all dollar amounts in US$ unless indicated otherwise

On June 21st Arianne Phosphate (TSX-V: DAN) / (OTCQX: DRRSF) announced positive results from third-party testing of its high-purity phosphate concentrate for use in technical-grade phosphoric acid suitable for EV batteries & residential Energy Storage Systems (ESS). This exciting news comes six months after testing began.

Although not a surprise, this represents yet another significant de-risking event for the Company’s 100%-owned Lac à Paul project in Quebec. The doors are now wide open for other EV/Battery makers to feel confident in talking with Arianne about securing phosphate concentrate off-take agreements and/or becoming a strategic partner.

Importantly, this ratchets up the competitive tension for ALL companies, in all sectors, that might want to collaborate with Arianne or become a key customer. I’ve been told since late last year that banks want to see a few more high-quality, long-term off-take agreements before committing capital. I strongly believe this latest news will facilitate new agreements.

Yesterday’s announcement arrived soon after the news of Michael Gentile being appointed a strategic advisor, advising the Board on capital markets and discussions with financial partners & investors. Mr. Gentile purchased 4M shares of Arianne in the open market (in a pre-market cross) at C$0.53.

Mr. Gentile is a leading strategic investor in the small/medium cap metals & mining sector and is an adviser to Arizona Metals & Geomega Resources. He’s also a director of Northern Superior Resources, Roscan Gold, Radisson Mining & Solstice Gold. Mr. Gentile co-founded an investment management firm based in Montreal.

Michael has already begun to introduce Arianne’s team to prospective investors, working closely with President/Director Brain Ostroff, to convey the Company’s compelling investment thesis.

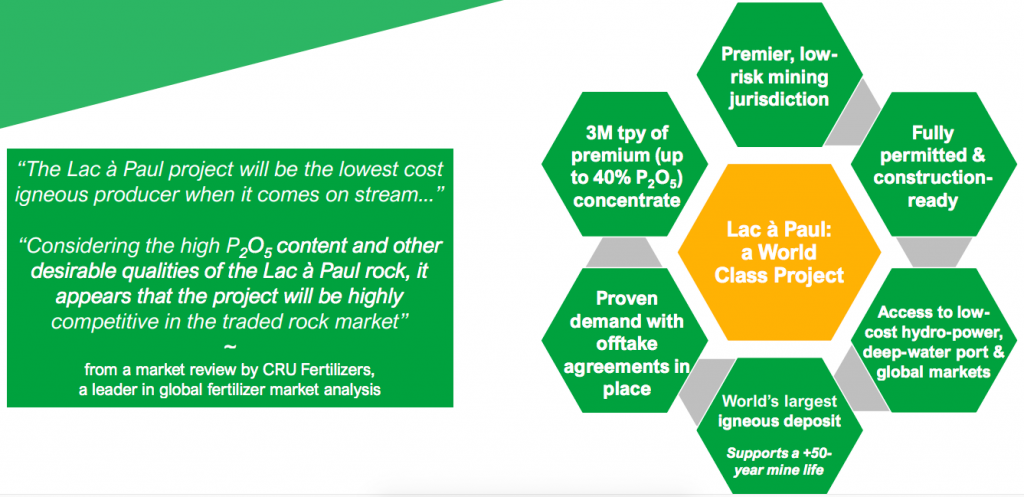

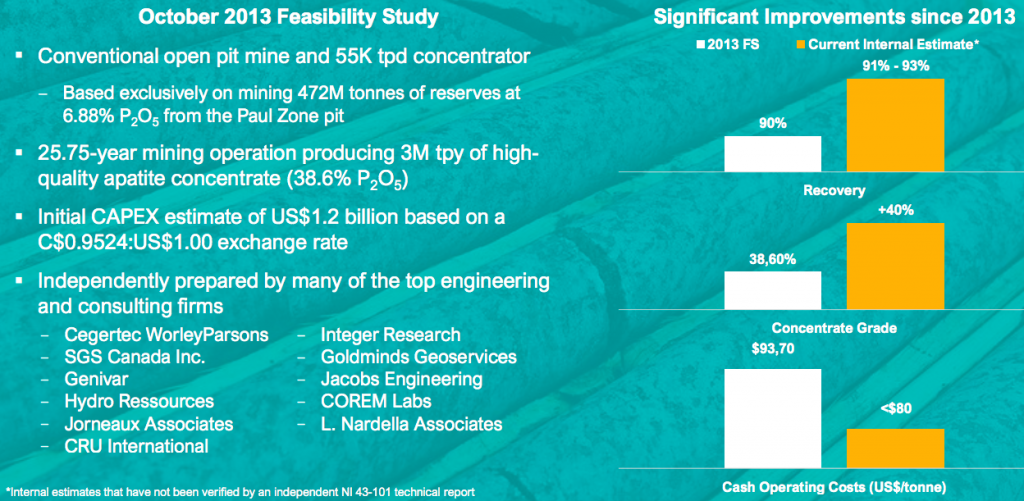

Despite an advanced stage of development, Arianne is valued at ~5% of its Bank Feasibility Study (BFS)-derived pre-tax NPV(8%). However, since the BFS was done, management successfully increased anticipated recoveries to ~92% and concentrate grade to ~40%, while lowering prospective op-ex from $93.70 to < $80/tonne (t).

