Maritime Resources (TSX-V: MAE) / (OTCQX: MRTMF) is an advanced-stage gold development company that will release the results of a third-party Bank Feasibility Study [BFS] in the next few weeks. Its 100%-owned Hammerdown (HD) project is in the fantastic mining jurisdiction of Newfoundland & Labrador (NL) in eastern Canada.

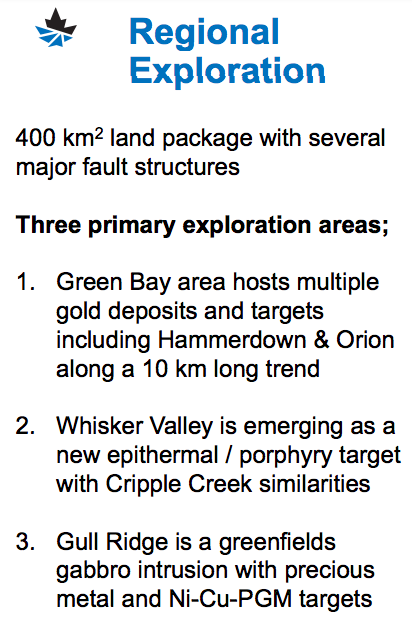

The Project is on the same property that hosted one of Canada’s highest-grade mines (15.8 g/t gold in the early 2000s). Importantly, there’s substantial long-term exploration potential on the Company’s 400 sq. km land package where numerous mineralized zones have been identified.

NOTE: All figures are US$ unless indicated otherwise.

