The Golden Triangle [GT] of B.C., Canada is one of the best gold mining jurisdictions in N. America. Not only does it already host Major mining companies like Newcrest, Newmont, Barrick, Teck Resources, Agnico Eagle, Gold Fields/Yamana & Kinross, others are sure to follow.

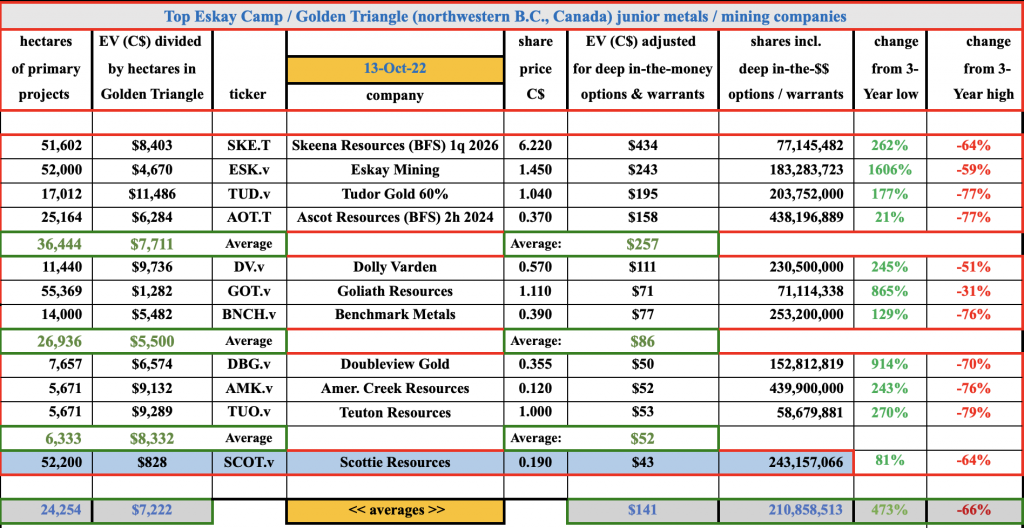

The top-4 pre-production juniors in the GT are Skeena Resources, Eskay Mining, Tudor Gold & Ascot Resources with an average Enterprise Value [EV] {market cap + debt – cash} of $257M. Notably, that average was upwards of ~$550M in March.

The flagship projects held by Skeena & Ascot have Bank Feasibility Studies on them, but Eskay & Tudor are earlier stage, [pre-Preliminary Economic Assessment (PEA)]. In fact, Eskay is pre-maiden resource estimate.

The next tier in the GT hierarchy contains Dolly Varden, Goliath Resources & Benchmark Metals with an average EV of $86M. That average was closer to ~$165M back in March.

Scottie Resources (TSX-V: SCOT) / (OTCQX: SCTSF) the feature of this article, is at the bottom of the third tier of GT peers; [after Doubleview Gold, American Creek & Teuton Resources] with an avg. EV of $52M. Scottie’s EV is $43M.

The average stock in the chart below is up +473% from its respective 3-yr low, but Scottie is up just +81%. I think Scottie could comfortably slide into the box with Dolly Varden, Goliath & Benchmark. Notice that although early-stage, Scottie’s [EV/GT hectare] ratio of $828 is far below the avg. of $7,222.

Of roughly 20 precious metal focused GT juniors (with market caps > $10M), I believe just 2 or 3 are ideally positioned to outperform the pack. What’s so great about Scottie Resources?