Cost inflation on materials, energy, labor, etc. will increase cap-ex & op-ex above what’s contained in the BFS, but those increases would be somewhat offset by a large positive move in the C$/US$ exchange rate if the BFS were to marked-to-market for changes since it was done in 2013.

Using current phosphate prices (north of $300/t adjusted for Arianne’s high-purity rock), Arianne is valued at ~3% of pre-tax NPV… That’s 3% for a project in Quebec that has a BFS, is shovel-ready with a Cooperation Agreement with the Innu First Nations, all key permits granted, strong provincial support, and two off-take agreements in place.

Notably, many BFS-stage projects have NPVs calculated using a 5% discount factor. At spot pricing and a 5% discount rate, Lac à Paul is valued at closer to 2% of NPV. Even after a brutal sell-off in junior miners, peer advanced-stage projects are valued at 20%-50% of their NPVs.

Given this substantial valuation disconnect — due in large part to investor fatigue — I firmly believe that shares of Arianne Phosphate could soar as soon as this year, and still have room to run further upon additional advances towards production.

It’s hard to imagine a better fundamental backdrop for phosphate rock than what we’re seeing today. As of May 31st, the benchmark (Morocco 70% BPL) price sits at a 13-yr. high of $255/t (up 260% since April 30, 2020) and Russia’s war on Ukraine is making the security of food/fertilizer supplies critically important.

The market was already becoming tight before inflation began to soar and Russia’s February invasion. Taken together with China’s export halt of phosphate fertilizers — rising food/fertilizer prices will remain front & center in the news.

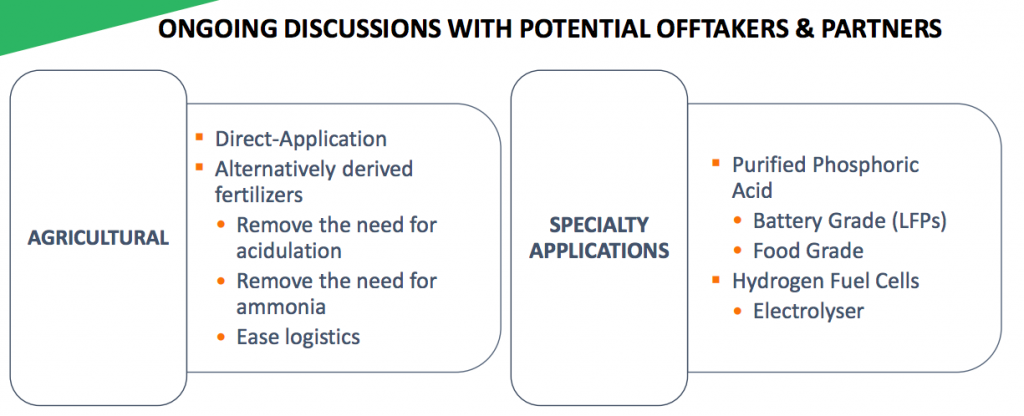

Rapidly growing demand for high-purity phosphate concentrate in Lithium Iron Phosphate (LFP) batteries for EVs, — and for residential energy storage systems — support the continuation of a multi-year bull market.

LFP battery chemistry has been established as the go-to battery for most standard range EVs, (low & medium-priced, non-luxury sedans). As a globally significant development project in Quebec, the provincial government and regional investment groups have indicated they want to be part of the funding process.

Arianne is having meaningful conversations with lenders including traditional mining finance banks, Export Credit Agencies, and equipment financing companies.

But wait, there’s more… Arianne’s concentrate is also being studied to be applied directly onto fields (without first being upgraded by fertilizer giants into end products like MAP & DAP) and in innovative alternative fertilizer formulations.

All of these new uses could deliver enhanced margins compared to conventional concentrate sales to Major fertilizer companies.

