Readers might be surprised at the number of silver (Ag) & gold (Au) juniors listed in N. America…. over 1,600. Of those I estimate 10%-15% are currently in production. However, starting from a greenfield property, the chances of making it are well under 5%.

Why does production matter so much? Look at the year-to-date price action in thermal coal +150%, nickel +142%, lithium carbonate +78%, and palladium +55%. I point out these huge moves because they’re becoming commonplace.

Compare those commodities to Ag & Au up 10% & 8%. Goldman Sachs just increased its 3 & 6-month US$/oz. forecasts on Au to $2,350 & $2,500/oz.. How realistic is $2,350/oz.? It’s another 18% above today’s spot price, so certainly within reach.

The war on Ukraine is creating terrible turmoil across Europe with no easy answers or near-term solutions. Global uncertainty often drives investors into hard assets like mining juniors.

Federal banks across the globe will likely continue printing money with no end in sight. Over time, this inflationary pressure is bullish for precious metals.

Being in production, vs. (possibly) reaching production in a few years, matters a lot as prices soar. Non-producers face exploration & development cost increases, with no offsetting earnings, leading to incremental equity dilution.

Guanajuato Silver [GSilver] (TSX-V: GSVR) / (OTCQX: GSVRF) is a great junior precious metals company to own, especially with Ag & Au prices moving higher.

Recent global events demonstrate that readers should pay closer attention to where a company’s operations are located. The U.S., Canada, Mexico, Australia & Scandinavia are among the best places. However, China & Russia rank #1 & #3, respectively in annual Au production. Ghana, Uzbekistan, Indonesia & Sudan are in the top-12.

For Ag, the supply situation is far better. While China, Russia & Bolivia are among the top-10, Mexico is #1. Peru & Chile are ranked #3 & #4, but even S. America is risky these days.

Chile is rewriting its constitution & politicians are openly talking about nationalizing companies. Both countries face water, local community & ultra-high site elevation (3,500+ m) challenges.

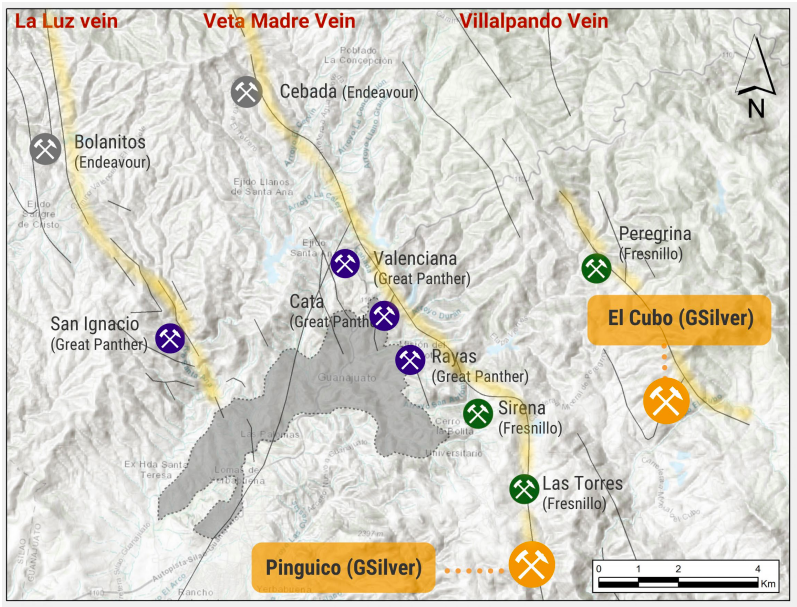

Speaking of Mexico, GSilver operates there. It’s not without risks, there’s been commentary on nationalizing lithium companies, but with its Ag mining industry #1 in the world, most pundits think precious metals will remain largely untouched. Taxes & royalties could go up, probably not by a lot, but that’s happening everywhere.

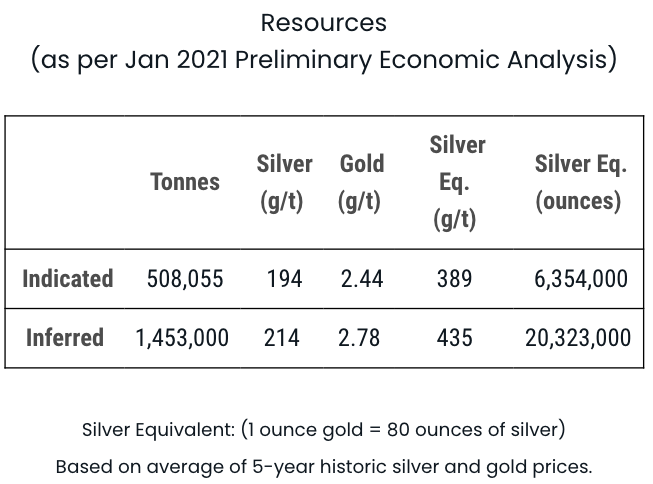

Depending on diluted head-grades going into the Mill & recoveries coming out, I believe 2022 production at GSilver’s El Cubo Mine Complex could be ~1.7M Ag Eq. ounces. If all goes reasonably as planned, 2023 will be significantly more profitable as GSilver works out operating kinks & optimizes the sequencing of ores.

Importantly, CEO James Anderson and his team believe they will be able to run El Cubo more efficiently than Endeavour Silver did.

In addition, there’s the possibility of acquiring stranded deposits and/or partnering with third parties under toll-milling arrangements. Readers are reminded that when Endeavour last operated El Cubo in 4Q 2019, silver was around $16-$17/oz. Now, it’s ~$26/oz.

