Although quite rare, once in a while a junior mining company trades at an Enterprise Value [“EV“] {market cap + debt – cash – value of investments} of LESS THAN zero. This can represent a tremendous investment opportunity, a “value trap,” or a company in serious financial trouble.

If investor fatigue has set in but the underlying assets & investments are attractive, and the management team/board robust, the opportunity to build a position at less than “cash value,” is compelling.

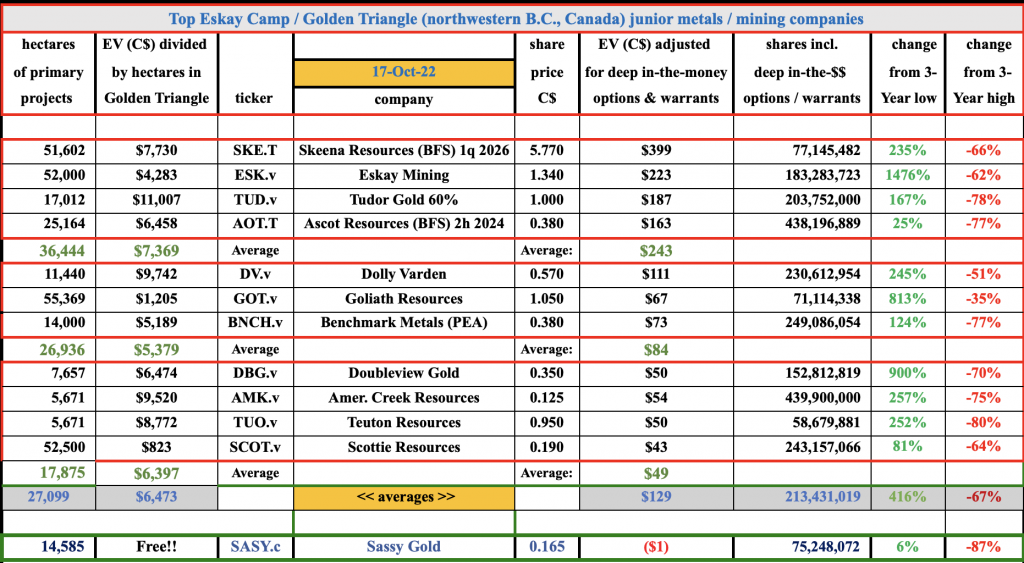

Sassy Resources (CSE: SASY) (OTCQB: SSYRF), at C$0.165/shr., has an EV of negative $1 million, but its prospects are strong. How do I calculate a negative EV for Sassy?

The market value of its three investment positions in other junior miners (described below) is modestly greater than Sassy’s entire market cap.

In my view, only the gold price is holding Sassy back. However, if one is bullish on gold, buying this Company at essentially a zero EV offers substantial potential for capital gains.

And, if the assets are as solid as I believe them to be, downside below C$0.165/shr. should be limited — unless the gold price tanks.

Sassy owns the sizable, highly promising Foremore project in the Essay Camp at the heart of the prolific Golden Triangle. It also owns stakes in two publicly-traded companies; Gander Gold & Max Power, plus privately-held Galloper Gold.

Note: Gander & Sassy share most of the same management team/board.

Foremore is near major infrastructure including roads, power & future milling operations. Fewer than 20 km away, Teck Resources & Newmont have a JV on PFS-stage Galore Creek, which hosts ~12.5B lbs. of copper + 12.8M ounces of gold.

