“Mexico’s fastest growing silver producer” is a tremendous title to hold in a once in 40-year global inflation event, a title covering (at least) the years 2022 & 2023. {dollar amounts US$ unless stated otherwise}

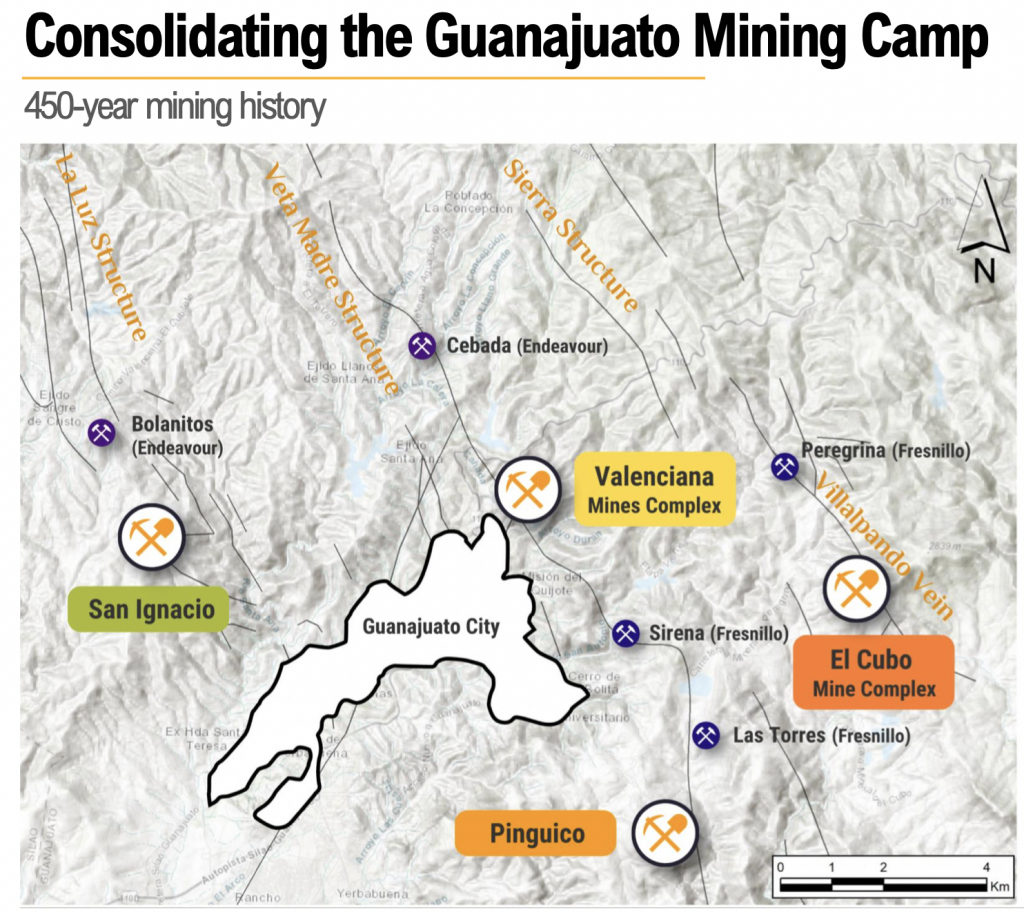

By achieving rapid but prudent & profitable, long-term sustainable growth, Guanajuato Silver [G-Silver] (TSX-v: GSVR) / (AQUIS: GSVR) (OTQXC: GSVRF) is locking in a highly attractive position in the central Mexican states of Guanajuato & Durango.

