Falcon Gold (TSX-v: FG) / (OTCQB: FGLDF), a company with 15 properties/projects in Canada, is always on the lookout for more. Despite vast blue-sky potential, the Company’s market cap languishes at ~C$12M. Please see new [corporate presentation.]

It has very promising gold assets in Newfoundland & Labrador (a top 6 claims holder) and its flagship Central Canada gold project in Ontario, but with the gold price under $1,700/oz. (from a high of $2,070/oz.) investors don’t seem to care.

Central Canada is ~20 km SE of Agnico Eagle’s Hammond Reef project with ~5.5M ounces of gold (Measured & Indicated) and a forecasted All-in-Sustainable Cost (“AISC“) of under US$900/oz.

CEO Karim Rayani and his team are expert dealmakers, so what are they doing while gold is temporarily out of favor? They’re locking down critical/battery metal properties across Canada.

Falcon might already have lithium (“Li“) exposure in Newfoundland with property that ties onto the Benton Resources / Sokoman Minerals JV that recently found meaningful Li values (incl. an 8.4 m drill interval of 0.95% Li2O) in its Kraken Lithium discovery zone.

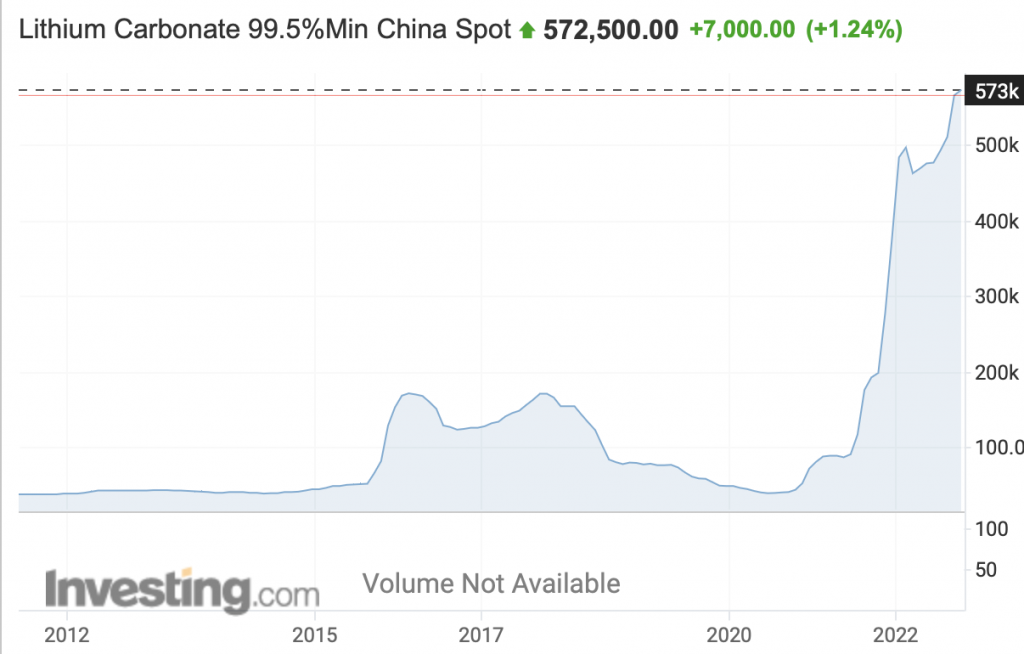

NOTE: {Lithium is the hottest commodity on the planet, up > 1,300% from COVID-19 lows. The following chart tracks the battery-qual. Li carbonate price in China. 572,500 yuan = ~US$78,600/tonne}.

CEO Rayani notes that this discovery is < 10 km from the footprint held by Falcon and appears to be on the same structural corridor. Importantly, Benton-Sokoman could release Li drill results at any time.

Another Newfoundland junior, Origen Resources, has amassed a meaningful property position immediately east of Falcon that’s also prospective for Li. Top-3 global Li producer Ganfeng owns a 5% investment stake in Origen.

Importantly, Benton/Sokoman, Origen (and hopefully Ganfeng) think Newfoundland is geologically similar to prolific Li pegmatite belts found in Ireland, Nova Scotia & N. Carolina (USA). If true, there could be a Li staking / M&A frenzy in Newfoundland.

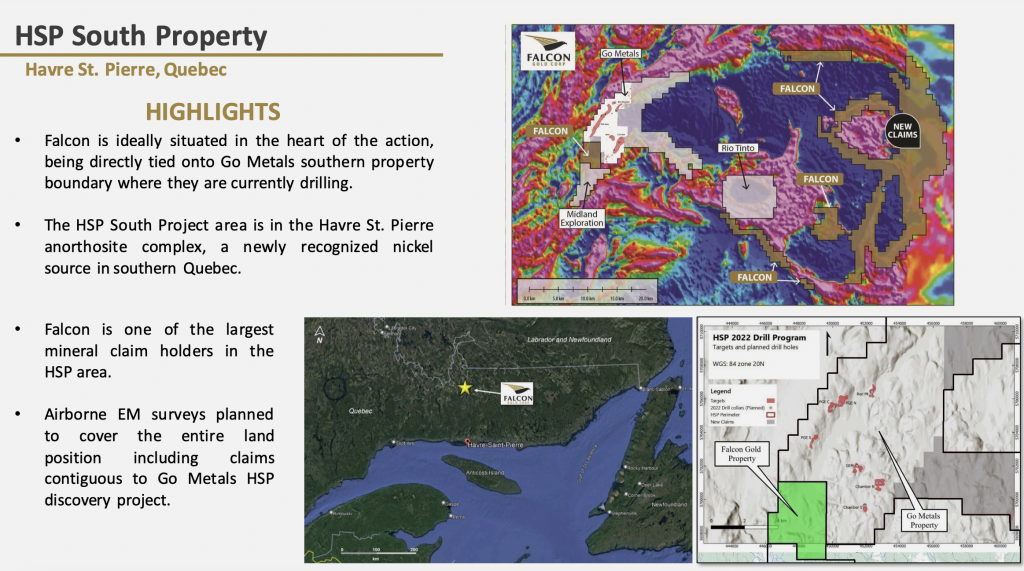

In October Falcon announced the addition of 37,962 hectares (“ha“) through an option agreement & staking of contiguous claims near Go Metals Corp’s HSP Nickel (“Ni”) Copper (“Cu“) & Platinum/Palladium (“PGE“) Project, 130 km north of Havre St. Pierre, Quebec.