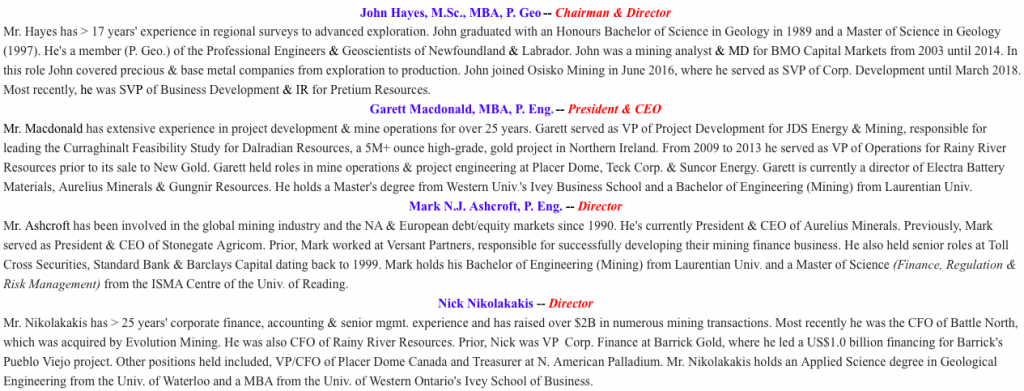

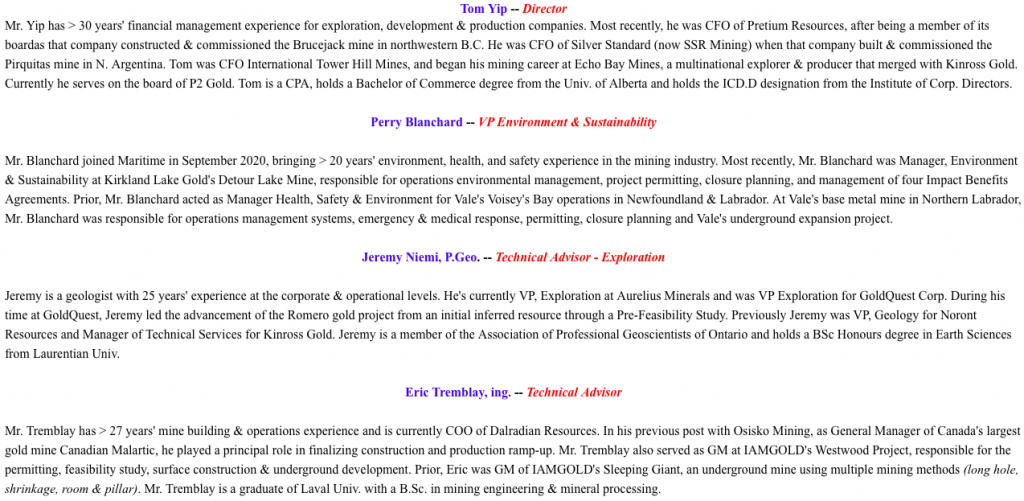

Maritime has a tremendous mgmt. team/board {see bios above & below}. Execs held (or currently serve in) CEO/COO/CFO/GM/Dir. roles at Vale, Barrick, Kinross, Teck, IAMGOLD, Kirkland Lake [acquired], SSR Mining, Pretium, Osisko Mining, Rainy River Resources [acquired], Aurelius Minerals, and others.

This is a team with a stellar track record and expertise in finance, capital markets + M&A.

Hammerdown is in the well-established Baie Verte Mining District and has cleared its provincial environmental assessment. The Project is surrounded by regional infrastructure [roads, water, power, etc.], skilled labor & mining services. Two mines + two mineral processing plants are operating in the district.

The Company has a non-core project {Lac Pelletier [LP], in Quebec} that mgmt. is trying to monetize. LP has a 226k oz. Measured + Indicated + Inferred resource grading nearly 4 g/t gold. In my view, LP should be worth C$5M+ as it’s permitted for 1,000 tpd of direct ship production.

Maritime Resources‘ $13M valuation; absurdly cheap vs. peer near-term producers…

Despite many favorable attributes, Maritime’s enterprise value [EV] {market cap + debt – cash} is $13M, an absurdly cheap valuation for a company with a BFS-stage Canadian project expected to reach production by the end of next year.

A prospective mine plus 100% ownership of the gold plant (CIP circuit) at the Nugget Pond mill that last operated at 95% recovery rates. CEO Garett Macdonald thinks it would take 4-5 years to design, permit, fund, construct & commission a new mill + associated tailings facilities.

Upfront capital to reach initial production is expected to be < $80 million, and op-ex (all-in) < $1,000/oz. in the upcoming BFS. That would compare quite favorably to today’s gold price of ~$1,715/oz. [Note: the All-In Sustaining Cost [AISC] in the 2020 Preliminary Economic Assessment [PEA] was $938/oz.]

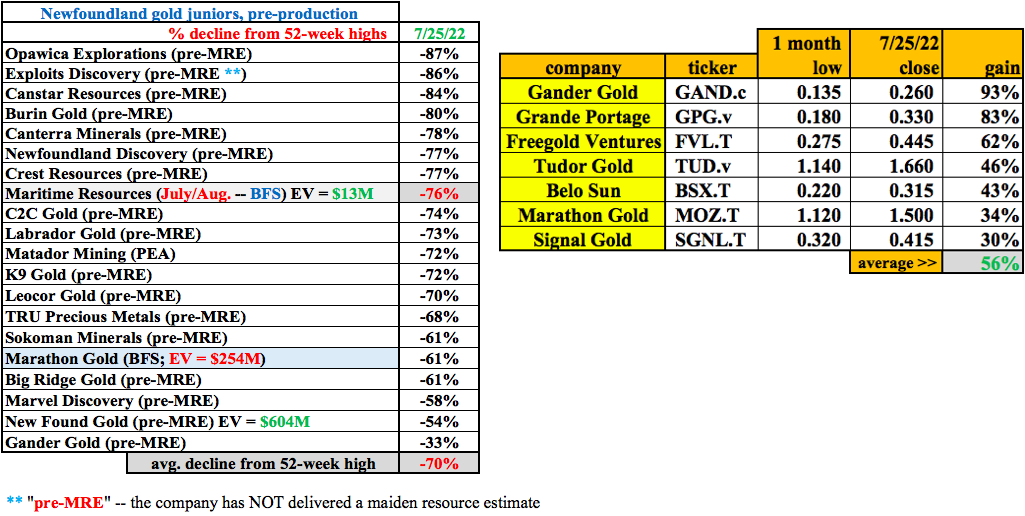

As of July 25th, a group of 20 Newfoundland gold juniors I’m tracking is down an average of 70% from 52-week highs. Despite being more advanced & de-risked than most NL and other Canadian peers, Maritime is more oversold. This introduces a compelling (albeit speculative) investment opportunity.

