This is the third article I’ve written on Arianne Phosphate (TSX-V: DAN) / (OTCQB: DRRSF). I believe this story has near-term catalysts & key investment attributes that investors may not be appreciating.

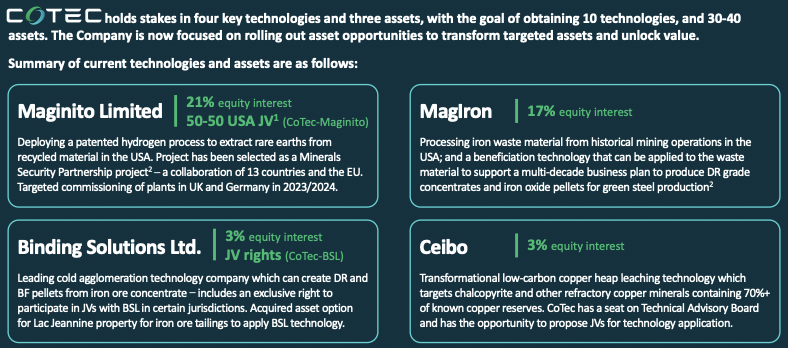

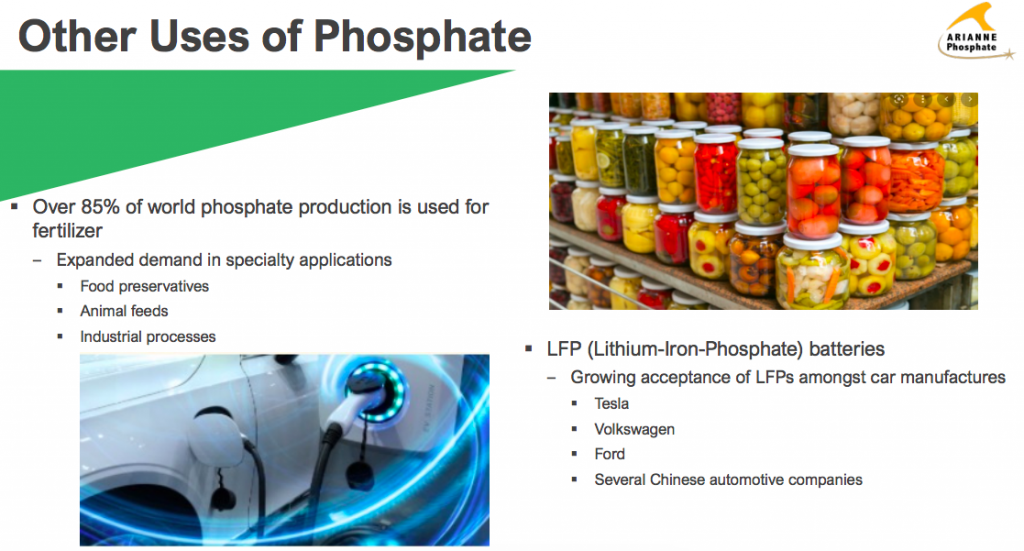

A significant corporate development was recently announced. It was revealed that, “several battery industry participants” have been working with Arianne (for months) on high-purity concentrate derived from phosphate rock sourced at its 100%-owned Lac à Paul project in Québec, Canada.

In the press release, it said test work on its phosphate concentrate is being done under the auspices of an MoU with a “major battery producer.” This could mean a top battery maker valued in C$10’s to C$100’s of billions is considering signing a major off-take agreement.

“Arianne’s high-purity phosphate is ideal for meeting growing demand for phosphate as it’s ideally suited for applications of all kinds; from fertilizers to advanced energy applications. As the project is located in Québec, it responds to the concerns of buyers regarding security of supply; a problem that continues to affect the world’s phosphate markets.”

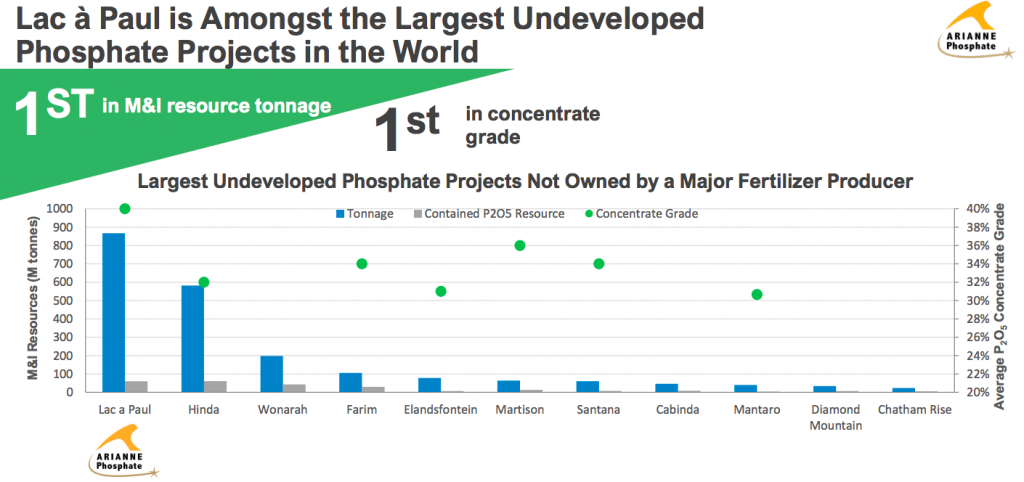

This announcement alerted every battery industry participant & fertilizer player that a very substantial source of the P [in LFP batteries] is up for grabs. There are few (if any) phosphate rock projects with Arianne’s combination of [size + concentrate grade].

Instead of 6 or 8 global fertilizer / Ag companies potentially interested in partnering with, obtaining off-take from, or acquiring all of the Lac à Paul project, there are now a handful of battery firms and perhaps auto OEMs in the hunt. Talk about competitive tension, it just went through the roof.

