vertical integration even more crucial.

On-shoring (obtaining materials from, and selling products in, the same region) is incredibly important. The practice facilitates speed, accuracy & reliability from raw material procurement, to manufacturing, to sales & delivery of finished goods.

On-shoring cuts shipping costs & transport times, both of which have soared with no easy answer or short-term workaround. Perhaps more important, it highlights the urgent need for security of supply. In addition to on-shoring, there are also ESG – Environmental, Social, Governmental initiatives.

ESG mandates for industrial companies & miners require adherence to minimizing CO2 emissions, tailings, chemical use & fresh water in each step of the supply chain and through delivery to endusers. Moreover, investment funds increasingly have their own ESG criteria.

While there are > 800 gold & silver juniors, in N. America, how many nitrogen juniors are there? There are fewer than a dozen N. American-listed juniors focused mainly on N, P or K. Yet the fundamentals of macronutrient demand are strong and very consistent.

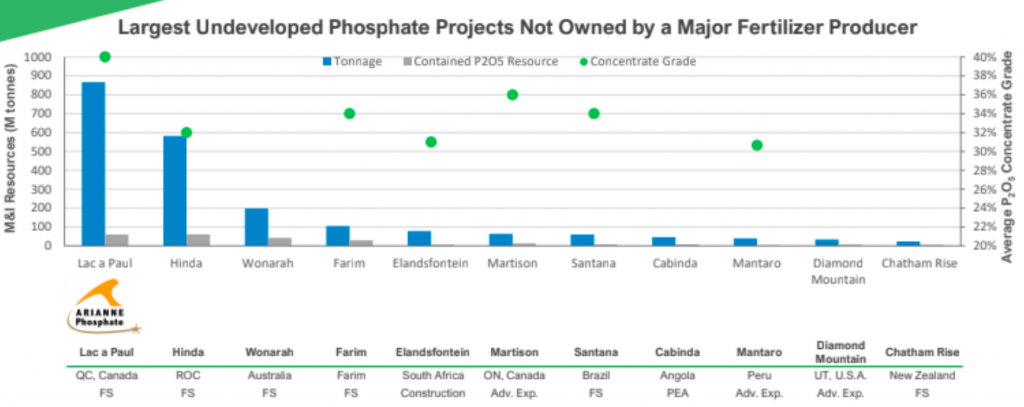

Arianne Phosphate (TSX-V: DAN) / (OTCQB: DRRSF) has a world class asset that’s larger, cleaner and more pure than almost any NPK project on earth. The Company’s Lac à Paul phosphate rock project in Quebec, Canada is at BFS-stage, in fact it’s been at BFS-stage since 2013.

In the above chart, Arianne’s 100%-owned Lac à Paul is the largest, and has the highest grade concentrate of any project not owned by a Major. It’s also one of the most advanced (fully permitted, shovel ready), with two long-term off-take agreements in place & good relations with local communities & First Nations.

I mentioned security of supply and on-shoring — look at the countries other projects are in — the DRC, Guinea-Bissau, Angola… I’ll take Canada over those three. Quebec is well situated to serve both Canadian & U.S. farming interests, especially farms on both sides of the border near the Great Lakes.

With Lac à Paul management proposes to produce & sell 3M tonnes/yr. into a 200M tonne market that’s growing by 1.5%-2.0%/yr. {perhaps 2.0%-2.5%/yr. with LFP battery demand}.

Nutrien, CF Industries, Mosaic, Archer-Daniels-Midland Co. & Yara Intl. have operations around the globe, including in Canada. These companies should be very interested in Arianne’s project.

Despite a market downturn from 2012-2019, then prolonged somewhat by COVID-19, very substantial de-risking of the story has occurred. Management continued to advance Lac à Paul, most notably by:

| the signing of 2 long-term off-take agreements, (working on 1-2 more) |

| the full permitting of the Project (now shovel ready), |

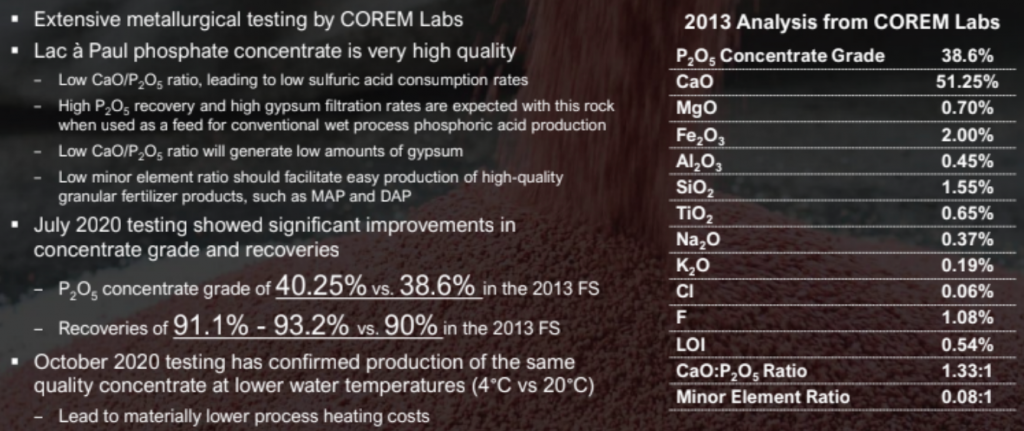

| improving expected recovery rates from 90% in BFS to 91%-93%, |

| enhancing concentrate grade assumption from 38.6% to 40.0%, |

| reducing proposed op-ex by 15%!! from $93.7/Mt to less than $80.0/Mt, |

| streamlining trucking logistics & environmental footprint, |

| progressing on higher-margin specialty products, |

| identifying new opportunity in LFP [the P is for phosphate] batteries in EVs, green hydro-electric power in Quebec rising in importance, the signing of a collaboration agreement with first nations, talking with banks, royalty companies & prospective strategic partners |

