WOW, gold is on a nice run, currently around $1,916/oz., up $302/oz. from a low of $1,614/oz. four months ago. That’s a gain of +18.7%. If gold were to rally another +18.7% it would reach a (nominal) all-time high of $2,274/oz.!

An increasing number of gold bulls are predicting much higher levels. Denmark’s Saxo Bank is saying that gold could hit $3,000/oz. this year.

“Three factors that could help push the metal to new record highs in 2023? One, an increasing ‘war economy mentality’ could discourage central banks from holding foreign exchange reserves, which would favor gold. Two, governments will continue to drive up deficit spending on ambitious projects such as the energy transition. And three, a potential global recession in 2023 would prompt central banks to open the liquidity spouts.”

Saxo bank

How aggressive is this call? Perhaps not as bold as it seems. On an inflation-adjusted basis gold traded at ~$3,035/oz. in 1980. What happened from 1978 to 1981? Very high inflation rates, just like we’re seeing today!

For the past decade goldbugs have been pounding the table for $3,000, $5,000, $10,000/oz. gold… Yet only in the past 18 months has inflation taken off — the highest in decades — not just in N. America, but around the world.

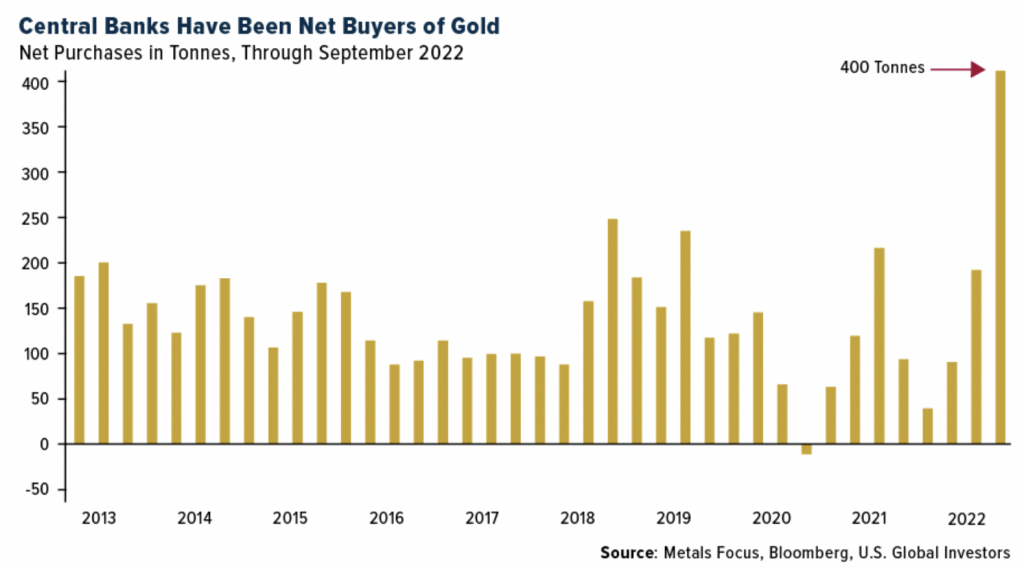

Only in the past few years have central banks in countries like China, India, Turkey & Russia begun to move away from US$ reserves in favor of gold. One look at the chart below says a lot.

This website tracks the most outlandishly aggressive gold price predictions — as high at $87,500/oz., (in 2032), and forecasts as far out as the year 2049.

