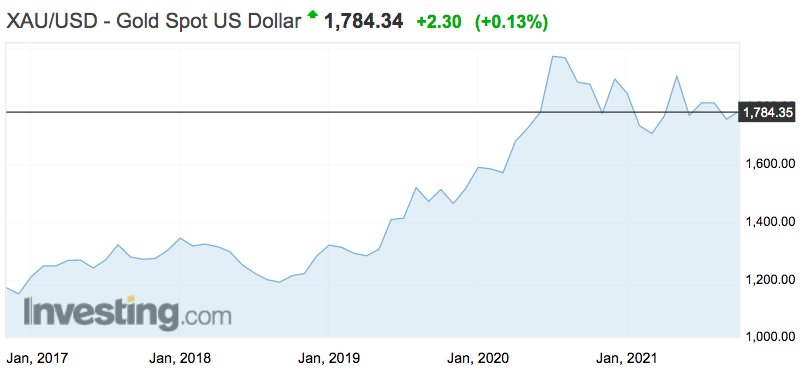

Commodity prices have been rallying for months, leading economists to worry about inflation. For example, lithium & coking coal prices have quadrupled from last year’s lows, and WTI crude oil & tin have doubled. Precious metals typically do well during inflationary periods.

However, so far this year gold has not done well. In fact it’s down ~14% from an Aug. 2020 high ~$2,070/oz. This pullback has caused gold juniors to trade much lower. Well known names are down up to 69%, Osisko Development -40%, Sabina Gold & Silver -55%, Novo Resources -58% & Pure Gold -69%.

Why is gold lagging so many other commodities? It should be leading the charge as a hedge against growing inflationary pressures. Many believe gold will bounce back above $2,000/oz. next year (if not sooner). Even a move above $1,850/oz. could rekindle interest in the sector.

Several months ago, the Newfoundland gold camp was the hottest in North America….

Newfoundland, one of the hottest gold camps on the planet earlier this year, has gone a bit cold. Pure-play Newfoundland juniors Labrador Gold, Exploits Discovery & Sokoman Minerals are down 44% – 65%. News from the island has slowed as companies are in no rush to announce drill results into a weak market.

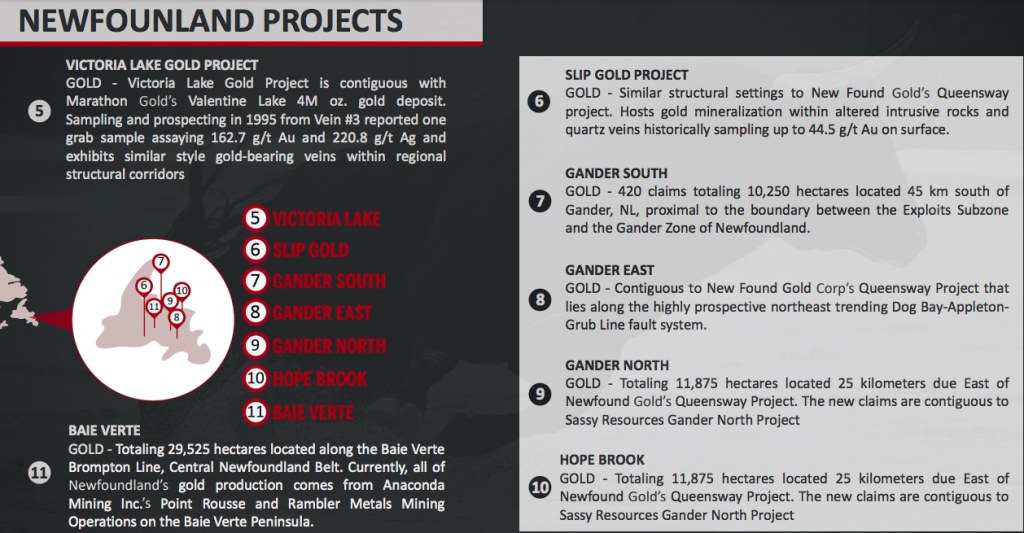

One company that’s made tremendous progress, despite poor investor sentiment, is Marvel Discovery (TSX-V: MARV) / (OTCQB: MARVF). From < 15,000 hectares of owned or controlled property in Newfoundland a year ago, Marvel has accumulated just shy of 92,000 ha.