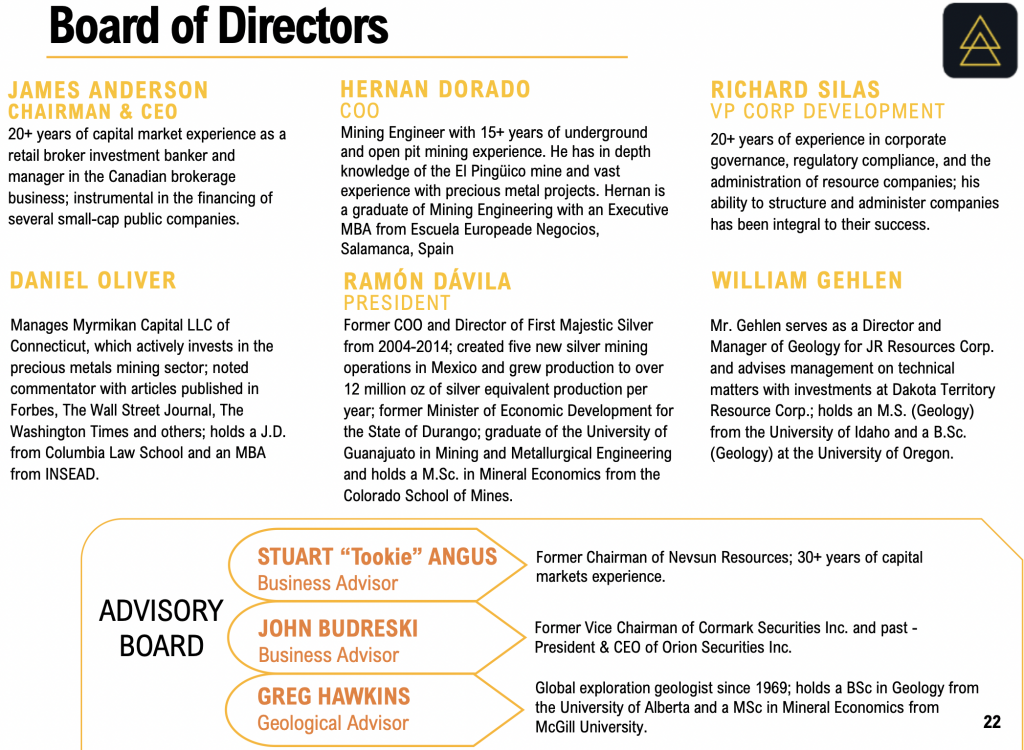

CEO/Chairman James Anderson and his expert Mexican national team recently expanded operations to five mines plus three production facilities. {see new corp. presentation}. It appears that the latest acquired assets [$14.7M paid] were obtained at a small fraction of their potential value.

According to Mr. Anderson,

“The assets we purchased from Great Panther continue to surprise to the upside… there’s more potential in the three mines than ever dreamed of. We feel the mines at Valenciana, especially, will continue to grow and deliver considerable value for many years to come.”