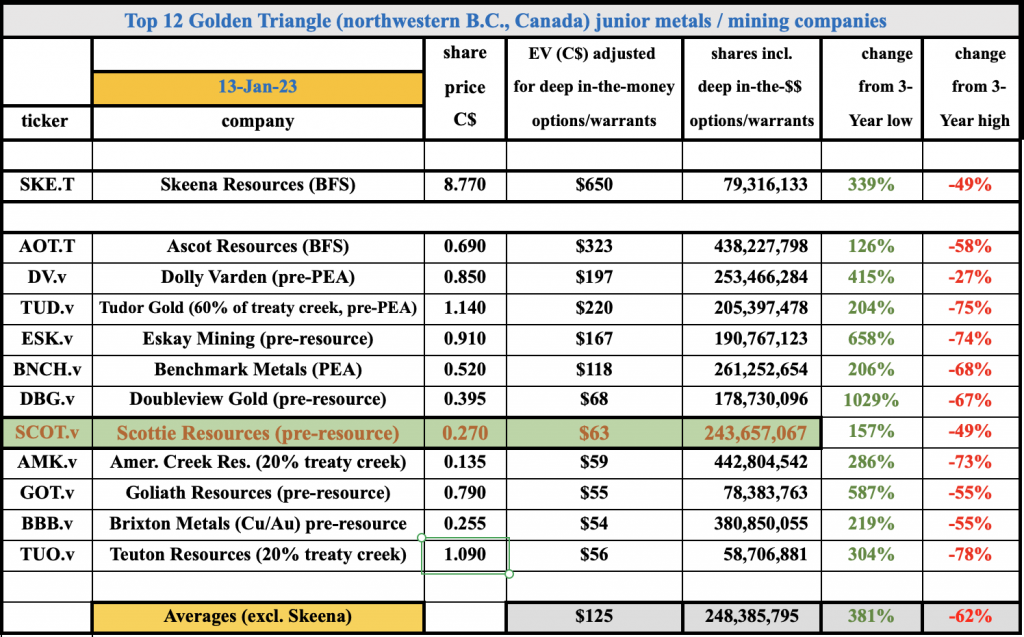

Golden Triangle (“GT“) juniors in B.C. Canada don’t need $3,000/oz. gold to be wildly successful. Companies like Scottie Resources (TSX-v: SCOT) / (OTC: SCTSF) are prime takeover targets even with gold in the $1,900s/oz.

Since my last article on Scottie the gold price has moved decisively higher and several GT juniors have rallied hard. Most notably, Ascot Resources is up +82% from C$0.38 to C$0.69 and its enterprise value {market cap + debt – cash} is now ~C$323M.

Ascot is up for two reasons. First, it announced a long-awaited C$200M funding package to bring its mining complex into production in 2024. Second, with funding in hand, Ascot is now a very attractive takeout candidate in its own right. When/if Ascot is taken out, a lot of attention will shift to Scottie.

Imagine if Ascot were acquired at a 50% premium. That would be a C$485M valuation, equal to ~C$120/oz. of gold in the ground. Nearby Skeena Resources is also valued at ~C$120/oz. Scottie’s resource grade might end up being nearly double Skeena’s 3.5 g/t.