Nutrien, Mosaic, CF Industries, Bunge Limited and others need continued access to long-term supplies of NPK, the closer to their own facilities & customers as possible. World class, advanced development assets, be they copper, gold, uranium … are few and far between.

If Arianne can deliver a growing volume of products into specialty applications, project margins could be greatly expanded. One area of interest is in the P in LFP batteries. Tesla made LFP chemistry, a version of a Li-ion battery, famous in China for smaller, entry-level vehicles.

A year ago, pundits thought LFP was just a niche market. However, Elon Musk is changing that view by announcing last week plans to expand its use of LFP batteries across more models & regions of the world. Some pundits now believe LFP batteries could capture a quarter of the global market for EV batteries by 2030.

China’s BYD (a top-selling EV manufacturer), battery manufacturer CATL (China’s largest battery maker), Tesla & Stellantis have announced plans to use LFP cathodes. Volkswagen & Ford are also pursuing LFP.

If LFP battery chemistry really takes off, where will the EV market get all the phosphate it needs? This is a very new development worth watching, how big a part of the market could batteries become? How large a premium could be obtained vs. selling phosphate to the fertilizer Majors.

Will other phosphate producers be able to make suitable material to sell to LFP companies? A main takeaway is that Arianne delivered a strong BFS in 2013, but the economics are meaningfully better today. Leaving pricing the same, recoveries are up and op-ex is down 15%.

The concentrate grade has been improved & trucking logistics streamlined to save on costs & lower traffic emissions. Arianne has key ESG credentials, sourcing power from a green hydro-electric grid & the cooperation agreement with First Nations groups.

That BFS, if updated for today’s reality, would generate a notably higher NPV & IRR. A hidden gem in the financial workings of the BFS model is that the USD$/CAD$ exchange rate has moved significantly in the Project’s favor. How much of a move?

Like the decline in op-ex, (down 15%) the improvement in the FX rate is currently +15% (this could change). These enhancements would increase the NPV by hundreds of millions of dollars. Better recoveries & a higher concentrate grade would also help the economics. Management believes the Project will be in the bottom (best) quartile on the cost curve.

Near-term catalysts include new off-take agreements, plus updates on funding discussions (debt + royalty / streaming) & possible upfront payments for off-take. These options are being pursued to keep the equity component of a construction funding package manageable.

If these and other milestones are met in coming months, I imagine the share price could move much higher than today’s C$0.49. The Company’s Enterprise Value {market cap + debt – cash} is currently ~C$112M. The Company has a moderate amount of net debt, but it’s not due until 2026.

With a strong strategic partner, Lac à Paul could be in production by 2024, in time to repay and/or refinance the debt.

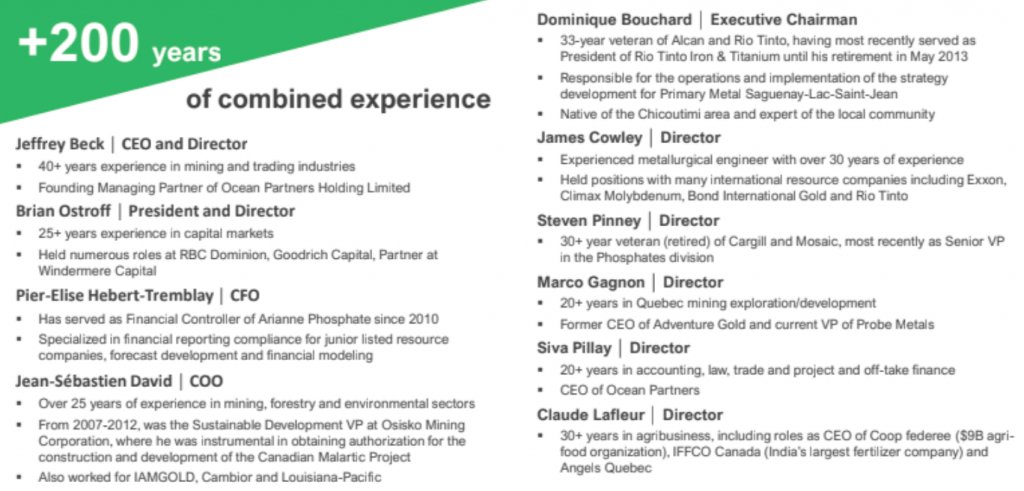

The province of Quebec, and various agencies & investment funds there, are known to be very supportive of major metals & mining projects. Arianne Phosphate (TSX-V: DAN) / (OTCQB: DRRSF) is in the right place, at the right time, with the right team and the right products.

Disclosures / Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Arianne Phosphate, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Arianne Phosphate are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Arianne Phosphate was an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)