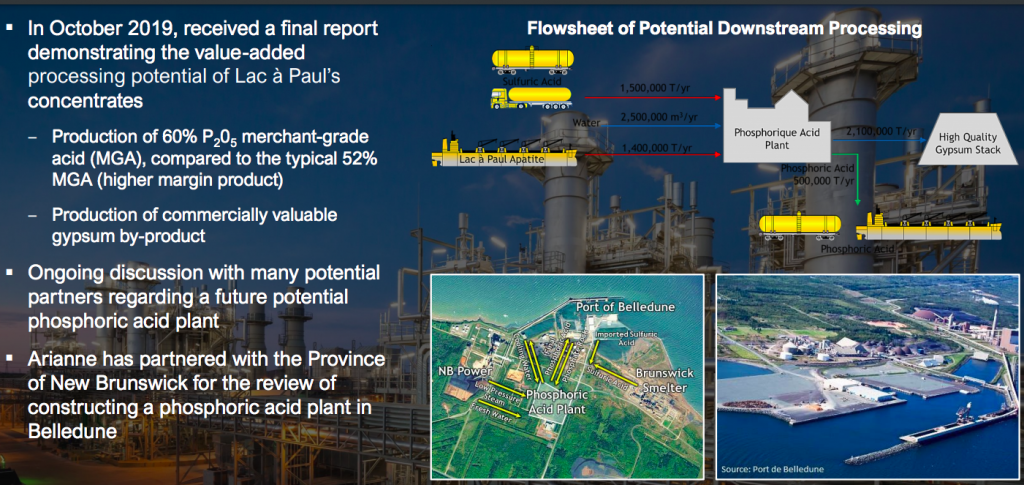

Management could also be negotiating downstream processing facilities with the potential to produce 60% P2O5 (merchant-grade acid). This would be a premium product vs. the benchmark 52% grade. To the extent that Arianne can share in the economics of a phosphoric acid plant, that would be additive to the financials contained in the BFS.

LFP batteries, energy storage, direct fertilizer applications & alternative fertilizers are making Arianne’s phosphate much more desirable & valuable. Readers are reminded that the long-term price assumption in the BFS was $213/tonne.

Today that price would be north of $300/tonne, which {all else equal} would re-value the NPV to ~$4 billion vs. a current Enterprise Value {market cap + debt – cash} of ~C$124 million.

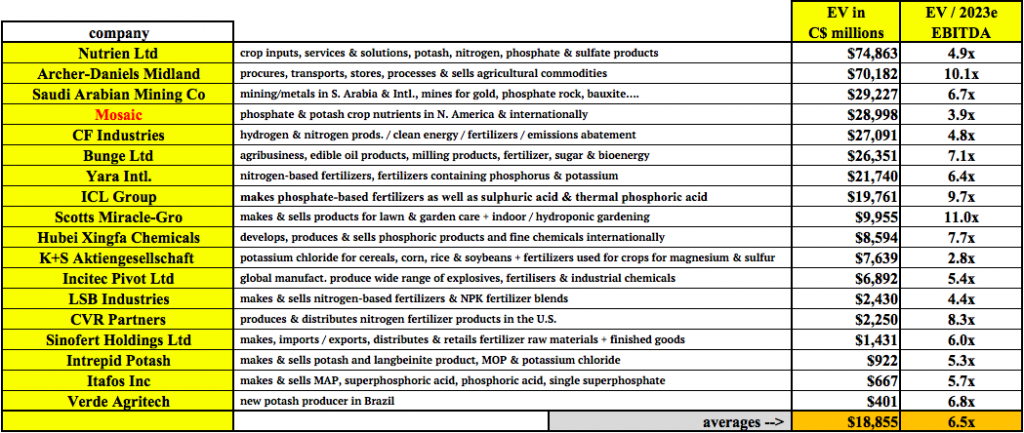

In a prior article I wrote, the following chart showed an average EV/EBITDA ratio of 10.3x. Today the average has fallen to 6.5x, but I expect valuations to strengthen as the broader stock markets recover. Notice that Mosaic’s valuation is low at 3.9x EV/2023e EBITDA.

Mosaic is printing money in this fertilizer market environment. Next year alone it’s poised to earn 3x the free cash flow it would need to acquire Arianne outright for say C$400M AND fund US$1.2 billion+ of cap-ex.

By investing < C$2.0 billion, Mosaic with an enterprise value of nearly C$30 billion could take full control of Lac à Paul, develop it, and be generating ~C$700M in EBITDA/yr., (at today’s prices) — for decades. There are at least a dozen publicly-traded Ag/Fertilizer companies that could make a run at Arianne.

Including EV/battery companies, there are dozens of prospective acquirers. Benchmark Mineral Intelligence tracks nine Tier-1 EV battery makers, plus another nine Tier-2 suppliers. I believe all 18 are multi-billion dollar companies or subsidiaries.

Since the 2013 BFS in which a high long-term price assumption (at the time) was chosen, phosphate rock prices fell for seven years before turning higher starting on April 30, 2020.

Price increases have accelerated in recent months. How much higher could prices go? The Moroccan benchmark I mentioned earlier hit an all-time high of $450/t (for six months in a row) from late 2008 to early 2009.

Adjusted for inflation, that $450/t figure is equivalent to $612/t in today’s dollars. I’m not suggesting prices are headed above $600/t vs. the 5/31/22 price of $255/t, but crazier things have happened, and inflation this year at ~7%-8% is double the rate of 2008-09.

The planets seem aligned for a re-rating in Arianne Phosphate’s (TSX-V: DAN) / (OTCQX: DRRSF) valuation. Of course, there’s no certainty the share price will climb, and no telling when it might move, but a re-rating could certainly happen this year, especially if beaten down fertilizer and other natural resource (gold, copper, coal, uranium, lithium, etc.) juniors rebound.

Disclosures / Disclaimers: The content of this interview is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Arianne Phosphate, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Arianne Phosphate are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Arianne Phosphate was an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)