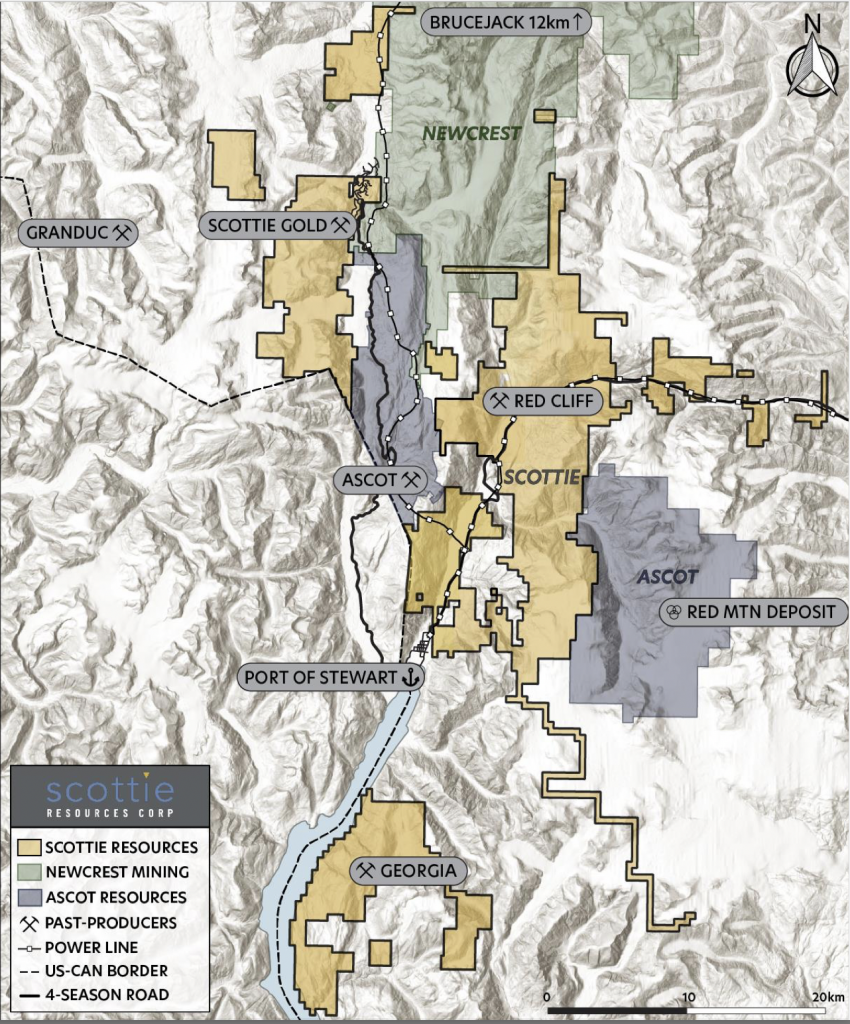

It has a superb combination of the following attributes; 1) location within the GT (access to roads & power, sandwiched between Newcrest & Ascot), 2) a prime takeover target, 3) project size + tremendous blue-sky exploration upside, 4) high-grade, and 5) cheap valuation.

Scottie Resources owns 100% of the high-grade, past-producing Scottie Gold Mine [SGM] & Bow properties, and Summit Lake claims (contiguous with the SGM), and owns the Georgia project (host to the high-grade, past-producing Georgia River Mine).

In addition, Scottie owns the Cambria project properties and the Sulu property. In total > 52,000 hectares are owned. Importantly, the SGM project has an active small mine permit.

The SGM is 35 km north of Stewart B.C., 20 km north of Ascot’s Premier Gold Mine project and 27 km south of Newcrest’s operating Brucejack Mine. In the early 1980s the SGM produced 95,426 ounces at a whopping 16.2 g/t gold.

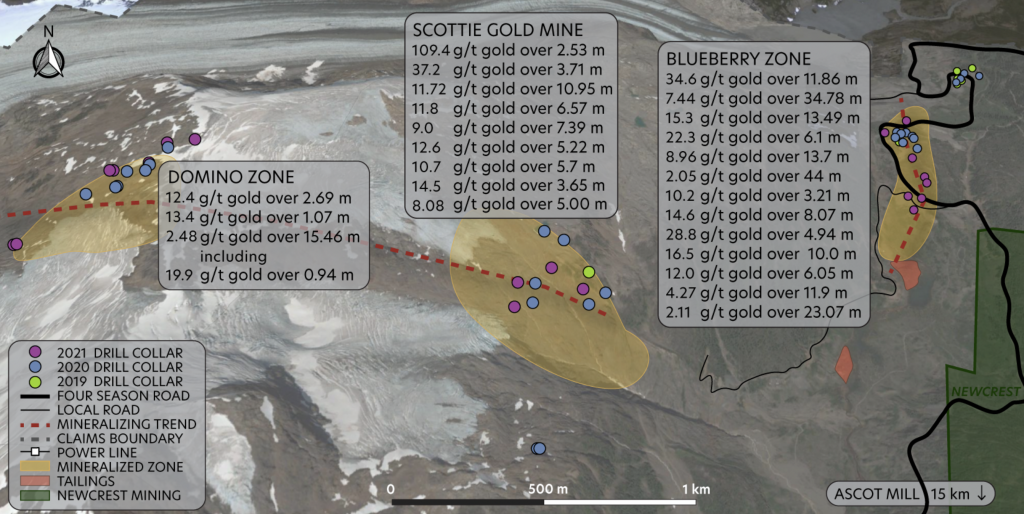

The Blueberry Contact Zone [BCZ] is ~2 km NE of the SGM project area. SMG’s & BCZ’s mineralized zones are similar to other notable deposits in the area including Snip, Premier-Dilworth, Red Mountain, Brucejack, KSM, Snowfield & Bronson Slope.

