In October, Guanajuato Silver Company Ltd. [GSilver] (TSX-V: GSVR) / (OTCQX: GSVRF) announced that its first shipment of precious metals concentrate from the newly refurbished, 100%-owned El Cubo mill in central Mexico.

On November 15th the Company received proceeds of ~US$750k from the sale of ~90 tonnes of bulk silver & gold concentrate grading ~220 ounces per tonne (“opt”) silver / ~2.2 opt gold. GSilver continues to ramp up both tonnes processed & head-grade. This shipment compares to ~200 opt silver + ~2.0 opt gold in the Company’s October delivery.

Since then, the Company delivered another ~175 tonnes at similar grades and expects payment of ~US$1.3M in the first week of December. GSilver continues to ramp up both tonnes processed & head-grade.

From October 15th, the Company has mined at a rate of ~450 tonnes per day (“tpd”) from the El Cubo mine. For the week ending November 21, 2021, the Company averaged 950 tpd (combined mining from El Cubo + deliveries from the El Pinguico stockpile).

El Cubo is now operating at ~1,000 tpd and the Company expects the plant to run for 22 to 24 days/month, with 6 to 8 days/month of downtime for refurbishment & mill maintenance. Management plans to operate El Cubo at ~22,500 tonnes/month through May 2022.

In coming months recoveries are expected to improve to a blended Ag Eq. level of between 86-88%.

I’m pleasantly surprised to learn that the Mill will be operated at ~1,000 tpd for the next six months (@22-24 days/month). Scheduled downtime will allow ores to be be optimal mixed and recoveries to be maximized. The prior goal was to process 750 tpd (30 days/month). In addition, a private placement was recently announced to raise C$8.8M.

Depending on diluted head grades going into the Mill & recoveries coming out, I believe 2022 production could be ~1.8M Ag Eq. ounces.

If all goes reasonably as planned, it appears that 2023 will be significantly more profitable than 2022 as GSilver works out operating kinks and optimizes the sequencing of ores. Anderson and team believe they will be able to run El Cubo more efficiently than Endeavour Silver did.

In addition, there’s the possibility of acquiring stranded deposits or partnering with third-parties under toll-milling arrangements. Readers are reminded that when Endeavour last operated El Cubo in 4Q 2019, silver was around $16-$17/oz. Now, it’s ~$23/oz., but it was as high as $28.8/oz. in May.

From 2015-2018, El Cubo operated at between 1,402-1,860 tpd, despite exploiting narrow veins that arguably called for mining at 750 tpd to control for dilution. Management will only mine optimal vein widths and supplement that with material from El Pinquico and possibly third-party sources.

Astute readers may have noticed that 1,860 tpd is 24% above El Cubo’s nameplate capacity of 1,500 tpd. Interestingly, in the final four (full) years of operation, average throughput was 1,572 tpd (based on 365 days/yr.).

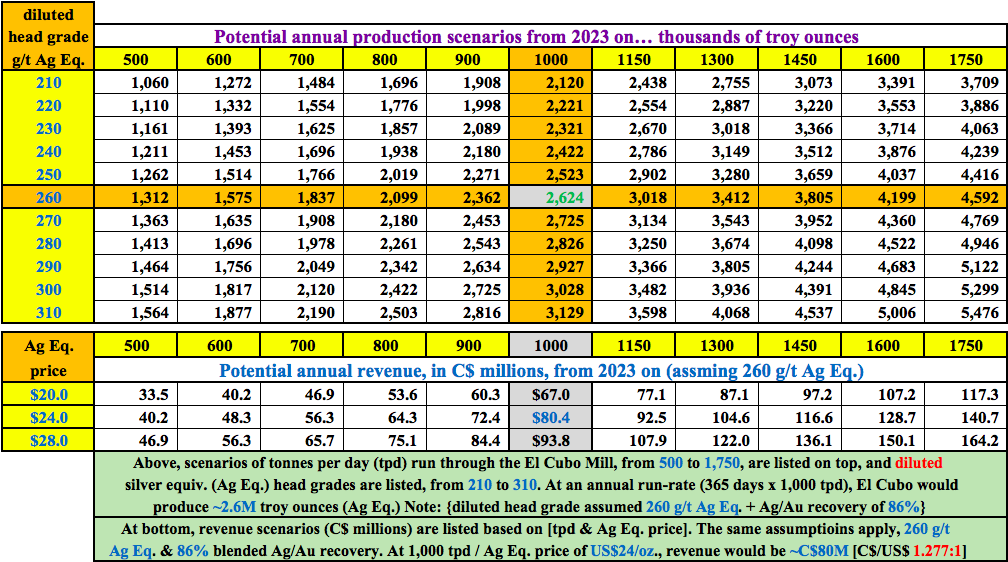

In the chart below, I show indicative operating rates ranging from 500 to 1,750 tpd, along with Ag Eq., diluted head grade assumptions of 210 – 310 g/t.