In the past month, I’ve noticed a number of gold juniors enjoy substantial rebounds. Included in the rebounders are Marathon Gold, Signal Gold & Gander Gold — all of which are Newfoundland-focused. Signal Gold is in small-scale production so it was not included in the list of 20.

These recent gainers are up an average of 56% from one-month lows. If Maritime were to gain 56% from its low, it would hit C$0.07. Hardly a stretch as shares traded as high as C$0.075 in June. As I write this sentence on July 25th, the stock is trading at its 52-wk low of C$0.045.

A knock on the Maritime story is that HD’s resource is small at one million ounces. However, with the help of a strategic partner or in the hands of a cashed-up producer, the resource could grow substantially, {including possible new discoveries} and more rapidly than with capital-constrained exploration campaigns.

Significant exploration upside + low cap-ex to reach production NEXT YEAR…

How much would a buyer be willing & able to pay for a high-grade mine & gold circuit entering production within 18 months that could eventually be ramped up to 100,000 oz., perhaps 150,000 oz./yr. — (if drilling/new discoveries can substantially increase resources)?

In my view, an acquirer could add 100,000-150,000 oz./yr. at a very attractive cost. As mentioned, Maritime’s EV is $13M. An acquirer would have to pay a multiple of this temporarily depressed valuation, but combined with upfront capital to put HD into production, the total investment would be < $150M.

Note: {there would be additional cap-ex needed to expand the mill, mining equipment & tailings facilities to accommodate 100k-150k oz./yr., a production level well above the 57,900 oz. starter mine outlined in the PEA. However, that incremental cap-ex could be funded from internal cash flow}

Roughly speaking, if HD could produce 100,000 oz./yr. at a prospective $715/oz. margin, (assuming an AISC of ~$1,000/oz.) that would be ~$71.5M/yr. in profits. If the longer-term gold price is closer to $2,000/oz. than today’s $1,715/oz., that would generate $100M/yr. in cash flow, or $150M/yr. @ a run-rate of 150k ounces.

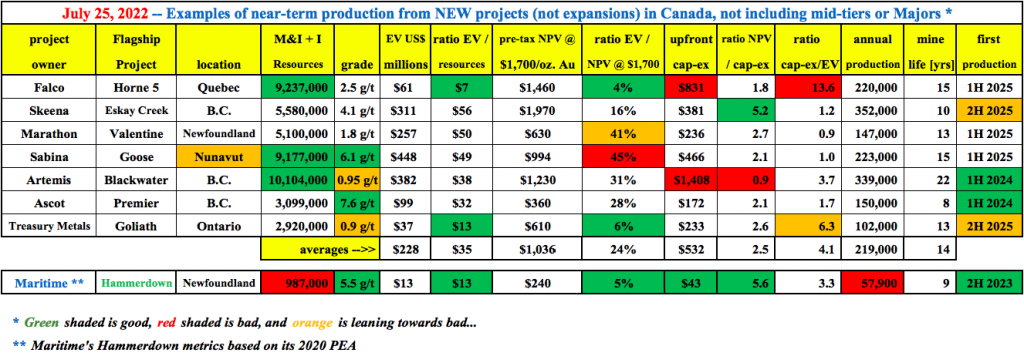

Including HD, about ten other Canadian gold mines are forecast to start in the next four years. These new operations will be larger, but HD’s project has the 3rd or 4th highest grade.

In the chart below of new projects coming only from gold junior miners, notice the average production rate & mine life is 219k ounces over 14 years and the average project valuation is $228M.

Maritime’s Hammerdown project appears undervalued…

Make no mistake, with its smaller scale Maritime does not warrant an EV near $228M anytime soon. However, if one imagines (as a strategic partner or acquirer would) ramping up to 150k ounces over time, that would make it as large (or larger) than three of the prospective mines on the chart.