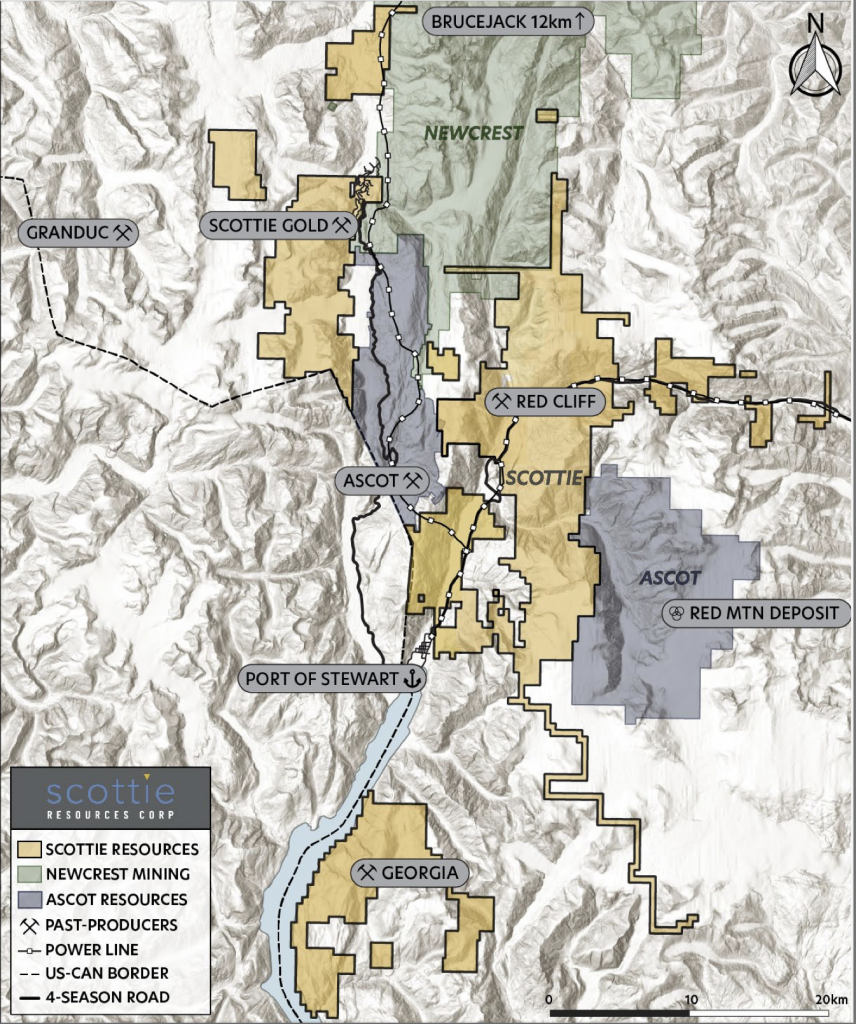

Make no mistake, an acquirer of Ascot is going to want Scottie as well. It’s right next door and has more than twice as much land (with no meaningful royalties). Please see Scottie’s brand new corporate presentation of January 12, 2023!

The synergies to an acquirer of owning BOTH Ascot & Scottie would be quite significant. Therefore, it’s hardly a stretch to envision up to C$100/oz. being paid for Scottie, even at a much earlier stage. Especially as Scottie’s Blueberry zone continues to hit pay dirt.

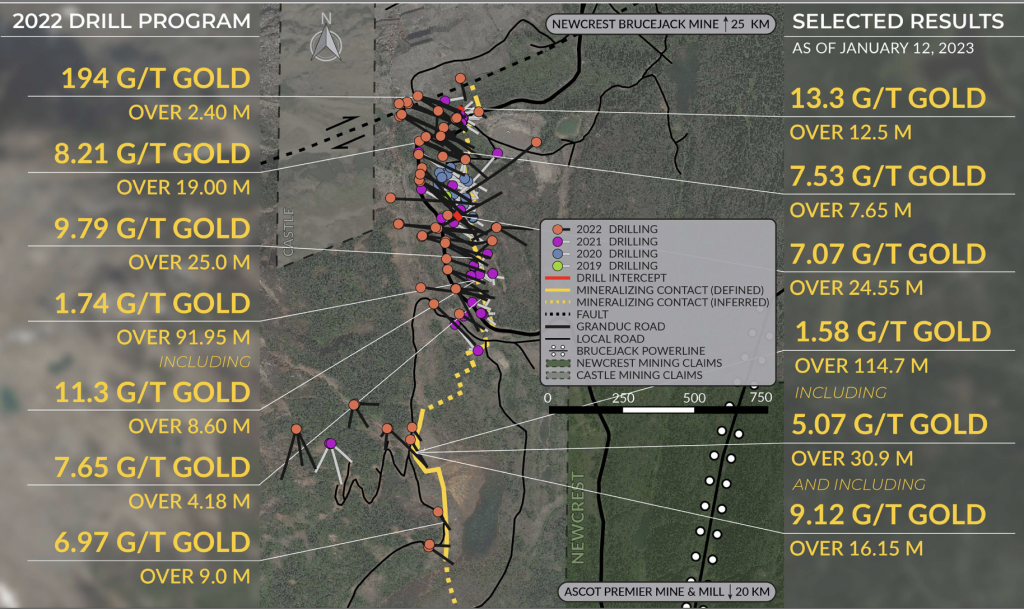

Yesterday, January 5th, management announced its best-ever drill hole interval of 194 g/t gold over 2.4 meters. This might be the best drill result in Canada (so far) this year. To recap, gold is on a tear, Ascot is up +82% and Scottie is drilling blockbuster high-grade holes.