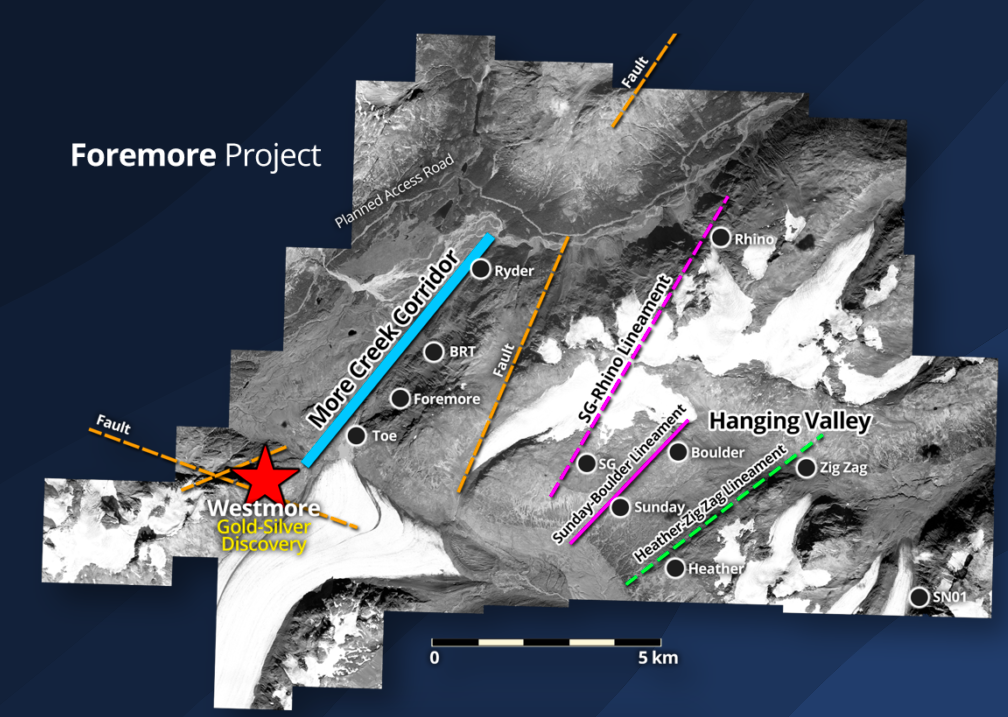

How big a deal is the 100%-owned, 14,600 hectare Foremore project? It has three prominent zones offering significant discovery potential, most notably the Westmore Zone (“WMZ“), but also the More Creek Corridor (“MCC“), and Hanging Valley (“HV“) target.

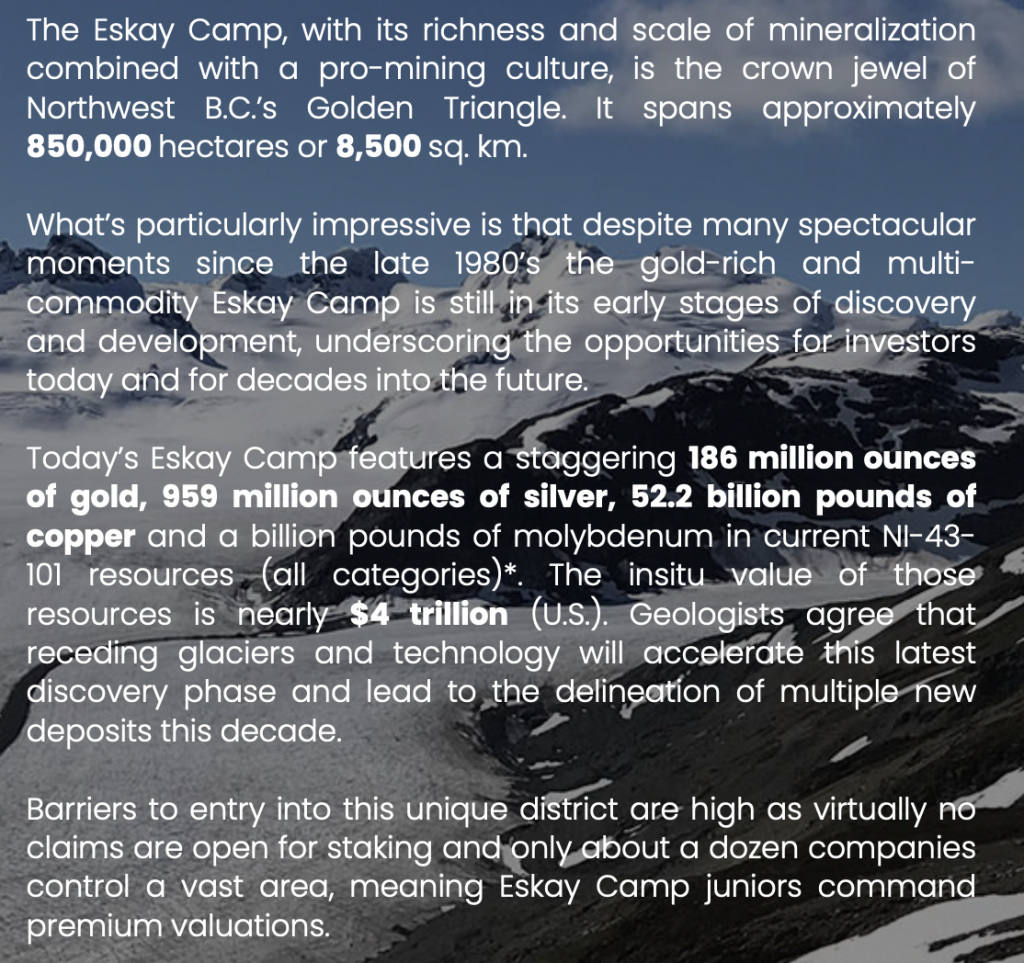

As can be seen in the chart below, Sassy has the potential to be re-rated higher. I’m not suggesting that C$50M of value could be added anytime soon, but I believe strong drill results and/or a higher gold price could add C$10’s of millions to Sassy’s valuation in the coming months.

Readers should note that Sassy shares closed at C$0.455 exactly three months ago on July 18th. Today’s valuation seems unfairly punished, representing a possibly attractive entry point.

Over the past several decades receding ice & snow at the WMZ has exposed gold veins in an area that has seen little-to-no historical exploration. The WMZ is a rapidly developing success story.

Beginning in 2019 surface grab samples returning 15.3-125.5 g/t gold, plus 203-1,900 g/t silver grabbed the market’s attention.