Notice the Domino Zone in the above map, is ~2 km to the west of the SGM — but it’s not a current focus of drilling. Imagine the upside potential if a meaningful degree of continuity could be established across all three zones, Domino, SGM & BCZ?

Historic trenching & channel sampling of the Blueberry Vein returned blockbuster results of 103.94 g/t gold over 1.43 m, and 203.75 g/t over 1.90 m. The BCZ is steeply dipping, there’s no known restraint on its potential depth; mineralization at the adjacent SGM has a vertical extent of > 450 m.

On October 11th additional drill results were reported, they did not disappoint. For example, 8.6 m @ 11.3 g/t gold [within 91.95 m @ 1.74 g/t] and 16.2 m @ 9.1 g/t gold [within 114.7 m @ 1.6 g/t]. These results extended the strike length at the BCZ alone to 1,200 m and its depth to 360 m.

In the press release it was stated that the strike length could soon be extended even further to 1,550 m. As a thought exercise, assume that the avg. width in the BCZ is 6 m, the avg. grade is 6 g/t gold, and depth is 360 m — that would equate to nearly 1.9 million ounces of gold.

If readers take away nothing else, they should recognize that the increase in strike length & depth (assuming constant width & grade assumptions) just increased the # of ounces in the BCZ by a factor of > 3x! And, drilling to date across the BCZ covers only ~0.1% (1/1,000th) of Scottie’s 52,000+ ha footprint.

Other zones including the main SGM area, the Domino target, the Bow properties, Summit Lake, and the Georgia, Cambria & Sulu properties (combined) could also deliver > a million ounces over the next few drill seasons.

In my opinion, by the end of 2024 Scottie could have line-of-sight to a multi-million-ounce resource.

Admittedly, I’m getting ahead of myself talking about millions of ounces, but the BCZ is a very exciting area with prior bonanza intercepts like; 34.8 m @ 7.4 g/t gold, 4.75 m @ 77.6 g/t gold [within 11.9 m @ 34.6 g/t gold], and 4.1 m @ 36.2 g/t gold [within 13.5 m @ 15.3 g/t gold].

Due to its blue-sky potential across 52,000+ ha and its ideal location, Scottie Resources is a prime takeover target, perhaps in combination with nearby Ascot who has a mill and hopes to be in production in a few short years.

Scottie/Ascot could be acquired by Newcrest, but also Newmont, Barrick, Agnico Eagle, Yamana (owns ~7.0% of Scottie & ~5.6% of Ascot), Teck, Kinross, Alamos, or B2Gold.

Other potential bidders (in my opinion) might include; SSR Mining, K92 Mining, Seabridge, IAMGOLD, Osisko Mining, Coeur Mining, KGHM Polska, Artemis, New Gold or Hochschild Mining.

To be fair, some of the other GT juniors might also be takeout candidates, but I believe the upside is less for them than for Scottie with all it has going for it.

With so many prospective suitors, the odds of a deal for Scottie seems high. More importantly, the chances of a bidding war is growing, especially if/when the gold price rebounds, and especially if management makes additional high-grade discoveries.

Between now and any acquisition, it’s drill, drill, drill. Scottie just raised capital, giving it ~C$3M in cash. This is a company that is undervalued and could be re-rated if/when the market sees more evidence of a multi-million-ounce deposit.

The Company is valued as if it hosts a million ounces, but if it’s actually sitting on millions of high-grade ounces, then all bets are off. I believe that Scottie’s valuation could double, or even triple, over the next two years.

And, if other GT players see big gains, Scottie could more than triple… Recall that as recently as March the three Tier-2 GT companies had an average valuation of ~$165M vs. Scottie’s current EV of $43m.

