2021 might be remembered as the year analysts realized that Lithium (“Li”) supply probably won’t keep up with soaring demand, mostly from the electrification of transportation and efforts to decarbonize the planet.

Roskill forecasts Li demand growth of 19.2%/yr. over the next decade to reach 3M tonnes/yr. of Li Carbonate Equiv. (“LCE”) in 2031.

Serious Li supply-side uncertainty this decade

Forget about 3M tonnes, the world will be lucky to see 2M/yr. in 2031. Yes, supply will be a major bottleneck. By the 2030s Li-ion battery recycling represents an opportunity for supply to catch up. However, even that’s far from a sure thing as LFP batteries might not be widely recycled if it’s not profitable to do so. LFP batteries contain no cobalt or nickel.

For years Li giants Albemarle & SQM have planned major expansions in Li carbonate production from their operations in Chile’s Atacama salar, literally the driest place on earth. Unsurprisingly, water concerns, local community opposition & left-leaning politics are thwarting those efforts.

Ganfeng (“GF”), Tianqi, Mineral Resources, Pilbara Minerals, Livent, Lithium Americas (“LAC”), Allkem (+ several private & Chinese firms) will pick up some of the slack.

That leaves juniors to bridge the widening gap. However, most new projects are typically 25-35k tonnes LCE/yr. and take 3+ years to ramp up. The market is already very tight. According to investing.com, the spot Li carbonate price in China is up a whopping +784% from its low of 38,500 yuan/tonne in mid-2020. Note: 340,500 yuan = ~US$53.6k/tonne.

The success of Direct Lithium Extraction (“DLE”) technologies + sedimentary (Li-bearing claystone) [“clay projects”] might be the only way to avoid a severe shortfall. But wait, there’s a slight problem…. Precious few DLE (some in China) and zero clay projects have reached commercial-scale production.

That’s about to change. LAC is developing a world-class clay project in Nevada, Standard Lithium (“SLI”) expects to enter production with two promising DLE projects in Arkansas, GF is firing up a clay project in Mexico and Australian-listed ioneer ltd. (“INR”) has a Li-boron clay project, also in Nevada. Germany is home to Vulcan Energy’s DLE asset, and Lake Resources is partnering with Lilac Solutions in Argentina.

All Lithium Hands on Deck!

The project I’m most interested in is Cypress Development Corp.’s (TSX-V: CYP) / (OTCQB: CYDVF) 100%-owned clay project in Nevada. Initial production is expected in 2025. Importantly, Cypress will benefit by following in the footsteps of the projects mentioned above.

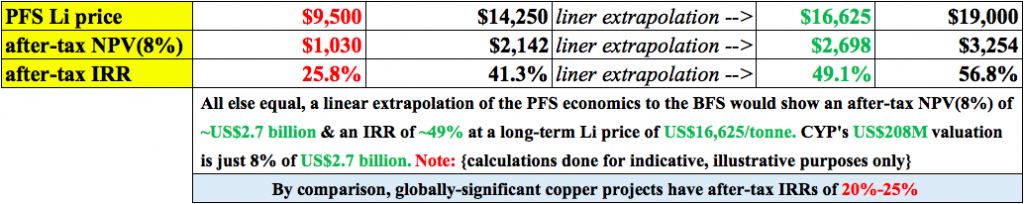

This is a project with a Pre-Feasibility Study (“PFS”) derived after-tax NPV(8%) of ~C$2B and an IRR of 33.6% {at a Li price = $11,875/tonne}. Cypress is one of fewer than 10 publicly-listed juniors with a 100%-owned, globally-significant Li project that could be in operation within four years, fewer still are in tier-one jurisdictions like Nevada, (USA).

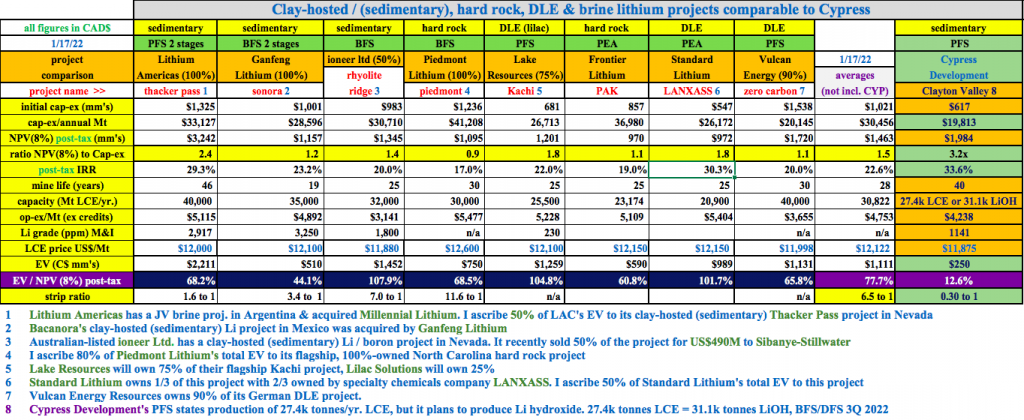

In the chart below, I show eight projects valued at an average of 78% of their after-tax NPV(8%). Note: Pre-revenue metals / mining projects can be valued at > 100% of their NPVs if investors are very bullish on the underlying commodity price vs. the price assumption used in a company’s Feasibility Study.

Cypress Development; valued at a very significant discount to Li peers

Cypress Development’s 100%-owned clay project is valued at just 13% of its after-tax NPV, an 84% discount to the average EV/NPV of peer projects. For comparison purposes, I normalized each project’s long-term assumed Li price to as close to $12,000/tonne as possible.