If management closes 1 or 2 more of the transactions they’re currently looking at, they would own/control the 5th largest land bank on the Island. Right now, few seem to care about 92,000 ha (and growing) in a great jurisdiction, but that could change in a heartbeat.

New blockbuster drill results like the ones reported by New Found Gold [NFG] and/or a higher gold price is all that’s needed. Readers are reminded that NFG reported one of North America’s best gold intervals of the century.

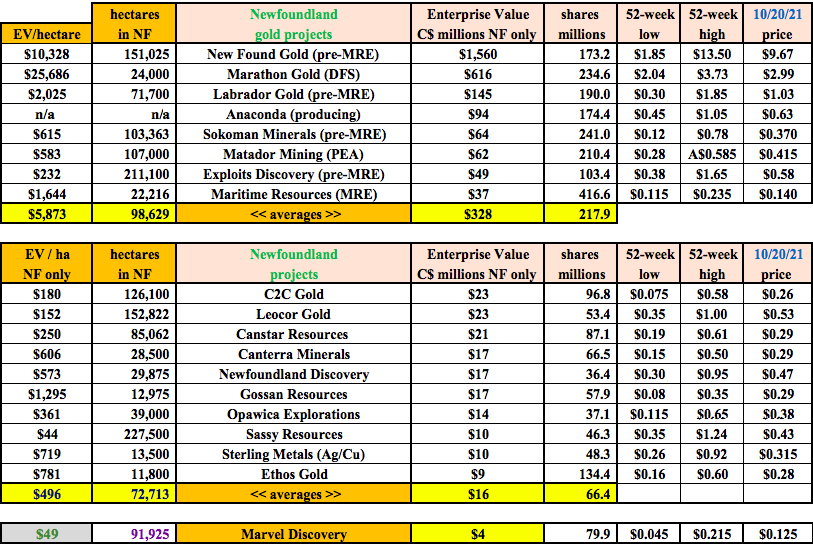

In the chart below, notice that Marvel is trading at an Enterprise Value [EV] {market cap + debt – cash} to hectare of just $49/ha. Compare that to peers valued at an average of $496/ha. Note: {each company’s EV is adjusted to reflect only its Newfoundland portfolio, all companies are pre-maiden resource}

Marvel Discovery trading at a 90% discount to Newfoundland peers (based on EV/hectare)

By this metric, Marvel is trading at a 90% discount to the peers in the chart. When gold prices rebound, Newfoundland juniors will have a nice bounce. Marvel is positioned to enjoy more than just a bounce. At some point, it should re-rate to a valuation closer to that of the peer average.

As Newfoundland juniors rebound, the peer average EV/ha ratio might increase by say 50%. If that were to happen, and Marvel can shrink its peer discount from 90% to 60%, then its shares would trade at $0.47. The current share price is $0.125.

Imagine that, MARV’s share price could nearly quadruple and its Newfoundland portfolio would still be valued at a 60% discount to pre-maiden resource stage Newfoundland peers.

Clearly the market doesn’t believe in, or doesn’t understand, what CEO Karim Rayani is up to in Newfoundland. Yet, unless he’s lying about the transactions & staking being done — it’s not that hard to understand…. ~92,000 ha owned outright via staking or controlled via option in a world-class mining jurisdiction.

Is it possible that Marvel’s property is situated in bad places? Sure, it’s possible. However, that fear makes little sense as Mr. Rayani has staked & optioned near established leaders on the Island.

When gold rebounds Newfoundland juniors could soar

MARV’s Victoria Lake? It’s near Marathon Gold’s flagship 4.8M ounce Valentine project. MARV’s Slip project? It touches property held by Exploits Discovery and is near Labrador’s high-grade Kingsway project.