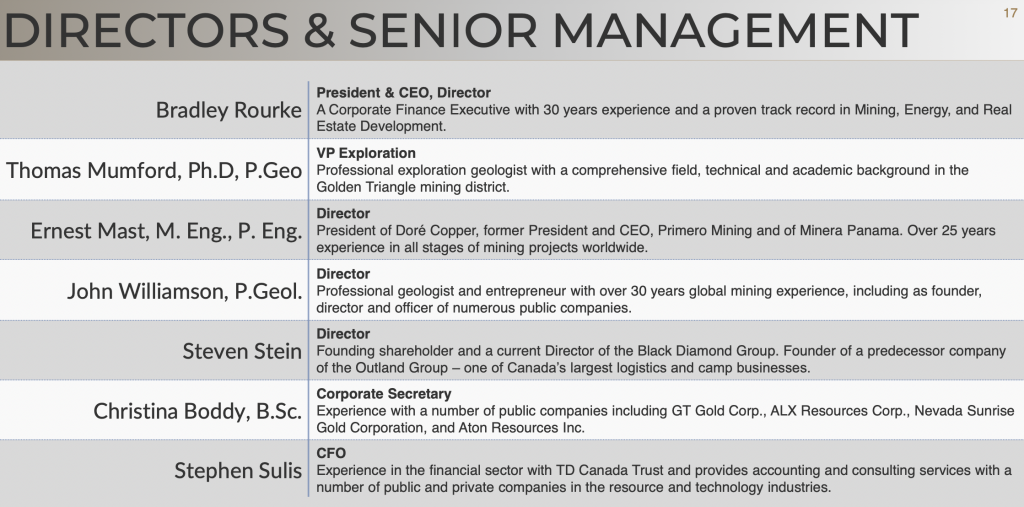

CEO Brad Rourke and his expert team have delivered an impressively strong ratio of high-grade hits to holes drilled and many assays are pending. Will Scottie receive additional barn-burner results from pending assays?

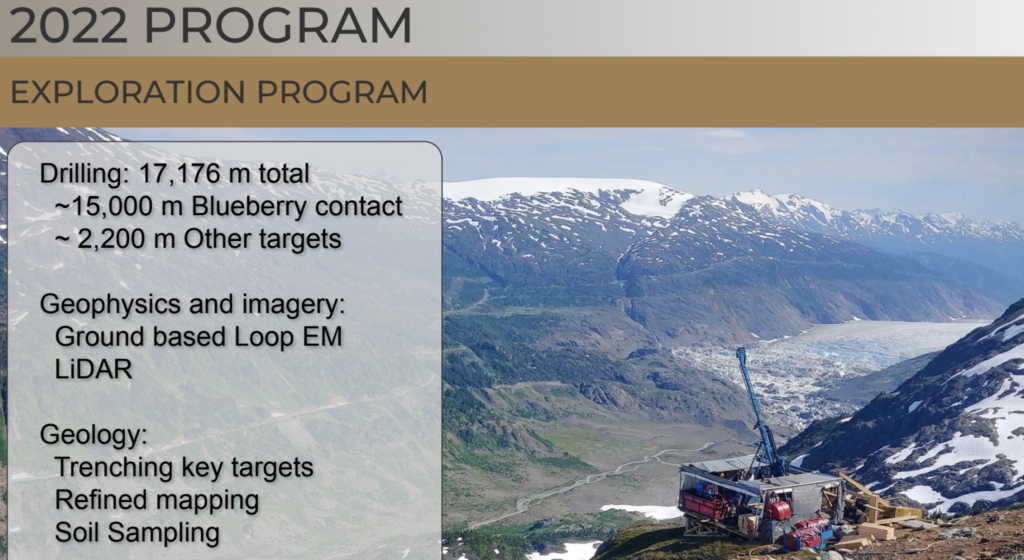

Might the BCZ be enlarged along strike and/or at depth? Over 80% of 2022’s drilling of 17.000+ meters is pending assays. That’s a lot of news to report.

Not all GT juniors will have multi-million-ounce endowments, not all projects are high-grade, and/or heavily gold focused. Not all are in the southern portion of the GT with excellent access to a year-round highway, a deep-water port (<40 km away),and a major power line (1.5 km away).

Not all projects are near ample, high-quality, labor & mining services. All of these factors enable Scottie to enjoy lower exploration costs than most northern GT peers.

In almost every critical respect, Scottie Resources (TSX-V: SCOT) / (OTCQX: SCTSF) is ideally positioned to benefit from a rebound in the gold price, new discoveries, a re-rating vs. GT peers and a potential takeout, but not before the valuation moves a lot higher.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Scottie Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Scottie Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Scottie Resources was an advertiser on [ER] and Peter Epstein owned shares in the company

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)