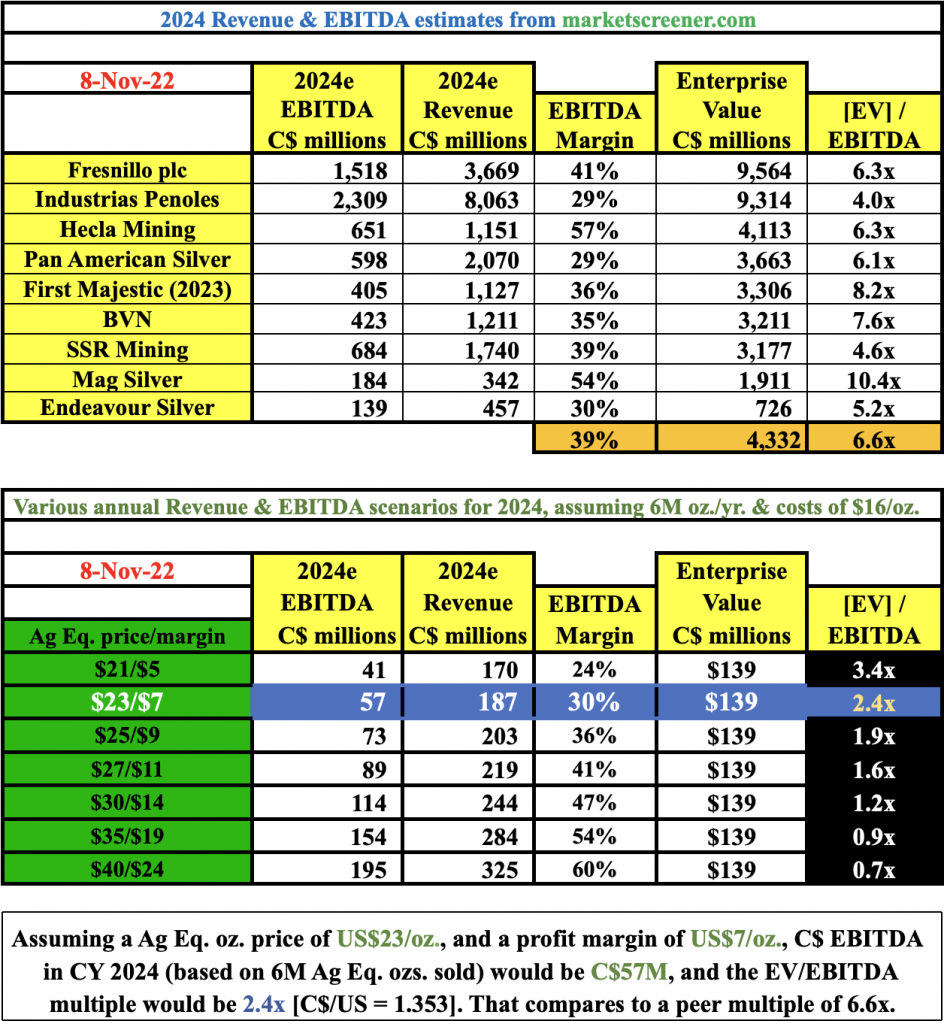

As production grows to as much as six million silver equiv. (Ag Eq.) ounces/yr. in CY 2024 — costs are expected to come in around $16/Ag Eq. oz. which I believe would be top-quartile performance in N. America.

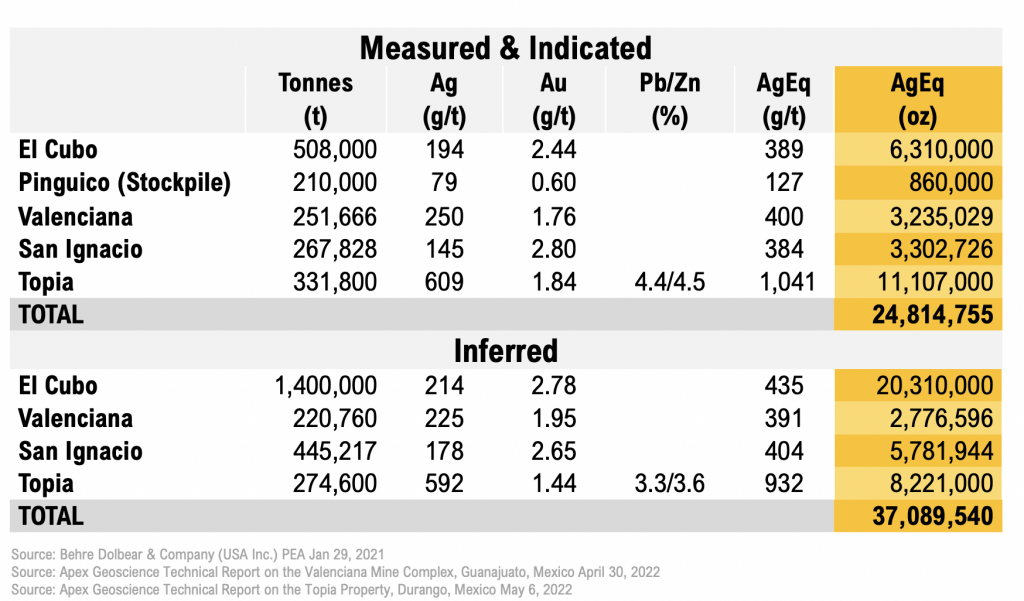

The company-wide Ag Eq. figure is now 61.9M ounces. Management believes there are numerous under-explored & never drilled zones across its expanding footprint.

