Is C*O*A*L” still a dirty word in investment circles? Yes & no. Over the long-term (decades, not years), thermal coal — burned to generate electricity — is unquestionably in secular decline. If nuclear power could scale up faster, it would hasten the demise of fossil fuels. But, there’s much more to the story…

There are two main types of coal; thermal & steelmaking or coking coal (used to manufacture steel). Thermal coal is being phased out, albeit very slowly. Burning BOTH thermal & steelmaking coal is bad for the environment, but I firmly believe that coking coal is a necessary evil.

There are no scalable and affordable alternatives for coking coal in blast furnaces. The problem is that any greener method comes with its own set of issues.

Global decarbonization is impossible without tremendous amounts of new steel capacity to build the power plants, infrastructure, and electrical grid expansions required to generate electricity for plug-in EVs (cars, trucks, vans, busses, aircraft, containerships, etc.).

Simply put, if the world is serious about fighting climate change, steelmaking coal will remain in high demand.

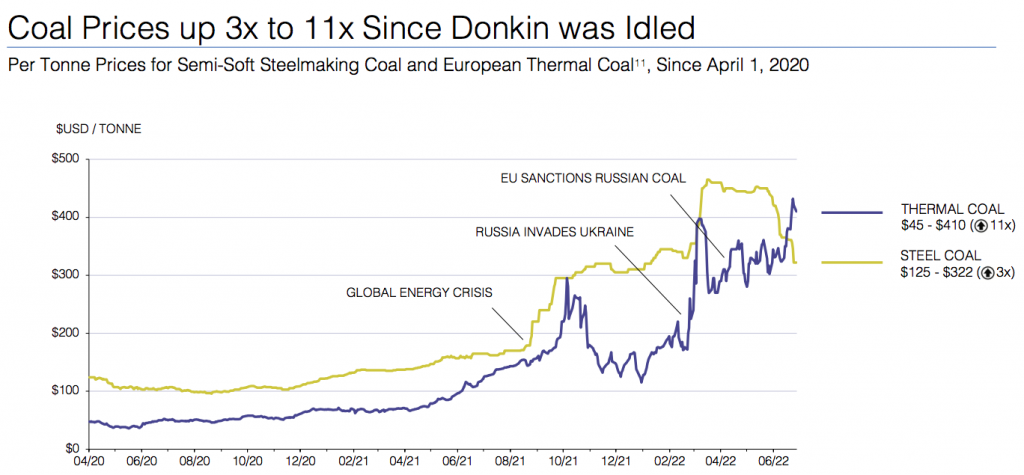

Despite a slowing global economy — soaring natural gas prices following Russia’s invasion of Ukraine is boosting the consumption of thermal coal. According to the IEA Coal Market Update (July), global consumption this year is poised to break its record level of 2013 and rise again in 2023.

Coals that have select characteristics can be utilized in both thermal & coking coal markets, making them more versatile & valuable. These are called swing or crossover coals.

In a highly unusual development, some thermal coals are trading well above the prices of benchmark coking coals. For example, Rotterdam & Newcastle thermal coal futures average roughly $350/t, whereas two benchmark premium low-vol (highest quality) coking coals (from Australia & China) average ~$270/t.

Morien Resources (TSX-v: MOX) / (OTCQB: APMCF) owns a 2% – 4% royalty on The Cline Group’s (CG) Donkin Mine in Cape Breton, Nova Scotia. For the initial 500,000 tonnes of coal sold in any quarter, Morien will receive 2% of topline revenue (net of transportation costs). In addition, Morien is paid 4% of net revenue on each tonne above 500,000.

NOTE: {this is a valuable “uncapped” royalty — if coal is mined at Donkin for 100 years, Morien collects royalties the entire time}

Since March 2020 the Donkin mine has been on Care & Maintenance due to much lower coal prices & roof control issues. The mine has a 484 million Indicated + Inferred tonne resource that ranks as a high-vol “B”, semi-soft coking coal, (low ash, high vitrinite & fluidity, high crucible swell number), but it ALSO has a high energy value.

