all figures US$ unless stated otherwise

Despite widespread COVID-19 disruptions since March 2020, the global EV market had a surprisingly strong year in 2020, and 2021 was even better — doubling to 6.3M units. This robust pace caused lithium (“Li”) giant Albemarle (“ALB”) to up its Li demand forecast for the second time in < 12 months.

Above is a slide from ALB’s mid-February earnings call showing 3.2M tonnes of Li Carbonate Equiv. (“LCE”) demand in 2030. Industrywide, the majority of forecasts are now falling in a range of 2.5-3.5M tonnes of LCE/yr. in 2030 or 2031.

Robust demand is no longer even a question, it will outstrip supply in most if not all of the next 10 years.

I’m more bullish on long-term Li demand & pricing than I’ve been on any commodity in my lifetime. Therefore, I continue to like high-risk/high-reward juniors like Cypress Development Corp. (TSX-V: CYP) / (OTCQB: CYDVF).

Cypress owns 100% of the 6.3M tonne (Indicated) sedimentary (clay-hosted), Clayton Valley Lithium Project (“CVLP”) in Nevada (USA).

This is a project with a Pre-Feasibility Study (“PFS”) derived after-tax NPV(8%) of ~C$2B and an IRR of 33.6% {at a Li price = $11,875/Metric tonne (Mt)}. There are fewer than a dozen publicly-listed Li juniors with 100%-owned, globally-significant assets that could be in operation within four years.

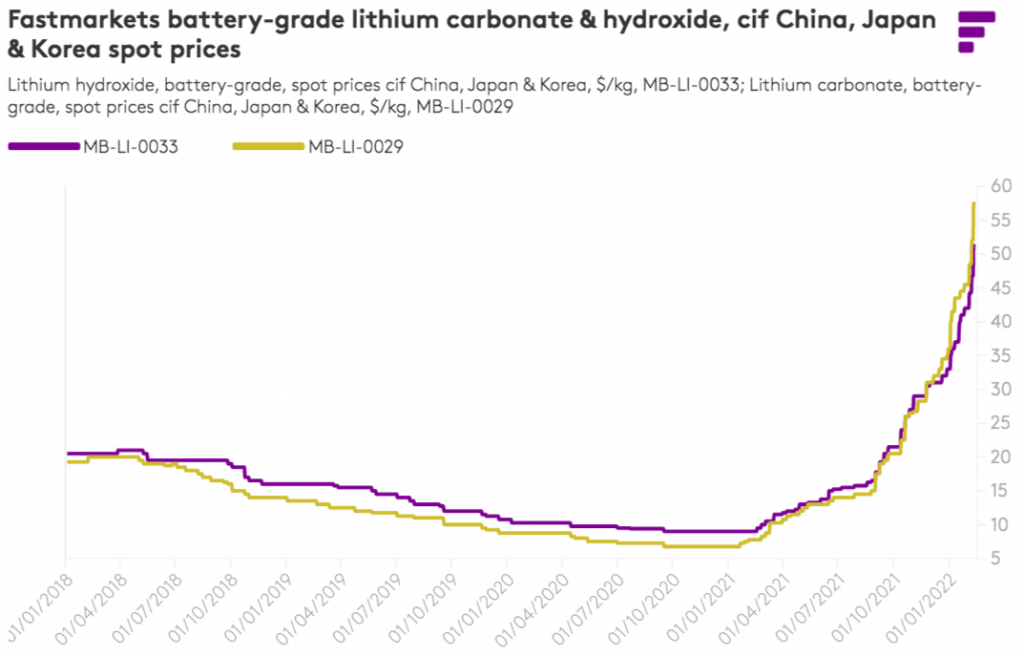

Notice the price assumption of $11,875/Mt in the PFS vs. the current spot price of Li hydroxide in China. Even if the spot price were to fall 75% from $75,150 {S&P Platts Mar. 4th} to $18,787/Mt, it would still be a huge # for Cypress with op-ex of < $3,500/Mt.