Importantly, there’s room to continue acquiring stranded deposits, mills & tailings capacity across Guanajuato and in neighboring central Mexican states like Durango.

At 6M oz./yr. the Company would rank in the top-5 largest Ag Eq. Mexican focused producers. In my view, management will be successful in continuing to make new discoveries.

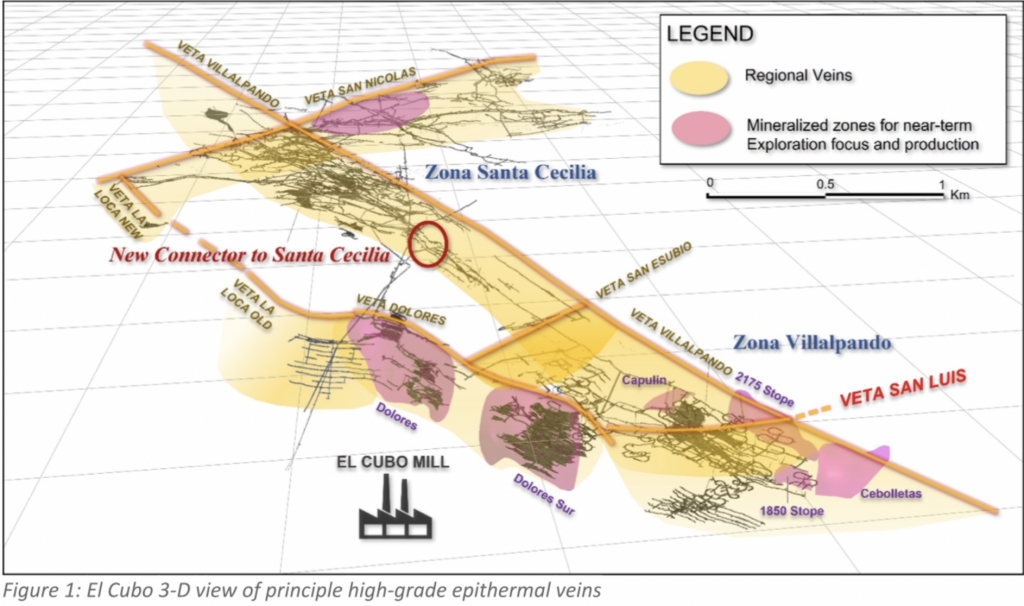

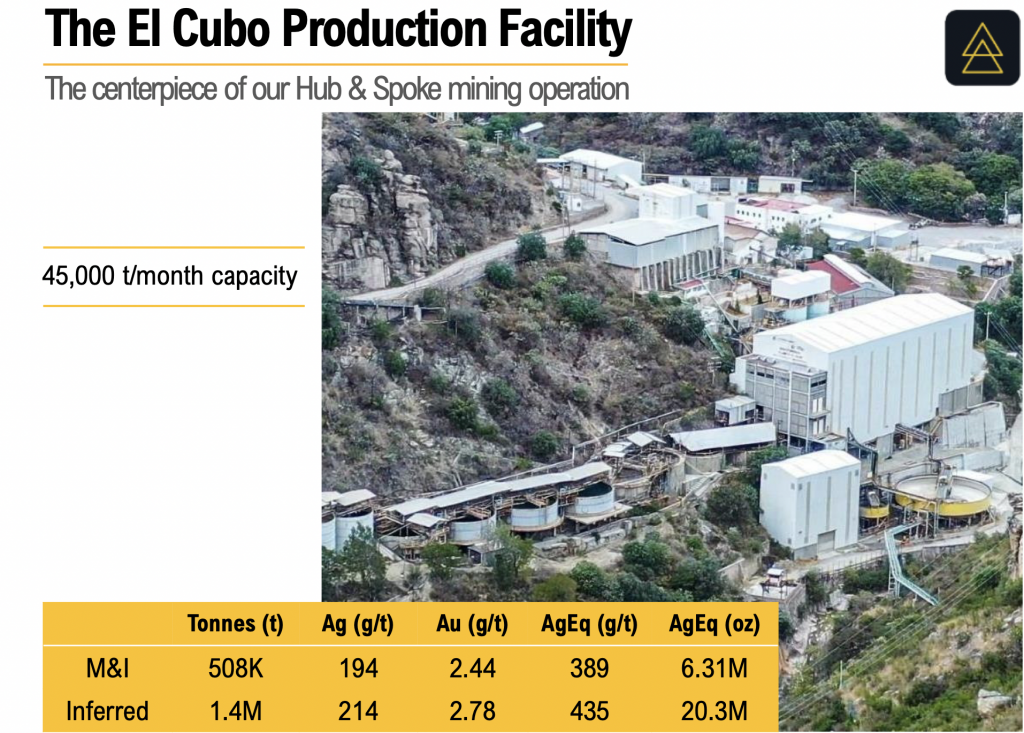

Speaking of new discoveries, management announced today (Nov. 10th) a new transverse vein at El Cubo — named San Luis — with four drill hole intervals averaging 1.0 meter @ 413 Ag Eq, equal to 5.2 g/t gold Eq.