Importantly, there’s no rush to run the Mill to nameplate capacity. Still, if the team can secure high-grade third-party ores, or make discoveries at El Cubo or El Pinguico, then the numbers on the right side of the chart could come into play.

It’s crucial to recognize that management intends to run El Cubo efficiently, maximizing margins not production. Narrow veins at El Cubo will not be over mined, that just generates excess waste that needs to be stored as tailings.

The earliest that 2M+ Ag Eq. ounces is possible is 2023, although reaching that run-rate level should happen next year. The chart shows C$ revenue (in millions) that would be generated over a range of tpd, assuming 260 g/t Ag Eq. & an 86% blended Ag/Au recovery.

While management can’t control silver/gold prices, it can control how rapidly it exploits its precious mineral endowment. In the Company’s PEA, there are ~27M Indicated + Inferred Ag Eq. ounces with undiluted grades ranging from 389 to 435 g/t Ag Eq.

At 1,000 tpd and improving recoveries, investors can start to think about 2023 and beyond. For the next 18 months, free cash flow will be applied to debt repayment & operational enhancements.

However, by 2H 2023, monthly free cash flow should be quite robust, in which case a regular dividend is possible. By my rough estimates, if 50% of free cash flow were distributed, the dividend yield would be ~5%. {assumes a 33.33% free cash flow margin & $24oz. Ag Eq.}

In addition, management is speaking with owners of some of the Ag/Au deposits in the mining camp. Readers are reminded that Endeavour Silver started as a very small operation and has grown to a C$1 billion company.

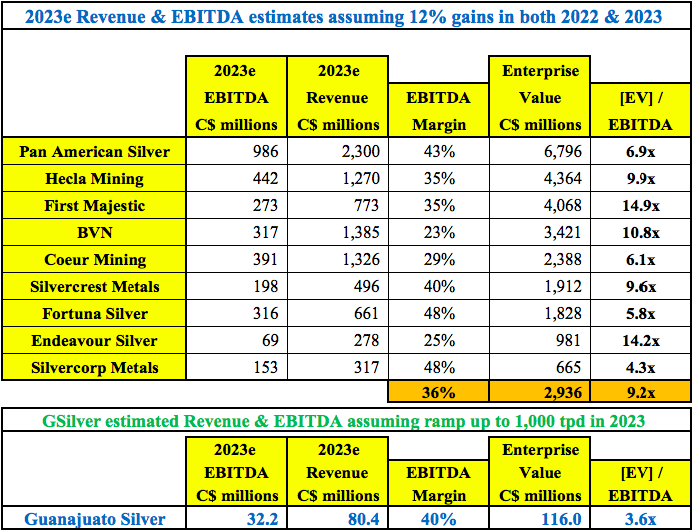

GSilver is trading at 3.6x 2023e EBITDA. Even better, revenue / EBITDA growth could be 40%+. Compare that to the expectations of these better known, larger silver producers. For the peers I assumed 12% growth in both revenue & EBITDA for 2022 & 2023 (vs. trailing 12-month figures).

Of course, GSilver might fail to deliver on expectations, that’s the nature of mining. However, the difference between this Company and most others is its production runway. It can go from zero to (a run-rate of) 1.8M ounces Ag Eq. in 2022, and possibly 2.6M+ ounces in 2023, from El Cubo & El Pinguico alone.

Companies with flat or low growth would greatly benefit from acquiring a rapidly expanding Mexican Ag/Au producer. But selling the Company is the last thing on management’s minds. They want to build GSilver into a profitable mid-tier producer and a strong corporate citizen.

If/when precious metals bounce back from a disappointing year, silver-gold juniors will be off to the races again. This time, Guanajuato Silver Company Ltd. [GSilver] (TSX-V: GSVR) / (OTCQX: GSVRF) is a producer, and expects to be EBITDA+ starting in 1Q 2022.

This Company is building a war chest to make acquisitions. Fast forward 4-5 years, could GSilver be the next Silvercrest Metals? The next MAG Silver?

Disclosures / disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Guanajuato Silver, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Guanajuato Silver are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned stock in Guanajuato Silver and the Company is a former advertiser on [ER].

While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will be (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)