Arianne has two off-take arrangements, a fully permitted project & a signed Cooperation Agreement with the Innu First Nations. This is a shovel-ready project that could be in production within three years.

Readers might be wondering why Lac à Paul has been slow to advance since its 2013 Feasibility Study (“FS”). A big part of the answer is that the Study was done soon after multiple years of elevated phosphate rock prices. In 2011-2012, the average month-end price was $174/t. Thereafter, the average price fell every year from 2013-to 2019.

By the Spring of 2020, phosphate rock (along with many other commodities) began marching higher. Now it’s near a 9-yr. high, up nearly 150% to $174.13/t on 1/31/22 from $70.75/t on 4/30/20.

Note, for six months (Oct 2008 – March 2009), the Moroccan phosphate price was $450/t. Adjusted for inflation, that’s $585/t today.

Until a few years ago the paradigm shift to LFP batteries for EVs barely existed. Imagine the possibilities for Arianne’s phosphate concentrate pricing. Not only are benchmark prices soaring due to growing fertilizer demand, global inflation & high energy prices — add to that 25%+ long-term annual growth for LFP batteries.

Compare Arianne’s phosphate, priced at ~$200s/t today, to lithium, nickel & cobalt prices in the $10,000s/t. Battery companies, especially those with plants in N. America, could easily afford to pay a 5%-10% premium to lock in reliable, high-purity phosphate concentrate from Canada. Note: {there’s no indication yet that a premium price would be received}

Astute readers may be thinking that demand for phosphate in EVs will not move the needle on price because the phosphate rock market is ~222M tonnes/yr. Phosphate tonnage earmarked for LPF batteries is estimated to be ~5% of the overall market by 2031; ~13M tonnes/yr.

However, not all phosphate rock is amenable to the high-purity standards of EV batteries. Only a fraction of the 222M tonnes/yr. market will qualify. Arianne states in its press release, “a very significant amount of its projected 3M tonnes of annual output” could potentially be sold into higher-value applications.

Readers are reminded that the 2013 FS used a $213/tonne price for 100% fertilizer-grade material. Today, management believes its high-grade phosphate rock might fetch ~$235/t.

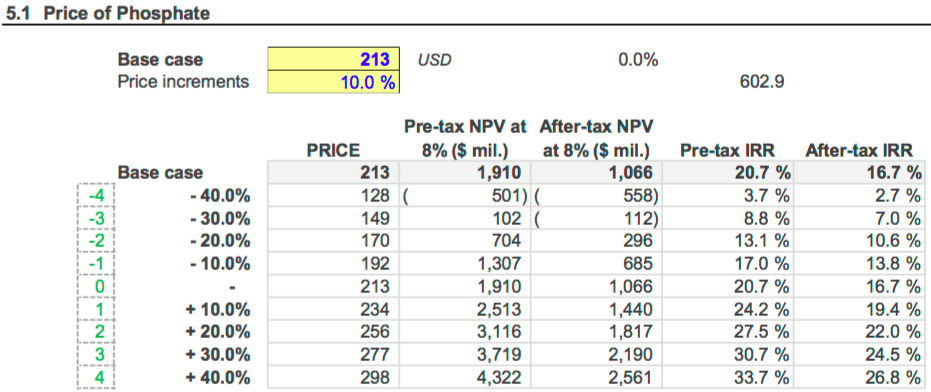

Each $1.00/t change in the phosphate price equals ~$17.5M in after-tax NPV(8%), so a $235/t price vs. $213/t adds $385M to the NPV.

Over a 12-month period in 2011-2012, the average benchmark price was ~$230/t (adjusted for inflation), ~30% higher than the current price of $173.13/t. If the benchmark index were to return to $230/t, that would imply a price for Arianne’s product of ~$300/t.

In the chart of NPV & IRR sensitivities from Arianne’s FS, one can see that at a realized price of $298/t, the after-tax NPV = $2.561B = C$3.27B. Compare that to the Company’s Enterprise Value {market cap + debt – cash} of ~C$118M.

Arianne is trading at ~4% of its pro forma after-tax NPV(8%) — at today’s phosphate price– and ~11% of its base case NPV. This is absurdly cheap compared to similar-stage, world-class natural resource projects.

For example, Skeena Resources’ (PFS-stage) gold project, Nexgen Energy’s (PFS) uranium project, Nouveau Monde’s (BFS/DFS) graphite project & Neo Lithium’s (BFS/DFS) lithium project trade at between ~62% to ~78% of their after-tax NPV(8%).

It should be noted that since 2013, the C$/US$ exchange rate has moved quite a bit in favor of Arianne’s project. Moreover, work done subsequent to the BFS/DFS shows op-ex can potentially be lowered by ~15%. These considerable enhancements are not included in the comparisons.

I argue that Arianne Phosphate (TSX-V: DAN) / (OTCQB: DRRSF) is more advanced than peers because it already has 1) two off-takes in place, 2) a signed agreement with First Nations, 3) ALL permits issued — [the Project’s shovel-ready], and 4) ample regional infrastructure available in a Tier-1 jurisdiction.

Québec Canada is one of the best locations in the world to develop & operate a mine. Management is having discussions with banks, equity providers, equip. financing lenders & royalty / streaming parties to provide up to 75%-80% of the upfront capital needed to reach commercial production.

Securing new off-takes, and/or landing a strategic partner could happen at any time, but sometime this year seems reasonable. Arranging a funding package should be this year’s business as well. These major achievements could propel the share price much higher, especially if the phosphate rock price continues to climb.

Disclosures / Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Arianne Phosphate, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Arianne Phosphate are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Arianne Phosphate was an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)