Drilling has established the continuity of the vein structure.

Like other transverse veins at El Cubo, San Luis appears to host pockets of elevated gold grades and the ore is accessible via existing ramps & adits.

Management is studying the potential for San Luis to develop into a gold-rich vein system like those found in the Santa Cecilia area, which has become the largest source of high-grade material at El Cubo.

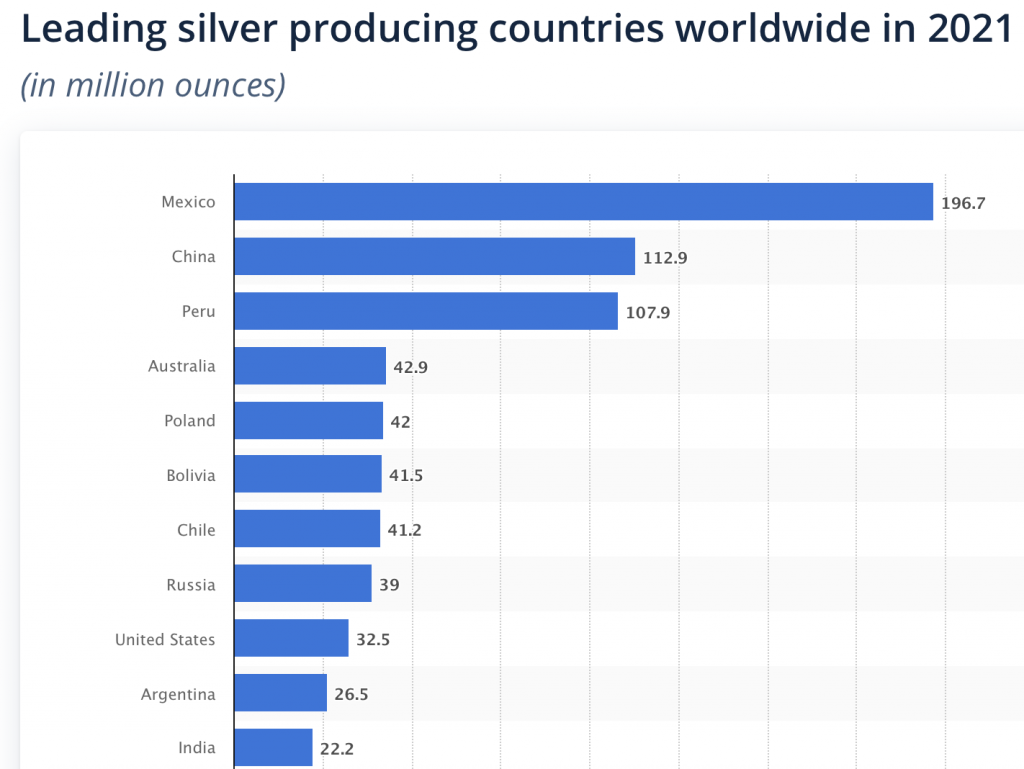

G-Silver is reporting exciting news on promising prospects in a great mining jurisdiction. As a reminder, Mexico is far and away the largest silver producing country. Less well known is that China is the world’s second largest.