The new ground covers ~135 km of prospective contact [close to hydropower & roads] to the Havre St. Pierre Anorthositic Complex (“HSAP“) where Go Metals recently found wide zones of visually identifiable Ni & Cu — drill results are expected this month.

The most westerly block of Falcon’s new claims is < 2.2 km from prominent airborne TDEM anomalies identified by Go Metals. Falcon will follow the exact same steps as Go Metals in exploring its sizable land package.

Staking by Falcon included four more target areas increasingly understood to be a key target area. Potential also exits for magmatic iron-titanium.

Rio Tinto has staked property south of the HSAP and owns the titanium dioxide producing Lac Tio Mine, ~100 km south of Falcon’s new Property.

Falcon’s holdings of nearly 38k ha make it the 2nd largest player (Go Metals’ HSP project is 39,600 ha and is valued at ~C$15M) in the very exciting HSAP Ni/Cu district of southern Quebec.

On June 22nd, the Company acquired the Timmins West & Outarde Nickel projects. Timmins West covers 1,940 ha and is 20 km northwest of Timmins, Ontario and 40 km southwest of the Crawford Ni-Co project being developed by Canada Nickel.

It shares characteristics of other well-known complexes such as the Bushveld complex of S. Africa, Stillwater in the U.S. and the Bell River Dore Lake complexes of Quebec. An outcrop grab sample in 2004 reported 0.44% Ni, 0.64% Cu & 330 ppm Co.

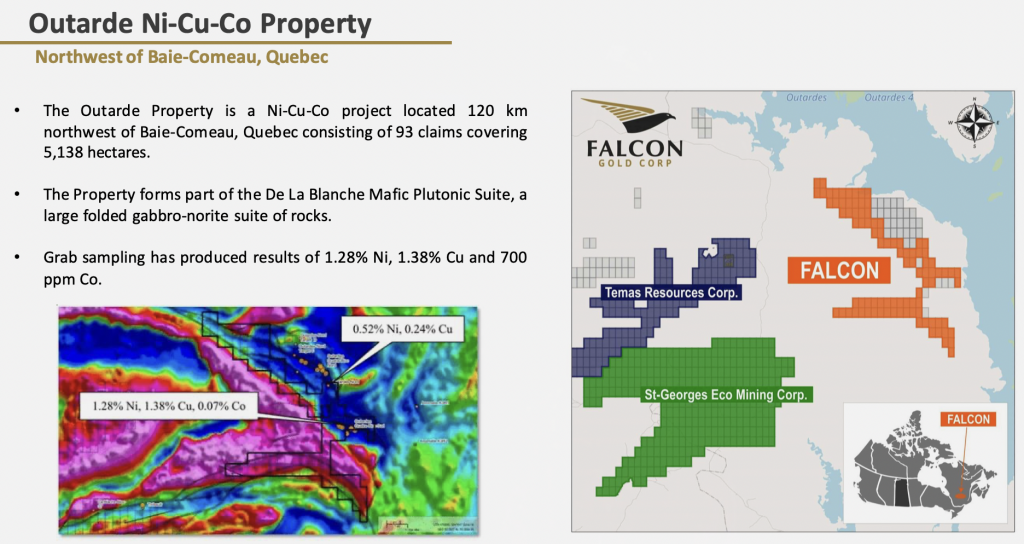

The Outarde Property is a 5,138 ha claims block in Quebec that also contains Ni-Cu-Co-style mineralization and was last explored by Falconbridge in 1997. The entire length of the property (about 30 km) has been under-explored.

Ni/Cu bearing sulfides are generally located in fracture or shear zones. Values up to 1.28% Ni, 1.38% Cu & 700 ppm Co were collected from a grab sample. Falcon is flying AirTEM surveys over the entire land package.

From time to time, when it makes sense, Karim will spinout an asset or two, which is what he’s done with Falcon’s Argentina gold play.

The spinout allows wholly-owned subsidiary Latamark to focus exclusively on the activities required to exercise the option on the Esperanza project comprising seven exploration concessions covering 11,072 hectares (“ha”) in Argentina’s La Rioja province.

Falcon is transferring its interest in the Esperanza option agreement to Latamark in exchange for issuing to Falcon shareholders one share of Latamark for every 5.8 shares held in the Company. Latamark will also issue 5,000,000 shares to Falcon.

In my this prior article on Falcon I described in some detail the Company’s Newfoundland gold prospects which are quite extensive in their own right.

With gold at $1,650/oz., many investors are more interested in Li, Cu, Ni, Co, & PGEs, but Falcon has exposure to all of the above.

I strongly believe that an increase of just $150/oz. (+9.1%) to $1,800/oz. would make a world of difference in gold investor sentiment. Please see new [corporate presentation.]

In the meantime, Falcon Gold (TSX-V: FG) / (OTCQB: FGLDF) will continue to deliver exciting exploration results and company updates across its overflowing portfolio of 15 properties/projects spanning Canada.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Falcon Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Falcon Gold are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Falcon Gold was an advertiser on [ER] and Peter Epstein owned shares in both companies.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)