Readers may be familiar with Lithium Americas’ (“LAC”) clay project Thacker Pass (“TP”), also in Nevada. TP has twice the resource size, twice the grade, and is nearly fully funded for Phase 1 of a 2 Phase 80,000 tonne LCE/yr. operation.

The CVLP has a much lower strip ratio, proposes to use a different leaching agent, and borders an existing Li operation. This means it might encounter fewer environmental & local community challenges than other mining juniors around the world. The CVLP has not pre-funded any part of construction.

Both the CVLP & TP have completed PFS reports and will have Bankable Feasibility Studies (“BFS”) out later this year. Many believe the CVLP is a few years behind TP. However, if Cypress can secure a strong strategic partner, its speed to market would improve.

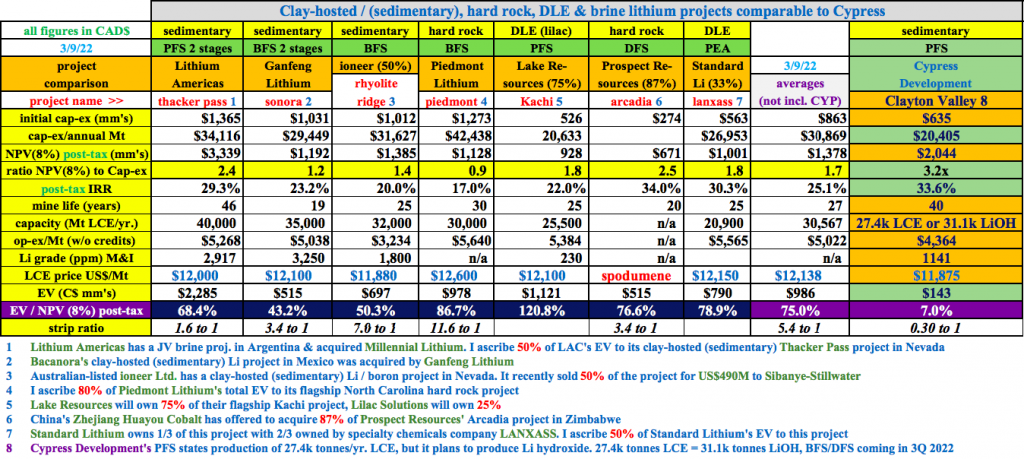

I believe that EVERY technically-sound project that can get permitted in a safe, mining-friendly jurisdiction will get funded & built. As of March 9th, the market was valuing LAC’s TP project at ~C$2.3 billion, but Cypress’ CVLP at only C$143M. This means TP is valued at 16x the CVLP.

That figure assumes TP accounts for 50% of LAC’s total enterprise value, (LAC owns two other Li assets). Should LAC’s clay project be valued 16x higher? Perhaps not…. not with Li prices so incredibly high. Not if Cypress can find a strong strategic partner.

Make no mistake, a large premium valuation of TP over the CVLP is warranted. However, if by year-end LAC were to rally 50% & Cypress executes on key initiatives and rallies 200%, then the valuation gap would be 8x. By no means is this meant to be a stock price target, just an illustrative relative value exercise.

Importantly, management recently raised capital giving the Company a healthy C$40M in cash. At current levels, cash is 28% of the total enterprise value {market cap + debt – cash}. This strong balance sheet will fund pilot plant work, permitting & other studies, and delivery of a BFS in the 3rd quarter.

Speaking of funding, in a recent interview of LAC’s CEO, he said his company is applying for a U.S. Dept. of Energy loan, at roughly a 3.0% interest rate, for 50%-60% of total upfront project cap-ex. I’m hoping Cypress will embark on a DOE loan application as well, perhaps after it finishes its BFS.

No clay project has ever reached commercial-scale production, but that’s about to change. In addition to TP, Australian-listed ioneer ltd. (partnered with Sibanye-Stillwater ) has a BFS-stage Li-boron clay project, and Ganfeng Lithium has a clay asset in Sonora, Mexico.