A lot has been written on the increasing danger to “the West” of China controlling critical battery metals & REEs… Earlier this month Canada made a move against Chinese interests in three Canadian battery metal juniors.

China plays a substantial role in the silver market. The West needs to watch China a lot more carefully, especially as they have aggressive plans to expand solar power production.

Geopolitical tensions is making investment decisions in countries aligned with China and/or Russia very difficult. At the same time, S. America is suffering from a rise in populist political leaders and Europe has sky-high energy costs — leaving N. America as a top mining destination.

G-Silver produces a meaningful amount of gold, but is more weighted towards silver, with smaller amounts of zinc & lead as well. Many pundits believe silver will outperform in the coming years for two main reasons. First, silver typically outperforms gold in precious metal bull markets.

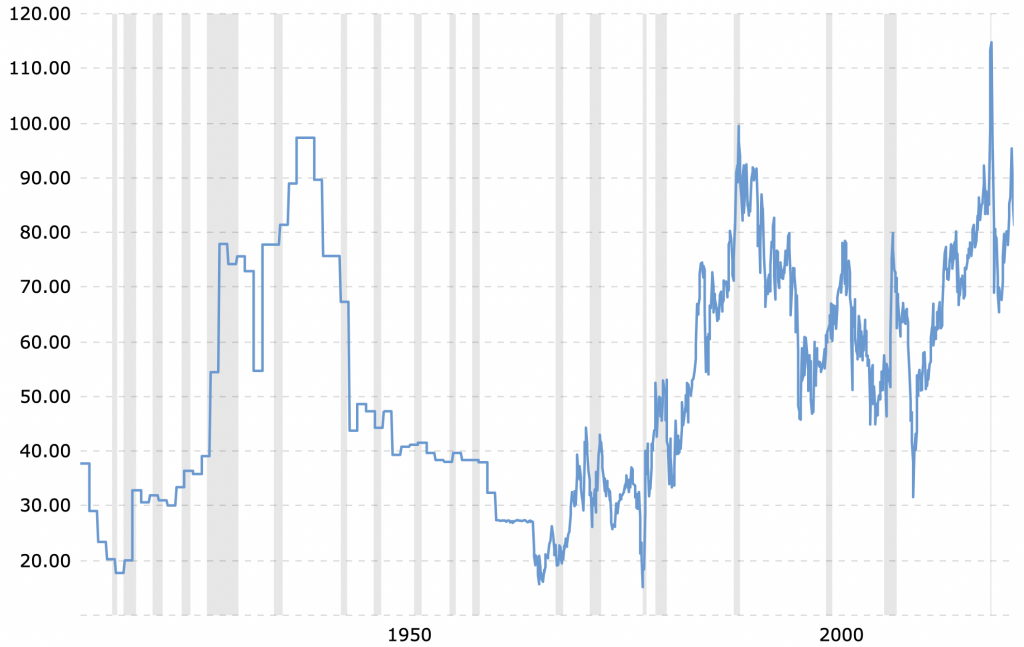

With the gold-silver price ratio at 81:1, silver seems poised to outperform yet again. If/when gold were to rebound 15% to $1,930/oz., and if the ratio were to decline to 70:1, the resulting silver price would be ~$27.5/oz. Notice in the chart below that the long-term average is 55 to 60:1.

Second, like gold, demand for silver comes from its strong investment (store of wealth), jewelry & safe-haven features, but ALSO from growing industrial uses, most notably in solar cells & electric vehicles.

According to Metals Focus’ statistics, silver used in solar cells will exceed 126M oz. this year. That’s nearly 25% of ~533M oz. of industrial demand. In EVs alone, silver demand is forecast to increase from ~55M to 90M oz/yr. (CAGR of 16%) over the next four years.