The chart lists the value of each project, not the value of the company that owns it. I do this because players like LAC & SLI have more than one major project. Others own < 100% of their flagship assets (INR [50%] & Lake Resources [75%]).

To be fair, some of the huge valuation discount can be attributed to funding, strategic partners and time to first output.

LAC is nearly fully-funded for a 40k tonne/yr. Phase 1 operation at its 100%-owned Thacker Pass project. INR has a large partner contributing US$490M to acquire 50% of the Rhyolite Ridge clay project. GF is a top-4 producer, it should be able to deliver the Sonora clay project without too much difficulty.

Cypress is currently raising cash, topping off its treasury to ~C$40M, giving the Company a pro forma Enterprise Value (“EV”) {market cap + debt – cash} of ~C$260M. [pro forma cash = a healthy 15% of pro forma EV, there’s zero debt].

Cypress could soon be a prime takeout target of five much larger Li companies with assets in the U.S. And, a few dozen Li-ion battery makers could have interest in vertically integrating into Li.

Moreover, > 30 auto OEMs around the world have valuations above C$2B, most with big plans for the U.S. EV market. Although I don’t see Cypress being acquired before 2023, nor would I want a takeout anywhere near today’s level, there are a number of investment catalysts on the horizon.

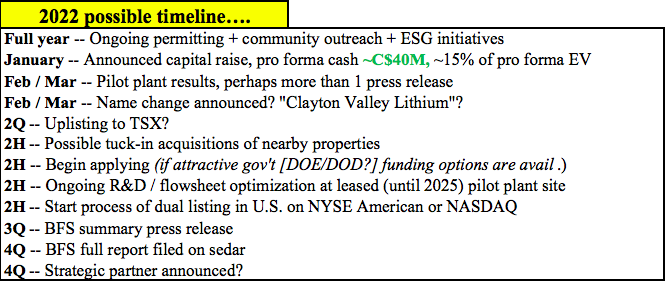

Many investment catalysts this year & next, will patience be rewarded?

One key catalyst is the results of ongoing pilot plant testing of a logistically & environmentally superior operating flow sheet using hydrochloric acid instead of the sulfuric acid leach method utilized in the PFS. All three other clay projects plan to use sulfuric acid.

The site-specific geology & uniform continuity of CYP’s deposit make it amenable to hydrochloric leaching of Li out of clay into solution. Why is this so important? It will avoid the logistics of building a sulfuric acid plant, eliminating the need to receive huge quantities of sulfur (shipped by truck) as feedstock for an onsite acid plant.

Avoiding sulfuric acid will reduce operational constraints that [sulfur + sulfuric acid] handling placed on the Project, allowing management to produce more than the 31.1k tonnes/yr. of Li hydroxide contemplated in the PFS. Cypress will also avoid carbon emissions from trucking sulfur.

The Project could potentially be expanded beyond 31.1k tonnes of hydroxide/yr., as the size of the resource is not a constraint. Cypress has a 6.3M tonne LCE resource in the Indicated category. Just half of that amount would be enough for ~67,000 tonnes of hydroxide/yr. for 40 years.

After pilot plant results are announced, there could be a company name change. How does, Clayton Valley Lithium or, Cypress Lithium grab you? New ticker TSX-V: CLAY? [just joking, I haven’t heard anything about possible names or tickers].

Then, the next really big news will be a BFS in the third quarter. BFS economics will benefit from a considerably higher long-term Li price assumption than the $9,500/t used in the PFS.

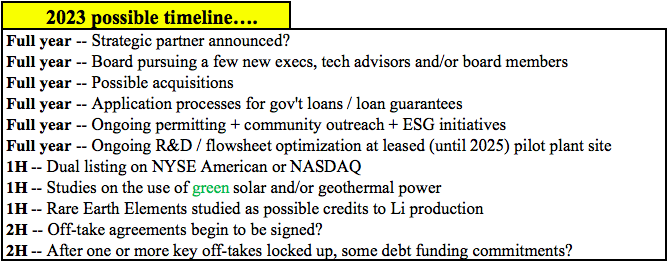

Management is also planning to dual list shares in the U.S. on the NYSE American or NASDAQ. Timing of this exciting move is unknown, but not before the BFS comes out in 3Q.

It should be noted that Cypress is leasing 640 acres ~5 miles north of its proposed mine site. The property hosts geothermal fluids. Could a geothermal power plant be built to support future processing facilities? Could a co-located solar farm + geothermal plant be constructed? Could excess power be sold?

With an EV of ~C$4.3 billion, LAC seemingly trades with high certainty of two mines coming online in 2022 (a brine JV in Argentina) & 2024 (Thacker Pass, Nevada). GF has provided a meaningful stamp of approval of clay projects with the acquisition of its Mexican clay project. Likewise, INR received a major vote of confidence when Sibanye-Stillwater agreed to acquire 50% of its Li-boron clay project.

Yet as measured by EV/NPV, Cypress is valued at a huge discount. After pilot plant results, name change, robust BFS, securing a partner, signing some off-take agreements, dual-listing on the TSX + [NYSE American or NASDAQ] and visibility on funding commitments — I think Cypress Development’s share price could climb a lot higher.

If, on average, peers were to trade +50% higher by 12/31/22 and CYP shares were to triple to $6.15, the valuation discount would shrink from 84% to 68%. Please note, this is NOT a price target, just one of many possibilities with which to frame the valuation disconnect.

Disclosures: The content of this article is for information only. Readers understand & agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Cypress Development Corp., incl. but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Cypress Development Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was originally posted, Peter Epstein owned shares of Cypress Development Corp. and the Company was an advertiser on [ER].

Readers should consider me biased in my view of the Company. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)