All three should be online by 2024 or 2025, with Cypress & [add partner name here] to follow thereafter.

Below are seven projects valued at an average of 75% of their respective after-tax NPV(8%)’s. For comparison purposes, I normalized each project’s long-term assumed Li price to as close to $12k/Mt as possible. The CVLP is valued at just 7% of its after-tax NPV, a 90% discount to the average EV/NPV ratio of peer projects.

The chart lists the value of each project, not the value of each company. I do this because some companies have more than one major project and others own < 100% of their flagship assets.

Having three clay start-ups potentially launching ahead of Cypress will provide CEO Dr. Bill Willoughby and his team with a tremendous amount of valuable data to work with, paths to follow, and mistakes to avoid.

It’s important to understand that each of the four clay projects has similar, but unique geological formations. The other three plan to produce their own sulfuric acid for leaching, which will definitely work, but Cypress believes they’ve developed a better mousetrap.

It may be that Cypress is the only player that can benefit from using hydrochloric instead of sulfuric acid, which is an important factor in its favor.

With at least two aspiring Li companies in Nevada both looking to truck elemental sulfur to be burned in custom-built acid plants, and a third junior; Australian-listed Jindalee Resources just across the border in Oregon — there’s a risk of supply constraints and/or periods of sulfur price volatility.

Cypress believes that using hydrochloric acid will be logistically less challenging (no trucks of sulfur coming & going). Fewer trucks = lower emissions, a greener solution.

Dr. Willoughby points out that the project size in the PFS was dictated in large part by sulfur/sulfuric acid handling. With a new flowsheet annual production of 27.4k tonnes carbonate, or 31.1k tonnes hydroxide, could be increased.

Unlike brine projects that take three years (or longer if done in stages) to reach nameplate capacity, the CVLP can be ramped up to a meaningful production rate in a year.

To be fair using hydrochloric acid will require significantly more power than sulfur-based leaching methods, but Cypress hopes to mitigate that by running partly or largely on solar and/or geothermal power. Management controls a nearby 640-acre parcel that hosts geothermal fluids.

If upfront cap-ex is a concern, a three-phase approach of (for example) 15k / 30k / 45k tonnes LCE/yr. could be adopted. But, if a strategic investor enters the picture — I imagine that ramping up to 45k (or more) tonnes/yr. in one or two phases would be possible.

In recent video presentations, Dr. Willoughby has said that the BFS will target ~30k tonnes LCE/yr. That equates to ~34k tonnes Li hydroxide (Cypress will be able to make either carbonate or hydroxide).

If the Company were to sell 34k tonnes/yr. at $20k/Mt, that would generate ~C$700M in EBITDA per year. Yet today’s enterprise value = C$143M (incl. C$40M in cash, no debt).

If the Li market remains stronger for longer, Cypress could (in some years) be delivering into contracts priced at > $24,000/Mt. I know it sounds crazy, but Cypress @ 34k tonnes of hydroxide/yr. could potentially generate above C$1.0 billion of EBITDA in peak years.

That prospect should be extremely compelling to prospective partners or acquirers.

In the opening paragraphs, I mentioned ALB’s 3.2M tonne LCE/yr. demand estimate for 2030. ALB also estimates demand of 1.5M tonnes in 2025. If true, the market will remain extremely tight as nearly a million extra tonnes/yr. will be needed.

Cypress Development Corp. (TSX-V: CYP) / (OTCQB: CYDVF) is well-positioned to deliver a BFS & secure a strategic/financial partner during a period of all-time high Li prices, while advancing a project in the U.S. at a time of ever-greater security of supply & ESG concerns.

And, on top of it all — it trades at an extreme undervaluation to peer projects.

Disclosures / Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about CYPRESS DEVELOPMENT CORP, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of CYPRESS DEVELOPMENT CORP are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, CYPRESS DEVELOPMENT CORP is an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)