Although silver & gold prices have been weak, I believe there’s clear upside — especially by 2024 — due to mining cost inflation running at (depending on jurisdiction) 10-20%, lengthening timelines to bring on new production & growing geopolitical tensions.

Perhaps the most important factor underpinning silver prices are the colossal global economic stimulus packages set into motion this decade. EVs & renewable power plants top the list of uses for stimulus funds.

Adjusted for inflation silver touched the equivalent (in today’s dollars) of ~$64/oz. in April, 2011 and ~$136/oz. in Jan/Feb 1980. As of 7:30 pm EST, November 9th, the price was ~$21/oz.

I believe the price could soar well beyond consensus expectations. Inflation across much of the world is at a 40+ year high. The last time inflation was this hot, silver hit that $136/oz. level. Could we see $30+/oz. next year? Hardly a stretch. Or, $40+/oz. in 2024? Certainly possible.

If one believes as I do that Mexico is a Tier-1 silver jurisdiction and that precious metal prices are headed higher, investing in the fastest growing silver producer makes a lot of sense.

From a valuation perspective, at an Ag Eq. price of $23/oz., G-Silver is trading at a 2.4x multiple of Enterprise Value [EV] {market cap + debt – cash} divided by 2024e EBITDA.

G-Silver’s 2024e EBITDA assumes production of six million Ag Eq. ounces and an all-in-sustainable-cost [AISC] of $16/oz. In a higher price scenario of $30/oz., the margin would double to $14/oz. — generating twice the EBITDA — C$113M.

In a $30/oz. market, even if G-Silver’s EV increased by 100% it would still be trading at the same 2.4x multiple, roughly a 2/3s discount to peers.

Even at $23/oz. G-Silver would deliver attractive cash flow after annual maintenance cap-ex. As mentioned in prior articles, the board could implement a substantial quarterly dividend.

By my estimates, if G-Silver retained C$20M/yr. from a prospective C$57M/yr. in EBITDA (for cap-ex & exploration / development), it could still pay a 14% dividend from 50% of the remaining free cash flow.

That would leave a meaningful C$18.5M/yr. of cash building up on the balance sheet. That excess cash would more than pay off all the debt at the Company.

G-Silver has done an excellent job of growing and integrating new acquisitions. In my view, with silver around $21/oz., it remains a buyer’s market for continued M&A.

Although the Company may not make another large acquisition anytime soon, it could make tuck-in acquisitions and/or toll-mill third party ore. Having five mines + three mills provides significant operating flexibility to optimize both production & margins.

Readers are reminded that President & Director Ramón Dávila is extremely well connected in the state of Durango, where he served as Minister of Economic Development.

There are ample opportunities to replicate the successful Hub & Spoke model at Guanajuato’s El Cubo complex in Durango.

In closing, readers should consider being invested in BOTH pre-revenue and currently-producing mining companies in safe, prolific jurisdictions.

If the silver price were to double to $40+/oz. next year, even for a limited period, G-Silver would be printing money and could make even more aggressive moves in central Mexico.

While there’s clear line of sight towards six million Ag Eq. ounces in 2024, it’s possible that production could ramp up well beyond that amount in 2025 or 2026. Notice on the map above the three Fresnillo plus two Endeavour Silver mines all less than 10 km from the El Cubo Complex.

If annual production could be increased to 8-10M Ag. Eq. ounces, G-Silver’s AISC would remain low, perhaps even sliding below $15/oz.

To be clear, this higher production level is not the current guidance of management, it’s merely speculation by a few shareholders. Six million ounces a year would be enough to launch G-Silver into the realm of mid-tier producers like Endeavour & Mag Silver.

Upon graduating to mid-tier status, additional institutional investors & sell-side research will surely follow.

Disclosures / disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Guanajuato Silver, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Guanajuato Silver are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned stock in Guanajuato Silver and the Company is an advertiser on [ER].

While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will be (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)