Moreover, HD will reach initial production ahead of the pack, AND it boasts the highest ratio [5.6:1] of enterprise value divided by upfront cap-ex. Speaking of cap-ex, $43M is NOT a scary number to try to fund with a combination of debt, equipment financing, streaming/royalties & equity.

Readers are reminded that I’m adjusting the PEA’s AISC figure of $938/oz. up to an estimated $1,000/oz. to reflect project inflation to be captured in the BFS. The other projects in the chart do not fully (if at all) incorporate recent inflationary pressures.

Importantly, the larger HD gets, the more economies of scale would kick in to reduce the AISC from my estimated~$1,000/oz. level.

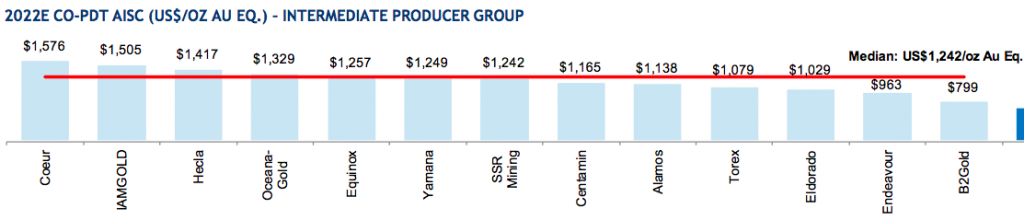

BMO shows the following chart of 2022E AISC. The average for Coeur Mining, IamGold, Hecla Mining, OceanaGold, Equinox, Yamana & SSR Mining = $1,368/oz Au Eq. These companies would benefit from adding a sub-$1,000/oz. mine. Gold Major Newmont Mining just revised its full year 2022 AISC guidance to $1,150/oz. Au Eq.

The beauty of HD having such a low upfront cap-ex hurdle is twofold. Since $43M should be fairly easy to fund, cash flows in 2024 & 2025 could be deployed to aggressively explore the 400 sq. km property AND then increase production.

For readers worried about the low share price and the potential for equity dilution, remember that management is trying to sell its Lac Pelletier project, which could bridge the Company to a better gold market and a higher share price. That and non-equity capital alternatives are being pursued.

Securing a strategic partner or selling a minority stake would be a MAJOR de-risking event

Since Maritime is debt-free and has done no streaming transactions thus far, it could execute a small streaming deal to mitigate the need for near-term equity capital. There are dozens of small-to-medium-sized streaming companies competing for assets. Production in 2023 is especially attractive to these players.

Another scenario would be to sell a minority stake in HD for enough cash to fully-fund Maritime’s portion of upfront cap-ex plus all other company needs (exploration, G&A, etc.) through positive free cash flow in 2024.

At today’s valuation of $13M, (C$0.045/shr. on July 25th) Maritime Resources (TSX-V: MAE) / (OTCQX: MRTMF) is valued as if it’s out of options, facing a life or death situation. However, this simply is not the case as the Company owns 100% of a high-grade (soon-to-be) mine in a great location.

A mine with substantial exploration upside, a valuable & strategic gold circuit, and multiple equity + non-equity funding prospects to bridge to positive cash flow and self-fund growth.

In a better market, as gold companies bounce back, some will soar more than others. I believe that Maritime Resources has the potential to be one of the stronger performers over the next 12-24 months.

Disclaimers/Disclosures: Peter Epstein of Epstein Research [ER] has no current or prior relationship with any management team or board member, and no current or prior dealings with Maritime Resources or any company mentioned above. The views contained herein are solely those of [ER] and are based 100% on publicly available information such as SEDAR filings, Maritime’s presentations, conversations with shareholders & peer company analysis.

Peter Epstein of [ER] should be considered biased as he owns shares of Maritime Resources acquired in the open market.

Although [ER] is bullish on the prospects of Maritime Resources, it’s possible that [ER] is wrong about the Company in one or more key respects. [ER] could be wrong about future environmental or permitting challenges. [ER] could be wrong about the considerable exploration upside on Maritime’s properties (as indicated by mgmt.). An investment in Maritime Resources is highly speculative, readers could lose all, or substantially all, of their investment. Please consult with trusted financial advisors before making investments in high-risk stocks.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)