Gander East, South & North are contiguous with, or close to, NFG’s world-class Queensway project where blockbuster assays have vaulted that company to a C$1.5B market cap. The Gander properties total ~29,000 ha, so a very substantial property package next to the hottest gold project in North America, if not the world.

MARV’s Hope Brook property is contiguous with, or close to, First Mining Gold and to a Sokoman + Benton Resources JV. First Mining has delineated 954k ounces (Indicated + Inferred) at a healthy grade of 4.7 g/t gold at its past-producing, 26,650 hectare Hope Brook project (same name as MARV’s property).

MARV’s Baie Verte property is in the Rambler Mining Camp, host to past & current gold producers, most notably Anaconda Mining. Hope Brook is 19k ha, and Baie Verte is 29k ha.

CEO Rayani has amassed three blocks of 29k, 29k & 19k hectares, each of which is larger than entire land packages held by peers in Newfoundland.

Before the end of this decade, Newfoundland will host multiple gold mines. NFG will gobble up the surrounding high-grade deposits that don’t become mines themselves. Marathon will grab nearby stranded deposits. First Mining will do the same.

Marvel has seven properties on the Island, a few of which could become mines, or if not mines, some might make it as valuable satellite deposits for Marathon, NFG & First Mining.

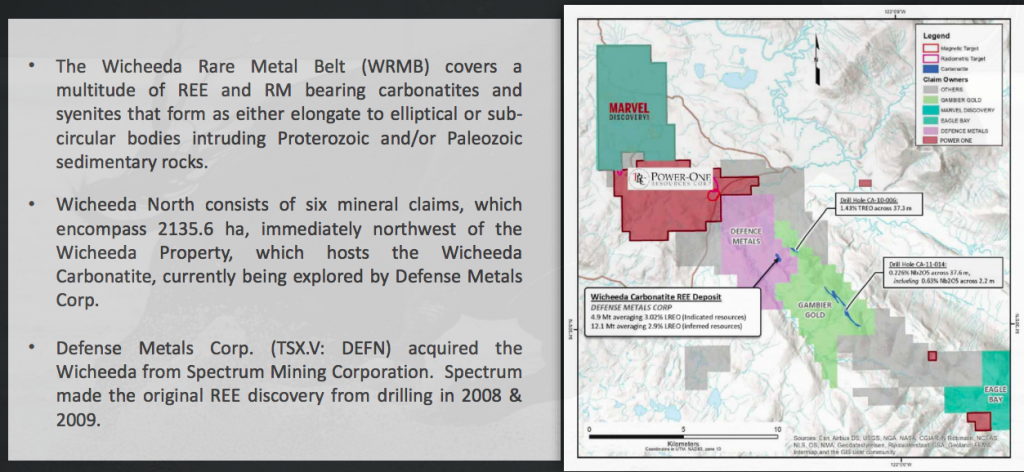

In my opinion, Marvel’s Newfoundland portfolio alone is worth well more than the entire EV of the Company. But wait there’s more…. In addition to the seven properties mentioned, there’s also a potentially important Rare Earth Elements property near Defense Metals’ advanced exploration play. Defense Metals has done a great job advancing its REE project.

Neodymium & Praseodymium prices are up 115% & 131% year-over-year. Unlike the 700+ gold-heavy juniors listed in Canada, there are probably fewer than 25 decent REE juniors. A good REE story would go a long, long way.

The Company has two projects in northwestern Ontario, a gold play in the Atikokan camp and a PGM property, but again, there’s little interest in precious metals these days.

No one cares about gold & silver, they care about lithium & uranium… people are even excited about coal stocks (coal prices are through the roof). Gold will shine again, and when it does investors will flock to high-grade, safe, gold camps like Newfoundland.

Readers are reminded that a stock down 60% has to rally 150% to get back to where it was. Marvel Discovery (TSX-V: MARV) / (OTCQB: MARVF) is not down 60%, but it has room to run before it hits C$0.215 again.

As investors recognize the very considerable land portfolio Marvel has in Newfoundland, the stock could move well beyond its former high.

Disclosures / Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Marvel Discovery Corp., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Marvel Discovery are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Marvel Discovery was an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)