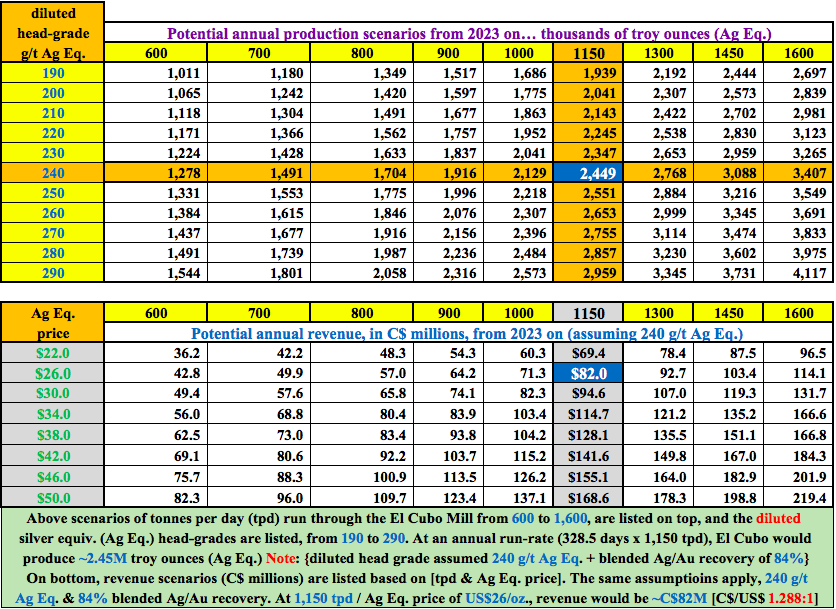

In the chart above are scenarios of possible outcomes for CY 2023. At an average run-rate of 1,150 tonnes per day (tpd), [90% of the year (328.5 days)] recovering a blended 84% of Ag + Au, an avg. head-grade of 240 g/t Ag Eq. and a $26/oz. Ag Eq. price — gross revenue would be C$82M & EBITDA (35% assumed margin) C$28.7M.

At 1,300 tpd next year, all else equal, but with a 40% EBITDA margin — revenue would be C$92.7M & EBITDA C$37.1M. While that annual EBITDA gain from $26 to $34/oz. pricing is not that exciting, higher pricing & margins would presumably boost GSilver’s cash flow multiple.

Moreover, higher earnings would allow mgmt. to pay down debt quicker & reduce the # of shares needed to be issued for acquisitions.

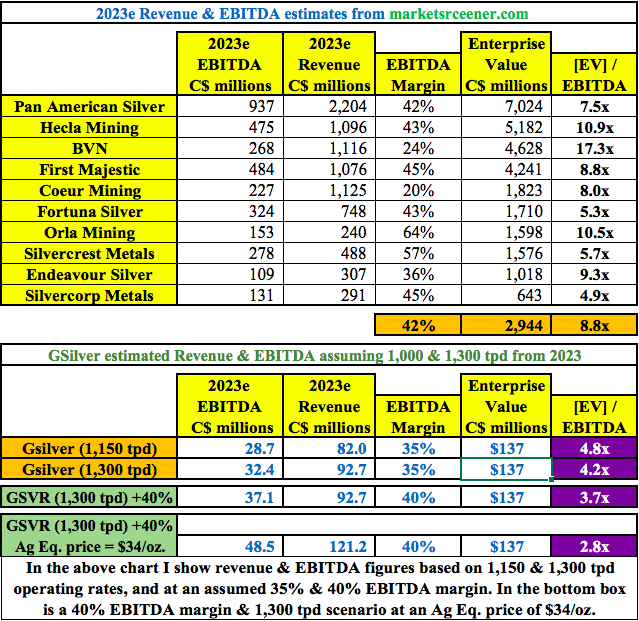

A few months ago I would not be pointing to $30+/oz. from 2023 on as a realistic scenario, but it seems a lot more reasonable now. The chart below shows several possible paths of revenue, EBITDA, and resulting 2023e EV/EBITDA multiples. GSilver trades at about half the peer average multiple of 8.8x.

However, the story does not end here. Peers in the chart are more established, but they’re growing slower than GSilver. In addition to internal expansion, CEO Anderson has made it clear that he and his Mexican team are growing the Company into a robust district-scale producer.

It’s my understanding that news on the M&A front could land within weeks. GSilver’s in-house geological team has been working non-stop for months outlining a number of attractive opportunities beyond just a single acquisition.

There are past producing (brownfield) mine sites to consider, various mining assets, extensions of existing owned properties, and surface work on underexplored areas across the Guanajuato district.

Now that the 100%-owned El Cubo Mine Complex is successfully up & running at ~1,000 tpd, any good grade ore that can be added to the mix will bring down unit operating costs, thereby enhancing margins.

This means select opportunities that are too small and/or in need of upgrading can profitably be integrated into GSilver’s mine plan. But, only the right assets at the right price at the right time.

Along the way, a lot of drilling will be done at El Cubo & El Pinquico, including three shallow holes in May/June towards the district’s extremely prolific Mother Vein. These holes will test for structure. If they hit the right markers, deeper holes will be aimed at where the heart of the Mother vein system is interpreted to be.

Depending on what properties, projects & mining assets can be prudently acquired, 2023’s production profile could be enhanced beyond what I outlined earlier. And, 2024 could be substantially more profitable than 2023 (more production & a higher EBITDA margin).

It seems very likely that Guanajuato Silver (TSX-V: GSVR) / (OTCQX: GSVRF) will enjoy the strongest growth among peers in the 3-yr. period 2022-2024 (albeit from a low base). Even though mgmt. has executed very well over the past year, I honestly believe the best is yet to come.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Guanajuato Silver, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Guanajuato Silver are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned stock in Guanajuato Silver and the Company is a former advertiser on [ER].

While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will be (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)