Coal quality is measured by its energy value (Btu/lb.), ash & sulfur content. Donkin has very high Btu coal at 14,000-15,000 Btu, compared to east coast (USA) coals at 11,500-13,500 Btu, the western U.S. at 8,000-9,000 Btu, and Indonesian at 7,560-9,900 Btu. Colombian & Russian coals are between 12,500-13,000 Btu, S. Africa is ~11,000 Btu, and coals from Australia range from 10,000-13,000 Btu.

Over the longer term Donkin’s product will likely be sold as steelmaking coal, but being viable in both markets is great for Morien’s shareholders. Having more customers around the world will enable The CG to lock in favorable pricing (if they want to) in multi-yr. contracts with a diverse range of end users.

Over the past few months, there have been noteworthy indications that Donkin might reopen as soon as this quarter, causing Morien’s share price to double to C$0.59 since early June.

Job postings for new hires at the mine and local news reports (incl. some opposition to reopening) clearly suggest that The CG is taking steps to restart. For the purposes of this article, I assume the mine reopens this year, but there’s no certainty it will. That’s the BIG risk for Morien shareholders.

There are of course approvals & permits to be obtained, which could take longer than expected. However, there’s widespread support for the hundreds of high-paying jobs that would be created and the hundreds more indirect jobs.

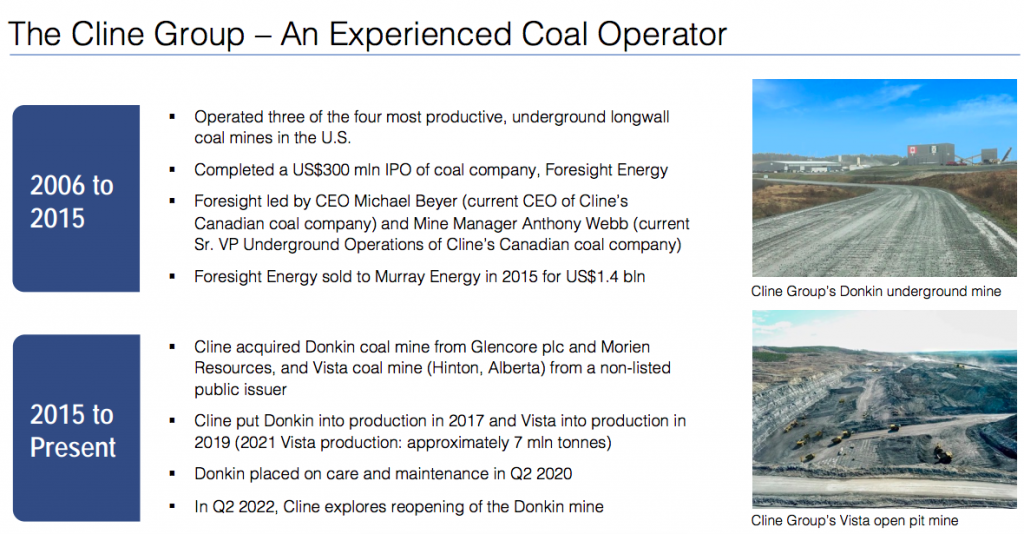

The CG has invested over C$250M into the Mine since 2015. They are very experienced underground coal miners with the ability to make Donkin a highly successful, safe & profitable mine.