In my prior article I detailed how the Company’s Blueberry zone alone probably (so far) hosts upwards of two million ounces (based on known length, width, depth, grade & approx. density figures).

Two million high-grade ounces on a tiny portion of Scottie’s 59,000+ hectare land position. Two million x C$100/oz. = C$200M vs. Scottie’s enterprise value sits at C$63M.

But wait, here’s where things get a lot more interesting… Scottie (in my view) likely can book 2M high-grade ounces next year, but one can’t rule out a multiple of that by 2025 or 2026. Only a very small portion of the Company’s property has been drilled.

In a potential gold bull market in 2023-24, a high-grade, pure-play gold junior with (probably) 2M, but (possibly) 4-6M ounces — in one of the best gold mining jurisdictions on the planet — is trading like its 59,000+ hectares is capped at 1.0 or 1.5M ounces.

Even if an acquirer paid C$60/oz. instead of C$100/oz., but on a 4M ounce (company-wide) assumption, that would be C$240M.

Of course, any acquirer would need fairly clear line-of-sight to a 4-6M ounce figure in order to pay a premium price. That means an acquisition might not happen before the end of 2024… unless Ascot gets taken out before then.

Over the next few years there will be routine equity raises to pay for robust drill programs, so a potential takeout at C$240M would be divided by a higher # of shares. Even if there were to be 50% equity dilution by 12/31/24, the takeout share price would be C$0.66 vs. today’s C$0.27.

Referring again to last month’s article, I named over 20 companies that might be interested in acquiring Scottie, players already invested in gold projects and/or in juniors across Canada, including existing producers.

Let’s drill down on the three most likely suitors of Scottie (and/or Ascot) — Newcrest, Newmont & Teck Resources. Any high-quality gold project with 2M (or more) ounces in a Tier-1 location should be very attractive to them.

Newcrest bought Premium and is now operating the high-grade Brucejack mine. Premium’s property shares a border with Scottie’s. Of the three most likely suitors, Newcrest has the most to gain in terms of synergies. In looking at the map below it’s clear why Newcrest should care.

Newmont is active in B.C., having acquired GT Gold in March of 2021 for about C$450M. Newmont also owns 50% of the world-class Galore Creek project, also in the GT.

There are good reasons for Newmont to continue expanding in the district to gain logistical synergies & benefit from economies of scale. It already has major gold assets in Ontario & Quebec, the GT appears to be the next step in Newmont’s Canadian game plan.

Teck is not a gold Major, it holds substantial copper & coking coal operations. The company is rapidly growing its copper business, but due to ESG concerns is not expanding in coking coal. Is Teck transitioning to a giant copper/gold company?

It owns 50% of previously mentioned Galore Creek and 75% of the C$2B, PEA-stage copper-gold Schaft Creek project. Both are world-class and in the heart of the GT.

Other billion dollar+ mining companies with investments in northwestern B.C. include Barrick, BHP, Freeport McMoran, Seabridge & Centerra Gold. It seems reasonable that 1 or 2 of these names could also be interested parties, but who knows which ones.

Scottie Resources is killing it on the exploration front yet its share price is 49% below it’s C$0.53 high. Will 2023 be a tremendous year for gold juniors? It sure looks like it could be.

If so, companies in world-class jurisdictions, near critical infrastructure, hosting (potential) multi-million ounce, high-grade gold deposits will be keenly sought after.

I invite readers to take an additional five minutes to read or re-read this article for more details on my bullish view on Scottie Resources (TSX-v: SCOT) / (OTC: SCTSF) in 2023 and beyond.

Please see Scottie’s brand new corporate presentation of January 12, 2023!!

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Scottie Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Scottie Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Scottie Resources was an advertiser on [ER] and Peter Epstein owned shares in the company

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)