Then in 2020 prospectors & geologists determined that vein density increased significantly in a southeasterly direction for up to 400 m from the initial discovery area and mineralization remained open in multiple directions with visible gold in many surface samples.

Fast forward to October 2022, Sassy has 36 drill holes under its belt at Westmore. That’s about 8,000 m of total drilling to date revealing what appears to be a structurally controlled gold-rich system with multiple vein structures.

Results are pending on 18 holes from last Summer’s campaign.

The 4Amigos vein (named after four rock stars on Sassy’s technical team) is a highlight at Westmore with 160 m of strike length exposed and open to depth and along strike to the west.

Importantly, mineralization is also open along strike & downslope to the east toward the nearby glacier.

The best drill intervals from 2020-21 included; 1.5 m @ 26.6 g/t gold and 1.4 m @ 43.2 g/t gold. Multiple vein structures have been identified at the WMZ covering an area of approx. 1 sq. km. Total vertical depth is unknown, but has already surpassed 400 m.

1,026 surface samples, mostly taken in 2020-21, returned a very respectable average grade of 2.65 g/t gold, but the Top-50 averaged 43.2 g/t gold plus 272 g/t silver {~46.3 g/t gold equiv. at spot prices}.

High-grade, vein-hosted gold-silver mineralization — in combination with zones of precious metal-enriched base metals — span a distance of 7 km along the northeast-trending MCC, beginning immediately north of the WMZ.

Significant historical data has been supplemented by Sassy with detailed surface sampling, mapping & geophysical surveys and a full-scale VTEM Survey.

The HV target is on the eastern side of Foremore, defined by multiple precious & base metal showings across multiple mineralization styles. Very limited mapping, sampling & historic drilling has been done at HV.

As mentioned earlier, extensive glacial retreat has opened up large swaths of new ground for aggressive, modern exploration.

Surface sampling along the Sunday-Boulder lineament at HV returned up to 142 g/t gold. Additional surface samples over a 1 km strike length at Boulder included 8.0, 36.3, 24.6, 20.9 & 13.9 g/t gold.

Two km north of Boulder an outcropping grab sample returned 10 g/t gold + 156 g/t silver and 19.7% (combined) zinc/lead. Two km south of Boulder, a surface sample returned a whopping 21.4% copper at the Heather showing.

Let’s take a closer look at Gander Gold, of which Sassy owns ~35.3 million shares and Eric Sprott is a major shareholder. Gander is laser-focused on gold in the exciting province of Newfoundland & Labrador.

At 226,300 hectares, Gander is a Top-5 or 6 gold claims holder on the Island. Importantly, ~3/4’s (176,300 ha) are contained in three main claims blocks; Mt. Peyton, Gander North & BLT.

Mt. Peyton’s land package alone, between New Found Gold’s Keats Zone & Sokoman’s Moosehead discovery, is larger than most other juniors’ entire footprints in Newfoundland. Not just a giant continuous land package at Mt. Peyton, but in a strategically important location.

Regarding Gander North, the western edge of this large block straddles the famous GRUB Line. Historical exploration at Gander North has returned, “very high gold-in-till anomalies.”

Finally, BLT sits on the same fault system that hosts Marathon Gold’s 5.1M oz. advanced-stage Valentine Gold project to the southwest.

Next up is Sassy’s investment in Galloper Gold, a well-funded private B.C.-registered junior gold company, also in Newfoundland, with > 200,000 hectares on the Island, including strategic claims near New Found Gold’s Queensway Project.

Galloper plans to list on a Canadian stock exchange in the next several months. Sassy holds eight million shares of Galloper.

Sassy’s third investment portfolio holding is five million shares in Max Power Mining, owner of the very promising Nickel-Copper-Cobalt-PGE Nicobat Project in Northwestern Ontario, purchased from Sassy last year.

Last but not least is the Company’s option to acquire 100% of the drill-ready Highrock uranium project just outside the world famous, high-grade, Athabasca basin in Saskatchewan.

Located immediately to the north, Cameco’s prolific, past-producing (1983-1997) Key Lake uranium mine extracted > 200 million open-pit pounds at an average grade of 2.3% U3O8.

In addition to the considerable value of Sassy’s three portfolio holdings, the Highrock project is arguably worth C$ millions, especially as the spot uranium price has recently inched back above $50/lb.

Management points out that Highrock can be explored year-round, helping to spread news flow across more months. A bull market run in the uranium price and/or promising drill results would make this asset worth a lot more. Each C$5M in potential value equates to ~C$0.066 per share.

Admittedly a lot’s riding on drill results at Foremore, but with the Company’s valuation near zero and with potential upside from meaningful share holdings in Gander Gold, Max Power, Galloper Gold & the Highrock uranium project, I believe the risk/reward proposition is compelling.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Sassy Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Sassy Gold are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Sassy Gold was an advertiser on [ER] and Peter Epstein owned shares & warrants in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)