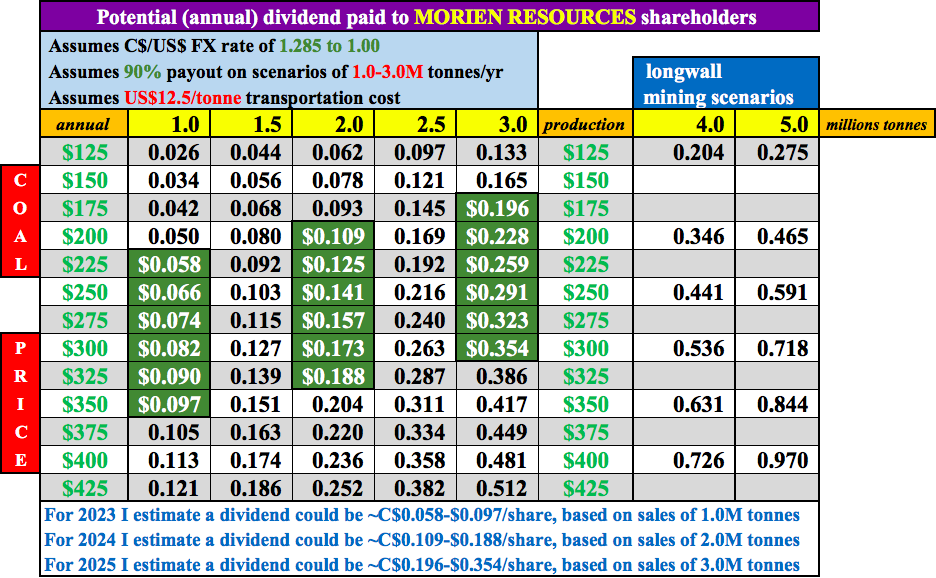

In the following chart, I show scenarios of annual distributions that Morien could make given a range of coal prices & # of tonnes sold. I assume 1.0M tonnes are sold in 2023, 2.0M in 2024 & 3.0M in 2025. Ramping up could definitely happen faster, my pace is conservative.

Importantly, The CG are experts at a highly efficient type of mining method called longwall mining. If a longwall operation could be set up (probably not before 2024 or 2025), then I believe production could eventually be increased to 4.0-5.0 million tonnes/yr.

Assuming a 90% payout of earnings from the Donkin royalty, I estimate an annual dividend of C$0.066 – $0.097 per share could be paid to Morien shareholders next year if Donkin were to sell 1.0M tonnes at an average price between $250-$350/t. In 2024, I estimate C$0.125 – $0.188, on 2.0M tonnes at an average between $225-$325/t. In 2025, C$0.228 – $0.354 on 3.0M tonnes between $200-$300/t.

NOTE: {I use a 90% payout ratio even though mgmt. typically mentions an 80% payout ratio. Using 80% potentially underappreciates the fact that 100% of royalty payments received will go towards enhancing shareholder value}.

Notice in the chart that even at a relatively low $125/t, if a longwall is installed an annualized dividend could be C$0.204 – $0.275 per share. I have no idea how probable a longwall is, only that The CG are experts in that mining method and if coal demand remains strong, it will absolutely be warranted.

A bet on Morien is a bet that high-vol, semi-soft coking [AND/OR high-Btu thermal] coal prices will remain elevated for years to come. I don’t necessarily mean $300+/t, just $125+/t.

At a long-term price of $125/t, Morien’s shareholders would do quite well if/when 3.0M tonnes/yr. are sold. The annualized dividend would be C$0.133 per share.

The past 2-3 years have proven that coal prices (supported by natural gas, which has soared much more than coal) — and subject to supply & transport disruptions — will remain highly volatile. However, if one believes the lower bound of that volatility is $100-$125/t, then high volatility should be welcomed by Morien’s shareholders.

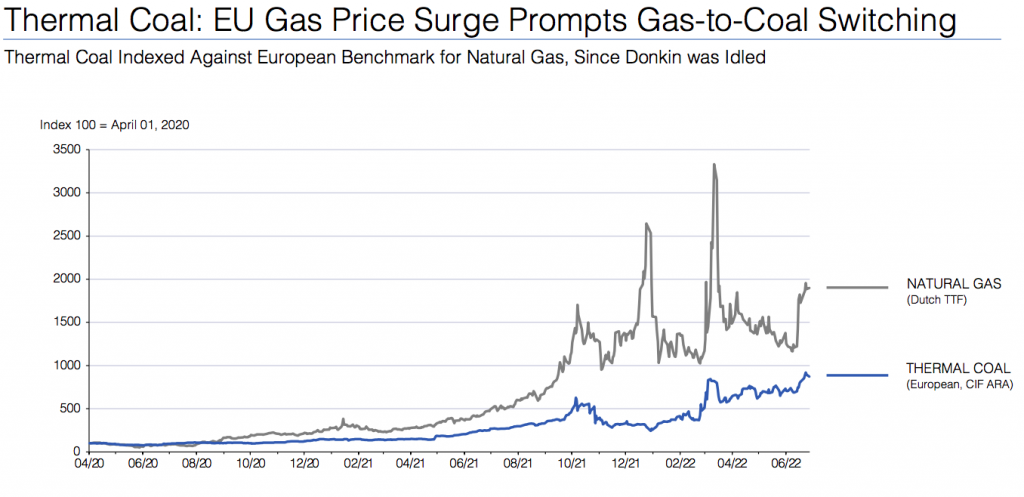

There are other compelling reasons to be bullish on thermal coal prices, look no further than what’s happened with natural gas. Nat gas in Europe has risen twice as much as European coal since Donkin shut down in 2020. If natural gas prices stay high, coal prices will as well because the fuels compete based on price.

Natural gas prices are expected to remain strong due to Russia cutting exports to Europe and the difficulty of bringing new nat gas supplies & infrastructure online rapidly. For example, it takes a decade or more to design, permit, fund & build multi-billion dollar Liquified Natural Gas (LNG) facilities.

And then there’s inflation, don’t forget inflation! Inflation is Morien’s secret weapon… The Cline Group only benefits from inflation if coal prices increase more than underlying costs.

By contrast, Morien’s shareholders benefit 100% from inflation because it receives a topline royalty (paid out BEFORE operating costs). Inflation alone gives me comfort that coal prices have a good shot at averaging at least $125/t going forward.

The beauty of Morien at C$0.59/shr. is that investors have tremendous upside potential if coal prices stay above $125/t. A C$0.133 payout on the current share price would be a very attractive 22.5% yield. Readers are reminded that an annualized dividend of C$0.133 would (very likely) not come before 2024.

Most stocks don’t carry 22% yields for extended periods, they get bid up in price to reflect yields of companies in similar sectors with comparable risk profiles. Imagine what might happen to Morien’s share price if Donkin entered production and announced a 2-yr. ramp up to 3.0M tonnes/yr.

At an average sales price of $200/t, that would equate to an annual payout (assuming 90% of cash flow is distributed) of C$0.228/shr. If that dividend amount became the long-term assumption and the investor yield requirement on Morien is 10%, then the share price should would (in theory) rise to C$2.28.

Assuming cumulative dividends of C$0.42 for 2023-2025 and an ending share price of C$2.28, that would be a total return of +357% from today’s C$0.59/shr.

To be clear, this would not happen overnight, but a C$2+ share price seems to be a reasonable possibility if The CG can execute well at the Donkin mine. And, if all goes mostly as planned, shareholders will be collecting robust dividends along the way.

Disclaimer: Peter Epstein of Epstein Research [ER] has no current or prior relationship with any management team or board member, and no current or prior dealings with Morien Resources (the Company). The views contained herein are solely those of [ER] and are based 100% on publicly available information such as sedar filings, the corp. presentation, conversations with mgmt. & peer company analysis. Teck Resources shares a considerable amount of data on the coking coal market in its corp. presentations, data that [ER] incorporates into its articles. Since July 2022, Peter Epstein has owned shares of Morien Resources acquired in the open market.

Although [ER] is bullish on the prospects of Morien Resources, it’s possible that [ER] is wrong about the Company in one or more of several key respects. [ER] could be wrong about environmental or permitting challenges in reopening the Donkin Mine. [ER] could be wrong about the ongoing strong demand for coking coal in blast furnaces. [ER] could be wrong in its view that coking coal prices will remain stronger for longer. [ER] could be wrong that Donkin’s high-Btu coal will successfully be sold into thermal coal markets. Although [ER] believes the reopening of the Donkin Mine should happen this year, it could be delayed until next year or not happen at all.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)